In this LANDE review you will find an extensive deep dive analysis of the Latvian marketplace that offers investments in agricultural loans. The review will cover the origin story of the platform, the shareholder structure, the LANDE business model, investment-related topics as well as all risks that investors need to be aware of.

The LANDE review will wrap up with a pro and con debate as well as with my final verdict of the plaform.

All the information that are covered in this LANDE review are based on my own personal experiences with the platform since 2021. Please make sure to do your own due diligence before investing on any platform. More information can be found in the Disclaimer.

Further analyses of other platforms can be found on my P2P Platform Review page.

LANDE Overview

Before we get started, here is a quick summary with the most important information about LANDE.

| Founded / Started: | December 2009 / January 2021 |

| Legal Name: | SIA Secured Finance MGMT (LINK) |

| Headquarter: | Riga, Latvia |

| Regulated: | Yes (ECSP License) |

| CEO: | Nikita Goncars (June 2019) |

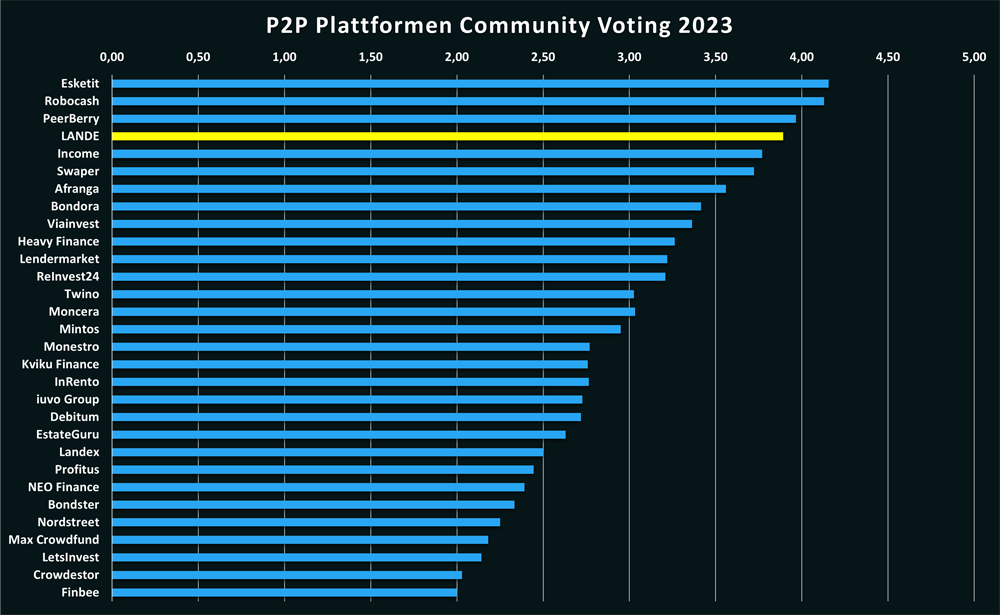

| Community Voting: | 3.89 out of 5 | See Voting |

| Assets Under Management: | EUR 13+ Million (April 2024) |

| Number of Investors: | 6.000+ (April 2024) |

| Expected Return: | 11,5% |

| Primary Loan Type: | Agricultural Loans |

| Collateral: | Mortgage |

| Bonus: | 1% Cashback for 180 Days |

About LANDE

LANDE (formerly LendSecured) is a Latvian P2P platform where investors can finance a variety of highly collateralized agricultural and development loans, earning an average return of 11.6%.

LANDE (formerly LendSecured) is a Latvian P2P platform where investors can finance a variety of highly collateralized agricultural and development loans, earning an average return of 11.6%.

With its business model, LANDE intends to close the underfinanced gap among small and medium-sized enterprises in the agricultural sector. According to a study by the European Investment Bank this gap has been between EUR 19.8 billion and EUR 46.6 billion in the European Union during 2020.

Due to its focus on the agricultural niche, LANDE offers an attractive opportunity for investors to diversify their P2P lending portfolio outside from traditional consumer loans.

The Origin Story

The origin of LANDE goes back to 2008. That year, Edgars Tālums, one of the two founders of LANDE, established the non-bank lender Latvijas Hipotēka. This is a company that specializes primarily in financing mortgage loans.

The origin of LANDE goes back to 2008. That year, Edgars Tālums, one of the two founders of LANDE, established the non-bank lender Latvijas Hipotēka. This is a company that specializes primarily in financing mortgage loans.

In 2011, Nikita Goncars joined the company as a second shareholder (35%) and business partner. Over the years, collateralization by agricultural land and smaller residential properties developed into a core competence of the company.

The loan financing came primarily from a small circle of wealthy private investors. Some of them are still cross-financing LANDE’s loan projects today (anchor investors). To help their investors monitoring their loan portfolios, the company created the first prototype of what is now known as the LANDE P2P platform in 2017.

In July 2020, a decision was made to allow also smaller retail investors to finance the loan portfolio, which enabled LANDE to further diversify their funding sources. The P2P platform was born.

Ownership

Who owns Lande? LANDE belongs to the Latvian company Secured Finance MGMT, which has been founded back in 2009. The company operates in real estate, mortgage lending and construction.

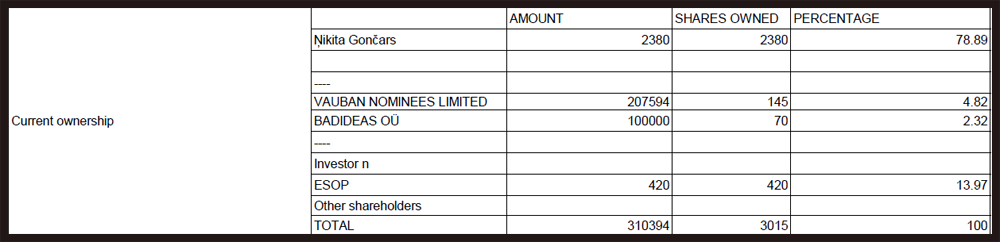

LANDE itself is owned by co-founder Nikita Goncars who holds 78.89% of the shares in the company. Employee stock ownership (ESOP) accounts for the second largest share with 13.97%, followed by VC investors Vauban Nominees (4.82%) and the Bad Ideas Fund (2.32%).

LANDE Management

Ņikita Gončars is the CEO, co-founder and strong man behind Latvian platform LANDE.

Ņikita Gončars is the CEO, co-founder and strong man behind Latvian platform LANDE.

He graduated from BA School of Business and Finance, one of the leading business schools in Latvia. He was then co-founding several companies in the financial, real estate and agricultural sectors. This was followed in June 2019 by the launch of LANDE, formerly LendSecured.

On this page, investors can get further insights into the platform’s team members.

Business Model & Finances

Throughout the process of due diligence, investors should also have a look at the business model of a P2P platform as well as the overall financial situation. How does the company earn money? Does the platform operate profitably? And how well is the company positioned financially? In the following paragraphs of this LANDE review, you can follow-up on those questions.

Monetization

LANDE earns its revenue on two different levels. On one side, there is a classic brokerage fee (success fee), which is due in the event of successful financing on the platform. This can amount to up to 10%.

On the other side, LANDE charges a monitoring fee, which is calculated from the outstanding repayment amount. This fee is between 1% and 4%.

Profitability

Is Lande profitable? Investors can access the key financial figures of the “Ltd. LANDE platform” on the website . Both the balance sheet and the profit-loss statement can be reviewed.

According to the report, the company made a profit of EUR 17,297 in 2022, with a turnover of close to EUR 350,000. However, investors should note that the reports have not been audited or checked from an external company.

Sign Up and Bonus

To invest on LANDE, investors must meet three requirements:

- A minimum age of 18 years

- Proof of residence in the European Economic Area

- SEPA bank account

The registration process at LANDE is fairly simple and intuitive. After opening the account via email, the KYC (Know-Your-Customer) and AML (Anti-Money-Laundering) questionnaires have to be completed. This is followed by the verification of identity.

Also legal entities have the opportunity to sign up on LANDE.

Bonus for New Investors

If you consider investing on LANDE, a sign up through this link will enable you to get a cashback bonus of 1% in the first 180 days after registration.

Investing on LANDE

How does LANDE work and what should investors know and consider when investing on the plaform? In the following sections of my LANDE review you will find all the necessary information that you need.

Loan Offering

The loans that are offered on LANDE can be segmented into five different areas:

- Seasonal loans secured with grain products

- Loans for agricultural machinery

- Loans for the purchase of land

In addition, two less common loan products are subsidized mortgage loans as well as factoring loans.

The primary borrower country on LANDE is Latvia. Target markets for global expansion include Lithuania, Romania, Bulgaria and Greece. The average loan term is currently 16 months.

Costs and Fees

There are no fees or hidden costs for retail investors on LANDE. Neither for deposits or withdrawals, nor for the functionalities when investing on the platform.

Expected Returns on LANDE

If you invest in agricultural loans with LANDE, you can achieve a return of up to 14% (taking cashback campaigns into account). The average interest rate is around 12%, depending on the market situation.

My personal return after 2+ years is only 7.7%. The reason for the slightly lower return is unresolved issues regarding some secondary market transactions. Without these, the total return would be around 10%.

LANDE Auto Invest

LANDE has launched an Auto Invest feature in December 2021. The Auto Invest is divided into “Basic” and “Advanced”.

With the basic Auto Invest, no criteria can be selected. This way, investors automatically invest in every loan that becomes avaiable. The minimum investment amount is EUR 50.

With the advanced Auto Invest strategy, investors can decide on the interest rate, the loan term and the Loan-to-Value (LTV). In order to use this strategy though, a minimum investment amount of EUR 250 for a single loan is required.

Secondary Market

LANDE integrated a secondary market in October 2020, where investors can sell their investments or buy already funded loans. Contrary to the minimum investment amount on the primary market (EUR 50), investors can purchase loans starting from EUR 2. No fees apply.

Investors that want to diversify their portfolio on a broader scale and that aim to allocate their funds a lot faster, the secondary market on LANDE can be a good place to start.

LANDE Buyback Guarantee

LANDE does not offer any kind of buyback guarantee. This is common practice for platforms that offer loans backed by collateral. The loans on LANDE are secured by mortgage with an average LTV of 43%, which is extremly low-risk. For comparison: Real estate platform EstateGuru offers an LTV average of 65%.

Whether the collateral may be overvalued can only be assessed when loans default and the collection processes have increased on the platform.

LANDE Forum

If you have questions about LANDE, other platforms or different p2p-related topics, you can join the re:think P2P Community on Facebook and engage in discussions with more than 1,000 other private retail investors.

Alternatively, you can also find the latest news and updates on my Telegram channel.

LANDE Taxes

Generally, interest income generated by loan financing is considered investment income and must be reported as such on the tax declaration. Unlike other platforms, LANDE does not withhold any taxes at the moment.

Generally, interest income generated by loan financing is considered investment income and must be reported as such on the tax declaration. Unlike other platforms, LANDE does not withhold any taxes at the moment.

For the tax declaration, investors can find the “Balance” tab in the main menu, where a tax report for the respective year can be downloaded as a PDF (“Income Statement”). This information can then be used to be submitted to the tax office.

LANDE Risks

Investors should look very carefully at the potential risk factors when evaluating a P2P platform. What is it that investors need to be aware of when it comes to LANDE? Where are the underlying risks and how are they assessed?

The get an idea about potential risk elements involved at LANDE, the platform published a list of aspects that investors need to be aware of. This includes market risk, liquidity risk, platform risk and many more.

Loan Default Risk

LANDE offers highly collateralized agricultural and development loans on its platform. The collateralization breaks down as follows:

- Properties and Agricultural Land: 46%

- Grain Products from Farm Production: 45%.

- (Heavy) Machinery: 9%

The average loan-to-value ratio is currently 43%. Should loan defaults occur, the loans appear to be well secured. The first loan defaults have all been successfully recovered to 100%.

War in Ukraine

The war in Ukraine has had a positive impact on LANDE. This is due to severe restrictions on the global trade of grain products, which has caused prices to skyrocket. At one point, a ton of wheat was traded for more than EUR 400, which meant an increase of 60%.

The war in Ukraine has had a positive impact on LANDE. This is due to severe restrictions on the global trade of grain products, which has caused prices to skyrocket. At one point, a ton of wheat was traded for more than EUR 400, which meant an increase of 60%.

Russia and Ukraine represent about 30% of world exports for wheat and barley. This has been beneficial to LANDE investors as approximately 50% of the outstanding loan portfolio has been secured with grain product purchase contracts. As the value of this collateral has increased significantly, the default risks for investors have also fallen at the same time.

To an extend this has also impacted new loans. Although the increasing grain prices also increase the production costs for borrowers, the harvest can also lead to a much higher asking price.

Is LANDE Safe?

LANDE is still a very young and relatively small P2P platform. Hence, investors should be cautious and follow developments closely. So far, the platform delivers very solidly and seems to be looking after the interests of its investors.

LANDE is still a very young and relatively small P2P platform. Hence, investors should be cautious and follow developments closely. So far, the platform delivers very solidly and seems to be looking after the interests of its investors.

So far, investors have not yet suffered any losses on their investments as securities have always had a sufficient risk buffer.

By obtaining the license as a regulated crowdfunding platform (ECSP), while publishing audited business reports, LANDE’s safety can be even further enhanced.

Pros and Cons

In this section I have listed the most important advantages and disadvantages of LANDE.

Advantages

- Attractive Niche: Agricultural loans are an exciting alternative compared to consumer loans as they offer investors an element of true diversification for their portfolio.

- Experienced Founders: Ņikita and Edgars are long-term business partners with loads of experiences in the financial, real estate and agricultural area.

- Segregation of Funds: By partnering with payment service provider Lemon Way, LANDE ensures proper segregation of investor funds and company capital.

- Collateral: The loan-to-value ratio on LANDE is very low. Only time and defaults can tell if collateral migh have been overvalued.

Disadvantages

- Track Record: LANDE is still a young and growing platform. Hence, the platform should be given time to integrate further functionalities and to deliver a stable performance over a longer period of time.

- Financial Reports: So far, there are no audited financial reports of the P2P platform, although a few financial figures of the group (also unaudited) have been published as a sign of goodwill.

- Regulation: LANDE is actively seeking to obtain the ECSP license in a timely manner. This would make the platform more compliant and ensure a higher level of transparency for investors.

LANDE Alternatives

If you are looking for a LANDE alternative you should keep an eye on HeavyFinance. The Lithuanian platform is also heavily promoting agricultural loans and hence offers the biggest overlap to LANDE.

You can find other LANDE alternatives on the P2P Platform Comparison page.

LANDE Community Feedback

The LANDE reviews within the P2P lending community are rated as above average. In the Community Voting 2023, a strong score of 3.89 was achieved with 93 votes (4th place out of 30). The year before, LANDE also reached 4th place (out of 20 platforms) with a score of 3.59.

In 2023, only Esketit (4.15), Robocash (4.13) and PeerBerry (3.97) have been more popular.

Summary LANDE Review 2024

What is the final verdict of my LANDE review and my personal opinion of the platform?

LANDE is a young P2P platform from Latvia that occupies an exciting and rapidly growing niche with its positioning in the agricultural sector. Hence, LANDE is a good fit for investors that seek to diversify their portfolio with strongly collateralized loans in the agricultural sector, while earning double-digit returns.

However, since LANDE has still to prove its performance throughout a longer period of time, the platform should only be considered from more experienced investors who have already built up a stable P2P lending portfolio.

FAQ LANDE Review

LANDE (formerly LendSecured) is a Latvian P2P platform where investors can finance a variety of highly collateralized agricultural and development loans, earning an average return of 11.6%.

LANDE is owned by co-founder Nikita Goncars who holds 78.89% of the shares in the company. Employee stock ownership (ESOP) accounts for the second largest share with 13.97%, followed by VC investors Vauban Nominees (4.82%) and the Bad Ideas Fund (2.32%).

LANDE earns its revenue on two different levels. On one side, there is a classic brokerage fee (success fee), which is payable in the event of successful financing on the platform. On the other side, LANDE charges a monitoring fee, which is calculated from the outstanding redemption.

If you consider investing on LANDE, a sign up through this link will enable you to get a cashback bonus of 1% in the first 180 days after registration.

Hi, ich bin Denny! Seit Januar 2019 schreibe ich auf diesem Blog über meine Erfahrungen beim Investieren in P2P Kredite. Meine Analysen sollen Privatanlegern dabei helfen reflektierte und gut informierte Anlageentscheidungen treffen zu können. Dafür schaue ich mir die Risikoprofile der einzelnen P2P Plattformen an, hinterfrage deren Entwicklungen, teile meine persönlichen Einschätzungen und beobachte übergeordnete Trends aus der Welt des Crowdlendings.

Mein Bestseller "Geldanlage P2P Kredite" gilt in Fachkreisen als das beste deutschsprachige Finanzbuch zum gleichnamigen Thema. Zudem versammeln sich in der P2P Kredite Community auf Facebook tausende von Privatanlegern, die sich regelmäßig über die Anlageklasse P2P Kredite austauschen.

Dont you think Lande is an EXTREMELY dangerous platform ?

All its loans are secured by land and other hard to sell and legally complicated assets?

I mean is Estateguru is taking years or maybe decades to recover failed investments and this is with houses I can only imagine Lande trying to sell some farmer’s field to recover investor’s money

Am I the only one thinking Lande is a tricking nuclear time bomb ?

How Lande is recovering defaulted assets will be interesting to watch, for sure. But so far, I don’t consider Lande being riskier than other comparable alternatives.