In recent years, PeerBerry has developed into one of the biggest and most trusted P2P platforms in Europe.

The trust of many investors derives from the reliability of the platform, which has emerged stronger from crisis situations than almost any other platform. Due to its attractive risk-reward profile, PeerBerry has developed into the biggest position of my personal P2P portfolio since September 2022.

Nevertheless, there are some crucial risk elements that investors need to be aware of before investing on the Croatian marketplace. Further explanations can be found within this extensive PeerBerry review.

All the information that are covered in this PeerBerry review are based on my own personal experiences with the platform for the past years. Please make sure to do your own due diligence before investing on any platform. More information can be found in the Disclaimer.

Further analyses of other platforms can be found on my P2P Platform Review page.

PeerBerry Overview

Before we get started, here is a quick summary with the most important information about PeerBerry.

| Founded / Started: | June 2017 / November 2017 |

| Legal Name: | PeerBerry d.o.o. (LINK) |

| Headquarter: | Zagreb, Croatia |

| Regulated: | No |

| CEO: | Arunas Lekavicius (January 2019) |

| Community Voting: | 3.97 out of 5 | See Voting |

| Assets Under Management: | EUR 108+ Million (April 2024) |

| Number of Investors: | 81.000+ (April 2024) |

| Expected Return: | Up to 12.50% |

| Primary Loan Type: | Consumer Loans |

| Collateral: | Buyback Guarantee |

| Bonus: | 0.5% Cashback for 90 Days |

About PeerBerry

PeerBerry is a Croatian P2P marketplace with Lithuanian roots, where investors can take advantage from a variety of international consumer loans, while earning a return of up to 12.5%.

PeerBerry is a Croatian P2P marketplace with Lithuanian roots, where investors can take advantage from a variety of international consumer loans, while earning a return of up to 12.5%.

The platform started operations in November 2017 and hence belongs to the more experienced and established players in the market. Considering KPIs such as assets under management or investor count, the marketplace is currently one of the biggest and fastest growing P2P platforms in Europe.

The engine behind PeerBerry is the Aventus Group, which offers a wide range of consumer and business loans on the marketplace for financing.

The Origin Story

PeerBerry is holding close ties to Aventus Group, a company founded in 2009. Within Aventus are currently 12 international non-bank lending companies that primarily finance short-term and unsecured consumer loans. The majority of them are located in Europe.

In order to access cheaper as well as a broader range of funding sources for their lending operations, Aventus founded the PeerBerry platform back in 2017.

In the early stages, the development of PeerBerry was significantly supported by Aušra Čiuplienė (picture) who was the CEO of the platform from September 2017 to January 2019. A year earlier, she had already worked as Chief Risk Officer at the Aventus Group. In an interview from July 2019, Aušra was talking about the early years of building up and growing the PeerBerry platform.

Aventus Group

The Aventus Group was founded in 2009. The company assembles a number of international non-bank lenders under one roof.

The Group’s credit offering is spread across 18+ different markets. In addition to the European focus, an increasing number of business areas is developing in emerging markets such as India, the Philippines or Mexico. The loans are primarily short-term and unsecured consumer loans.

The Aventus Group uses the PeerBerry marketplace to finance parts of its loan portfolio. At the end of 2023, 66% of all outstanding loans came from Aventus Group lending companies.

PeerBerry is currently the only external source of funding for Aventus loans.

Ownership

Who owns PeerBerry? PeerBerry is owned by three different shareholders. 50% of the shares are held by Andrejus Trofimovas who is also CEO of the Aventus Group.

Who owns PeerBerry? PeerBerry is owned by three different shareholders. 50% of the shares are held by Andrejus Trofimovas who is also CEO of the Aventus Group.

The Lithuanian is an experienced businessman with a background in fintech and property. He has been CEO of Aventus Group since January 2017 and has since ensured that PeerBerry investors have received their repayments even in times of crisis.

The other 50% are shared equally by the two Lithuanian private investors Vytautas Olšauskas and Ivan Butov.

PeerBerry Management

Arunas Lekavicius has been CEO of the PeerBerry platform since January 2019. In his time before PeerBerry, he worked for nearly four years at 4finance, one of the largest non-bank lenders in Europe.

Further information about the team members can be found on this page.

Business Model & Finances

Throughout the process of due diligence, investors should also have a look at the business model of a P2P platform as well as the overall financial situation. How does the company earn money? Does the platform operate profitably? And how well is the company positioned financially? In the following paragraphs of this PeerBerry review, you can follow-up on those questions.

Monetization

PeerBerry is earning money primarily through fees and commission income. These are paid by the lenders that offer their loans for funding on the marketplace. The commission fee can range from 1% to 5%. The exact commission depends on the quality of the lender and its loan portfolio.

In 2021, PeerBerry was able to generate EUR 3.69 million in revenue.

Profitability

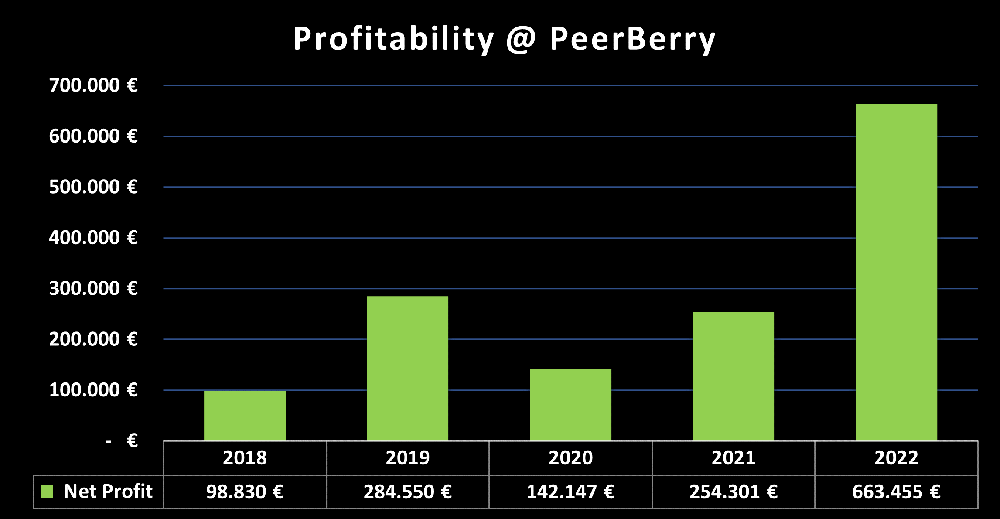

PeerBerry is a profitable P2P platform. According to the annual report for 2022, the platform was able to achieve a record profit of EUR 663,455. Despite the difficult circumstances due to the war in Ukraine, the platform finished the fifth year in a row with a profitable business result.

But as in recent years as well, investors should keep in mind that PeerBerry doesn’t publish financial reports that are audited and that are neither prepared in accordance with IFRS standards.

Sign Up and Bonus

To invest on PeerBerry, investors must meet three requirements:

- A minimum age of 18 years,

- a residence in the European Economic Area

- and a European bank account.

The sign-up process is fairly simple and intuitive. After opening the account via email, the KYC (Know-Your-Customer) and AML (Anti-Money-Laundering) questionnaires must be completed. This is followed by the verification of the identity and the confirmation of the tax residence.

The sign-up process is fairly simple and intuitive. After opening the account via email, the KYC (Know-Your-Customer) and AML (Anti-Money-Laundering) questionnaires must be completed. This is followed by the verification of the identity and the confirmation of the tax residence.

Also legal entities have the opportunity to sign up on PeerBerry.

Bonus for New Investors

If you want to invest on PeerBerry, you will receive a cashback bonus of 0.5% if you register via this link.

Investing on PeerBerry

How does PeerBerry work and what should investors know and consider when investing on the plaform? In the following sections of my PeerBerry review you will find all the necessary information that you need.

Loan Offering

PeerBerry promotes four different lender groups on its marketplace: Aventus Group, Gofingo, Lithome and SIBgroup.

Through these lenders, investors have the opportunity to invest in five different types of loans: Short-term consumer loans (up to max. 30 days), long-term consumer loans, real estate loans, leasing loans and business loans.

The geographic focus of the lenders is very international. Thus, investors have the opportunity to invest in borrower countries such as Czech Republic, Lithuania, Kazakhstan, Moldova, Poland, Sri Lanka, Vietnam or Spain, among others.

With the outbreak of war in Ukraine, lending companies from both Russia and Ukraine have been temporarily suspended.

Costs and Fees

Currently, there are no costs or hidden fees for investors at PeerBerry. Neither for deposits or withdrawals. Also investing on the platform is free of charge.

Expected Returns on PeerBerry

PeerBerry is currently promoting a return of up to 12.5% on its homepage. Investors should take notice that the interest rates on PeerBerry can be adjusted depending on the market environment and lender needs.

PeerBerry is currently promoting a return of up to 12.5% on its homepage. Investors should take notice that the interest rates on PeerBerry can be adjusted depending on the market environment and lender needs.

My personal investment experience with PeerBerry goes back to June 2021. During this period, I was able to achieve a return of 12.86%. Both the additional bonus through the loyalty program as well as the above-average interest paid throughout 2022 have helped to push the return this far.

Through the loyalty program, investors have the opportunity to receive additional cashback depending on the amount invested:

- Silver: 0.5% Cashback for outstanding investment portfolio > EUR 10,000

- Gold: 0.75% Cashback for outstanding investment portfolio > EUR 25,000

- Platinum: 1% Cashback for outstanding investment portfolio > EUR 40,000

Auto Invest

On PeerBerry, investors have a chance to invest in loans manually as well as through an Auto Invest.

The PeerBerry Auto Invest allows investors to select individual lenders as well as borrower countries, loan terms, interest rates, investment amount, loan type or the buyback guarantee option.

The minimum investment amount per loan is currently EUR 10, which is common practice for most consumer loan focused platforms.

A secondary market, which would offer additional liquidity for investors, is currently not available.

PeerBerry Buyback Guarantee

PeerBerry, among other platforms, also offer a buyback guarantee. In this case, loans are repurchased by the respective lenders in the event of loans being 60+ days late for repayment. In addition, some lenders also offer an additional group guarantee as a liability option.

| Lender | Buyback Guarantee | Group Guarantee |

|---|---|---|

| Aventus Group | Yes | Yes |

| Gofingo | Yes | Yes |

| Lithome | Yes | No |

| SIBgroup | Yes | No |

The PeerBerry T&C make it clear that PeerBerry doesn’t cover for any liability that is offered or promoted by their lending companies.

The User is aware of the risk of default on Borrower’s obligations, as a result of which the User might not fully recover the Claim. The Loan Originator will perform all the necessary and allowed actions to facilitate timely and full recovery of the Claim without an involvement of the User. In event of the Borrower’s default, PeerBerry and the Loan Originator shall not assume the responsibility for the security of the Claim.

PeerBerry App

If you want, you can also use the mobile app from PeerBerry. The PeerBerry App was launched in 2021 and can be downloaded from the operating systems iOS (App Store) or Android (Play Store).

PeerBerry Forum

If you have questions about PeerBerry, other platforms or different p2p-related topics, you can join the re:think P2P Community on Facebook and engage in discussions with more than 1,000 other private retail investors.

Alternatively, you can also find the latest news and updates on my Telegram channel.

PeerBerry Taxes

Generally, interest income generated by loan financing is considered investment income and must be reported as such on the tax declaration.

Unlike other platforms, PeerBerry does not withhold taxes through interest income such as in Latvia or Lithuania.

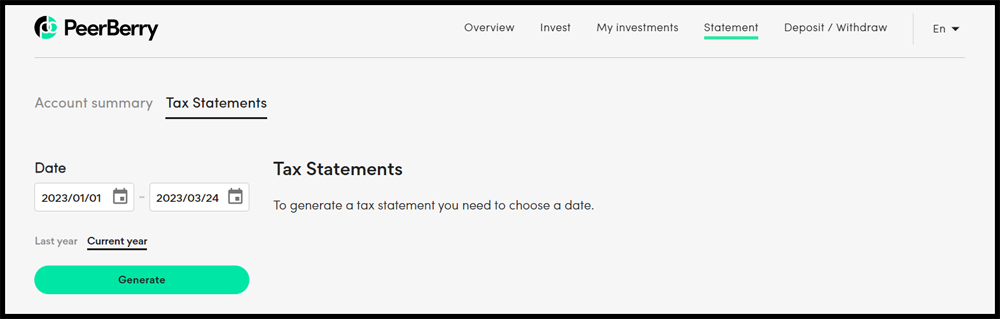

Through the dashboard, investors can download an extract of the tax report for the given year, where the corresponding income is listed.

PeerBerry Risks

Investors should look very carefully at the potential risk factors when evaluating a P2P platform. What is it that investors need to be aware of when it comes to PeerBerry? Where are the underlying risks and how are they assessed?

Something that clearly stands out is that the platform seems very good at handling crisis situations, which make the marketplace emerge even stronger.

Corona Crisis / Covid-19 Pandemic

12 months after the global Covid-19 pandemic hit, PeerBerry has to be seen as one of the big beneficiaries, since the outstanding portfolio amount has more than doubled since March 2020.

12 months after the global Covid-19 pandemic hit, PeerBerry has to be seen as one of the big beneficiaries, since the outstanding portfolio amount has more than doubled since March 2020.

PeerBerry has performed according to it promises and delivered a very stable and reliable performance throughout all the time, whereas many competitors have struggled to deal with a steady cashflow. There have been no delays in payments, defaults or other inconveniences for investors. Instead, PeerBerry delivered was straight forward communication on how the situation would be handled and what investors could expect.

When necessary, lenders have repurchased late loans in a timely and reliable manner. Aventus Group, by far the biggest lender on the marketplace, even generated a net profit of EUR 10 million in 2020 despite difficult market conditions.

War in Ukraine

The war in Ukraine has had a massive impact on PeerBerry. A total of 12 lenders on PeerBerry have been affected by the war in Ukraine and the sanctions against Russia. The outstanding loan portfolio in Russia and Ukraine, at the time of the outbreak of the war, amounted to approximately EUR 50 million.

PeerBerry has communicated that the primary goal is that investors will not suffer any capital losses. In the initial planning, the platform assumed that the outstanding receivables, of the loans affected by the war, would be repaid in full within 24 months.

In fact, the investment platform has made considerable progress in repaying loans affected by the war. By the end of 2023, 92% of all outstanding claims had already been repaid to investors.

Is PeerBerry Safe?

In general, PeerBerry can be seen as a safe P2P platform, although there is still potential for more transparency and security.

On one hand, the annual reports are not audited by a major auditor, nor are they reviewed in accordance with IFRS standards. On the other hand, the non-regulated platform operations should be reviewed as well. PeerBerry cites that, unlike the EU crowdfunding regulation, there is no EU-wide regulation for online P2P marketplace lending.

Although this is a correct statement, PeerBerry also had the choice of operating in a regulated environment in Latvia – which was ultimately refused. PeerBerry looks on regulation as a trade-off between the costs incurred and the actual value added for investors. Since PeerBerry has delivered impeccably so far, the few flaws seem to be tolerable for investors.

Pros & Cons

In this section I have listed the most important advantages and disadvantages of PeerBerry.

Advantages

- Track Record: PeerBerry has now been in the market since 2017, while funding EUR 2+ billion loans during that time.

- Strong Lenders: The platform collaborates with big, established and profitable non-bank lending companies.

- Crisis-Proven: No matter Corona pandemic or the war in Ukraine, PeerBerry has showcased very good crisis management, which enabled them to emerge even stronger.

- Risk Management: PeerBerry has implemented several rules to ensure a good performance on the platform. Lenders can for instance only offer max. 45% of their loan portfolio on P2P platforms. Also, a liquidity reserve of 10% of the loan book value must be formed to immediately service loan defaults if necessary.

- Clean Slate: So far, no payment delays nor investment losses have occured on the platform.

- Liquidity: Due to the majority of loans being short-term, investors can access their funds fairly quickly – even without a secondary market.

Disadvantages

- Regulation: PeerBerry has decided to withdraw its application to become a licensed investment brokerage firm in Latvia after being in the process for more than two years. Instead, the platform settled in Croatia.

- Audited Reports: To date, PeerBerry does not publish audited financial reports.

- Conflicts of Interest: Andrejus Trofimovas ist both UBO of Aventus Group and PeerBerry.

PeerBerry Alternatives

The closest PeerBerry alternatives that investors can find are Mintos and Income Marketplace. In both cases, the marketplace approach is the common business model.

You can find other PeerBerry alternatives on the P2P Platform Comparison page.

PeerBerry Community Feedback

The Croatian-based P2P platform is extremely popular among German investors. In 2021, PeerBerry achieved a score of 3.56, in 2022 it was 3.33 points and in 2023 even 3.97 points. This means that PeerBerry has always been among the six most popular platforms in the P2P lending community.

In 2023, only Esketit (4.15) and Robocash (4.13) were able to achieve an even better result.

Summary PeerBerry Review 2024

PeerBerry is one of the best and most popular P2P platforms in Europe.

Its great popularity is in particular due to the platform’s stability and crisis management. Whether a lack of regulation, the coronavirus pandemic or the war in Ukraine, the platform has emerged even stronger from every difficult situation to date.

The increasing market maturity and market penetration, coupled with competitive interest rates, make PeerBerry one of the first platforms to consider for new investors in 2024.

It is therefore no surprise that PeerBerry has become the largest position in my personal P2P portfolio since September 2022. If the marketplace continues to maintain its reliability, I will remain invested with a larger amount for a very long time to come.

FAQ PeerBerry Review

PeerBerry is a Croatian P2P marketplace with Lithuanian roots, where investors can take advantage from a variety of international consumer loans while earning a return of up to +12.5%.

PeerBerry is owned by three different shareholders. 50% of the shares are held by Andrejus Trofimovas who is also CEO of the Aventus Group. The other 50% are shared equally by the two Lithuanian private investors Vytautas Olšauskas and Ivan Butov.

PeerBerry is earning money primarily through fees and commission income. These are paid by the lenders that offer their loans for funding on the marketplace. The commission fee can range from 1% to 5%. The exact commission depends on the quality of the lender and its loan portfolio.

If you want to invest on PeerBerry, you will receive a cashback bonus of 0.5% if you register via this link.

Hi, ich bin Denny! Seit Januar 2019 schreibe ich auf diesem Blog über meine Erfahrungen beim Investieren in P2P Kredite. Meine Analysen sollen Privatanlegern dabei helfen reflektierte und gut informierte Anlageentscheidungen treffen zu können. Dafür schaue ich mir die Risikoprofile der einzelnen P2P Plattformen an, hinterfrage deren Entwicklungen, teile meine persönlichen Einschätzungen und beobachte übergeordnete Trends aus der Welt des Crowdlendings.

Mein Bestseller "Geldanlage P2P Kredite" gilt in Fachkreisen als das beste deutschsprachige Finanzbuch zum gleichnamigen Thema. Zudem versammeln sich in der P2P Kredite Community auf Facebook tausende von Privatanlegern, die sich regelmäßig über die Anlageklasse P2P Kredite austauschen.