After the operational launch of the platform in 2021, Esketit has developed into one of the best and most popular P2P platforms in Europe. This is due to its high degree of transparency, reliable repayments, high liquidity and competitive interest rates. Hence, since 2022 Esketit has become an integral part of my personal P2P portfolio.

In my Esketit review, I examine the background of the P2P platform, the risks to be aware of and how much substance there is behind one of the fastest-growing platforms in Europe.

All the information that are covered in this Esketit review are based on my own personal experiences with the platform for the past years. Please make sure to do your own due diligence before investing on any platform. More information can be found in the Disclaimer.

Further analyses of other platforms can be found on my P2P Platform Review page.

Esketit Overview

To begin, I’ve put together a brief summary of the most important Esketit information for you.

| Founded / Started: | July 2020 / March 2021 |

| Legal Name: | Esketit Platform Limited (LINK) |

| Headquarter: | Dublin, Ireland |

| Regulated: | No |

| CEO: | Vitalijs Zalovs (April 2021) |

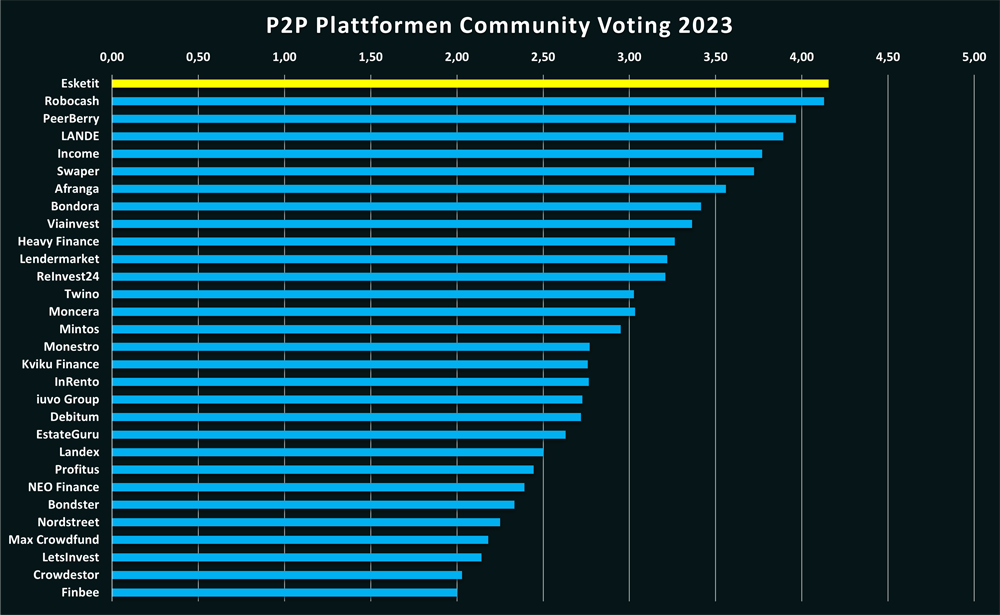

| Community Voting: | 4.15 out of 5 | See Voting |

| Assets Under Management: | EUR 39+ Million (April 2024) |

| Number of Investors: | 19.000+ (April 2024) |

| Expected Return: | 13,39% |

| Primary Loan Type: | Consumer Loans |

| Collateral: | Buyback Guarantee |

| Bonus: | 0.5% Cashback for 90 Days |

About Esketit

Esketit is an Irish-based P2P platform, launched in December 2020. On Esketit, investors can fund a variety of international consumer loans, while earning an average return of up to 12%.

Esketit is an Irish-based P2P platform, launched in December 2020. On Esketit, investors can fund a variety of international consumer loans, while earning an average return of up to 12%.

The platform is still in its early stages compared to other market players. However, the platform is led by an experienced founding team and is also supported by a big non-bank lending company.

At the time of this review, Esketit is among the fastest growing and most stable platforms in the current P2P environment. Find out more in this Esketit review if the platform is a suitable addition to your portfolio.

The Origin Story

Esketit was founded in July 2020. The launch of the website happened in December 2020 and the first loans have been issued in March 2021.

Esketit was founded in July 2020. The launch of the website happened in December 2020 and the first loans have been issued in March 2021.

The driving forces behind Esketit are the two founders Matiss Ansviesulis (left) and Davis Barons (right), who have already built a succesful company with AvaFin Holidng, formerly known as Creamfinance.

The idea behind Esketit is to establish a low-cost funding source for their worldwide lending operations.

Interestingly, the name “Esketit” is based on a song and a frequently used word by the US rapper Lil Pump, who came up with the expression “esketit” which refers to “Let’s get it”.

Ownership

Who owns Esketit? The “Esketit Platform Ltd.” is owned 50% each by the two founders Davis Barons and Matiss Ansviesulis. In 2012, both businessmen already founded the Latvia-based SIA Cream Finance, which operates as an international non-bank lender in the consumer loans segment.

Who owns Esketit? The “Esketit Platform Ltd.” is owned 50% each by the two founders Davis Barons and Matiss Ansviesulis. In 2012, both businessmen already founded the Latvia-based SIA Cream Finance, which operates as an international non-bank lender in the consumer loans segment.

In 2019, I was able to meet one of their two founders, Matiss Ansviesulis, in person. During our meeting we also recorded a short video for my YouTube channel.

We had another conversation in May 2023 when I was recording a podcast regarding the recent hype surrounding the platform. At this occasion, Matiss also revealed that Esketit is about to onboard external loan originators to meet the ever increasing demand on the platform, hence transforming the platform into a P2P marketplace.

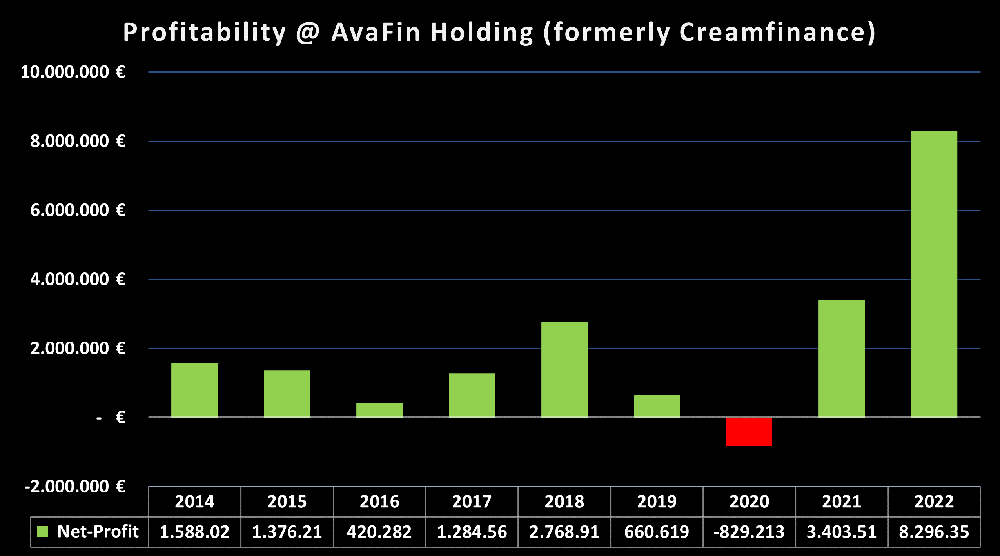

AvaFin Holding (formerly Creamfinance)

AvaFin Holding (formerly Creamfinance) is the driving force behind Esketit. Most of the lenders on the Esketit marketplace belong either to AvaFin Holding or its founders. Therefore, a few remarks about the Latvian company.

- Creamfinance Holding was founded in 2012 in Latvia and today employs over 300 people in 15 different countries.

- The Group has EUR 29 million in equity, with total assets worth EUR 105 million (Q3/2023).

- Creamfinance lenders have financed more than EUR 1.3 billion in loans to date.

- Only 18% of the loan portfolio is financed via P2P platforms. The primary sources are crowdfunding (41%) and institutional investors (38%).

In 2022, AvaFin Holding was able to achieve a record profit of EUR 8.3 million. The driving force behind Esketit is thus in a better financial position than ever before.

Esketit Management

Latvian Vitalijs Zalovs is CEO of the Esketit platform since April 2021.

Latvian Vitalijs Zalovs is CEO of the Esketit platform since April 2021.

Vitalijs is not an unknown face in the industry. He previously worked for six years at the Latvian P2P marketplace Mintos where he was employed as Head of Investor Relations.

After being identified by a head-hunter for the CEO position, he jumped at the chance and moved into the management position at Esketit.

Business Model & Finances

Throughout the process of due diligence, investors should also have a look at the business model of a P2P platform as well as the overall financial situation. How does the company earn money? Does the platform operate profitably? And how well is the company positioned financially? In the following paragraphs of this Esketit review, you can follow-up on those questions.

Monetization

Esketit earns money primarily through commission fees that are charged to lenders represented on the platform. These fees are divided into a fixed fee and a variable fee, which is calculated based on the financed loan volume. The average commission is around 2%, which corresponds to a normal market rate.

Profitability

Is Esketit profitable? The platform claims to have reached profitability on a monthly basis during the second half of 2022. According to Esketit, the threshold for reaching break-even comes with an outstanding loan portfolio of around EUR 20 million. This allows the platform to cover its total expenses of approximately EUR 35,000 per month.

However, no audited financial statements have been published so far to review both the income and expense structure of the platform.

Sign Up and Bonus

To invest on Esketit, investors must meet two requirements: A minimum age of 18 years and a bank account in the European Union or the European Economic Area.

The sign-up process on Esketit is fairly simple and intuitive. After opening the account via email, the KYC and AML questionnaires must be completed. After that, the verification of the identity takes place as well as from the bank account.

Also legal entities have the opportunity to register with Esketit.

Bonus for New Investors

If you consider investing on Esketit, a sign up through this link will enable you to get an unlimited cashback bonus of 0,5% in the first 90 days after registration.

Investing on Esketit

How does Esketit work and what should investors know and consider when investing on the plaform? In the following sections of my Esketit review you will find all the necessary information that you need.

Loan Offering

The Esketit marketplace is home to a large number of international lenders who offer their loan portfolio for financing. These lenders can be roughly divided into three categories.

- Lenders of AvaFin Holding: Lendon and Extraportfel (both from Poland), CreditAir (Czech Republic) and Creditosi (Spain)

- Lenders owned by the shareholders: Spanda Capital (Spanish NPLs) and Money for Finance (Jordan)

- External lenders: Utopia Music (Liechtenstein) and A24 Group (Latvia)

The loans on Esketit are predominantly short-term and unsecured consumer loans.

Due to increasing demand from investors, cash drag has been an issue at times on the platform in 2023. In order to meet the high demand, Esketit is planning to add more lenders in the future.

Costs and Fees

Private investors can register on Esketit free of charge. There are also no costs or hidden fees for investing and trading P2P loans on the platform. But it’s not just investing that is free of charge on Esketit, also depositing funds and withdrawals on the platform are. Unfortunately, this is no longer a common thing among many other P2P platforms.

Private investors can register on Esketit free of charge. There are also no costs or hidden fees for investing and trading P2P loans on the platform. But it’s not just investing that is free of charge on Esketit, also depositing funds and withdrawals on the platform are. Unfortunately, this is no longer a common thing among many other P2P platforms.

Expected Returns on Esketit

The average interest rate on Esketit is around 12%, which is an appropriate return for the risk profile. My personal return on Esketit is 10.87% at the end of 2023.

If you invest enough money on the platform, you can also increase your return via the loyalty program. With an outstanding portfolio of more than EUR 25,000, investors receive an additional 0.5% interest on top. With more than EUR 50,000 it is even 1% more.

Important: The additional interest is currently only added for Jordan loans.

Auto Invest

On Esketit, investors can invest in loans manually as well as through an Auto Invest feature. This leads to returns being automatically reinvested in the self-selected criteria.

The Esketit Auto Invest is divided into two types: the “Esketit Strategies” and the “Custom Strategies”.

Custom Strategies are more or less the classic Auto Invest. Investors can select individual lenders, borrower countries, the term of the loans, the interest rates, the investment amount, the loan type as well as the buyback guarantee option.

Esketit Strategies, on the other hand, have three predetermined investment options with different country weightings and interest rates.

The “Diversified” strategy automatically invests on all lenders, with an average expected return of 12%. The country weighting is composed of 33% Jordan, 37% Poland, 27% Spain and 3% Czech Republic loans. The “Jordan” strategy includes only Jordanian loans at an interest rate of 12%.

With the “AvaFin (CreamFinance)” strategy, an average return of 11% can be achieved, with a country breakdown of 55% Poland, 40% Spain and 5% Czech Republic.

Those who opt for one of the predefined Esketit strategies can liquidate their entire loan portfolio immediately if there is also a corresponding market demand.

Secondary Market

Esketit also offers a secondary market. Here, investors can both buy and sell loans prior maturity. Both a discount or a premium can be specified on the sale. In addition, no fees are paid for the use of the secondary market. A rare expection in the current P2P environment.

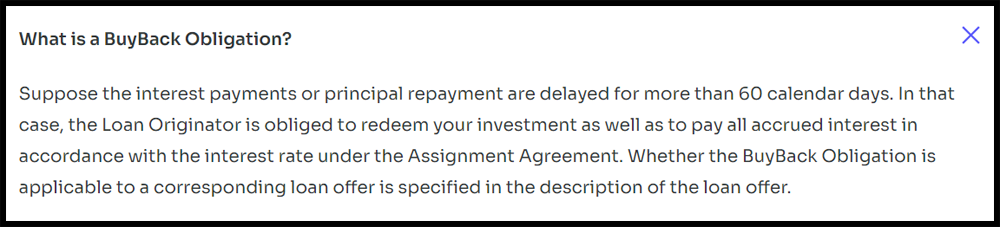

Buyback Guarantee

Esketit promotes the concept of a buyback guarantee, whereby the loans are repurchased by the lenders after the loans are 60+ days late in the repayment schedule. Here, also the accrued interest is reimbursed. On top, AvaFin Holding offers an additional group guarantee as a liability for its own lenders.

Esketit Forum

If you have questions about Esketit, other platforms or different p2p-related topics, you can join the re:think P2P Community on Facebook and engage in discussions with more than 1,000 other private retail investors.

Alternatively, you can also find the latest news and updates on my Telegram channel.

Esketit Taxes

Generally, interest income generated by loan financing is considered investment income and must be reported as such on the tax declaration. Unlike other platforms, Esketit does not withhold any taxes at the moment.

For the tax declaration, investors can download an income statement for tax report purposes as PDF within the “Statement” tab in the main menu. This information can then be used and forwarded to the tax office.

Esketit Risks

Investors should look carefully at the potential risk factors when evaluating a P2P platform. What is it that investors need to be aware of when it comes to Esketit? Where are the underlying risks and how are they assessed?

The platform itself is providing a list of potential risk elements that could mature for investors. These include e.g. regulatory risk, credit default risk or loan originator risk.

War in Ukraine

Esketit has not been affected directly by the war in Ukraine, as their lending companies don’t operate in neither Ukrainian or Russia. There doesn’t seem to be any indirect influences either, as the platform was able to continue its day-to-day operations as usual.

The funded loan volumes in 2022 have also shown that investors have not perceived any threats on Esketit either.

Esketit Loans in Jordan

The fact that political risks should not be underestimated has been proven not least by the war in Ukraine. The increasing tensions in the Middle East also lead to Jordan loans on Esketit being under special observation.

The fact that political risks should not be underestimated has been proven not least by the war in Ukraine. The increasing tensions in the Middle East also lead to Jordan loans on Esketit being under special observation.

The local management commented on Telegram that Jordan, due to its neutrality, has always been a stable cornerstone in the politically unstable region of the Middle East. The management doesn’t see any negative effects at the moment. Instead, the lender is experiencing stable growth in loan volume, while at the same time maintaining a calculable risk profile.

The majority of the 184 participants who were asked in a survey about their reactions to the war in Israel came to a similar assessment. More than half of the respondents indicated that they would leave their investment in Esketit unchanged. 32% will temporarily pause their investment, while 12% will actively sell their investments and 8% will increase their position.

Is Esketit a Safe Platform?

Esketit can be assessed as a safe P2P platform, although there is still room for improvements in terms of more transparency and security.

This includes publishing audited financial statements or becoming a regulated entity.

On the other hand, there are also good arguments that speak for the safety of Esketit:

- Loan Default Risk: Esketit’s founders have 10+ years of experiences in the lending industry, so they are familiar with responsible lending practices. In the event of loan defaults, investors are covered by a buyback guarantee, which has been honored to date without any problems.

- Lender Risk: In the event of difficulties with a specific lender, the Group guarantee can serve as a hedge if necessary. If this isn’t the case, the claim rights against the borrower still exist.

- Regulatory Risk: Even though Esketit is not a regulated platform, at least all lenders that are promoted on the marketplace are. These are subject to national guidelines and regulations when granting consumer loans.

Pros & Cons

In this section I have listed the most important advantages and disadvantages of Esketit.

Advantages

- Lender Support: With AvaFin (formerly Creamfinance), Esketit is supported by a big, profitable and established non-bank lender in its lending activities.

- Strong Partners: In addition to AvaFin, Eskeit holds close ties to Capitec Bank (the largest retail bank in South Africa), which they have on their side as a strategic partner and investor.

- Experienced Founders: Both Esketit founders have many years of experiences in the lending business and a proven-record of establishing succesful businesses.

- High Liquidity: Whether PayDay Loans, secondary market or early cash-out via Esketit Strategies, investors have the opportunity to access their funds in a short period of time.

- No Fees: No fees or hidden costs apply for investors on Esketit.

Disadvantages

- Regulation: Esketit opted for being an Irish-based company and is therefore not subject to any supervision by a financial authority.

- Segregation of Funds: Obtaining an EMI license, either directly or in collaboration with a payment service provider, would increase the security of stored funds.

- Possible Liability: According to a clause in Esketit’s general terms and conditions, investors may contribute to costs in case of a recovery process.

- Conflict of Interest: There is a shareholder overlap between Esketit and AvaFin, which could cause a negative impact for investors in the event of an emergency.

Esketit Alternatives

The closest Esketit alternatives that investors can find is by looking at platforms such as PeerBerry, Robocash or Lendermarket. All those platforms have a strong and established lender in the background, which provides the platform with a sufficient loan supply.

You can find other Esketit alternatives on the P2P Platform Comparison page.

Esketit Community Feedback

Esketit made the biggest jump forward of all platforms in the Community Voting 2023, improving by 1.97 points to a total score of 4.15 (71 votes). This leads to Esketit being the voted as the most popular P2P platform out of 30 competitors.

In the previous year, Esketit ranked only 18th out of 20.

Other platforms in top 5 have been Robocash, PeerBerry, LANDE and Income Marketplace.

Summary Esketit Review 2024

What the final verdict of my Esketit review and which conclusions can be drawn for investors?

With a track record of 3+ years, Esketit is still a among the younger P2P platforms. Nevertheless, the platform achieved an impressive growth during this time and has built up a good reputation in the P2P environment.

The main arguments in favour of Esketit are the platform’s strong partners (AvaFin Holding and Capitec Bank), a very experienced founding team, a compelling offer compared to other platforms (high interest rates and high liquidity) and reliable repayments, taking into account the buyback obligation that has always been fulfilled.

The framework at Esketit is therefore in place to establish itself at the forefront of the top P2P platforms in the long term. If you are looking for a reliable P2P platform and want to add short-term consumer loans to your portfolio, you should consider giving a chance to Esketit.

FAQ Esketit Review

Esketit is an Irish-based P2P platform with Latvian roots, founded in July 2020. Investors can fund a variety of international consumer loans on the platform, while earning an average return of 12%.

The “Esketit Platform Ltd.” is owned 50% each by the two founders Davis Barons and Matiss Ansviesulis. In 2012, both businessmen already founded the Latvia-based SIA Cream Finance, which operates as an international non-bank lender in the consumer loans segment. At this company too, the shares are split 50/50 between the two Latvians.

Esketit earns money primarily through commission fees that are charged to lenders represented on the platform. These fees are divided into a fixed fee and a variable fee, which is calculated depending on the financed loan volume. The average commission is around 2%, which thus corresponds to a normal market rate.

If you consider investing on Esketit, a sign up through this link will enable you to get an unlimited cashback bonus of 0,5% in the first 90 days after registration.

Hi, ich bin Denny! Seit Januar 2019 schreibe ich auf diesem Blog über meine Erfahrungen beim Investieren in P2P Kredite. Meine Analysen sollen Privatanlegern dabei helfen reflektierte und gut informierte Anlageentscheidungen treffen zu können. Dafür schaue ich mir die Risikoprofile der einzelnen P2P Plattformen an, hinterfrage deren Entwicklungen, teile meine persönlichen Einschätzungen und beobachte übergeordnete Trends aus der Welt des Crowdlendings.

Mein Bestseller "Geldanlage P2P Kredite" gilt in Fachkreisen als das beste deutschsprachige Finanzbuch zum gleichnamigen Thema. Zudem versammeln sich in der P2P Kredite Community auf Facebook tausende von Privatanlegern, die sich regelmäßig über die Anlageklasse P2P Kredite austauschen.