Bondster is a Czech P2P marketplace where investors can finance loans from external lenders. By doing so, the platform advertises an above-average return of up to 14%.

This Bondster analysis tries to cover everything investors need to know prior making an investment decision. Is Bondster worth your time and money? Let’s find out!

All the information that are covered in this Bondster review are based on my own research. Please make sure to do your own due diligence on this or any other platform before investing. More information can be found in the Disclaimer.

Further analyses of other platforms can be found on my P2P Platform Review page.

Bondster Overview

Before we get started, here is a quick summary with the most important information about Bondster.

| Founded / Started: | June 2014 / May 2017 |

| Legal Name: | BONDSTER Marketplace s.r.o. (LINK) |

| Headquarter: | Prague, Czech Republic |

| Regulated: | No |

| CEO: | Pavel Klema (November 2020) |

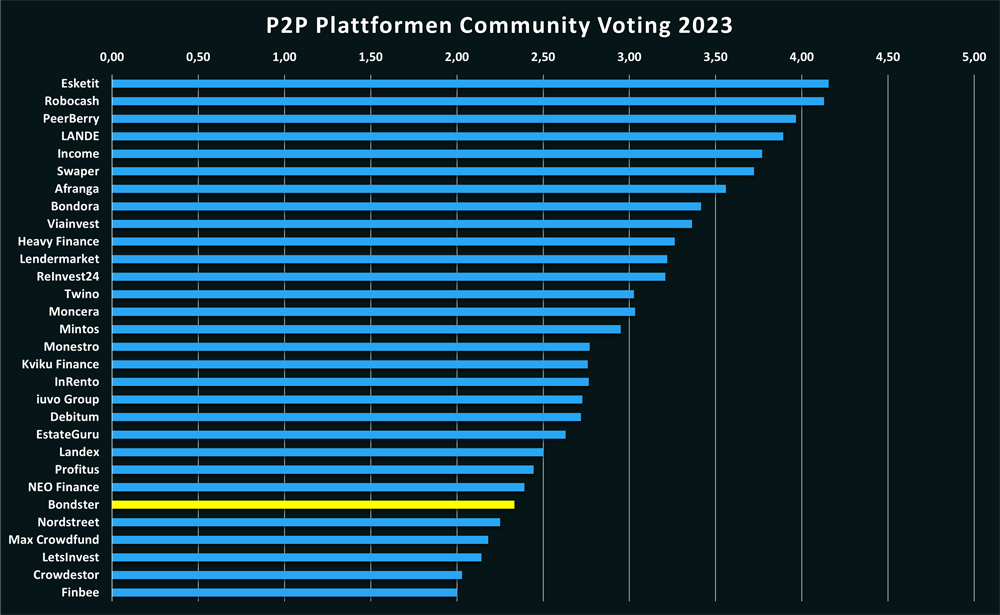

| Community Voting: | 2,33 out of 5 | See Voting |

| Assets Under Management: | Not Disclosed |

| Number of Investors: | 20.000+ (April 2024) |

| Expected Return: | Up to 17% |

| Primary Loan Type: | Consumer Loans |

| Collateral: | Buyback Guarantee |

| Bonus: | 1% Cashback for 90 Days |

About Bondster

Bondster is a Czech-based P2P platform, launched in May 2017, where investors can invest in a variety of international consumer loans, while earning an advertised return of up to 14%.

The platform has already gained some market experiences in previous years. Given the funded loan volumes though, Bondster is still one of the smaller platforms in the current P2P environment.

Ownership

Who owns Bondster? Bondster is 100% owned by the Czech company CEP Invest Private Equity. The ultimate beneficiary shareholder (UBO) of this company is the Czech investor and businessman Václav Valeš. The platform’s strategic partner is ACEMA Credit Czech, a.s.

Bondster Management

In November 2020, Pavel Klema was introduced as the new CEO of Bondster, following a number of changes at the top of the company.

In November 2020, Pavel Klema was introduced as the new CEO of Bondster, following a number of changes at the top of the company.

Pavel has 10+ years of experiences in the financial sector. Among other jobs, he has also worked in the lending sector in management positions.

Prior to Bondster, he spent three years at Czech non-bank lender Profi Credit Czech, where he was their CEO for two years.

The contact with Bondster came through Profi Credit in 2019, as they had exchanged ideas about a cooperation on the marketplace at the time.

Business Model & Finances

Throughout the process of due diligence, investors should also have a look at the business model of a P2P platform as well as the overall financial situation. How does the company earn money? Does the platform operate profitably? And how well is the company positioned financially? In the following paragraphs of this Bondster review, you can follow-up on those questions.

Monetization

Bondster earns money through different fees that are charged to the lenders on the marketplace. At the core, there are two pillars:

- A commission fee for funding the loans (up to a maximum of 3%).

- A fixed platform fee for administration and management.

For investors, investing on Bondster is free of charge. However, if you want to invest in Czech crowns, you pay a 1% fee of the invested amount.

Profitability

Is Bondster profitable? The Bondster platform does not publish regular annual reports. This makes it difficult to assess the profitability and overall financial situation of the company. Investors should take the lack of transparency into account when evaluating the P2P platform.

The latest official information corresponds to the published annual report for 2020, which showed a loss of EUR 20,000. However, this annual report was neither audited nor reviewed in accordance with current reporting standards.

Sign Up and Bonus

To invest on Bondster, investors must meet three requirements:

- A minimum age of 18 years

- A residence in the European Union or the European Economic Area

- A bank account in the European Union in their own name.

Also legal entities with a company in the EU can register on Bondster.

The registration process is fairly simple and intuitive. After opening an account via email, the KYC (Know-Your-Customer) and AML (Anti-Money-Laundering) questionnaires must be completed. This is followed by the verification of the identity and the bank account.

Bondster Bonus for New Investors

If you register on Bondster via this link, you will receive a cashback of 1% on all investments made in the first 90 days after registration.

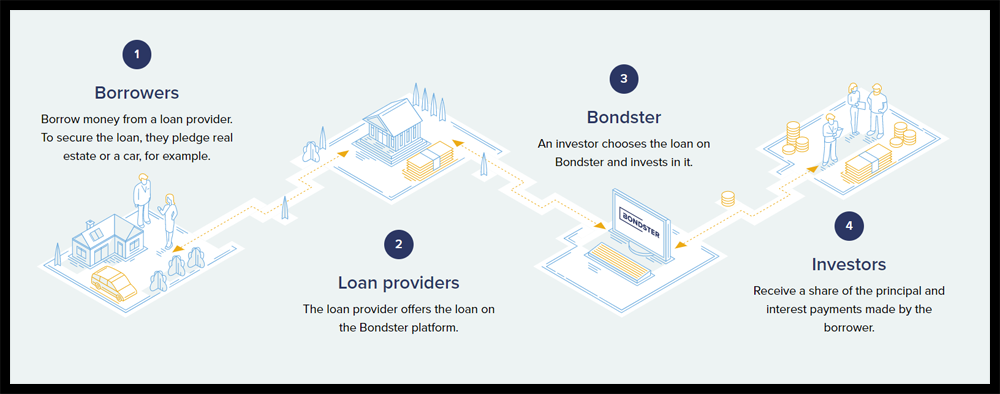

Investing on Bondster

How does Bondster work and what should investors know and consider when investing on the plaform? In the following sections of my Bondster review you will find all the necessary information that you need.

Loan Offering

Bondster is a P2P marketplace. This means a large number of international lenders are offering their loans for financing on Bondster. At the time of this Bondster review, there are almost 30 different lenders on the marketplace.

The majority of the loans offered on Bondster are consumer loans. Occasionally, there is also the possibility to invest in business or real estate loans.

There is no geographical focus among the borrower countries. In Europe, markets such as Bulgaria, the Czech Republic, Kazakhstan, Lithuania, Poland and Spain are represented. Outside Europe, there are also loans from Colombia, the Philippines, South Africa, Mexico or Russia.

Costs and Fees

Bondster is very transparent with regard to the cost and fee structure.

Bondster is very transparent with regard to the cost and fee structure.

There are no costs for investors for registering on the P2P platform, managing the account or investing on the primary market.

The only exception: While facilitating investments in Czech crowns, investors will incur currency exchange fees as well as a 1% fee for the amount of all investments made in CZK.

Expected Returns on Bondster

On its website, Bondster advertises an interest rate of up to 17%, which is above average in the context of comparable P2P platforms. However, the average expected return is stated as 13.6%.

On its website, Bondster advertises an interest rate of up to 17%, which is above average in the context of comparable P2P platforms. However, the average expected return is stated as 13.6%.

Because I consider Bondster’s risk profile to be too high, I personally have not yet invested on Bondster. Therefore, I cannot comment on a realisticly expected return.

Bondster Auto Invest

There are three ways for investors to invest on Bondster:

- Manual loan selection via the primary market

- Manual loan selection via the secondary market

- Automated investment strategy

With the automated investment strategy, investors can choose between three predefined options: A diversified strategy, a conservative strategy and a high-yield strategy.

The individual strategies differ in terms of the selection of individual lenders and the expected return. Those who want more control can also pursue a customised investment strategy and set their own criteria.

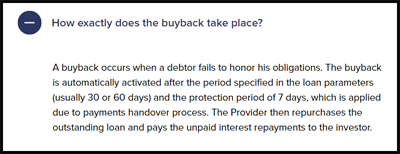

Bondster Buyback Guarantee

At Bondster, loans are offered both with and without a buyback guarantee.

At Bondster, loans are offered both with and without a buyback guarantee.

If a buyback guarantee is available, then the loans in delay are repurchased by the lender either after 30 or after 60 days. The outstanding interest is also to be refunded in the process.

Unfortunately, there are a many lenders on Bondster who have failed to fulfil this obligation in the past (including Right Choice Finance). The platform has not managed to enforce the interests of its investors.

Bondster Forum

If you have questions about Bondster, other platforms or different p2p-related topics, you can join the re:think P2P Community on Facebook and engage in discussions with 1,000+ other private retail investors.

Alternatively, you can also find the latest Bondster news and updates on my Telegram channel.

Bondster Taxes

In general, interest income generated by loan financing is considered capital income and must be declared as such in the tax return.

Bondster does not withhold any taxes, as is the case in Latvia or Lithuania.

For the tax declaration, investors can download a tax report for the respective year in the main menu. This information can then be submitted to the relevant tax office as part of a tax return.

Bondster Risks

Investors should look very carefully at the potential risk factors when evaluating a P2P platform. What is it that investors need to be aware of when it comes to Bondster? Where are the underlying risks and how are they assessed?

Covid-19 Pandemic / Corona Crisis

Investor interest in Bondster dropped significantly after the outbreak of the Corona pandemic, similar to other P2P platforms. The loan volume, which stood at EUR 4 million at the end of 2019, fell to around EUR 500,000 in the second quarter of 2020.

Polish lenders have been particularly problematic during this period, struggling with the introduction of new credit regulations (interest rate restrictions) even before Corona. The lack of liquidity and the introduction of interest moratoriums ensured that Bondster itself took over the loan portfolio of its former lenders from Poland and tried to collect the outstanding repayments through collection agencies.

Intransparency

Bondster has some problems in terms of transparency. Here are some examples:

- No data for development of assets under management.

- No performance data of individual lenders.

- No news and updates regarding problematic lenders.

- No publicly available annual reports. Neither on the platform nor on its lenders.

Transparency is a crucial aspect when making an educated investment decisions. The fact that Bondster does not meet these criteria is something investors should take into account.

Is Bondster a Safe P2P Platform?

Bondster operates in an unregulated environment. The platform is therefore not supervised or controlled by any authority. In addition, Bondster, like other platforms, has no form of deposit insurance. The total loss of the investment is therefore theoretically possible.

In addition, there are the indicated problems with regard to lender risk management and the outlined issues with transparency.

Overall, there are certainly much safer platforms than Bondster at the time of this review.

Pros & Cons

In this section I have listed the most important advantages and disadvantages of Bondster.

Advantages

- Interest Rates: Bondster offers above-average interest rates.

- Diversification: Investors have access to a variety of international lenders to diversify their loan portfolio.

- Liquidity: Investors can sell their loans prior maturity on the secondary market.

Disadvantages

- Regulation: There is no legislation in the Czech Republic regulating Bondster’s business activities.

- Transparency: The platform is extremely non-transparent on many levels.

- Risk Management: Many lenders on Bondster do not meet the buyback obligation on time or honor it at all.

- Ownership: Little is known about the Valeš family business, which controls Bondster through CEP Invest.

Bondster Alternatives

Those who prefer to invest in international consumer loans on P2P marketplaces should look at Mintos, PeerBerry and Income Marketplace as possible Bondster alternatives. In the Czech Republic itself, there is no alternative to Bondster worth mentioning.

You can find other PeerBerry alternatives on the P2P Platform Comparison page.

Bondster Community Feedback

Bondster is rated as a rather below-average platform in the P2P community. In the community voting 2023, a score of 2.33 was achieved with 24 votes. In the years before, Bondster reached 2.45 points (2022) and 2.37 points (2021).

The most popular platforms in 2023 included Esketit, Robocash, PeerBerry, LANDE and Income Marketplace.

Summary Bondster Review 2024

Bondster has been on the market since 2017. Although a certain market experience can’t be denied, the platforms development in recent years seems to be stagnant.

The platform’s poor risk management is something investors should be concerned about. Several lenders do not meet their obligations to repay according to schedule, with Bondster being unable to manage and represent the interests of its investors.

In addition, transparency and communication are also happening at a very low level. As a consequence, investors do not receive any news or information regarding current developments.

Considering the entire risk-reward profile, Bondster does not qualify at this point in time for an investment. Instead, investors should turn to other alternatives.

FAQ Bondster Review

Bondster is a Czech-based P2P platform, launched in May 2017, where investors can invest in a variety of international consumer loans and earn a return of up to 14%.

Bondster is 100% owned by the Czech company CEP Invest Private Equity. The ultimate beneficiary shareholder (UBO) of this company is the Czech investor and businessman Václav Valeš. The platform’s strategic partner is ACEMA Credit Czech, a.s.

On its website, Bondster advertises an interest rate of up to 17%, which is above average in the context of comparable P2P platforms. However, the average expected return is stated as 13.6%.

If you register on Bondster via this link, you will receive a cashback of 1% on all investments made in the first 90 days after registration.

Hi, ich bin Denny! Seit Januar 2019 schreibe ich auf diesem Blog über meine Erfahrungen beim Investieren in P2P Kredite. Meine Analysen sollen Privatanlegern dabei helfen reflektierte und gut informierte Anlageentscheidungen treffen zu können. Dafür schaue ich mir die Risikoprofile der einzelnen P2P Plattformen an, hinterfrage deren Entwicklungen, teile meine persönlichen Einschätzungen und beobachte übergeordnete Trends aus der Welt des Crowdlendings.

Mein Bestseller "Geldanlage P2P Kredite" gilt in Fachkreisen als das beste deutschsprachige Finanzbuch zum gleichnamigen Thema. Zudem versammeln sich in der P2P Kredite Community auf Facebook tausende von Privatanlegern, die sich regelmäßig über die Anlageklasse P2P Kredite austauschen.