Profitus is a comparatively small and unknown crowdfunding platform in the P2P environment. The Lithuanian-based platform, which is regulated and supervised by the Central Bank of Lithuania, offers its investors primarily mortgage-backed loans with an expected return of around 10%.

The very good performance of Profitus’ loan portfolio stands out in particular. Of the first 1,000 loans financed, only two property projects had to enter the debt collection process. Investors have not yet suffered any loss of capital.

This Profitus review will reveal if the platform is worth your time and money. All the information that are covered in this Profitus review are based on my own research. Please make sure to do your own due diligence before investing on any platform. More information can be found in the Disclaimer.

Further analyses of other platforms can be found on my P2P Platform Review page.

Profitus Overview

Before we get started, here is a quick summary with the most important information about Profitus.

| Founded / Started: | July 2017 / August 2018 |

| Legal Name: | UAB Sutelktinio finansavimo platforma PROFITUS (LINK) |

| Headquarter: | Vilnius, Lithuania |

| Regulated: | Yes (ECSP License) |

| CEO: | Viktorija Cijunskyte (December 2017) |

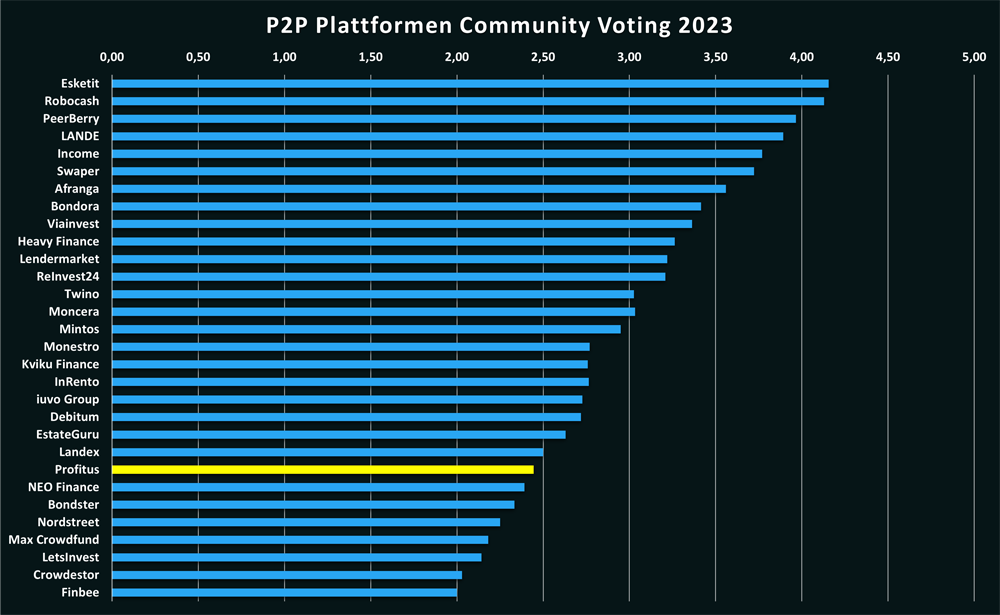

| Community Voting: | 2.44 out of 5 | See Voting |

| Assets Under Management: | EUR 37+ Million (April 2024) |

| Number of Investors: | 9.000+ (April 2024) |

| Expected Return: | 9,87% |

| Primary Loan Type: | Real Estate Loans |

| Collateral: | Mortgage |

| Bonus: | EUR 25 Bonus (Code: RETHINKP2P25) |

About Profitus

Profitus is a Lithuania-based P2P platform where investors can fund mortgage-backed business loans from Lithuania, earning an average return of 10%.

Profitus is a Lithuania-based P2P platform where investors can fund mortgage-backed business loans from Lithuania, earning an average return of 10%.

The platform has been regulated and supervised by the Central Bank of Lithuania since its inception. In combination with the legally prescribed separation of investor and company funds, the safety of funds on Profitus is higher than with comparable alternatives.

As Profitus operates in a very small and narrow market, the funded loan volumes are relatively low. By the end of 2023, a total of EUR 150 M of real estate loans have been financed through the platform.

The Origin Story

Viktorija Cijunskyte, one of the two co-founders of Profitus, developed an interest for real estate in her early years. After working for a brokerage firm for a year, she decided to pursue her own business and set up her own agency.

At the same time, she also founded a real estate development company, in which the later Profitus partner, Mindaugas Vanagas, was also involved.

Several aspects came together which then led to the foundation of Profitus: On one side there were retail investors who wanted to know how to invest in real estate. On the other side there have been developers who asked for financing options and debt capital. The final piece of the puzzle came together at the real estate fair MIPIM in Cannes 2015, where Viktorija learned about the crowdfunding model.

In 2017, the company “UAB Sutelktinio finansavimo platforma PROFITUS” was founded. The platform started its operational activities in August 2018, approximately one year after its establishment.

Ownership

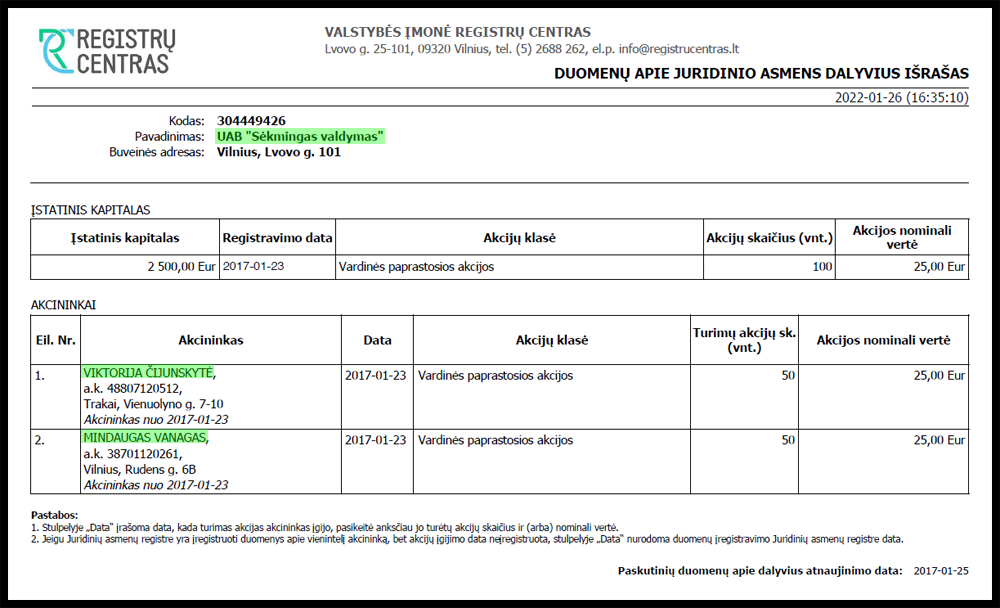

The two shareholders of Profitus, who each own 50% of the shares in the company, are Viktorija Cijunskyte (CEO) and Mindaugas Vanagas. Both are Lithuanian citizens and long-time business partners.

The registered name of the P2P platform is “UAB Sutelktinio finansavimo platforma Profitus”. This in turn belongs to the company “UAB Sėkmingas valdymas”.

To this day, no venture capital has been raised to fuel the growth of the platform. Hence, the company is 100% owner-managed.

Profitus Management

The Profitus team is led by CEO Viktorija Cijunskyte. The Lithuanian, who is also one of the co-founders of Profitus, has been managing the platform’s operational activities since December 2017.

The Profitus team is led by CEO Viktorija Cijunskyte. The Lithuanian, who is also one of the co-founders of Profitus, has been managing the platform’s operational activities since December 2017.

Her resume includes a master’s degree in business administration from the Lithuanian ISM University of Economics and Management. Prior to Profitus, she both founded her own real estate company, but also worked as a partner at a construction firm.

On the Profitus website, investors can find more information about the team members of the platform which currently adds up to around 25 employees.

You can listen to an extensive conversation with Viktorija, which was recorded in March 2023:

Business Model & Finances

Throughout the process of due diligence, investors should also have a look at the business model of a P2P platform as well as the overall financial situation. How does the company earn money? Does the platform operate profitably? And how well is the company positioned financially? In the following paragraphs of this Profitus review, you can follow-up on those questions.

Monetization

How does Profitus earn money? Profitus monetizes primarily through a commission fee charged to borrowers upon successful project financing. This can range from 0.5% to 8% of the loan amount.

In addition, an administrative fee is also charged, which ranges from 0.1% to 0.2% per month. Since Profitus is quite transparent about their fee structure, investors can take a look at the price list themselves.

Investors pay only a 2% transaction fee on Profitus when selling loans through the secondary market.

Profitability

In 2021, Profitus was able to achieve a profitable business year for the first time in company history. The profit was around EUR 10,000.

In 2021, Profitus was able to achieve a profitable business year for the first time in company history. The profit was around EUR 10,000.

In 2022, EUR 44 million in loans were financed through the platform, generating a turnover of EUR 1.7 million. Profit after tax was just close to EUR 200,000. On this page investors can access insights into the financial key figures of the platform.

Sign Up and Bonus

Investors can register on Profitus both as a natural person and as a legal entity. New users must be at least 18 years of age.

Overall, the registration process is fairly simple and intuitive. Investors need to submit information about their name, email, phone number and a password must be provided. This is followed by the verification of the identity. Here Ondato is offered as the first option.

Alternatively, the identity can also be verified with Paysera, in case an account already exists. In this case, however, deposits and withdrawals can only be made via Paysera. With Ondato, on the other hand, foreign banks (SEPA) can also be used.

Bonus for New Investors

You have the possibility to get an exclusive EUR 25 bonus at Profitus. To get the bonus, sign up via this link. Then you can enter the promo code “RETHINKP2P25” when making your first investment. This amount will then be offset against your investment.

Investing on Profitus

How does Profitus work and what should investors know and consider when investing on the plaform? In the following sections of my Profitus review you will find all the necessary information that you need.

Loan Offering

Profitus offers two types of business loans on their platform.

Firstly, real estate secured business loans with first-ranking collateral. Secondly, business loans where assets of the company (equipment, cars, stock, personal guarantees, etc.) are pledged.

It is important to note that Profitus acts as an intermediary between borrowers and investors. This means the credit agreements are made with the borrower and not with the platform. So if Profitus had to file for insolvency, the receivables would continue to exist.

The loan terms are between 3 and 36 months. The loan-to-value ratio (LTV) is 56%.

The majority of the loans offered on Profitus come from the Lithuanian home market. In terms of geographic expansion, the company plans to add Spanish loans to its portfolio in the future, in addition to the two Baltic countries Estonia and Latvia.

Costs and Fees

There are no costs or hidden fees for investors on Profitus. Both deposits and withdrawals are free, as well as investing on the platform itself. The only fee that is charged is a 2% transaction fee when using the secondary market.

Expected Returns on Profitus

The expected return on Profitus is promoted with 9.87%. Compared to similar P2P platforms, this is an average return, which comes with a higher collateral and a lower loan-to-value (LTV) though.

In addition, the lower interest rate also seems to pay off in terms of performance, as Profitus is able to attract significantly better borrowers as a result.

Overall, Profitus offers a very attractive return, considering the underlying risk.

Auto Invest

On Profitus, investors can invest on the platform in three different ways:

- Manual credit selection on the primary market

- Manual credit selection on the secondary market

- Automated investing on the primary market

With the Auto Invest feature, investors have the option to set predefined criteria for loan selection, thus passively managing the investment. Possible configuration criteria include:

- Investment Amount: At least EUR 100 per loan

- Annual Interest Rate: From 6% upwards

- Loan-to-Value Ratio: Mortgage lending value of the property

- Loan Term: Up to 36 months

- Project Rating: Platform risk rating

Liquidity

The commercial loans secured by real estate have an average term of 12 months. This is an average period for this segment. Those who need more liquidity can also use the platform’s secondary market that has been established in January 2022. On the secondary market, loans can be sold prior maturity in exchange for a 2% transaction fee.

Note: Since the relaunch of the platform in May 2023, the secondary market is temporarily unavailable.

Profitus Forum

If you have questions about Profitus, other platforms or different p2p-related topics, you can join the re:think P2P Community on Facebook and engage in discussions with more than 1,000 other private retail investors.

Alternatively, you can also find the latest news and updates on my Telegram channel.

Profitus Taxes

Generally, interest income generated by loan financing is considered investment income and must be reported as such on the tax declaration.

As a Lithuania-based P2P platform, Profitus is legally obliged to withhold 15% taxes on interest income earned. This is automatically retained by the platform. Depending on the investors residency, the withholding tax can be reduced to 10%, when using the “DAS-1 form”.

As there is a double taxation treaty between Lithuania and many European countries, the withholding tax withheld can be offset. This is therefore not paid twice.

Through the dashboard, investors can pull an investment statement where the income earned on Profitus is listed.

Profitus Risks

Investors should look very carefully at the potential risk factors when evaluating a P2P platform. What is it that investors need to be aware of when it comes to Profitus? Where are the underlying risks and how are they assessed?

The platform itself offers an initial overview. In this document Profitus lists a number of possible risks. These include general investment risks, influences due to the economic situation in Lithuania, poor performance or liquidity risks.

How Does the Platform Assess Credit Risks?

The loans offered on Profitus are 100% mortgage-backed. In most cases, also with first-ranking collaeral. The average loan-to-value (LTV) ratio is 56%.

To minimize the risk of loan defaults, Profitus gathers a range of different information from public registers and credit rating companies.

After that, the platform evaluates the business plan of the real estate developer and how he plans to return the funds to the investors. Profitus also evaluates the developer’s experience, the property and the location where the project is being developed.

After this evaluation, a decision is made whether the project will be funded or not. Out of 10 projects, only 3 make it to the funding stage on the platform. If the decision is positive, then the borrower is assigned with a rating from A+ to D. According to the platform, around 50% of the borrowers are repeated customers who finance their projects several times via Profitus.

Further details on how Profitus assesses and classifies credit risks can be found in this document.

Is Profitus a Safe Platform?

Profitus can be considered a safe and very secure P2P platform.

- Regulation and supervision by the Central Bank of Lithuania

- Segregation of investor and company funds

- Proven track record and good performance of the loan portfolio

Obtaining the European Crowdfunding Licence (ECSP) is also a positive development.

Some points can be deducted when it comes to transparency. Although the platform has published many documents on business processes, no consolidated financial reports of the platform are shared publicly.

Pros & Cons

In this section I have listed the most important advantages and disadvantages of Profitus.

Advantages

- Regulation: Profitus is controlled and supervised by the Central Bank of Lithuania.

- Segregation of Company and Investor Funds: A big benefit for safety of funds.

- Portfolio Quality: Only around 6% of the outstanding portfolio is late in repayments.

- Risk-Reward Profile: The expected returns are very competitive for the underlying risk profile.

- Profitability: The P2P Platform has been profitable since 2021.

- Owner-managed: The shareholders built the platform with their own funds and without raising external capital.

Disadvantages

- Small Loan Offering: Profitus is a small platform with a small supply of loans.

- Low Diversification: Mainly Lithuanian business loans can be found on Profitus.

- Annual Reports: The platform does not share its annual reports publicly, hence no conclusions can be drawn about the company’s financial situation.

- Withholding Taxes: Withholding taxes between 15% and 10% for private investors.

Profitus Alternatives

The closest Profitus alternative is Crowdpear as both platforms share the same legislation and regulation status as well as the same borrower market and primary loan type.

Another Profitus alternative, in terms of business model, can be seen in Estonian platform Estateguru. Also this platform offers primarily short-term and real estate collateralized business loans. However, Estateguru’s focus is somewhat more international, whereas Profitus takes a more focused approach with the Lithuanian borrower market.

You can find other Profitus alternatives on the P2P Platform Comparison page.

Profitus Community Feedback

Profitus took part in the Community Voting 2023 for the first time. At their debut, the platform managed to achieve a score of 2.44 points. Due to the fact that only 9 votes were submitted for Profitus, the significance of the result is rather low.

The most popular platforms in 2023 included. Esketit, Robocash, PeerBerry, LANDE and Income Marketplace.

Summary Profitus Review 2024

What is the final verdict of my Profitus review and my personal opinion?

Profitus is a small and hidden gem in the P2P environment, which clearly deserves much more attention.

The basic framework, consisting of regulation, profitability and stability of the loan portfolio, are good and strong pillars for a successful investment.

Those who do not mind the somewhat lower diversification and the withholding taxes can add Profitus to their portfolio as a promising low-risk platform.

Since May 2023 I am invested with a smaller amount as well.

FAQ Profitus Review

Profitus is a Lithuania-based P2P platform where investors can fund mortgage-backed business loans from Lithuania, earning an average return of 10%.

The two shareholders of Profitus, who each own 50% of the shares in the company, are Viktorija Cijunskyte (CEO) and Mindaugas Vanagas. Both are Lithuanian citizens and long-time business partners.

Profitus monetizes primarily through a commission fee charged to borrowers upon successful project financing. This can range from 0.5% to 8% of the loan amount.

You have the possibility to get an exclusive EUR 25 bonus at Profitus. To get the bonus, sign up via this link. Then you can enter the promo code “RETHINKP2P25” when making your first investment. This amount will then be offset against your investment.

Hi, ich bin Denny! Seit Januar 2019 schreibe ich auf diesem Blog über meine Erfahrungen beim Investieren in P2P Kredite. Meine Analysen sollen Privatanlegern dabei helfen reflektierte und gut informierte Anlageentscheidungen treffen zu können. Dafür schaue ich mir die Risikoprofile der einzelnen P2P Plattformen an, hinterfrage deren Entwicklungen, teile meine persönlichen Einschätzungen und beobachte übergeordnete Trends aus der Welt des Crowdlendings.

Mein Bestseller "Geldanlage P2P Kredite" gilt in Fachkreisen als das beste deutschsprachige Finanzbuch zum gleichnamigen Thema. Zudem versammeln sich in der P2P Kredite Community auf Facebook tausende von Privatanlegern, die sich regelmäßig über die Anlageklasse P2P Kredite austauschen.