Monefit SmartSaver is a new alternative for P2P investors who prefer to invest in products with high liquidity, calculable returns and easy handling. The product of Monefit SmartSaver was set-up by the Creditstar Group, which wants to establish yet another financing source for its loan portfolio.

This Monefit SmartSaver review aims to provide insights for investors as to which underlying risks are involved when using this product and which group of investors might benefit from taking advantage adding Monefit to their P2P portfolio.

All the information that are covered in this Monefit SmartSaver review are based on my own due diligence of the platform. Please make sure to do your own research before investing on the platform. More information can be found in the Disclaimer.

Further analyses of other platforms can be found on my P2P Platform Review page.

Monefit SmartSaver Overview

Before we get started, here is a quick summary with the most important information about Monefit SmartSaver.

| Founded / Started: | 2022 |

| Company: | Monefit Card OÜ (Part of Creditstar Group AS) |

| Headquarter: | Tallinn, Estonia |

| Regulated: | No |

| Latest Annual Report: | Creditstar Group 2022 |

| Expected Return: | 7.25% |

| Assets Under Management: | Not Disclosed |

| Number of Investors: | Not Disclosed |

| Primary Loan Type: | Consumer Loans |

| Minimum Investment Amount: | EUR 10 |

| Costs and Fees: | None |

| Bonus: | EUR 5 Bonus + 0.25% Cashback for 90 Days |

About Monefit SmartSaver

Monefit SmartSaver is a new investment platform from international lender Creditstar, which allows investors to invest directly in the group’s loan portfolio, earning a 7.25% return.

Monefit SmartSaver is a new investment platform from international lender Creditstar, which allows investors to invest directly in the group’s loan portfolio, earning a 7.25% return.

The selling point of the product is the high liquidity with up to max. 10 days after payout request, as well as the easy handling when investing. This provides some similarity to the already established Bondora Go & Grow offering.

The first experiences can be made with as little as EUR 10. The interest is added on a daily basis, which increases the APY to 7,25%.

Creditstar Group

The Monefit SmartSaver product is operated by the 2006 founded Creditstar Group. Creditstar is a large and established lender, active in many European credit markets as a licensed lender.

With Monefit SmartSaver, Creditstar Group is looking to build another source of funding for its loans. In April 2019, they also founded the P2P platform Lendermarket, where investors can earn an above-average return of up to 16%.

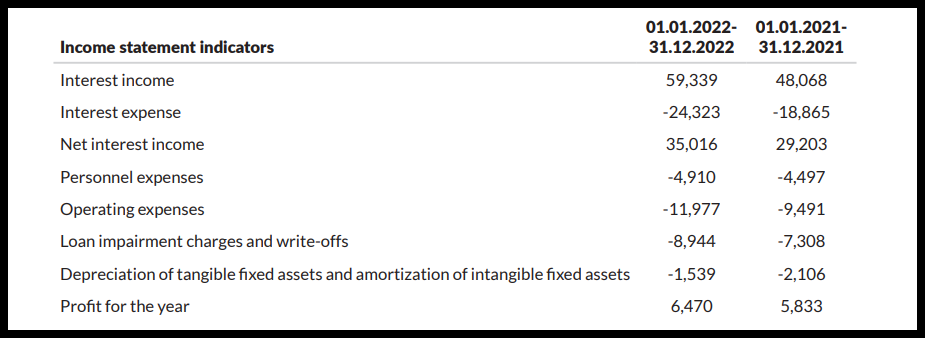

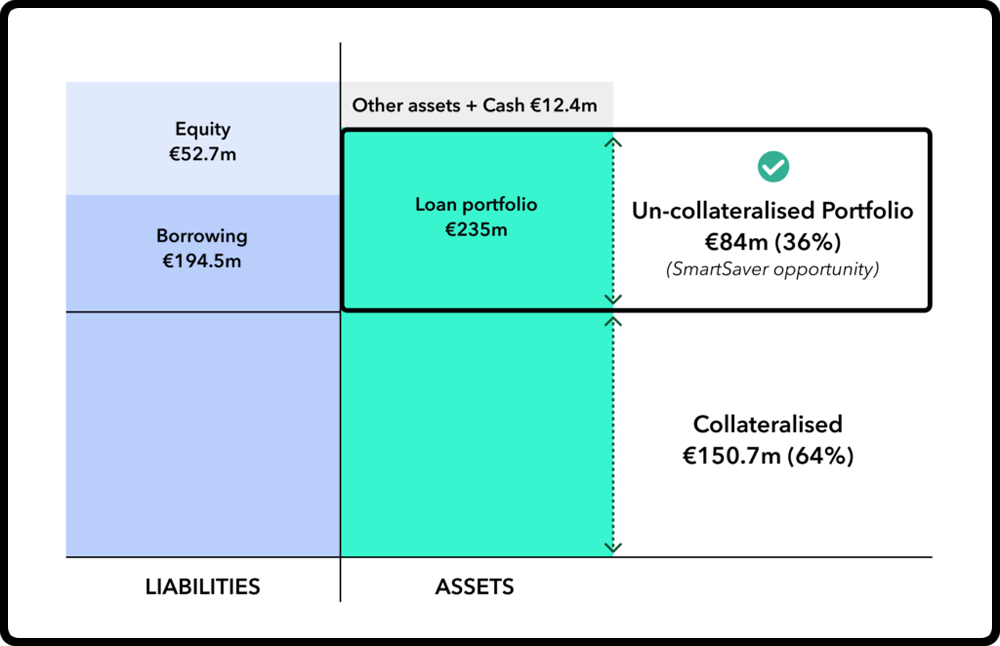

Since loans on Monefit are offered exclusively by Creditstar, investors should look into the performance of the Latvian company more closely. According to the last audited annual report for 2022, the Group has been able to achieve a net profit of EUR 6.4 million (2021: EUR 5.8 million). Equity, on the other hand, amounts to EUR 47 million (equity ratio 20.2%).

Ownership

Who owns Monefit SmartSaver? Monefit SmartSaver operates under the legal name of Monefit Card OÜ. This is a limited liability company from Estonia with an equity contribution of EUR 50,000. The company is more than 50% owned by businessman Aaro Sosaar who is also the founder of Creditstar Group and Lendermarket. Another shareholder is Tauri Jaanson.

Management

The Monefit SmartSaver team is led by Creditstar CPO Kashyap Shah, who is a manager with 20+ years of experience in the financial sector. At Monefit, he looks after the strategy, new implementations as well as growth at the product.

The Monefit SmartSaver team is led by Creditstar CPO Kashyap Shah, who is a manager with 20+ years of experience in the financial sector. At Monefit, he looks after the strategy, new implementations as well as growth at the product.

According to him, there are currently 10 permanent employees working on the development of Monefit. In addition, there are shared resources through the Creditstar Group as well. In my podcast with Kashyap, we talked, among other things, about the origin story of Monefit SmartSaver, how transparent the product will become later on, how to ensure liquidity and when Creditstar repayments on Mintos will occur.

Sign Up and Bonus

To invest on Monefit SmartSaver, investors must meet three requirements:

- A minimum age of 18 years,

- A personal bank account in the European Economic Area or Switzerland,

- Successful verification of identity by the SmartSaver team

Also legal entities have the opportunity to register on Monefit SmartSaver. These must also have a bank account in the EEA or Switzerland.

Monefit SmartSaver Bonus

If you want to register on Monefit SmartSaver, make sure to use this link for sign up. This will enable you to get an additional Cashback of 0.25% on all net deposits in the first 90 days after registration, including a EUR 5 sign up bonus after succesful registration.

Investing on Monefit SmartSaver

How does Monefit SmartSaver work and what should investors keep in mind when investing on the platform? In the following sections of my Monefit SmartSaver review you will find all the necessary information that you need.

How Does It Work?

Investing on Monefit SmartSaver works as easy as with Bondora Go&Grow. Deposit money, start investing and you’re done. There is no need to configure an Auto Invest or manually select any loans.

Investing on Monefit SmartSaver works as easy as with Bondora Go&Grow. Deposit money, start investing and you’re done. There is no need to configure an Auto Invest or manually select any loans.

In the background, the platform automatically invests in a broadly diversified loan portfolio of the Creditstar Group. There is no precise insight into which loans are bought in the process. In this regard, the “black box” character is similar to Go & Grow.

What can be said about the loans is that they are unsecured consumer loans from the EEA. Possible borrower countries include Estonia, Finland, Sweden, Czech Republic, Denmark, Poland and the UK.

Currently, investments are possible from as little as €10 at Monefit SmartSaver. The maximum amount, on the other hand, is currently EUR 250,000. There is no such thing as a monthly deposit limit in place.

Expected Return

The expected return is currently at 7%. However, possible adjustments can be made at any time in the future. Interest is added on a daily basis, which is why the effective APY increases to 7.25%.

The interest rate of 7.25% is quite competitive due to the high liquidity on the platform.

“Vault” Fixed-Term Deposit

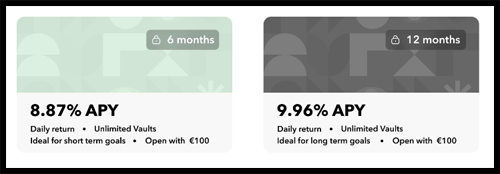

Since March 2024, Monefit SmartSaver offers a fixed-term deposit opportunity called “Vault”. Anyone interested to commit for a longer period of time can achieve different levels of return.

Since March 2024, Monefit SmartSaver offers a fixed-term deposit opportunity called “Vault”. Anyone interested to commit for a longer period of time can achieve different levels of return.

The 6-month term offers investors the prospect of a 8.87% APY return, while the 12-month term offers a return of 9.96% APY. As part of the announcement, Monefit also communicated a new deposit limit which was increased to EUR 500,000.

Costs and Fees

The use of Monefit SmartSaver is completely free of charge for investors. This applies to registration, investing as well as deposits and withdrawals.

Monefit SmartSaver Forum

If you have questions about Monefit SmartSaver, other platforms or different p2p-related topics, you can join the re:think P2P Community on Facebook and engage in discussions with more than 1,000 other private retail investors.

Alternatively, you can also find the latest news and updates on my Telegram channel.

Monefit SmartSaver Taxes

Generally, interest income generated by loan financing is considered investment income and thus must be reported as such at the tax declaration.

Unlike other platforms, Monefit SmartSaver does not withhold taxes through interest income such as in Latvia or Lithuania.

Monefit SmartSaver Alternatives

Due to its similarity, Monefit SmartSaver is often compared to Bondora Go & Grow. But how similar are the two investment products really? Here is the answer:

| Criteria | Monefit SmartSaver | Bondora Go & Grow |

|---|---|---|

| Expected Return | 7.25% | 6.75% |

| Credit | Daily | Daily |

| Availability | Max. 10 Days after Request | Daily |

| Minimum Investment Amount | EUR 10 | EUR 1 |

| Maximum Investment Amount | EUR 100.000 | Unlimited |

| Deposit Limit | No | Max. EUR 1.000 / Month |

| Deposit Insurance | No | No |

As you can see, the liquidity is a bit better at Bondora Go & Grow. In return, Monefit SmartSaver can score with a slightly higher return and more flexibility when it comes to deposits. With Go & Grow Unlimited, on the other hand, the deposit limit would be off, but the expected return would be significantly lower at 4%.

You can find more Monefit SmartSaver alternatives on the P2P Platform Comparison page.

Monefit SmartSaver Risks

The risks of Monefit SmartSaver should be considered in a differentiated and precise manner, as it is neither a classic P2P platform nor a P2P marketplace. Monefit’s primary purpose is to raise money to fund Creditstar’s lending business.

So, where are the underlying risks at Monefit SmartSaver and how are they assessed?

Intransparency of Loan Portfolio

The concept of Monefit SmartSaver is clearly inspired by Bondora Go & Grow. Unfortunately, this means that investors don’t receive any insights as to how the underlying loan portfolio is performing. However, this would be necessary for investors to assess risk-profile more appropriately.

The concept of Monefit SmartSaver is clearly inspired by Bondora Go & Grow. Unfortunately, this means that investors don’t receive any insights as to how the underlying loan portfolio is performing. However, this would be necessary for investors to assess risk-profile more appropriately.

In this regard, the “black box” nature of Monefit SmartSaver is something investors should consider in their valuation. This also implies that the focus should be very much on the development of the Creditstar Group.

Is Monefit a Serious Platform?

Behind the Monefit offer stands the Creditstar Group. A company with a 16+ year track record that focuses on unsecured consumer loans in the European Economic Area. The audited annual reports make it clear that the Group has built up a profitable business model in recent years. Hence, the seriousness is definitely given.

Also my personal discussions with Creditstar CPO Kashyap Shah have underlined the serious impression so far.

Also my personal discussions with Creditstar CPO Kashyap Shah have underlined the serious impression so far.

Monefit has kept all its promises so far – both in terms of interest rates and payouts.

Repayment Issues

What should not be concealed about Monefit is the possibility of delays after requested withdrawals. A point that is particularly sensitive because Monefit SmartSaver promotes its high liquidity. Creditstar Group has certainly a track record of not delivering on promised buyback guarantees on time, which has already caused a lot of displeasure among investors on Mintos and Lendermarket.

Creditstar follows a fairly aggressive loan-financing course. Hence, a certain volatility in attracting new funds can lead to delays in repayments. This is probably why Monefit SmartSaver has been set-up to be yet another source of funding.

Investors should be prepared that liquidity at Monefit SmartSaver cannot be met at all times.

“In the rare event that a substantial number of our investors request withdrawals simultaneously, we have a plan in place. Withdrawals may be processed gradually over time, ensuring fairness for all investors.”

Pros & Cons

In this section I have listed the most important advantages and disadvantages of Monefit SmartSaver.

Advantages

- Strong Lender: Creditstar Group owns a 16+ year track record in the lending business and has also been operating a very profitable business model.

- High Liquidity: Compared to classic P2P platforms, Monefit SmartSaver offers higher liquidity and thus faster availability of your money.

- Go&Grow Alternative: New investors on Bondora can only use Go & Grow Unlimited for a return of 4%. Who seeks a higher return but doesn’t want to compromise on liquidity, can opt for Monefit as an alternative.

- No Delays: So far, Monefit has delivered on its promises and paid out withdrawal requests after a max. 10 days.

Disadvantages

- Low Return: Compared to classic P2P platforms, the return of 7% is not competitive.

- Transparency: Monefit SmartSaver is a black box with no insights into the actual performance of the loan portfolio.

- Protection: The investment is not protected or secured in any other way.

Summary Monefit SmartSaver Review 2024

What is the final verdict of my Monefit SmartSaver review?

Monefit SmartSaver is an investments product from international lender Creditstar. The two main selling points are high liquidity and ease of use. If you are an investor who does not want to deal with P2P loans in depth and who is looking for similar alternatives to Go & Grow, this offer may be for you.

In general, the return of only 7% for short-term and unsecured consumer loans does not represent an appropriate risk-return ratio. Especially since there is no guarantee on the part of Monefit for the advertised return.

The argument of high liquidity, with up to 10 days, should also be questioned in relation to other P2P platforms. Platforms like Esketit or Income Marketplace allow to pursue short-term strategies as well, while at the same time the expected return could be significantly higher and more appropriate to the risk profile.

It also remains to be seen whether Monefit’s repayment practices will be adhered to. Due to the frequently used credit lines, it also occurred on marketplaces such as Mintos or Lendermarket that repayments have been delayed numerous times. Should a bigger amount of withdrawal requests occur, partial payouts would certainly not be a big surprise.

If you want to test Monefit SmartSaver, sign up via this link and get an additional 0.25% cashback on all deposists in the first 90 days, including a EUR 5 sign up bonus after succesful registration.

FAQ Monefit SmartSaver Review

Monefit SmartSaver is a new investment platform from international lender Creditstar, which allows investors to invest directly in the group’s loan portfolio, earning a 7.25% return.

Monefit SmartSaver operates under the legal name of Monefit Card OÜ. This is a limited liability company from Estonia with an equity contribution of EUR 50,000. The company is more than 50% owned by businessman Aaro Sosaar who is also the founder of Creditstar Group and Lendermarket. Another shareholder is Tauri Jaanson.

The company behind Monefit SmartSaver is limited by liability. In addition, there is no form of investment protection. The funds can theoretically be lost at any time.

As you can see, the liquidity is a bit better at Bondora Go & Grow. In return, Monefit SmartSaver can score with a slightly higher return and more flexibility when it comes to deposits.

If you want to register on Monefit SmartSaver, make sure to use this link for sign up. This will enable you to get an additional Cashback of 0.25% on all net deposits in the first 90 days after registration, including a EUR 5 sign up bonus.

Hi, ich bin Denny! Seit Januar 2019 schreibe ich auf diesem Blog über meine Erfahrungen beim Investieren in P2P Kredite. Meine Analysen sollen Privatanlegern dabei helfen reflektierte und gut informierte Anlageentscheidungen treffen zu können. Dafür schaue ich mir die Risikoprofile der einzelnen P2P Plattformen an, hinterfrage deren Entwicklungen, teile meine persönlichen Einschätzungen und beobachte übergeordnete Trends aus der Welt des Crowdlendings.

Mein Bestseller "Geldanlage P2P Kredite" gilt in Fachkreisen als das beste deutschsprachige Finanzbuch zum gleichnamigen Thema. Zudem versammeln sich in der P2P Kredite Community auf Facebook tausende von Privatanlegern, die sich regelmäßig über die Anlageklasse P2P Kredite austauschen.