Robocash is among the biggest and most established platforms in the current P2P environment.

Its popularity is based on a combination of: A competitive interest rate, high liquidity and strong reliability in times of crisis. It is therefore no surprise that Robocash has become one of the most popular platforms in recent years among investors.

This analysis tries to cover everything investors need to know prior making an investment decision. Is Robocash worth your time and money? Let’s find out!

All the information that are covered in this Robocash review are based on my own personal experiences with the platform. Please make sure to do your own due diligence before investing on any platform. More information can be found in the Disclaimer.

Further analyses of other platforms can be found on my P2P Platform Review page.

Robocash Overview

Before we get started, here is a quick summary with the most important information about Robocash.

| Founded / Started: | September 2016 / February 2017 |

| Legal Name: | ROBOCASH d.o.o. (LINK) |

| Headquarter: | Zagreb, Croatia |

| Regulated: | No |

| CEO: | Sergey Sedov (February 2017) |

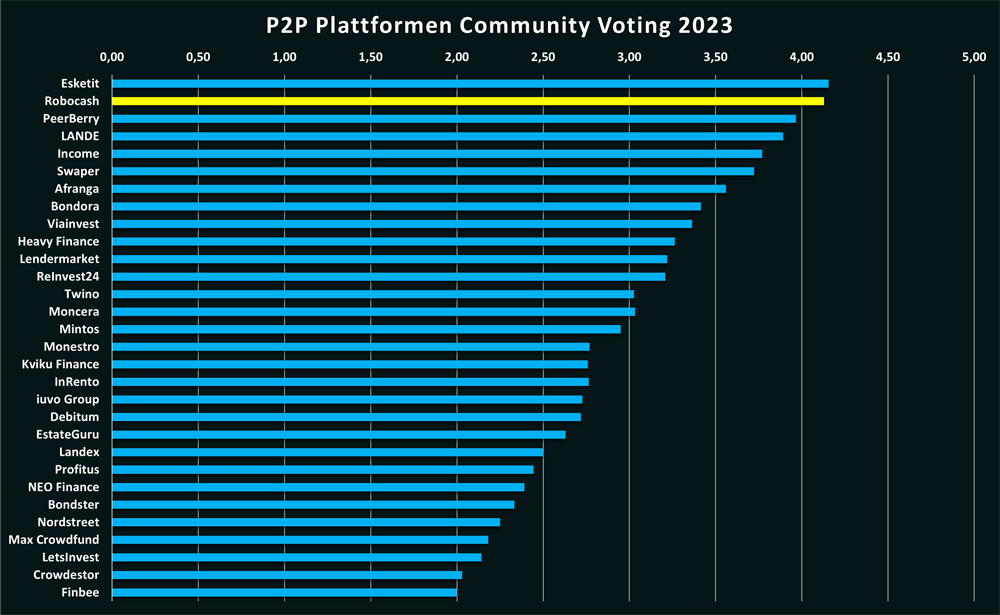

| Community Voting: | 4.13 out of 5 | See Voting |

| Assets Under Management: | EUR 82+ Million (April 2024) |

| Number of Investors: | 37.000+ (April 2024) |

| Expected Return: | Up to 11.8% |

| Primary Loan Type: | Consumer Loans |

| Collateral: | Buyback Guarantee |

| Bonus: | 0.5% Cashback for 30 Days |

About Robocash

Robocash is a P2P platform based in Croatia, on which investors can invest in a variety of international consumer loans, earning a return of up to 11.8%.

Robocash is a P2P platform based in Croatia, on which investors can invest in a variety of international consumer loans, earning a return of up to 11.8%.

The Robocash platform belongs to the in 2013 founded Una Financial Group (formerly known as Robocash Group). This is in turn a holding company located in Singapore, which has several international non-bank lending companies incorporated.

Considering its size and track record, Robocash is among the bigger and more established platforms in the current P2P environment.

Una Financial (Robocash Group)

The Una Financial company (formerly known as Robocash Group) is a global fintech company headquartered in Singapore. Since 2013, the company has been active primarily in the European and Asian markets. The company’s lending activities focus in particular on short-term and unsecured consumer loans, which are offered to borrowers both online and offline.

The Una Financial company (formerly known as Robocash Group) is a global fintech company headquartered in Singapore. Since 2013, the company has been active primarily in the European and Asian markets. The company’s lending activities focus in particular on short-term and unsecured consumer loans, which are offered to borrowers both online and offline.

With the inception of the Robocash P2P platform in 2017, the company wanted to establish another financing source for its loan portfolio. Currently, about 12% of all loans are financed with funds of the P2P platform.

Ownership

Who owns Robocash? The ultimate beneficial owner of Una Financial (99+%), who also exercises control over the Robocash P2P platform, is the Russian citizen Sergey Sedov. He also is the CEO of the Robocash P2P platform since February 2017.

Sergey Sedov holds a PhD in economics (from the Institute of the Russian Academy of Sciences) and has 20+ years of experience in corporate management, lending and real estate.

He entered the credit sector in 2010. That year he founded “FinTerra”, a non-bank lender in Russia. This was followed three years later by “Robot Zaymer”, a fully automated online credit service in Russia, which paved the way for the development of the Robocash Group.

Robocash Management

Since February 2017, Sergey Sedov is the CEO of the Robocash P2P platform. The other management members consist of a number of experienced managers from the financial industry, which in turn strengthens the competence and integrity of the platform’s operations.

On the “About Us” page, investors can gain further insight into Robocash’s team members.

Business Model & Finances

Throughout the process of due diligence, investors should also have a look at the business model of a P2P platform as well as the overall financial situation. How does the company earn money? Does the platform operate profitably? And how well is the company positioned financially? In the following paragraphs of this Robocash review, you can follow-up on those questions.

Monetization

How does Robocash earn money? A look at last year’s annual report reveals that the company makes money on three different levels:

- Net Interest Income: Net interest income is the interest spread, meanding what the borrowers have to pay in interest and what Robocash pays out in interest to fund the loans – for example to Robocash investors.

- Fees and Commission Income: The second biggest pillar is fee and commission income.

- Operating Revenue: Other operating income accounts for the smallest share of the revenue.

Profitability

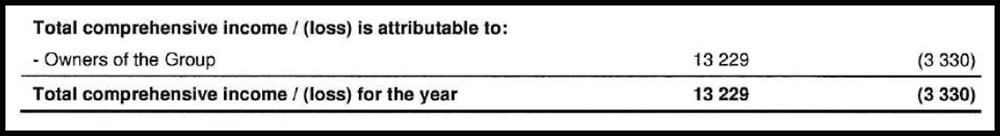

Is Robocash profitable? The Robocash Group was able to achieve a consolidated profit of EUR 13.2 million in 2022. The annual report was audited by Grant Thornton and conducted in accordance with IFRS standards.

Sign Up and Bonus

To invest on Robocash, investors must meet three requirements:

- Minimum age of 18 years

- Residence in Europe, Switzerland or the United Kingdom

- Bank account in Europe, Switzerland or the United Kingdom

The registration process at Robocash is simple and intuitive. After opening the account via email, the KYC (Know-Your-Customer) and AML (Anti-Money-Laundering) questionnaires must be completed. This is followed by the verification of identity.

Legal entities have currently no possibility to register on the platform.

Bonus for New Investors

If you want to join Robocash, a registration through this link will enable you to get an unlimited 0.5% cashback for all investments made in the first 30 days after sign-up.

Investing on Robocash

On Robocash, loans can only be selected automatically and not manually. In the following sections you will learn what else you need to consider when investing on the platform.

Loan Offering

Currently, investors can invest in loans from five different borrower countries: The Philippines, Kazakhstan, Sri Lanka, Singapore and Spain. The majority of the loan portfolio comes from Singapore, where also the headquarters of the Robocash Holding are.

Currently, investors can invest in loans from five different borrower countries: The Philippines, Kazakhstan, Sri Lanka, Singapore and Spain. The majority of the loan portfolio comes from Singapore, where also the headquarters of the Robocash Holding are.

Robocash offers both private consumer loans and business loans on its platform. In the case of business loans, investors have the opportunity to finance the business development of the Robocash Group (Kazakhstan, Sri Lanka and Singapore).

Depending on the lender, the loan term can be up to 30 days (Spain) or up to three years (Sri Lanka). The average loan amount on the platform is EUR 140.

Costs and Fees

There are no fees or hidden costs for private investors on Robocash. Neither for deposits or withdrawals, nor for the functionalities when investing on the platform.

Expected Returns on Robocash

Which returns can be expected on Robocash?

Which returns can be expected on Robocash?

It is important to understand that interest rates are adjusted dynamically depending on the market situation – especially on Robocash, where there have been many adjustments in the past.

The interest rates on Robocash range from 8% to 11%. According to the platform, investors can achieve a return of up to 11.8%. This is by taking into account the loyalty program where an additional bonus can be earned, depending on the amount invested:

- Gold: +0,5% with EUR 20,000 until EUR 49,999

- Platinum: +0,8% from EUR 50,000

Robocash Auto Invest

On Robocash, investors can invest in loans only via Auto Invest. As a result, the returns are automatically reinvested in the self selected criteria. A manual selection of loans is not possible.

On Robocash, investors can invest in loans only via Auto Invest. As a result, the returns are automatically reinvested in the self selected criteria. A manual selection of loans is not possible.

How does the AI work on Robocash?

With the Robocash Auto Invest, individual lenders can be selected as well as the term of the loan, the interest rate, the investment amount per loans or the maximum size of the portfolio.

What else there is to know?

The minimum investment amount per loan is currently EUR 10, which is standard practice for most platforms. Also, Robocash applies a monthly deposit limit, similar to Bondora Go & Grow. On Robocash, this limit is EUR 25,000 per month.

Secondary Market

On the Robocash secondary market, investors can sell their loans prior maturity, in case the loans are not in the buyback process. The platform itself does not buy back any loans. The trading is therefore happening only among investors. For using the secondary market, no costs or fees apply for either the seller or the buyer.

Buyback Guarantee

Robocash offers a buyback guarantee. This way, investors are compensated both the outstanding principal as well as the outstanding interest as soon as the borrower is more than 30 days late in the repayment schedule.

So far, Robocash lenders have always honoured the buyback guarantee.

Robocash Forum

If you have questions about Robocash, other platforms or different p2p-related topics, you can join the re:think P2P Community on Facebook and engage in discussions with more than 1,000 other private retail investors.

Alternatively, you can also find the latest news and updates on my Telegram channel.

Robocash Taxes

Generally, interest income generated by loan financing is considered investment income and must be reported as such on the tax declaration.

Generally, interest income generated by loan financing is considered investment income and must be reported as such on the tax declaration.

Unlike other platforms, Robocash does not withhold taxes through interest income such as in Latvia or Lithuania.

For the tax statement, investors navigate to the “Account statement” tab in the main menu. Here investors can select the category “Tax report” for the statement type. This information can then be downloaded and used for the tax declaration.

Robocash Risks

Investors should look very carefully at the potential risk factors when evaluating a P2P platform. What is it that investors need to be aware of when it comes to Robocash? Where are the underlying risks and how are they assessed?

No Regulation, No Problem?

As the regulation of P2P platforms operating in Latvia gained momentum, Robocash quickly became one of three platforms to move its business abroad. At first sight it looked like an escape from Latvia. In Grupeer’s case, it turned out that the company was clearly trying to avoid regulation due to its unethical practices.

The fact that Robocash operates as a P2P platform in Croatia and is therefore not subject to any regulated supervision should be taken into account by investors in their risk assessment. Together with the segregation of investor and company funds, these are the two most important safety aspects that are not adhered to at the platform.

War in Ukraine

The war in Ukraine had no direct impact on Robocash at first glance, since the P2P platform’s credit markets are all located outside of Ukraine and Russia. The platform has its business headquarters in Croatia, they work with a Dutch bank for payment processing and the Robocash Holding headquarters is located in Singapore.

Nevertheless, the parent company has been affected by the events of the war in Ukraine. Especially due to the sanctions against Russia, where the Robocash Group generated 60% of its revenues in 2021. The target of achieving a net profit of USD 45 million in 2022 (2020: USD 24 million) seems quite challenging, considering the current circumstances.

Pros & Cons

In this section I have listed the most important advantages and disadvantages of Robocash.

Advantages

- Track Record: The Una Financial company (Robocash Group) has been active with its non-bank lending companies for nearly a decade and therefore has significantly more experience than many competitors.

- Financial Stability: Una Financial has been well managed in recent years and thus is financially very stable.

- Transparency: Overall, the company is very transparent in its communication. In addition, the audited annual reports are also published regularly.

- Expected Returns: The platform offers a competitive interest rate for its loans, considering the risk-profile.

- High Liquidity: Robocash offers mainly short-term assets on the plaform and delayed loans are bought back after 30 days.

Disadvantages

- Regulation: Robocash is not controlled by any financial regulator or other authority in its business activities.

- Low Diversification: Because the loans are brokered exclusively by Una Financial (Robocash Group), this creates a greater dependence and a lower degree of diversification for investors.

Robocash Alternatives

In terms of long track record, business model and focus on one lending segment, Robocash is most comparable to P2P platforms like Bondora, Twino or Esketit.

You can find other Robocash alternatives on the P2P Platform Comparison page.

Robocash Community Feedback

The Croatian P2P platform is extremely popular among private investors. This is also illustrated by the results of my annual community voting.

In 2022, Robocash has been voted the third most popular platform with an average score of 3.71. In 2023, the platform even became the second most popular platform with a score of 4.13. The only platform with a better result was Esketit with 4.15 points.

Summary Robocash Review 2024

Robocash is one of the bigger and more established P2P platforms in the market. This is primarily due to the support of Una Financial group, a big and financially profitable company.

Since the platform has constantly delivered good returns for its investors, it doesn’t come as a surprise that Robocash is among the most popular P2P platforms.

Robocash offers a very competitive risk-reward profile and should therefore appeal to many investors that are looking for another platform to diversify their P2P portfolio.

The platform is also on my short list for an investment. As soon as legal entities are approved again for registration, I might start to invest on Robocash as well.

FAQ Robocash Review

Robocash is a P2P platform based in Croatia, on which investors can invest in a variety of international consumer loans, earning an average return of 11.8%.

The ultimate beneficial owner of Una Financial (99+%), who also exercises control over the Robocash P2P platform, is the Russian citizen Sergey Sedov. He is the founder of Una Financial (formerly Robocash Group) and he is also in charge as the CEO of the Robocash P2P platform.

A look at last year’s annual report reveals that the company makes money on three different levels: Interest rate spread, commission fees and operational income.

The interest rate on Robocash ranges from 8% to 11%. According to the platform, investors can currently achieve a return of up to 11.8%.

If you want to join Robocash, a registration through this link will enable you to get an unlimited 0.5% cashback for all investments made in the first 30 days after sign-up.

Hi, ich bin Denny! Seit Januar 2019 schreibe ich auf diesem Blog über meine Erfahrungen beim Investieren in P2P Kredite. Meine Analysen sollen Privatanlegern dabei helfen reflektierte und gut informierte Anlageentscheidungen treffen zu können. Dafür schaue ich mir die Risikoprofile der einzelnen P2P Plattformen an, hinterfrage deren Entwicklungen, teile meine persönlichen Einschätzungen und beobachte übergeordnete Trends aus der Welt des Crowdlendings.

Mein Bestseller "Geldanlage P2P Kredite" gilt in Fachkreisen als das beste deutschsprachige Finanzbuch zum gleichnamigen Thema. Zudem versammeln sich in der P2P Kredite Community auf Facebook tausende von Privatanlegern, die sich regelmäßig über die Anlageklasse P2P Kredite austauschen.