With a track record since 2016, Viainvest is one of the more established platforms in the P2P environment. Due to an often very reserved communication and a rather passive marketing approach, the P2P platform usually flies under the radar of many investors. This makes Viainvest a calm and reliable investment, especially in good times.

However, the platform also faced some severe challenges as of late, which to an extend also frustrated some investors. The aftermath of the pandemic as well as the shift to a regulated platform proved to be more challenging than from many anticipated.

In this Viainvest review you will get a bettter understanding about the current risk-reward profile of the platform and in which circumstances Viainvest might be a good addition to your P2P portfolio.

All the information that are covered in this Viainvest review are based on my own personal experiences with the platform for the past years. Please make sure to do your own due diligence before investing on any platform. More information can be found in the Disclaimer.

Further analyses of other platforms can be found on my P2P Platform Review page.

Viainvest Overview

Before we get started, here is a quick summary with the most important information about Viainvest.

| Founded / Started: | August 2016 / December 2016 |

| Legal Name: | SIA Viainvest (LINK) |

| Headquarter: | Riga, Latvia |

| Regulated: | Yes (Financial and Capital Market Commission) |

| CEO: | Eduards Lapkovskis (December 2016) |

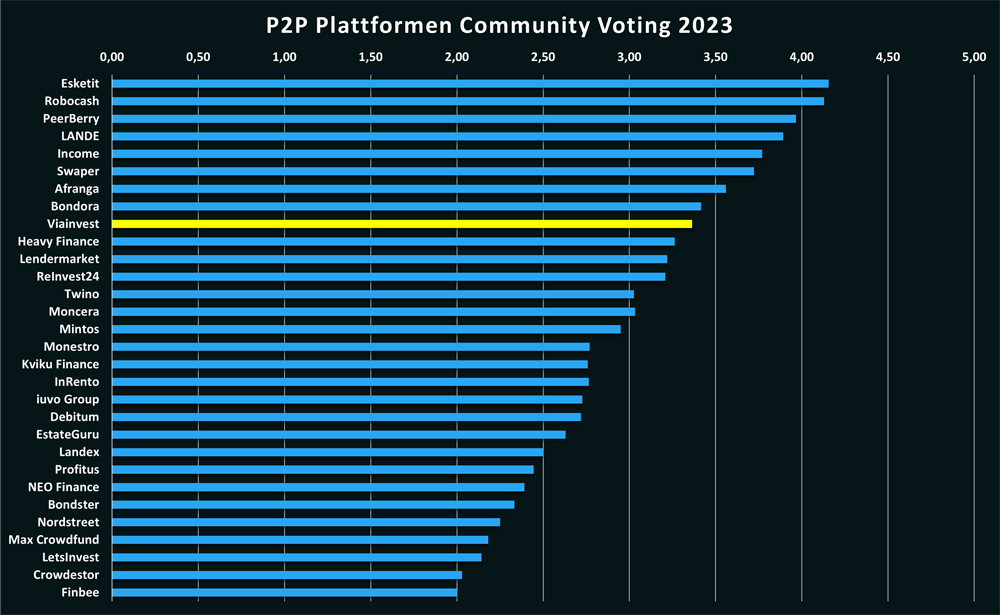

| Community Voting: | 3,36 from 5 | See Voting |

| Assets Under Management: | Not Disclosed |

| Number of Investors: | 38.000+ (April 2024) |

| Expected Return: | Up to 13% |

| Primary Loan Type: | Consumer Loans |

| Collateral: | Buyback Guarantee |

| Bonus: | 1% Cashback for 90 Days |

About Viainvest

Viainvest is a regulated P2P platform from Latvia where investors can benefit from a variety of international short-term consumer loans, while earning a return of up to 13%.

Viainvest is a regulated P2P platform from Latvia where investors can benefit from a variety of international short-term consumer loans, while earning a return of up to 13%.

The platform is part of the Latvian VIA SMS Group, a holding company that was founded in 2009. The group offers a range of different financial products and services. In addition to Viainvest and the expanding lending operations, this also includes the digital payment platform VIALET.

Over the past decade, the Group has managed to build and establish a profitable business model in one of the most strictly regulated loan segments.

Ownership

Who owns Viainvest? Viainvest is a subsidiary of the VIA SMS Group. This holding company in turn is currently owned by two shareholders:

- Georgijs Krasovickis: 80%

- SIA Financial Investment: 20%

Georgijs Krasovickis is one of the founding members of the company and he is currently obtaining one of three board member roles. Behind “SIA Financial Investment” is the 50-year-old Latvian Andris Riekstins. He ownes 20% of the shares in the company since 2012.

Business Model & Finances

Throughout the process of due diligence, investors should also have a look at the business model of a P2P platform as well as the overall financial situation. How does the company earn money? Does the platform operate profitably? And how well is the company positioned financially? In the following paragraphs of this Viainvest review, you can follow-up on those questions.

Monetization

How does Viainvest earn money? Since the VIA SMS Group has a broad portfolio of products and services, the company generates income through multiple revenue sources. However, there are a two dominant revenue sources that can be found when reviewing the latest financial report.

The biggest income stream is generated by the commission fee (58%) which derives from the lending operations. In this regard the company was able to generate EUR 22.1 million in 2022. The second biggest income source comes from online banking fees which in turn is related to the VIALET digital payment platform.

Other revenue sources include credit renewal fees, late payment penalties, or restructuring commissions.

Profitability

Is Viainvest profitable? The company has been able to generate solid profits for many years. However, after the outbreak of the pandemic, the company struggled to break even again. The audited annual report for 2021 showed a loss of EUR 2.5 million, which was the worst financial result in the history of the VIA SMS Group.

However, 2022 saw the best result in the company’s history, with a profit of EUR 4.1 million.

Balance Sheet

After a difficult year in 2021, in which the poor KPIs were due in particular to an extraordinary dividend payment (EUR 2.7 million) and the loss for the 2021 reporting period (EUR 2.5 million), the balance sheet looks much better at the end of 2022.

Sign Up and Bonus

To invest on Viainvest, investors must meet three requirements:

- A minimum age of 18 years,

- a residence in the European Economic Area

- and a European bank account.

The registration process at Viainvest is fairly simple and intuitive.

- Entering the profile information (including name, email, password)

- Entering personal information (e.g. address, date of birth, ID card details)

- AML & KYC questionnaires

- Final verification of identity (via Veriff)

Currently, legal entities can’t register on Viainvest.

Bonus for New Investors

If you consider investing on Viainvest, a sign up through this link will enable you to get a cashback bonus of 1% in the first 90 days after registration.

Investing on Viainvest

How does Viainvest work and what should investors know and consider when investing on the plaform? In the following sections of my Viainvest review you will find all the necessary information that you need.

Asset-Backed Securities

On 28 September 2021, Viainvest obtained an IBF licence and became a regulated platform by the Financial and Capital Market Commission (FCMC). As a result, investors no longer invest in loans structured in the form of assignment agreements, but in a regulated financial product, in short: ABS (asset-backed securities). This is a combined bundle of several individual loans. However, the default risk remains unchanged.

Loan Offering

The ABS on Viainvest are primarily private and unsecured consumer loans. These are pre-funded by individual non-bank lenders affiliated with the VIA SMS Group.

The borrower countries are mainly located in Europe. These include Latvia, Poland, Sweden, Czech Republic and Romania. With a lender from the Philippines, the company also holds a presence in Southeast Asia.

The average loan term is usually up to 182 days.

Costs and Fees

There are no fees or hidden costs for retail investors on Viainvest. Neither for deposits or withdrawals, nor for the functionalities when investing on the platform.

There are no fees or hidden costs for retail investors on Viainvest. Neither for deposits or withdrawals, nor for the functionalities when investing on the platform.

Expected Returns on Viainvest

At Viainvest, the interest rates can vary depending on the borrower country and market phase. In general, interest rates range between 10% and 13%. This corresponds to a competitive interest rate appropriate to the risk.

Based on my Viainvest experiences as an active investor, I can confirm the constant and reliable return expectation in the double-digit percentage range.

My personal return on Viainvest, after 5+ years with the platform, is at 11.16%.

Auto Invest

Investors can invest in ABS either manually or via Auto Invest functionality. Within the auto invest feature, certain investment criteria can be defined in advance and later on the returns are automatically reinvested. The Viainvest Auto Invest allows the following settings to be configured:

- Minimum investment amount: From EUR 50

- Interest rate: Currently only 13% possible

- Loan term: Currently up to 182 days

- Lender: Borrower countries

- Buyback guarantee

Buyback Guarantee

Also Viainvest is offering the frequently used buyback guarantee. As soon as a borrower fails to make a payment on time, the lender is obliged to buy back the loan after 60 days of delayed repayments.

Viainvest Forum

If you have questions about Viainvest, other platforms or different p2p-related topics, you can join the re:think P2P Community on Facebook and engage in discussions with more than 1,000 other private retail investors.

Alternatively, you can also find the latest news and updates on my Telegram channel.

Viainvest Taxes

In principle, interest income generated by loan financing is considered investment income and must be reported as such in the tax declaration. After obtaining the investment brokerage firm license in 2021, Viainvest is now legally required to also withhold taxes on interest income that is collected through regulated financial instruments.

The applied tax rate is based on the country of tax residency and the tax information that are submitted.

- 20% for investors from Latvia

- 20% for investors outside the EU or EEA

- 5% for investors with residency in the EU or EEA (except Latvia)

- 0% for investors from Lithuania (tax certificate required)

- 0% for legal entities

When paying taxes in your country of residence, the withheld taxes can usually be deducted from the overall balance. This means that the effective taxation rate will be the same as it has been before when investing into claim rights. To get access to the relevant data, Viainvest offers to download tax reports and income statements from the platform.

Viainvest Risks

Investors should look very carefully at the potential risk factors when evaluating a P2P platform. What is it that investors need to be aware of when it comes to Viainvest? Where are the underlying risks and how are they assessed?

Regulated Brokerage Platform

Although Viainvest obtained an investment brokerage firm license in 2021 by financial regulator FCMC, the transition process has revealed some weaknesses and problems:

- For a long time, the account balances did not reflect the actual value of the investment.

- The buyback guarantee, which could have been initiated after 120 days for the credit lines, was cancelled retroactively. As a result, these can now be extended indefinitely.

- Auto Invest settings have been switched, without investor consent, to investments in asset-backed securities with a maturity of 180 days.

Viainvest also failed to comply with certain requirements from the Latvian regulator, so the company received a fine of EUR 21,000 in addition to further consequences.

Corona Crisis / Covid-19 Pandemic

VIAINVEST responded very calmly after the outbreak of the pandemic. As a consequence, around 10% of employees had to be laid off. Due to a more conservative growth path, Viainvest made fewer adjustments and changes than other platforms.

Economically, however, the pandemic has left its mark on Viainvest. Although revenue increased a little, expenses grew much faster in proportion. After seven years in a row, in which VIA SMS Group was able to earn profits, the year 2020 ended with a loss of EUR 280,000.

War in Ukraine

At first glance, the war in Ukraine has not had a direct impact on Viainvest, as the platform’s lending markets are located only in Europe and Asia. The decision not to be active in the CIS markets was made on purpose at the time in order to avoid geopolitical risks or strong currency fluctuations.

But even if the lending markets are not directly affected by the war in Ukraine, the economic consequences of the war may be felt in the Baltics as well. In this regard, Viainvest is watching the situation in Ukraine very closely.

Is Viainvest a Safe P2P Platform?

Viainvest is a crisis-tested P2P platform that has proven itself to be safe and reliable in the past. Another advantage is that Viainvest has been operating as a regulated P2P platform since 2022 and is therefore subject to supervision by a financial authority.

The financial strength of the parent company is also a major advantage in terms of security. In addition, audited annual reports have been published regularly since 2012 to provide information on the company’s financial situation.

Pros & Cons

In this section I have listed the biggest advantages and disadvantages of Viainvest.

Advantages

- Track Record: Viainvest has been active as a platform for 6+ years and hence obtains a decent track record.

- Regulation: The platform is supervised and controlled by the Latvian regulator FCMC.

- Transparency: The Group publishes its audited annual reports already for many years.

- Crisis-Proven: The platform has mastered every crisis so far without any major side effects.

- Auto Invest: Investors can invest automatically in the assets on the platform.

- Expected Return: For years, investors have been able to achieve a reliable return of 10%+ on Viainvest.

Disadvantages

- IT Security: A two-factor authentication would provide more security and protection for investors.

- Adjustment of T&C: The platform can make immediate changes to the T&C without investor consensus.

- Transparency: It is not possible to perform your own analyses on the quality of the loan portfolio.

- Secondary market: There is no possibility to sell loans early.

Viainvest Alternatives

The closest Viainvest alternative that investors can find is by looking at the Latvian P2P platform TWINO. In terms of history, origin story, loan offering and business model, both platforms have the biggest interface. In fact, both companies have already been working together, launching the venture VAMO for lending operations in Vietnam.

Other Viainvest alternatives would be Esketit, Income Marketplace or the Croatia-based platform PeerBerry.

You can find other Viainvest alternatives on the P2P Platform Comparison page.

Viainvest Community Feedback

Viainvest is a very popular P2P platform among many investors. This is also illustrated by the results of the community votings, where Viainvest was always able to achieve an above-average result. In 2021 it was 3.56 points, in 2022 3.50 points and in 2023 3.36 points.

The most popular platforms in 2023 have been Esketit, Robocash, PeerBerry, LANDE and Income Marketplace.

Summary Viainvest Review 2024

Viainvest is a Latvian P2P platform that I have been following very closely since 2018 and where I have many years of experiences as an active investor.

Viainvest’s long track record, the transparency applied in most areas and the financial stability are positive aspects to emphasise. In addition, there are rarely any issues or complications. Viainvest generally delivers what was promised in advance.

However, there are also some problems that have accumulated since the provisional receipt of the investment brokerage firm licence (summer 2021). These include the seemingly never-ending problems with regard to IT, coupled with decisions in regard to the switch to asset-backed securities.

If you are keen to invest on regulated P2P platform and achieve a competitive double-digit return, while understanding certain downsides of the business, Viainvest could be a solid option to add to your P2P portfolio.

FAQ Viainvest Review

Viainvest is a regulated P2P platform from Latvia where investors can benefit from a variety of international short-term consumer loans, while earning a return of up to 13%.

Viainvest is a subsidiary of the VIA SMS Group. This holding company in turn is currently owned by two shareholders: Georgijs Krasovickis holds 80% of the shares and SIA Financial Investment 20%.

Viainvest is a thoroughly crisis-tested P2P platform that has proven to be safe and reliable in the past. Another advantage is that Viainvest has also been operating as a regulated P2P platform since 2021 and is therefore subject to the supervision of a financial authority.

If you consider investing on Viainvest, a sign up through this link will enable you to get a cashback bonus of 1% in the first 90 days after registration.

Hi, ich bin Denny! Seit Januar 2019 schreibe ich auf diesem Blog über meine Erfahrungen beim Investieren in P2P Kredite. Meine Analysen sollen Privatanlegern dabei helfen reflektierte und gut informierte Anlageentscheidungen treffen zu können. Dafür schaue ich mir die Risikoprofile der einzelnen P2P Plattformen an, hinterfrage deren Entwicklungen, teile meine persönlichen Einschätzungen und beobachte übergeordnete Trends aus der Welt des Crowdlendings.

Mein Bestseller "Geldanlage P2P Kredite" gilt in Fachkreisen als das beste deutschsprachige Finanzbuch zum gleichnamigen Thema. Zudem versammeln sich in der P2P Kredite Community auf Facebook tausende von Privatanlegern, die sich regelmäßig über die Anlageklasse P2P Kredite austauschen.