Income Marketplace is a comparatively new and rapidly growing platform in the current P2P environment. The P2P lending platform, which is based in Estonia, is characterised in particular by its highly innovative security concept, which is designed to significantly minimise the lender risk.

How good security features such as the junior share or the cash flow buffer actually are or whether they are just clever marketing tools to differentiate themselves from other P2P platforms such as Mintos & Co. is one of the topics covered in my Income Marketplace review 2024.

Please note that all the information that are covered in this Income Marketplace review are based on my own personal experiences with the platform. Please make sure to do your own due diligence before investing on any platform. More information can be found in the Disclaimer.

Further analyses of other platforms can be found on my P2P Platform Review page.

Income Marketplace Overview

Before we get started, here is a quick summary with the most important information about Income Marketplace.

| Founded / Started: | July 2020 / January 2021 |

| Legal Name: | Income Company OÜ (LINK) |

| Headquarter: | Tallinn, Estonia |

| Regulated: | No |

| CEO: | Lavrenti Tsudakov (October 2023) |

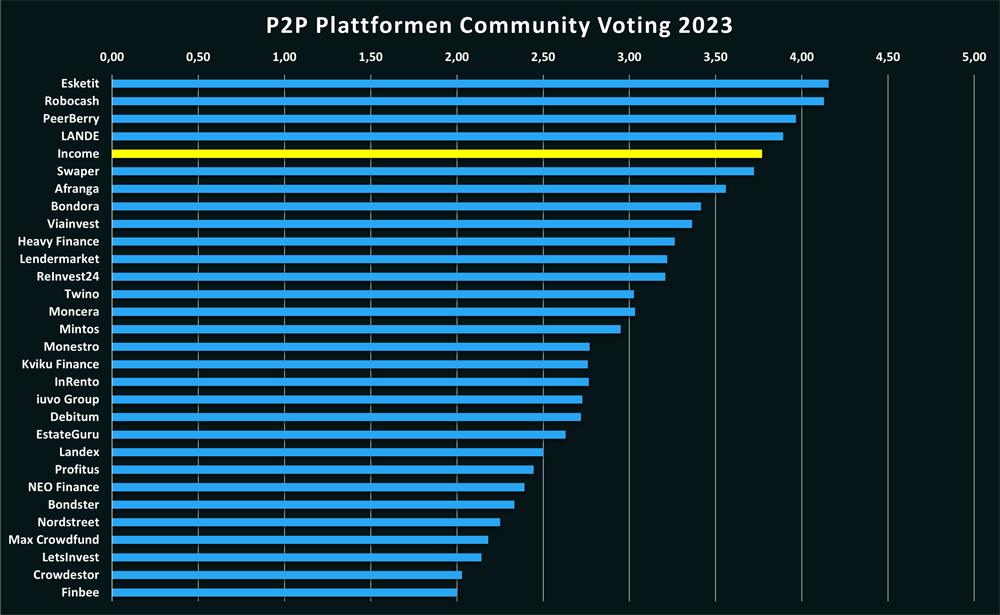

| Community Voting: | 3.77 out of 5 | See Voting |

| Assets Under Management: | EUR 10+ Million (April 2024) |

| Number of Investors: | 7.000+ (April 2024) |

| Expected Return: | 11,81% |

| Primary Loan Type: | Consumer Loans |

| Collateral: | Buyback Guarantee (60 Days) |

| Bonus: | 1% Cashback for 60 Days (with Code: Q6DCGX) |

About Income Marketplace

Income Marketplace is an Estonian P2P marketplace founded in July 2020 by Kimmo Rytkönen and Mikk Läänemets. Since 2021, investors can fund a wide range of international consumer loans on the platform, while earning returns of up to 15%.

Income Marketplace is an Estonian P2P marketplace founded in July 2020 by Kimmo Rytkönen and Mikk Läänemets. Since 2021, investors can fund a wide range of international consumer loans on the platform, while earning returns of up to 15%.

What is particularly outstanding about Income Marketplace is its marketing as the safest marketplace to invest in personal loans. This comes from newly developed security features such as the junior share or the cash flow buffer, which differ from the classic buyback guarantee concept.

In this Income Marketplace review you can find out if the P2P marketplace can live up to this expectations.

The Origin Story

Before he became CEO and co-founder of Income, Kimmo Rytkönen had already worked in the international lending business for more than 15 years. Among other projects, he was also the founder of the Polish lending company Aasa Polska, which was also present on the Mintos marketplace at the time.

His experiences are not just connected to the lender side though, as Kimmo was also involved as a private investor on many different P2P platforms over the years.

This way he experienced firsthand how little investors were protected after the pandemic outbreak and where the obvious problems and vulnerabilities have been in some marketplaces.

Kimmo subsequently took these events as an opportunity to build a new P2P lending marketplace according to his own ideas and with additional security features.

In July 2020, the company “Income Company OÜ” was then registered in the Estonian Company Register, which is considered the birth of Income Marketplace.

In September 2022 I was able to visit Income Marketplace in Tallinn, while also meeting and getting to know Kimmo in person. We had lengthy discussions and also recorded a podcast on this occasion.

Ownership

Who owns Income Marketplace? The majority shareholder and the ultimate beneficiary owner of Income Marketplace is Kimmo Rytkönen. He currently holds 28.91% of the shares through his company “KJ Holdings OÜ”. The second biggest shareholder is the German Dr. Karl Hauptmann with 17.34%. He is chairman of a large private equity group based in Berlin and is one of the platform’s early supporters.

MR Holdings 101 holds the third most shares with 14.03%. The Estonian Meliina Räty is one of the co-founders of the platform. The rest of the shares are distributed among the other founding team, angel investors, private equity firms or smaller private investors who recently secured shares in the company via Seedrs.

| Shareholder | Share of Income Marketplace |

|---|---|

| KJ Holdings OÜ | 28,91% |

| Dr. Karl-Heinz Hauptmann | 17,34% |

| MR Holdings 101 | 14,03% |

| Gulfstream Holdings OÜ | 7,36% |

| Mikk Läänemets | 4,44% |

Income Marketplace Management

Income Marketplace has a management team that is experienced across the board and appears very reputable to the outside world. On the team page you can find out more information about the most important people in the background of the platform.

CEO of Income Marketplace is Estonian Lavrenti Tsudakov since October 2023. He has previously worked for Income Marketplace since June 2021. At Income, he was COO of the platform, which is why he should have a good insight into the operational challenges in the day-to-day business.

CEO of Income Marketplace is Estonian Lavrenti Tsudakov since October 2023. He has previously worked for Income Marketplace since June 2021. At Income, he was COO of the platform, which is why he should have a good insight into the operational challenges in the day-to-day business.

Majority shareholder Kimmo Rytkönen, who has been CEO of the platform since its inception, will focus more on the strategic challenges at Income Marketplace. These include the onboarding of new lenders, the licensing process as a regulated P2P platform and the company’s next funding round.

Business Model & Finances

Throughout the process of due diligence, investors should also have a look at the business model of a P2P platform as well as the overall financial situation. How does the company earn money? Does the platform operate profitably? And how well is the company positioned financially? In the following paragraphs of this Income Marketplace review, you can follow-up on those questions.

Monetization

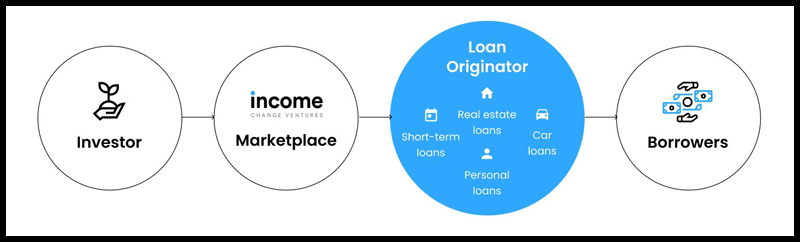

How does Income earn money? The marketplace earns its revenue primarily through a commission fee, which is charged to lenders on the marketplace. In this regard, the business and monetization model is not much different from other P2P marketplaces such as Mintos, Debitum or PeerBerry.

The commission fee at Income is between 2% to 4% of the outstanding loan portfolio and is calculated on a daily balance basis. Invoicing takes place on a monthly basis.

Profitability

Income Marketplace is not profitable yet. To reach break-even, the platform would need to achieve an outstanding portfolio of around EUR 20 million, given the current cost structure of the marketplace.

The P2P marketplace is yet to publish any audited reports on the company’s financial situation.

Sign Up and Bonus

To invest on Income Marketplace, investors must meet three requirements:

- A minimum age of 18 years,

- a residence in the European Economic Area

- and a European bank account.

The registration process at Income is fairly simple and intuitive. After opening the account via email, the KYC and AML questionnaires have to be completed, followed by the identity verification through Veriff.

Also legal entities have the opportunity to sign up on Income Marketplace.

Bonus for New Investors

If you consider investing on Income Marketplace, a sign up through this link will enable you to get an unlimited cashback bonus of 1% in the first 30 days after registration. A second requirement is that you also use my personal bonus code: Q6DCGX.

Investing on Income Marketplace

How does Income Marketplace work and what should investors know and consider when investing on the plaform? In the following sections of my Income Marketplace review you will find all the necessary information that you need.

Loan Offering

There are a variety of international lenders on Income. These are geographically spread over the following regions: Europe (including Estonia, Latvia, Finland and Bulgaria), South America (Mexico and Colombia), and Southeast Asia (Indonesia).

The loans themselves are predominantly short-term consumer loans. Depending on the lender, the loan term can be up to 72 months, although the average loan term is very short at 51 days. The average loan amount offered on the platform is EUR 114.

Costs and Fees

There are no fees or hidden costs for retail investors on Income Marketplace. Neither for deposits or withdrawals, nor for the functionalities when investing on the platform.

Expected Returns on Income Marketplace

The interest rate on P2P loans can be up to 15% on Income. According to the P2P platform, the average interest rate is currently 11.81%.

The interest rate on P2P loans can be up to 15% on Income. According to the P2P platform, the average interest rate is currently 11.81%.

So what are the returns investors can expect when investing in Income? My personal return in 2022 was 11.18%, whereas in 2023 it was 13.78%. A positive aspect to consider is that I have not been affected by any lender default and I haven’t been invested on ClickCash as well.

Depending on the selection and performance of the lenders, a return of between 9% and 12% seems to be realistic.

Auto Invest

On Income Marketplace, investors have the opportunity to invest manually in loans as well as through an Auto Invest feature.

With the Income Auto Invest, individual lenders can be selected as well as the borrower countries, the term of the loans, the interest rates, the investment amount, the loan type or the loan status. In addition, there are even more advanced filter options, where you can also filter by the total loan amount or the remaining loan amount, among other things.

The minimum investment amount per loan is currently EUR 10, which is common practice for most platforms.

Income Marketplace does not (yet) have a secondary market. The marketplace plans to introduce this functionality in the future though.

Income Marketplace App

In September 2021, Income Marketplace also released an app for the platform. Investors can download them through iOS (App Store) as well as via Android (Play Store).

Income Marketplace Forum

If you have questions about Income Marketplace, other platforms or different p2p-related topics, you can join the re:think P2P Community on Facebook and engage in discussions with more than 1,000 other private retail investors.

Alternatively, you can also find the latest news and updates on my Telegram channel.

Income Marketplace Taxes

Generally, interest income generated by loan financing is considered investment income and must be reported as such on the tax declaration. Unlike other platforms, Income Markeplace does not withhold any taxes at the moment.

For the tax declaration, investors can find an overview in the dashboard where a tax report for the respective year can be downloaded. This information can then be forwarded to the respective tax office as part of a tax declaration.

Income Marketplace Risks

Investors should look very carefully at the potential risk factors when evaluating a P2P platform. What is it that investors need to be aware of when it comes to Income Marketplace? Where are the underlying risks and how are they assessed?

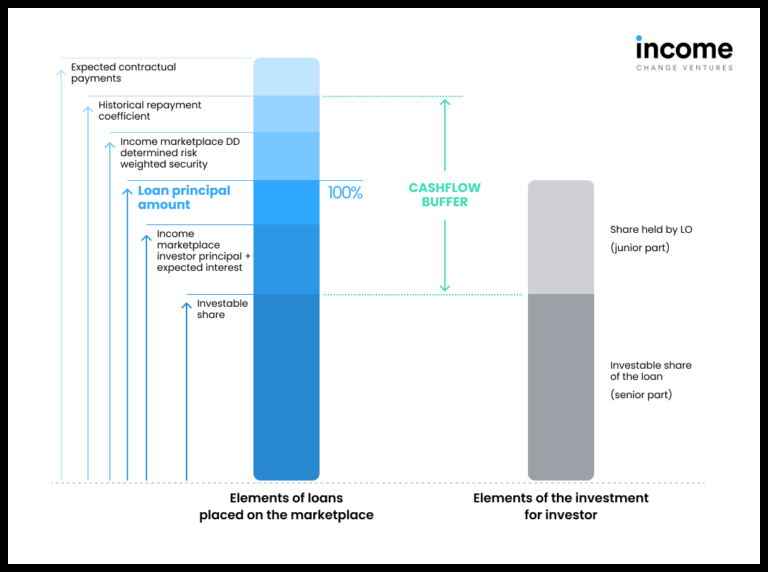

It is striking that Income markets itself as safest platform for investing in loans. In doing so, the platform refers in particular to security features such as the “junior shares” or the “cashflow buffer”.

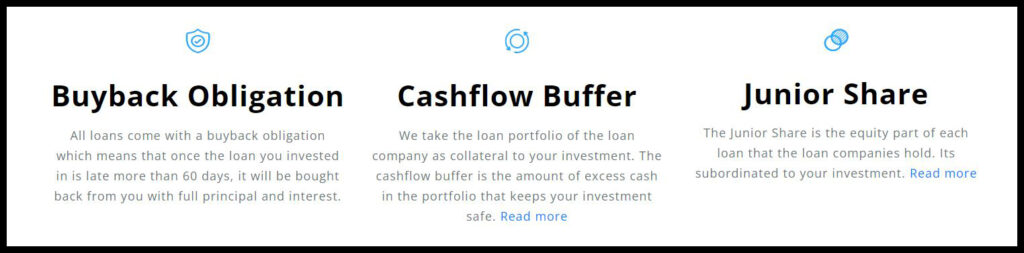

Buyback Obligation

At first, Income Marketplace is also offering the concept of the buyback obligation. This doesn’t differ much from the buyback guarantee on other platforms. Any loan repayment that is 60+ days late will be bought back by the respective lender, reimbursing both the principal and the accrued interest.

As it is often the case, investors should keep in mind that a guarantee is only as good as the financial strength of the lender promising it.

Junior Shares

The Junior Shares are a modified version of the common “skin in the game” concept. The general assumption is that lenders should be similarly motivated to collect the debt in the event of default. Both parties, investors and lenders, are equal in this case.

Junior Shares on Income Marketplace differ as far as the lender’s “skin in the game” share is registered as a junior debt. This means that lenders, in the scenario of a default, have a lower repayment priority. Only when all outstanding receivables from the investors have been repaid in full, the lender has the option of get back his share. Accordingly, investors enjoy a preferential treatment in the event of default.

There are specific SPVs created for settlement, making borrower repayments being directly under the control of Income Marketplace. Lenders must also transfer their individual share of junior shares into this structure.

Cashflow Buffer

At Income Marketplace, the junior share is intended in particular to hedge the risk of default by borrowers and to encourage lenders to work to the best of their ability. The cashflow buffer, on the other hand, is designed to address the risk of a potential lender default.

The cashflow buffer is made up of several aspects. It is a combination of:

- Loan profitability of the lender loan portfolio

- Risk adjustment on the part of Income Marketplace

- The Junior Share

In reality, the way it works is that Income Marketplace looks at the quality of the lenders’ loan portfolio and calculates how much money those loans make on a portfolio basis (see “historical repayment coefficient” in the chart) and how profitable they are. This determines the value of the collateral, similar to how it works with mortgage loans.

After taking into account possible risk factors such as currency fluctuations, pandemics or other value-reducing aspects, Income Marketplace checks how many junior shares are needed so that investors are fully covered in case of default. For this reason, junior shares among lenders, averaging 20% to 35%, are also significantly higher than the classic “skin in the game” share of 5% to 10%.

Problems with ClickCash

Only when the first lending companies find themselves in trouble, it will become evident how well the security concepts listed work in reality. A first test in this context is provided by the Brazilian lender ClickCash, which was suspended in October 2022. The outstanding receivables at that time amounted to approximately EUR 180,000, with cashflow from the pledged loan portfolio of only approximately EUR 50,000.

“According to the data we have at hand today, the cash-flows from the pledged book show an inflow of approximately €50K as per original borrower payment schedules. The lower than expected cash-flows seem to be the result of relatively fast deterioration of the pledged loans and ClickCash not keeping the pledges at the agreed level.”

This leaves the question open why Income didn’t follow up on the monitoring in a more stringent manner, which would have alerted them to this problem at an earlier stage. Even if the chances are relatively good that the outstanding receivables will be repaid in full, the question of the effectiveness of the touted measures remains open.

Is Income Marketplace Safe?

Aside from monitoring its lenders, open questions of the platform’s overall security remain.

- Regulation: Currently, the Estonian regulator is working on a legislation for the regulation of marketplaces like Income. However, little progress has been made in recent years.

- Finances: Income is not yet profitable. In addition, no publicly available and audited annual reports of the platform have been published yet.

- Deposit Insurance: As with all other P2P platforms, Income does not have any form of deposit insurance. The theoretical loss of the entire investment is therefore possible.

Income Insights Podcast

In November 2023, Income launched a monthly podcast called “Income Insights” with founder Kimmo Rytkönen. The podcast aims at keeping investors informed on the latest trends and developments of the marketplace.

In November 2023, Income launched a monthly podcast called “Income Insights” with founder Kimmo Rytkönen. The podcast aims at keeping investors informed on the latest trends and developments of the marketplace.

As someone who has been actively involved at Income since almost the very beginning, I was asked to take over the moderation of the new format. My approach is to critically question the developments of the P2P platform and give investors a realistic insight into the challenges of the marketplace.

The Income Insights podcast is available on all major streaming platforms, as well as on the platform’s YouTube channel.

Pros & Cons

In this section I have listed the most important advantages and disadvantages of Income Marketplace.

Advantages

- Security Features: With the Junior Shares and the Cashflow Buffer, Income Marketplace has found new and innovative ways to protect investors even more effectively against default risks.

- Founding Team: Income Marketplace’s team seems to be very well staffed across the board and also has a charismatic, experienced figurehead in CEO Kimmo Rytkönen.

- Communication: Overall, the team is very active in communicating with investors. The homepage even explicitly refers to the Telegram group to enter into a dialog with the platform.

- Attractive Returns: With interest rates of up to 15%, Income offers a very attractive and competitive return compared to other platforms.

- High Liquidity: Investors can take advantage of very liquid assets without having to rely on a secondary market.

Disadvantages

- Track Record: Income is still a young P2P marketplace and therefore needs more time to prove itself to a broader investor audience.

- Financial Stability: Income is yet to publish any financial report that showcases financial key figures of the company’s development.

- Segregation of Funds: Income cooperates with the Estonian LHV Bank. EMI connectivity, whether directly or through an external service provider, could further enhance the security of investors’ deposited funds.

- Low Diversification: Income lacks a variety of different lenders to expand its portfolio size significantly.

Income Marketplace Alternatives

In terms of the business model, Income Marketplace is most comparable to other marketplaces such as Mintos, PeerBerry or Lendermarket. These also have a similar focus in terms of loan types and regional orientation.

You can find other Income Marketplace alternatives on the P2P Platform Comparison page.

Income Marketplace Community Feedback

The Income Marketplace reviews within the P2P lending community are rated as above average. In the Community Voting 2023, a strong score of 3.77 was achieved with 87 votes (5th place out of 30 platforms). The year before, Income managed to reach 7th place (out of 20 platforms) with a score of 3.15.

Only Esketit (4.15), Robocash (4.13), PeerBerry (3.97) and LANDE (3.89) have been more popular in 2023.

Summary Income Marketplace Review 2024

Income Marketplace is a young, ambitious and thoroughly innovative P2P platform from Estonia. I have been closely monitoring the development of Income since the very beginning, while being an active investor myself since April 2022.

At the beginning of 2024, my outstanding portfolio totalled EUR 9.075, with a total return of 13.18%.

So far, investors on Income Marketplace have not suffered any capital losses yet. However, problems with lenders such as ClickCash or Vivus Mexico have made it clear that the effectiveness of the innovative security features can be questioned.

Any investor with a slightly higher risk-appetite that is looking for high liquidity with above-average interest rates should definitely look into Income Marketplace.

FAQ Income Marketplace Review

Income Marketplace is an Estonian P2P marketplace founded in July 2020 by Kimmo Rytkönen and Mikk Läänemets. Since 2021, investors can fund a wide range of international consumer loans on the platform, while earning returns of up to 15%.

The majority shareholder and the ultimate beneficiary owner of Income Marketplace is Kimmo Rytkönen. He currently holds 28.91% of the shares through his company “KJ Holdings OÜ”.

Income Marketplace earns its revenue primarily through a commission fee, which is charged to lenders on in the marketplace. The commission fee at Income is between 2% to 4% of the outstanding loan portfolio and is calculated on a daily balance basis. Invoicing takes place on a monthly basis.

If you consider investing on Income Marketplace, a sign up through this link will enable you to get an unlimited cashback bonus of 1% in the first 30 days after registration. A second requirement is that you also use my personal bonus code: Q6DCGX.

Hi, ich bin Denny! Seit Januar 2019 schreibe ich auf diesem Blog über meine Erfahrungen beim Investieren in P2P Kredite. Meine Analysen sollen Privatanlegern dabei helfen reflektierte und gut informierte Anlageentscheidungen treffen zu können. Dafür schaue ich mir die Risikoprofile der einzelnen P2P Plattformen an, hinterfrage deren Entwicklungen, teile meine persönlichen Einschätzungen und beobachte übergeordnete Trends aus der Welt des Crowdlendings.

Mein Bestseller "Geldanlage P2P Kredite" gilt in Fachkreisen als das beste deutschsprachige Finanzbuch zum gleichnamigen Thema. Zudem versammeln sich in der P2P Kredite Community auf Facebook tausende von Privatanlegern, die sich regelmäßig über die Anlageklasse P2P Kredite austauschen.