On this page you will find my P2P platform comparison. Since there are already 200+ different platforms in Europe alone, you will get a compact overview of the largest and most important providers that you should know as a private retail investor.

The pre-selection is based on personal criteria. Overall, the selection is divided into two tables, each of which is arranged alphabetically. The first table contains the top 10 P2P platforms that investors should currently consider first when making a choice where to invest. In the second table there is a selection of advanced platforms.

Please note that the P2P platform comparison presented is for guidance only and is not intended to be a recommendation for or against any P2P platform. Read more in the disclaimer.

Last update: 22.04.2024

My Top 10 P2P Platforms in Europe

- Bondora: Estonia

- Crowdpear: Croatia

- Debitum Investments: Latvia

- Esketit: Ireland

- HeavyFinance: Lithuania

- Income Marketplace: Estonia

- LANDE: Latvia

- PeerBerry: Croatia

- Robocash: Croatia

- Viainvest: Latvia

- Bondora: 2008

- Crowdpear: 2021

- Debitum Investments: 2018

- Esketit: 2020

- HeavyFinance: 2019

- Income Marketplace: 2020

- LANDE: 2019

- PeerBerry: 2017

- Robocash: 2017

- Viainvest: 2016

- Bondora: No

- Crowdpear: Yes (ECSP License)

- Debitum Investments: Yes (Financial and Capital Market Commission)

- Esketit: No

- HeavyFinance: Yes (ECSP License)

- Income Marketplace: No

- LANDE: Yes (ECSP License)

- PeerBerry: No

- Robocash: No

- Viainvest: Yes (Financial and Capital Market Commission)

Are the P2P platforms regulated and controlled by a supervisory authority? The decisive factor is the regulation as a platform, not the supervision of individual lenders of the platform.

- Bondora: Consumer Loans

- Crowdpear: Real Estate Loans

- Debitum Investments: Business Loans

- Esketit: Consumer Loans

- HeavyFinance: Agricultural Loans

- Income Marketplace: Consumer Loans

- LANDE: Agricultural Loans

- PeerBerry: Consumer Loans

- Robocash: Consumer Loans

- Viainvest: Consumer Loans

- Bondora: Yes

- Crowdpear: No

- Debitum Investments: Yes

- Esketit: Yes

- HeavyFinance: Yes

- Income Marketplace: Yes

- LANDE: Yes

- PeerBerry: Yes

- Robocash: Yes

- Viainvest: Yes

- Bondora: 1 Euro

- Crowdpear: 100 Euro

- Debitum Investments: 50 Euro

- Esketit: 10 Euro

- HeavyFinance: 100 Euro

- Income Marketplace: 10 Euro

- LANDE: 50 Euro

- PeerBerry: 10 Euro

- Robocash: 10 Euro

- Viainvest: 10 Euro

- Bondora: None

- Crowdpear: Mortgage

- Debitum Investments: Buyback Guarantee (90 Days)

- Esketit: Buyback Guarantee (60 Days)

- HeavyFinance: Land, Grain and Machinery

- Income Marketplace: Buyback Guarantee (60 Days)

- LANDE: Land, Grain and Machinery

- PeerBerry: Buyback Guarantee (60 Days)

- Robocash: Buyback Guarantee (30 Days)

- Viainvest: Buyback Guarantee (60 Days)

- Bondora: Yes

- Crowdpear: Yes

- Debitum Investments: No

- Esketit: Yes

- HeavyFinance: Yes

- Income Marketplace: No

- LANDE: Yes

- PeerBerry: No

- Robocash: Yes

- Viainvest: No

- Bondora: 1 Euro Withdrawal Fee at Bondora Go & Grow

- Crowdpear:

- Debitum Investments:

- Esketit:

- HeavyFinance: See Fee Structure

- Income Marketplace:

- LANDE:

- PeerBerry:

- Robocash: See Fee Structure

- Viainvest: See Fee Structure

- Bondora: 6.75%

- Crowdpear: 10.62%

- Debitum Investments: Up to 15%

- Esketit: 13.25%

- HeavyFinance: 13.13%

- Income Marketplace: 11.81%

- LANDE: Up to 14%

- PeerBerry: 12.5%

- Robocash: Up to 13.3%

- Viainvest: Up to 13%

The expected return refers to information provided by the P2P platform. These numbers do not display a guarantee to reach a certain return.

- Bondora: 5 Euro Bonus

- Crowdpear: 0.5% Cashback for 90 Days

- Debitum Investments: 1% Cashback for 90 Days

- Esketit: 0.5% Cashback for 90 Days

- HeavyFinance: 2% Cashback for 30 Days

- Income Marketplace: 1% Cashback for 30 Days (Code “Q6DCGX“)

- LANDE: 1% Cashback for 180 Days

- PeerBerry: 0.5% Cashback for 90 Days

- Robocash: 1% Cashback for 30 Days

- Viainvest: 10 Euro Bonus

- Bondora: Bondora Review

- Crowdpear: Crowdpear Review

- Debitum Investments: Debitum Investments Review

- Esketit: Esketit Review

- HeavyFinance: HeavyFinance Review

- Income Marketplace: Income Marketplace Review

- LANDE: LANDE Review

- PeerBerry: PeerBerry Review

- Robocash: Robocash Review

- Viainvest: Viainvest Review

- Bondora: 3.42 out of 5

- Crowdpear:

- Debitum Investments: 2.72 out of 5

- Esketit: 4.15 out of 5

- HeavyFinance: 3.26 out of 5

- Income Marketplace: 3.77 out of 5

- LANDE: 3.89 out of 5

- PeerBerry: 3.97 out of 5

- Robocash: 4.13 out of 5

- Viainvest: 3.36 out of 5

Results refer to the Community Voting 2023.

Extended Selection of P2P Platforms

- Afranga: Bulgaria

- Boldyield: Estonia

- Bondster: Czech Republic

- Estateguru: Estonia

- Exporo: Germany

- Fintown: Czech Republic

- iuvo Group: Estonia

- Lendermarket: Ireland

- Maclear: Switzerland

- Max Crowdfund: Netherlands

- Mintos: Latvia

- Monefit SmartSaver: Estonia

- Monestro: Estonia

- NEO Finance: Lithuania

- Profitus: Lithuania

- Swaper: Estonia

- Twino: Latvia

- Afranga: 2021

- Boldyield: 2019

- Bondster: 2017

- Estateguru: 2013

- Exporo: 2014

- Fintown: 2023

- iuvo Group: 2016

- Lendermarket: 2019

- Maclear: 2020

- Max Crowdfund: 2019

- Mintos: 2015

- Monefit SmartSaver: 2022

- Monestro: 2016

- NEO Finance: 2015

- Profitus: 2018

- Swaper: 2016

- Twino: 2015

- Afranga: No

- Boldyield: No

- Bondster: No

- Estateguru: Yes (ECSP License)

- Exporo: Yes (BaFin)

- Fintown: No

- iuvo Group: No

- Lendermarket: No

- Maclear: Yes (Self Regulatory Organization)

- Max Crowdfund: Yes (Authority for Financial Markets)

- Mintos: Yes (Financial and Capital Market Commission)

- Monefit SmartSaver: No

- Monestro: No

- NEO Finance: Yes (Central Bank of Lithuania)

- Profitus: Yes (Central Bank of Lithuania)

- Swaper: No

- Twino: Yes (Financial and Capital Market Commission)

Are the P2P platforms regulated and controlled by a supervisory authority? The decisive factor is the regulation as a platform, not the supervision of individual lenders of the platform.

- Afranga: Consumer Loans

- Boldyield: Business Loans

- Bondster: Consumer Loans

- Estateguru: Real Estate Loans

- Exporo: Real Estate Loans

- Fintown: Real Estate Loans

- iuvo Group: Consumer Loans

- Lendermarket: Consumer Loans

- Maclear: Business Loans

- Max Crowdfund: Real Estate Loans

- Mintos: Consumer Loans

- Monefit SmartSaver: Consumer Loans

- Monestro: Consumer Loans

- NEO Finance: Consumer Loans

- Profitus: Real Estate Loans

- Swaper: Consumer Loans

- Twino: Consumer Loans

- Afranga: Yes

- Boldyield: No

- Bondster: Yes

- Estateguru: Yes

- Exporo: No

- Fintown: No

- iuvo Group: Yes

- Lendermarket: Yes

- Maclear: No

- Max Crowdfund: No

- Mintos: Yes

- Monefit SmartSaver: Yes

- Monestro: Yes

- NEO Finance: Yes

- Profitus: Yes

- Swaper: Yes

- Twino: Yes

- Afranga: 10 Euro

- Boldyield: 100 Euro

- Bondster: 5 Euro

- Estateguru: 50 Euro

- Exporo: 500 Euro

- Fintown: 1 Euro

- iuvo Group: 10 Euro

- Lendermarket: 10 Euro

- Maclear: 50 Euro

- Max Crowdfund: 100 Euro

- Mintos: 10 Euro

- Monefit SmartSaver: 10 Euro

- Monestro: 10 Euro

- NEO Finance: 10 Euro

- Profitus: 100 Euro

- Swaper: 10 Euro

- Twino: 10 Euro

- Afranga: Buyback Guarantee (60 Days)

- Boldyield: Mortgage

- Bondster: Buyback Guarantee (30 to 60 Days)

- Estateguru: Mortgage

- Exporo: Mortgage

- Fintown: Corporate Guarantee Vihorev Group

- iuvo Group: Buyback Guarantee (60 Days)

- Lendermarket: Buyback Guarantee (60 Days)

- Maclear: Mortgage

- Max Crowdfund: Mortgage

- Mintos: Buyback Guarantee (60 Days)

- Monefit SmartSaver: None

- Monestro: Buyback Guarantee (60 Days)

- NEO Finance: Provision Fund

- Profitus: Mortgage

- Swaper: Buyback Guarantee (60 Days)

- Twino: Buyback Guarantee (60 Days)

- Afranga: Yes

- Boldyield: No

- Bondster: No

- Estateguru: Yes

- Exporo: No

- Fintown: No

- iuvo Group: Yes

- Lendermarket: No

- Maclear: No

- Max Crowdfund: No

- Mintos: Yes

- Monefit SmartSaver: No

- Monestro: No

- NEO Finance: Yes

- Profitus: Yes

- Swaper: No

- Twino: Yes

- Afranga:

- Boldyield:

- Bondster: See Fee Structure

- Estateguru: See Fee Structure

- Exporo:

- Fintown: See Fee Structure

- iuvo Group: 1% Transaction Fee Secondary Market

- Lendermarket:

- Maclear:

- Max Crowdfund:

- Mintos: See Fee Structure

- Monefit SmartSaver:

- Monestro: See Fee Structure

- NEO Finance: See Fee Structure

- Profitus: See Fee Structure

- Swaper: See Fee Structure

- Twino: See Fee Structure

- Afranga: Up to 18%

- Boldyield: 7% to 15%

- Bondster: 13.5%

- Estateguru: 10.76%

- Exporo: 4% to 6%

- Fintown: Up to 15%

- iuvo Group: Up to 15%

- Lendermarket: 14.57%

- Maclear: Up to 14.9%

- Max Crowdfund: 10%

- Mintos: 12.7%

- Monefit SmartSaver: Up to 9.88%

- Monestro: Up to 13%

- NEO Finance: 14.49%

- Profitus: 10%

- Swaper: Up to 16%

- Twino: 12%

The expected return refers to information provided by the P2P platform. These numbers do not display a guarantee to reach a certain return.

- Afranga:

- Boldyield: No

- Bondster: 1% Cashback for 90 Days

- Estateguru: 0.5% Cashback for 90 Days

- Exporo: No

- Fintown: 2% Cashback (First Investment)

- iuvo Group:

- Lendermarket: 2% Cashback for 60 Days

- Maclear: 1,5% Cashback for 90 Days

- Max Crowdfund: 0.5% Cashback for 90 Days

- Mintos: No

- Monefit SmartSaver: 5 Euro Bonus + 0.25% Cashback for 90 Days

- Monestro:

- NEO Finance: 1% Cashback for 90 Days

- Profitus: 25 Euro Bonus (Code “RETHINKP2P25“)

- Swaper: No

- Twino: 20 Euro Bonus (100 Euro Investment)

- Afranga:

- Boldyield:

- Bondster: Bondster Review

- Estateguru: Estateguru Review

- Exporo:

- Fintown: Fintown Review

- iuvo Group:

- Lendermarket: Lendermarket Review

- Maclear: Maclear Review

- Max Crowdfund:

- Mintos: Mintos Review

- Monefit SmartSaver: Monefit SmartSaver Review

- Monestro: Monestro Review

- NEO Finance: NEO Finance Review

- Profitus: Profitus Review

- Swaper:

- Twino: Twino Review

- Afranga: 3.56 out of 5

- Boldyield:

- Bondster: 2.33 out of 5

- Estateguru: 2.63 out of 5

- Exporo:

- Fintown:

- iuvo Group: 2.73 out of 5

- Lendermarket: 3.22 out of 5

- Maclear: 2.18 out of 5

- Max Crowdfund: 2.18 out of 5

- Mintos: 2.95 out of 5

- Monefit SmartSaver:

- Monestro: 2.77 out of 5

- NEO Finance: 2.39 out of 5

- Profitus: 2.44 out of 5

- Swaper: 3.72 out of 5

- Twino: 3.03 out of 5

Results refer to Community Voting 2023.

Important note: If you have questions about specific P2P platforms, it’s best to take a look at my P2P Platform Reviews, where I have analysed the individual providers in detail. If you still have questions, take a look at the P2P Lending Community on Facebook. There are 1,000+ private investors that can help you with your questions.

What are Advantages of P2P Lending?

Investing in P2P loans can bring certain advantages. Here are some of them:

- High Liquidity: If you only want to invest a part of your money in short term assets, p2p lending can be a suitable option. Either through short-term consumer loans, the use of the secondary market or special investment products with high liquidity.

- Low Entry Barrier: Accounts can be opened within a few minutes and investors can start to invest right away.

- Diversification Investment Portfolio: P2P lending offers, in addition to other asset classes such as real estate, shares, ETFs or commodities, another possibility to diversify one’s investment portfolio.

- Automated Investing: On most P2P platforms, you don’t have to select your loans manually, but can use presets so that the money is (re)invested automatically.

- Regular Cash Flow: P2P loans provide income-oriented investors with a reliable way to regularly draw interest payments from their investments.

What are Disadvantages of P2P Lending?

Where there are advantages, there are also disadvantages. What should investors look out for when investing in P2P lending?

- High-Risk Investment: The legal framework for online lending between private individuals is often in a grey area. Especially the P2P platforms, which often operate abroad, are usually subject to very few or no regulations. Hence, the risk can be extremely high. In the worst case this can lead to a loss of capital.

- Credit Performance and Leveraged Credit Risks: Investments in P2P loans are subject to leveraged credit risks. If the performance of the loan portfolio declines and no liquidity can be procured, insolvencies of lenders may well be a consequence.

- No Passive Investment: Although automated investing is certainly an advantage of P2P lending, this does not make the asset class a passive investment. Since the opportunities and risks change very quickly in a dynamic environment, this also requires a certain degree of activity in tracking one’s P2P investments.

How Do P2P Platforms Work?

P2P platforms work in two directions: On one hand, they raise money from private investors to finance their loans. To be as attractive as possible, platforms promote high returns and often also lure with bonus campaigns to attract new investors.

On the other hand, platforms also take care of the lending business. The lenders can come from within the company (classic P2P lending) or they can be external lenders who have no overlap with the platform (P2P marketplace model). So, depending on the business model, the P2P platform takes care of acquiring new borrowers or one monitors the quality of external lenders.

In the end, both parties are brought together on the P2P platform.

Choosing the right P2P platform

There are a number of factors to consider when choosing the right P2P platform. Below is a small and incomplete list of points that investors should consider when deciding in favour of or against a platform.

Transparency

Does the P2P platform provide public information so that investors can make an informed investment decision? The most important criteria include audited financial reports, information on assets under management and the performance of the outstanding loan portfolio.

Track Record

The P2P lending business model has become increasingly established in recent years. New platforms are being added almost every day and the variety is correspondingly large. Even if the track record does not always indicate the quality of a platform, it can surely be seen as a positive criteria.

Number of Investors

Here too, size is not necessarily the decisive factor. P2P marketplaces such as Mintos, which have well over half a million registered users, are therefore not automatically a good platform. However, investors should be careful if the user base is too small. From 5,000 investors, or even better 10,000, you can assume that the platform is of a certain size.

Testimonials & Review

What opinions do individual bloggers have of certain P2P platforms? Investors should also take this criteria into account. For critical and independent analyses, I recommend taking a look at this page.

Regulations

Regulations are not a cure for increasing the security of a P2P investment. Investors can lose money despite regulation. At the same time, regulation minimises the risk of being affected by a dubious platform because the costs and compliance requirements are often too high for these providers.

Functionalities

Do you need a one-click solution like Bondora Go&Grow? Should there be free trading on the secondary market? Or does a German interface have to be available? Investors should consider in advance which functionalities they need in order to make a certain pre-selection.

Pricing & Fees

Most P2P lending platforms do not charge investors for registering or investing on their platforms. In some cases though, fees are being charged. Be it for trading via the secondary market, withdrawal fees or currency exchange.

P2P Lendings Risk

There are a variety of risks that can arise in the context of an investment in P2P lending. These affect either the P2P platform directly (platform risk) or its lenders (lender risk).

At both levels, there are corresponding economic risks as well as the associated market risks of the lending business. These include risk factors such as country risk, interest rate risk, liquidity risk or exchange rate risk.

Default Risk

The return to be achieved on a P2P lending platform is largely determined by the performance of the loan portfolio. In this regard, the loan default risk plays an important role in the valuation of a platform.

A default occurs when the borrower exceeds a certain period of time, usually 60 or 90 days, during which no repayments have been made in accordance with the repayment schedule.

However, a loan default does not mean that the money invested by investors is automatically lost. It is possible to recover all or part of the outstanding receivables through the debt collection process carried out after the loan default.

It is not possible to make a generalised statement about how high the default rates are for individual P2P lending platforms. The decisive factor here is the transparency of the respective platform and how openly it communicates the performance of the loan portfolio. Investors should therefore closely monitor which information a platform does or does not publish regarding the loan default risk.

Incorrectly Assessed Creditworthiness

Most lenders have a systematic evaluation process in place to assess the creditworthiness of borrowers. Depending on the credit segment, there can be significant differences. The creditworthiness of a private individual who wants to take a short-term and unsecured consumer loan of up to EUR 1,000 usually differs significantly from that of an agricultural business that wants to buy new machinery for EUR 100,000.

How well or poorly a lender has done its homework when checking creditworthiness can be seen from the NPLs (non-performing loans), which are usually published in the annual financial statements. These are non-performing loans that are very unlikely to be recovered and therefore have to be written off.

What Happens in the Event of a Payment Default?

If a payment default occurs, the P2P platforms attempt to recover the money as part of a debt collection process. As there are different types of loans, the security and recovery mechanisms are quite different.

In the case of consumer loans, many lenders are liable for investors in form of a buyback guarantee, whereby loan defaults are repaid out of their own pockets. The prerequisites for this are the economic conditions.

In the case of mortgage-backed loans, such as property, it depends on the proceeds from the sale of the collateral how much money investors will get back in the end.

With other platforms, on the other hand, there is no protection, which is why investors have to bear the default risk directly.

Insolvency or Closure of a P2P Platform

Another risk associated with P2P loans is insolvency, i.e. the inability of a platform to pay. Most P2P marketplaces are usually asset managers who receive a commission for their brokerage activities depending on the loans financed.

In this respect, investors should familiarise themselves with the business models of the individual P2P lending platforms and their financial situation. The audited annual financial statements, if they are published, provide valuable insights into this.

P2P Lending Platforms with Buyback Guarantee

A few years ago, Mintos established the so-called Buyback Guarantee (also known as Buyback Obligation) on its P2P marketplace. This concept, which aims to eliminate the supposed default risk for investors, was subsequently adapted by many P2P platforms. Today, it is one of the key security features of lenders who finance unsecured consumer loans.

How the Buyback Guarantee Works

The way the buy-back guarantee works is relatively simple: As soon as the loan is in delay for a certain period of time, the issuer (the lender) undertakes to buy back the receivable from the investor. As a rule, this period is 60 days. With some P2P platforms, however, the repurchase obligation period is 30 or 90 days.

In addition to the outstanding repayment, the accrued interest is usually also reimbursed.

Which P2P Platforms Offer a Buyback Guarantee?

The buyback guarantee can be found on many P2P platforms where lenders offer unsecured consumer loans. These include lenders on Mintos, Esketit, PeerBerry or Income Marketplace. P2P platforms that offer collateral for the loans (mortgages, land, machinery, etc.) generally do not have any form of buyback guarantee.

When Does the Buyback Guarantee Kick In?

The timing of the buyback obligation varies greatly from one P2P platform to another. With Swaper or Robocash, the buyback is supposed to take place after 30 days. With Mintos, PeerBerry, Esketit or Income Marketplace, on the other hand, it is 60 days. The longest buyback period has Debitum with 90 days.

Advantages and Disadvantages of the Buyback Guarantee

The major advantage of the buy-back guarantee is that the supposed default risk of the loan is eliminated. This gives investors reliable repayments and a predictable cash flow. Provided, of course, that the buy-back guarantee is honoured.

The disadvantage of the buy-back guarantee is that investors may be blinded by a “false sense of security”. This is because honouring the buyback guarantee, which is promised by the lender itself, is only as secure as the payment morale of the issuer itself. If the issuer has financial problems, the shift in default risk will fall back on the investor.

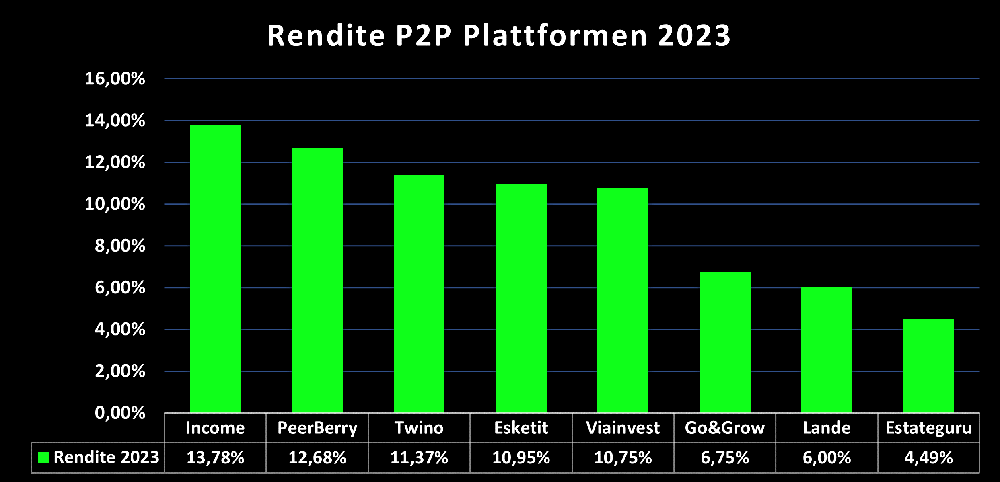

What Returns can be Achieved?

The returns on P2P platforms can vary greatly depending on the platform. Usually, the average range is between 8% and 14%. Experience shows that investors can expect a realistic return of between 6% and 10% after deducting possible defaults.

The returns can vary from year to year and may be better or worse.

What Role do P2P Marketplaces Play?

In recent years, P2P marketplaces have become increasingly important in the asset allocation of many private investors, especially in Germany. As the asset class is still comparatively young, dynamic and very risky, it is advisable to allocate only a small part of the investment portfolio to P2P loans.

A total of around EUR 3.5 billion in loans were financed via European P2P lending platforms in 2022.

Types of Investors

In recent years, an interesting change has been observed among many investors. Whereas a few years ago it was primarily about the level of return, the greed for the highest interest rate has now significantly decreased. Many investors, deterred by some of the scams of recent years, are now taking a much closer look at the platforms.

Platform diversification across as many providers as possible has also decreased significantly in recent years. The mantra of quality > quantity has led to a rethink among many private investors.

What has remained, however, is impatience. For example, when the supply of loans is temporarily too low, resulting in cash drag or when a platform is temporarily unavailable.

Minimum Investment for P2P Loans

The minimum investment amount per loan can be between EUR 10 and EUR 100. It is advisable for investors to invest in at least 100 different loans per platform in order to obtain a reasonably diversified portfolio. This means that with a minimum investment amount of EUR 10, you should invest at least EUR 1,000.

FAQ P2P Platform Comparison

The P2P platform comparison offers investors the possibility to directly compare the different providers. Several criteria have been used to provide comprehensive information about the individual P2P platforms.

The P2P platforms comparison includes two lists of different platforms each. The first list contains the top 10 P2P platforms that investors should consider first. These include companies such as Bondora, Estateguru or PeerBerry. The second list includes an extended version with further P2P platforms that can be considered.

On my blog you will always find new content with detailed analyses of the most important P2P platforms. In addition, the blog also contains high-quality reviews of individual P2P platforms.

The returns on P2P platforms can vary greatly depending on the platform. Usually, the average range is between 8% and 14%. Experience shows that investors can expect a realistic return of between 6% and 10% after deducting possible defaults.