Bondora is one of the biggest and most established P2P platforms in Europe. Hence, the platform owns a special status among many private investors. With the inception of Bondora Go & Grow in 2008, the platform has set a new standard in terms of offering a P2P product that is easy tu use, that offers daily liquidity and that has a fixed return.

However, investors should be aware of potential risks as well, specifically when it comes to the performance of the loan portfolio. Further analysis can be found in this Bondora review. All the information that are covered in this analysis are based on my own personal experiences with the platform for the past 6+ years. Please make sure to do your own due diligence before investing on any platform. More information can be found in the Disclaimer.

Further analyses of other platforms can be found on my P2P Platform Review page.

Bondora Overview

Before we get started, here is a quick summary with the most important information about Bondora.

| Founded: | 2008 |

| Legal Name: | Bondora Capital OÜ (LINK) |

| Headquarter: | Tallinn, Estonia |

| Regulated: | No |

| CEO: | Pärtel Tomberg (December 2007) |

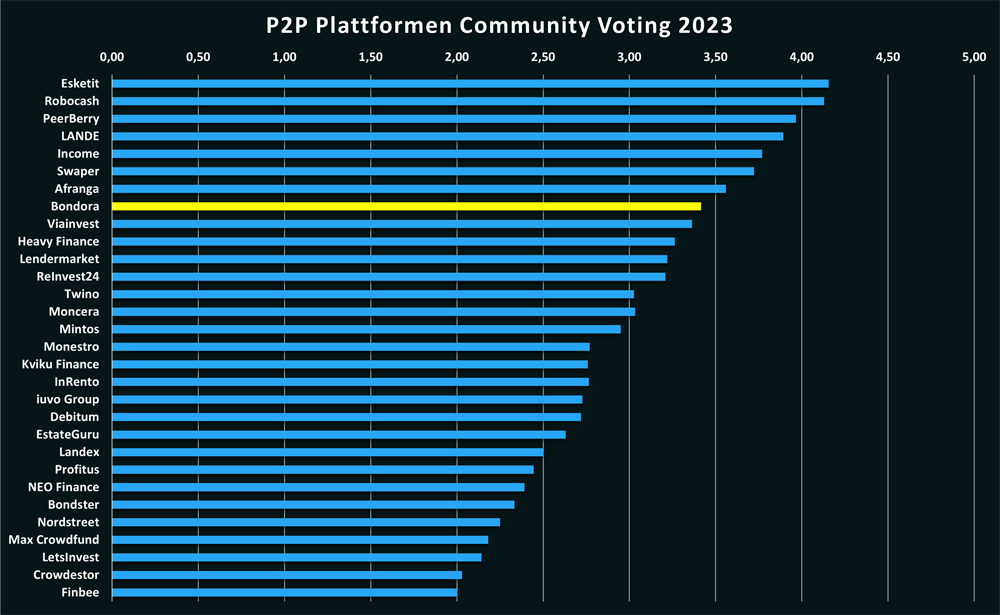

| Community Voting: | 3,42 out of 5 | See Voting |

| Assets Under Management: | Not Disclosed |

| Number of Investors: | 226.000+ (April 2024) |

| Expected Return: | 6.75% |

| Primary Loan Type: | Consumer Loans |

| Collateral: | No |

| Bonus: | 5 Euro |

About Bondora

Bondora is an Estonian P2P platform, founded in March 2008, where investors can invest in a variety of European consumer loans. In terms of track record, Bondora is among the oldest and most established P2P platforms in Europe.

With 15+ years of market experience, Bondora has earned a reputation as a crisis-proven, innovative and reliable P2P platform. That’s why the plaform is constantly voted as one of the most popular platforms within the annual P2P Community Voting.

Particularly popular is the investment product Bondora Go & Grow, which was launched in 2018. This caused a massive growth spurt for the platform in recent years and set new standards across platforms.

The Origin Story

While studying in England, on a bus trip from Oxford to Bristol, Pärtel Tomberg, who was only 19 at the time, stumbled across an article in the Economist. The article was about the British P2P platform Zopa, the world’s first marketplace for P2P loans.

Pärtel was attracted by this story because lending by non-banks had been little known until then and because there seemed to be an ever-increasing need for it.

Increasing digitalisation, which has made it possible to automate complex business processes, but also the stricter regulations on lending for traditional banks, which arose as a result of the financial crisis, were two important trends that played into the Bondora CEO’s hands.

Pärtel Tomberg completed the first business plan by the end of 2007. The knowledge about marketing, the credit system or the acquisition of investors was added and covered by the later co-founders.

Friend Loan, isePankur and Bondora

The P2P platform, which is known to most investors as Bondora, had two other names in its history. Originally, the P2P platform was called “Friend Loan”. However, this name was changed already after two months. The reason: There is an Estonian proverb that says you should never lend money to a friend – unless you are prepared to lose it.

The P2P platform, which is known to most investors as Bondora, had two other names in its history. Originally, the P2P platform was called “Friend Loan”. However, this name was changed already after two months. The reason: There is an Estonian proverb that says you should never lend money to a friend – unless you are prepared to lose it.

In order to make the perception of the company more positive, it was then decided to use the name “isePankur”. This translates as “iBanker” and was based on Apple’s iPods, which were on the rise at the time. This terminology led many Estonians to believe that isePankur was an Apple company.

The third name change took place in April 2014, again motivated by a desire to change the perception of the company. The focus of the name “Bondora” is supposed to be on the English word “bond”. The double meaning of the word refers to both the bond between people and the “bond” as a financial instrument.

The figure of Bondora is thus a characterisation between the human and the financial bond and is still considered the figurehead and symbol of the company today. The Bondora figure was designed by the brother of CEO Pärtel Tomberg, who is an animator.

Ownership

Who owns Bondora? The platform has two major shareholders:

- The first is a subsidiary of Valinor Management, a EUR 3.5 billion investment company from the US. The company, which was also an early promoter of the US platform Lending Club, invested EUR 4.5 million in Bondora in January 2015.

- The second is an affiliate of Global Founders Capital, one of Rocket Internet’s largest shareholders. The funding amounted to approximately EUR 1.3 million in 2014.

Bondora Management

Pärtel Tomberg is the CEO and the face of Bondora. Born in Estonia and raised in Tallinn with three siblings, Tomberg emigrated to the UK at the age of 17 to study International Business Management, graduating from Oxford Brookes University after three years.

Pärtel Tomberg is the CEO and the face of Bondora. Born in Estonia and raised in Tallinn with three siblings, Tomberg emigrated to the UK at the age of 17 to study International Business Management, graduating from Oxford Brookes University after three years.

During this time, the idea of founding a P2P platform based in Estonia was also established. After gaining numerous business experiences at a young age, he founded the P2P platform that is today known as Bondora, in 2008. To this day he is the CEO of the platform.

Business Model & Finances

Throughout the process of due diligence, investors should also have a look at the business model of a P2P platform as well as the overall financial situation. How does the company earn money? Does the platform operate profitably? And how well is the company positioned financially? In the following paragraphs of this Bondora review, you can follow-up on those questions.

Monetization

Bondora earns money by different fees charged to borrowers. The figures listed in the chart correspond to the results from the consolidated Bondora AS annual report for 2022.

Loan Management Fees: Bondora generated the most revenue in 2022 with the loan management fee (EUR 20.1 million). Bondora is charging 4% annualy of the original loan amount.

Origination Fees: The second largest revenue block consists of commission income from loan brokerage (EUR 8.8 million). Borrowers are charged a fixed fee of 5.95% of the loan amount, which has to be paid to Bondora at the beginning of the loan term.

Additional Services: This includes first and foremost the fee for BSecure. Here, in exchange for a monthly fee of EUR 10, borrowers can adjust the day of the instalment payment or the length of the loan term.

Profitability

Is Bondora profitable? Yes, Bondora has been consistently profitable since 2017. For 2022, the platform announced a consolidated profit of EUR 2.1 million.

Bondora’s financial stability is a big advantage compared to many other P2P platforms. The balance sheet of the platform is also extremely clean and presentable.

The equity ratio is an impressive 78% and also Bondora’s debt-to-equity ratio (0.27) has never been better. The liquidity ratio of 5.18 is also absolutely impressive. From a financial point of view, Bondora is therefore a very well-positioned company.

Sign Up and Bonus

In order to invest at Bondora, investors must be at least 18 years old and also have a residence in the European Union, Norway or Switzerland.

Overall, the registration process is very intuitive and takes only a few minutes. Here are the step-by-step instructions:

- Click on the green button “Register now” on the homepage.

- Enter your email, name and mobile phone number.

- Verify the email in your mailbox.

- Log in with email and password.

- Enter personal data (name, address, phone number).

- Complete AML and KYC questionaires.

- Verify your identity.

Bonus for New Investors

If you want to invest on Bondora, you will receive a EUR 5 welcome bonus if you register via this link.

Investing on Bondora

How does Bondora work and what should investors know and consider when investing on the plaform? In the following sections of my Bondora review you will find all the necessary information that you need.

Loan Offering

Bondora offers investments in private and unsecured consumer loans from Estonia, Finland, Spain and the Netherlands on its platform. In the course of expansion, further borrower countries from the European economic area are to be added in the future.

In terms of borrowers, Bondora focuses on people with medium incomes who need a loan of between EUR 500 and EUR 10,000, with a term of three to 60 months. The average loan amount on Bondora is around EUR 2,800.

There is no Auto Invest at Bondora. Anyone planning to invest in Go & Grow has no control over which loans are selected to their portfolio.

Costs and Fees

The registration at Bondora is free of charge. There are also no fees that apply for using the platform.

The only exception is a EUR 1 withdrawal fee when withdrawing funds from Bondora Go & Grow / Go & Grow Unlimited.

Expected Returns on Bondora

Returns can vary greatly with Bondora, depending on the investment strategy and investment product. My experience with Bondora Portfolio Pro has been very negative. After more than five years, my Portfolio Pro return is less than 2%. The statistics show that 14% of investors have suffered a negative return at Bondora.

Important: On 27 February 2023, Bondora’s two portfolio builders (Portfolio Manager and Portfolio Pro) were stopped.

When using Bondora Go and Grow, investors can expect a return of 6.75%.

Bondora Go & Grow

Bondora Go & Grow was launched by the Estonian P2P platform in spring 2018. Go & Grow advertises a fixed interest rate of 6.75%, simple handling and daily liquidity. Hence, the one-click-solution product is among the most popular investment opportunities for European P2P investors.

Go & Grow Unlimited

Bondora announced the launch of Go & Grow Unlimited on 06.04.2022. This product is structured the same way as the classic Bondora Go & Grow product, but with two major differences: There is no monthly deposit limit and the interest rate is 4% p.a.

Originally, the interest rate was set at only 2% p.a. Due to a lack of demand, Bondora has increased the return to 4%.

Bondora Limit

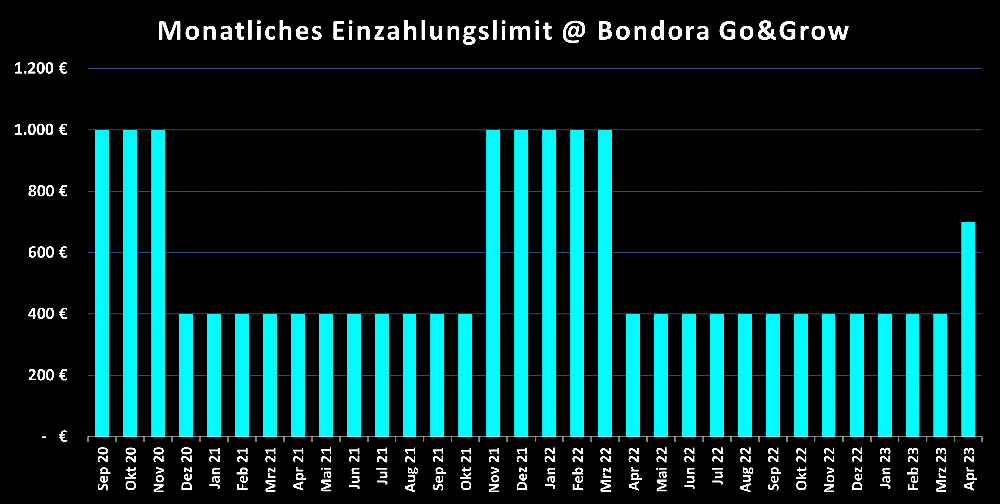

In the past, Bondora has frequently adjusted the monthly limit for possible deposits. After the corona-virus pandemic, this limit was adjusted to EUR 1,000 per month for Go & Grow (September 2020) and later even to EUR 400 per month (December 2020). The current monthly deposit limit is at EUR 1,000 per month.

The exception is Bondora Go & Grow Unlimited where investors can deposit as much money as they want without a monthly limit.

Bondora Forum

If you have questions about Bondora, other platforms or different p2p-related topics, you can join the re:think P2P Community on Facebook and engage in discussions with more than 1,000 other private retail investors.

Alternatively, you can also find the latest posts, Bondora news and updates on my Telegram channel.

Bondora Taxes

In general, interest income generated by loan financing is considered investment income and thus must be declared as such in the tax declaration.

Unlike other platforms, Bondora does not withhold taxes through interest income such as in Latvia or Lithuania.

Bondora Risks

Bondora is a very crisis-tested company. In the last 15+ years, it has experienced the recessions in their borrower countries Finland and Spain, the Corona pandemic and most recently the war in Ukraine. Last but not least, Bondora is a company that emerged from the financial crisis of 2008. In this regard, the Bondora CEO rightly said:

“Being ready for a crisis is part of the Bondora DNA” – Pärtel Tomberg

Of course, future risks could also pose a test for Bondora: These include new regulations in the lending business, a weak performance of the loan portfolio, the general profitability of the company or emerging competition.

Is Bondora a Safe P2P Platform?

Bondora is an unregulated P2P platform from Estonia. This means that there is no financial regulator that controls and monitors the operational activities of the platform. An exception is the licence for lending in Estonia, which has been issued by the FSA.

Furthermore, there is no form of deposit insurance at Bondora. In theory, investors’ funds are therefore not protected against a total failure of the platform.

On the other hand, the financial stability of the platform, which has been profitable for many years, is positive. Equally important: Bondora continously publishes consolidated financial reports that are audited by large and reputable auditors. The fact that this process takes place on a voluntary basis can be seen as a good sign by investors.

Performance Issues Loan Portfolio

Bondora, unlike many other P2P platforms that are active in the same lending segment, does not offer a buyback guarantee for their loans. This means that investors have to bear 100% of the default risk of loans themselves.

As the public Bondora statistics show, about 15% of investors have suffered a negative return in the last three years. This is probably one of the reasons why the Portfolio Builders (Portfolio Pro and Portfolio Manager) were discontinued in February 2023.

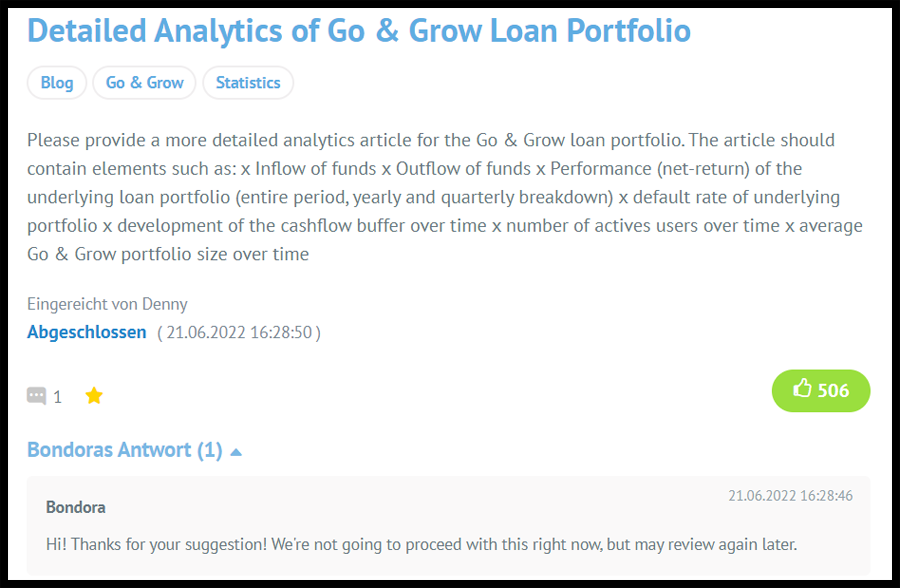

The question about the performance of the Go & Grow loan portfolio and how sustainable the advertised return for investors is, remains open. Despite the public offer to showcase more transparency, Bondora ultimately decided against publishing a detailed performance report. Something that investors should evaluate very critically with regards to the transparency of the platform.

Corona Crisis / Covid-19 Pandemic

Bondora reacted early after the outbreak of the Covid-19 pandemic and adjusted its business processes accordingly. New lending has been sharply reduced. In Spain and Finland, lending has even been completely suspended until further notice.

The P2P platform has pursued a very conservative and cautious course. As a consequence, many expenses have been cut back, which are connected to the financed loan volume. This adaptability has resulted in Bondora’s strongest financial year to this point. In 2020, the platform announced a net profit of EUR 3.4 million.

One of the consequences of this period has been the introduction of a monthly deposit limit at Bondora Go & Grow. This allows the P2P platform to control demand from the investor side much more strongly and to adapt it to the supply on the borrower side.

War in Ukraine

The war in Ukraine didn’t have a direct impact on Bondora as the platform’s credit markets are located outside the war-affected countries. However, economic consequences may also reach the Baltic States and Scandinavia.

According to its own information, the platform didn’t suffer any operational restrictions. Nevertheless, the situation continues to be monitored very closely.

Pros & Cons

In this section I have listed the most important advantages and disadvantages of Bondora.

Advantages

- Track Record: Bondora has a long track record of 15+ years. Hence, the platform is one of the most established players in the P2P environment.

- High Liquidity: With the Go & Grow products, the platform offers daily liquidity for its investors.

- Financial Stability: Bondora has been well managed in recent years and is now financially very stable.

- Community Support: Bondora enjoys a good reputation among many investors. The platform has been voted tthe most popular P2P plaform in both 2021 and 2022.

Disadvantages

- Lack of Transparency: Bondora is yet to publicly communicate the performance of the Go & Grow loan portfolio.

- Poor Performance: The non-transparency of the Go & Grow loan portfolio and the publicly visible statistics suggest that the platform has problems with its loan performance. Approximately 16% of investors have suffered a negative return in the last three years.

- Low Return: With Bondora Go & Grow, investors can achieve a maximum return of 6.75%, which is not a competitive return in the current market environment.

Bondora Alternatives

In terms of history, business model and focus on one credit segment, Bondora is most comparable to the Croatian P2P platform Robocash. Other alternatives are PeerBerry and Esketit.

You can find other Bondora alternatives on the P2P Platform Comparison page.

Bondora Community Feedback

For a long time, Bondora was one of the most popular P2P platforms among private investors. In both 2021 (4.14 points) and 2022 (4.27), Bondora achieved the best result of all platforms.

However, due to the constant changes in the core product Go&Grow, as well as the lack of transparency in the performance of the loan portfolio, Bondora was penalised in the 2023 Community Voting. In the end, Bondora achieved only a score of 3.42 from 154 votes.

The most popular platforms in 2023 included Esketit, Robocash, PeerBerry, LANDE and Income Marketplace.

Summary Bondora Review 2024

Bondora is one of the largest and most established P2P platforms in Europe. Therefore, anyone considering an investment in P2P loans will hardly be able to avoid the Estonian platform.

However, the developments in 2022 have contributed to the fact that new investors may be better off with other alternatives in the current P2P environment. While the liquidity of Go & Grow / Go & Grow Unlimited is a unique selling point across platforms, the interest rate of only 6.75% for new investors is not an adequate compensation for the risk involved.

German savings deposits, which are secured with up to EUR 100,000 and which offer an interest rate of up to 4%, appear much more attractive in relation. If only the P2P environment is considered, yields of 12%+ for short-term consumer loans are absolutely realistic.

On top of that, there is still an open question regarding the performance of the Go & Grow loan portfolio and why Bondora still refuses to share these figures publicly. Hence, investors should rather look at platforms like Esketit, PeerBerry or Income, where the risk-reward profile is much more balanced than at Bondora.

FAQ Bondora Review

Bondora is an Estonian P2P platform, founded in March 2008, where investors can invest in a variety of European consumer loans. In terms of track record, Bondora is among the oldest and most established P2P platforms in Europe.

Bondora earns money by different fees charged to borrowers. Those are mainly management fees and origination fees.

Bondora has been consistently profitable since 2017. In 2021, the platform could announce a record profit of EUR 6.67 million, which was almost double the previous year’s figure.

If you want to invest on Bondora, you will receive a EUR 5 welcome bonus if you register via this link.

Hi, ich bin Denny! Seit Januar 2019 schreibe ich auf diesem Blog über meine Erfahrungen beim Investieren in P2P Kredite. Meine Analysen sollen Privatanlegern dabei helfen reflektierte und gut informierte Anlageentscheidungen treffen zu können. Dafür schaue ich mir die Risikoprofile der einzelnen P2P Plattformen an, hinterfrage deren Entwicklungen, teile meine persönlichen Einschätzungen und beobachte übergeordnete Trends aus der Welt des Crowdlendings.

Mein Bestseller "Geldanlage P2P Kredite" gilt in Fachkreisen als das beste deutschsprachige Finanzbuch zum gleichnamigen Thema. Zudem versammeln sich in der P2P Kredite Community auf Facebook tausende von Privatanlegern, die sich regelmäßig über die Anlageklasse P2P Kredite austauschen.