Lendermarket is an Irish-based P2P platform that advertises an above-average market return of 16%.

After serving primarily as a funding source for Creditstar Group lenders for the first three years, the platform evolved in 2022 to become a standalone and independent P2P marketplace, offering fundraising and liquidity to different non-bank lending institutions around the world.

Lendermarket thus wants to move away from the image of a Creditstar spin-off.

This Lendermarket review will reveil how the P2P platform is currently set up, where the underlying risks are and how the overall risk-reward profile can be assessed.

All the information that are covered in this Lendermarket review are based on my own due diligence. Please make sure to do your own research before investing on the platform. More information can be found in the Disclaimer.

Further analyses of other platforms can be found on my P2P Platform Review page.

Lendermarket Overview

Before we get started, here is a quick summary with the most important information about Lendermarket.

| Founded / Startet: | June 2016 / June 2019 |

| Legal Name: | Lendermarket Limited (LINK) |

| Headquarter: | Dublin, Ireland |

| Regulated: | No |

| CEO: | Carles Federico (September 2023) |

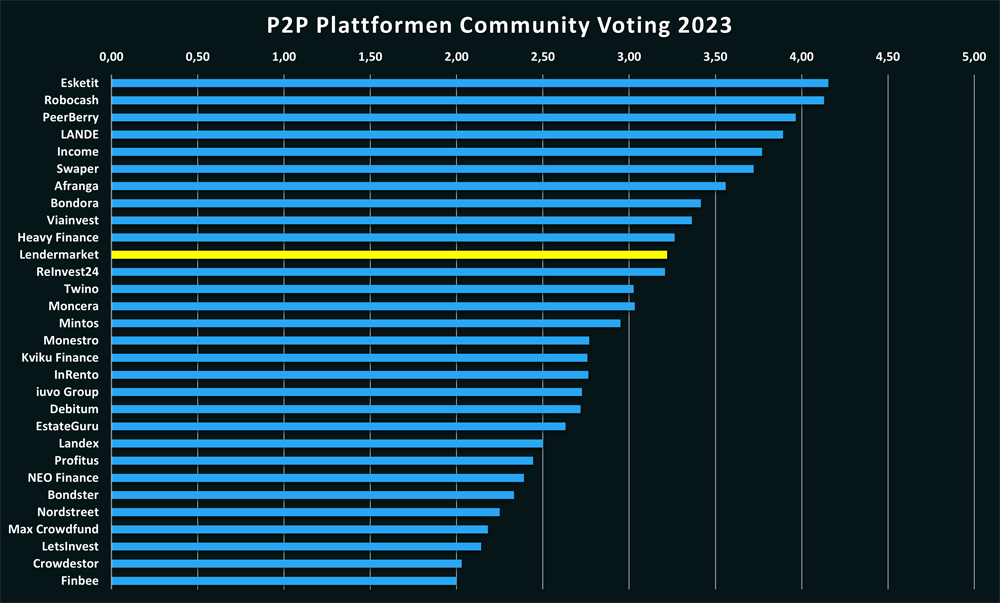

| Community Voting: | 3,22 out of 5 | See Voting |

| Assets Under Management: | Not Disclosed |

| Number of Investors: | 12.000+ (April 2024) |

| Expected Return: | 15.2% |

| Primary Loan Type: | Consumer Loans |

| Collateral: | Buyback Guarantee |

| Bonus: | 1% Cashback for 60 Days |

About Lendermarket

Lendermarket is an Irish-based P2P platform founded by Creditstar Group in June 2016. Since the operational launch of the platform, in June 2019, investors have been able to invest in a variety of international consumer loans on Lendermarket, earning an advertised average return of 15.5%.

What is particularly striking about Lendermarket is the high returns of up to 16%, which is thus significantly above the market average for unsecured consumer loans.

After the platform has served as a funding source for Creditstar Group lenders for three years, the first external lender was added to the marketplace in May 2022.

Creditstar Group

Until May 2022, Lendermarket exclusively offered loans from Creditstar Group, which still accounts for a large part of the assets on the marketplace. The group is a company founded 2006 in Estonia, which has been active in the European lending business ever since.

Until May 2022, Lendermarket exclusively offered loans from Creditstar Group, which still accounts for a large part of the assets on the marketplace. The group is a company founded 2006 in Estonia, which has been active in the European lending business ever since.

Anyone looking into Lendermarket should also review the situation and development of Creditstar. Here is a brief summary of some important information:

| Founded: | 2006 in Estonia (Creditstar Group AS) |

| Shareholder: | Aaro Sosaar (UBO) |

| Borrower Countries: | 8 |

| Employees: | 120+ |

| Assets: | EUR 230 million (December 2022) |

| Equity: | EUR 47 million (December 2022) |

| Profit 2022: | EUR 6.5 million |

Here you can download the Creditstar annual report 2022.

In April 2019, Creditstar Group launched the Lendermarket platform to fund a part of its loan portfolio through the platform.

“Lendermarket was initially founded by Creditstar Group’s management team in order to provide

additional liquidity to their growing lending business.”

In addition to other marketplaces such as Mintos, the loans are also financed with private bonds, bank loans, credit lines and equity. A precise financing structure is not communicated by the Group. The same applies to the performance of the portfolio under management.

Ownership

Who owns Lendermarket? The P2P platform “Lendermarket Limited” is fully owned by “SA Financial Investments OÜ“. This is an Estonian holding company to which a total of 18 companies belong.

Its owner and ultimate beneficiary is Aaro Sosaar, who is also the CEO and main shareholder of Creditstar Group.

He holds a university degree in banking and international finance. He describes himself as an entrepreneur and investor in financial services and technology.

Lendermarket Management

Carles Federico has been the new CEO of the Lendermarket P2P platform since September 2023. He replaces Conor Gibney, who took over this position in May 2023. Before that, Endrik Eller had led the platform since 2021. Thus, Lendermarket has had three different CEOs in 2023.

Carles Federico has been the new CEO of the Lendermarket P2P platform since September 2023. He replaces Conor Gibney, who took over this position in May 2023. Before that, Endrik Eller had led the platform since 2021. Thus, Lendermarket has had three different CEOs in 2023.

Carles is an experienced manager from the sales and finance environment who already worked for the Creditstar Group between September 2015 and April 2021. The frequently emphasised independence of Lendermarket from its largest lender should therefore be strongly doubted.

Currently, there are 15 to 20 employees directly employed by Lendermarket. According to the platform, it receives no operational support from Creditstar Group. Investors can get an insight into the platform’s team members on the “About Us” page.

Business Model & Finances

Throughout the process of due diligence, investors should also have a look at the business model of a P2P platform as well as the overall financial situation. How does the company earn money? Does the platform operate profitably? And how well is the company positioned financially? In the following paragraphs of this Lendermarket review, you can follow-up on those questions.

Monetization

How does Lendermarket earn money? Lendermarket generates its revenue through a variable brokerage fee, which is charged to lenders in exchange for financing through the marketplace. This amount is primarily dependent on the amount of the financed loan volume and can range from 2% to 5%. The exact percentage also depends on the borrower country and the type of loans the lender offers.

Profitability

Lendermarket is currently not profitable. The last published annual report for 2021, which was audited by Grant Thornton, showed a loss of approximately EUR 600,000.

The platform says it has made a conscious decision to spend more money on marketing and product development in order to increase its user base and add new product features to the platform. The platform hopes to be in a stronger market position in 12 to 24 months.

Sign Up and Bonus

In order to invest on Lendermarket, investors must meet three requirements:

- A minimum age of 18 years,

- a residence in the European Economic Area

- and a European bank account in the specified name.

The subsequent registration with Lendermarket takes place in a few simple steps:

- Click on the “Register” button on the homepage.

- Register via email, assign a password and agree to the platform rules + privacy policy.

- Verify the email in your mailbox.

- Enter personal data (name, address, phone number, etc.).

- Verify the account / identity.

Bonus for New Investors

If you sign up for Lendermarket via this link, you will receive a 1% cashback on all investments made in the first 60 days after registration.

Investing on Lendermarket

How does Lendermarket work and what should investors know and consider when investing on the plaform? In the following sections of my Lendermarket review you will find all the necessary information that you need.

Loan Offering

There are four different lending groups on Lendermarket, which map the offer on the marketplace with their respective lenders. These include the Creditstar Group, Credory, QuickCheck and CrediFace.

The borrower countries represented include Poland, Estonia, Finland, Sweden, Denmark, Spain and the Czech Republic. Nigerian loans are also represented from Africa.

The types of loans are primarily short-term and unsecured consumer loans. The average loan term is 81 days, although in some cases it can be up to 36 months. The average loan amount financed, on the other hand, is EUR 2,330.

The Estonian lender Credory also offers secured business loans for small and medium-sized enterprises (SME loans). Here, the average loan-to-value (LTV) is 65%.

Costs and Fees

There are currently no costs or hidden fees for investors at Lendermarket. Neither for deposits and withdrawals, nor for other functionalities or investing itself.

“Investing through Lendermarket is completely free of charge. Lendermarket does not charge any fees for opening an account, depositing or withdrawing funds.”

Expected Returns

Lendermarket offers above-average interest rates compared to similar platforms. According to Lendermarket, the average interest rate is 15.50%. In some cases, there have already been loans with an interest rate of up to 19%.

Auto Invest

At Lendermarket, investors have the opportunity to invest their money with the help of an Auto Invest. This means that certain criteria can be defined in advance, which are then taken into account by an algorithm when allocating new loans. This means that the investment can be passively controlled and managed on Lendermarket.

The criteria to be selected include the minimum and maximum amount per loan, the interest rate, the loan term or the lenders.

A secondary market, where loans can be sold before maturity, does not yet exist on Lendermarket.

Lendermarket Buyback Guarantee

Lendermarket also advertises the protection of loans in form of a buyback guarantee.

This applies when loans are 60+ days in delay. The lenders are then encouraged to repurchase the loan in full, including repayment and accrued interest.

However, there are some differences in the extension periods depending on the lender. With Creditstar for example, up to 6 extensions of 30 days each can occur. This means that a loan with an original term of 30 days can theoretically be repaid 240 days later (60 days to buyback guarantee + 180 days extension period). As there is no secondary market on Lendermarket, liquidity for investors can be very limited.

To date, the buyback guarantee has always been met.

Lendermarket Forum

If you have questions about Lendermarket, other platforms or different p2p-related topics, you can join the re:think P2P Community on Facebook and engage in discussions with more than 1,000 other private retail investors.

Lendermarket Taxes

Generally, interest income generated by loan financing is considered capital income and thus must be declared as such in the tax declaration.

Unlike other platforms, Lendermarket does not withhold taxes through interest income such as in Latvia or Lithuania.

For the tax declaration, investors can select the “Account Statement” tab in the main menu, where a tax report for the respective year can be downloaded. This information can then be submitted to the relevant tax office as part of a tax return.

Lendermarket Risks

Investors should look very carefully at the potential risk factors when evaluating a P2P platform. What is it that investors need to be aware of when it comes to Lendermarket? Where are the underlying risks and how are they assessed?

Creditstar Repayments

So far, the buyback guarantee on Lendermarket has always been honoured. However, there is growing resentment among investors who have invested in assets of the Creditstar Group. The lender often makes use of the extension periods, which could be due to liquidity issues from Lendermarket’s biggest lending partner.

Also the introduction of pending payments, whereby investors can reinvest funds that have not yet been returned, is also an indication of possible liquidity problems on the part of the lender.

Another argument are the high interest rates that Creditstar offers, especially for long-term loans. In addition, there are permanent cashback campaigns of up to 5%, which should encourage investors to continue investing their money on Lendermarket. Investors should be aware of these risks and carefully consider their choice of lenders.

Is Lendermarket a Safe Platform?

Lendermarket has been on the market since 2019, which means the platform is no longer a brand new provider. On top, EUR 300+ million in financed loans indicate a certain market size.

However, there are also some negative points at Lendermarket when it comes to the safety of the platform:

- There is no form of deposit insurance with Lendermarket. A total default is therefore theoretically possible.

- The platform is not controlled and monitored by any governmental financial supervision or authority.

- Lendermarket is far from being profitable.

- There is no insight into the performance of the lenders loan portfolio.

- Constant changes in key management positions

- Introduction of pending payments

- Frequently high cash back campaigns

Pros & Cons

In this section I have listed the most important advantages and disadvantages of Lendermarket.

Advantages

- Competitive Return: With an average interest rate of 15.5%, Lendermarket’s expected return is higher than at comparable P2P platforms.

- High Liquidity: Lendermarket offers short-term assets which increases liquidity.

- Established Lenders: Through Creditstar Group, Lendermarket has access to some large and internationally experienced lenders.

- Segregation of Funds: Lendermarket works with FIRE Financial Services, an e-money institution authorised by the FCA and regulated by the Central Bank of Ireland.

Disadvantages

- Transparency: Lendermarket does not publish any performance-relevant data on its lenders, which makes it impossible to assess the risk profile (black box).

- Management Changes: In 2023, three different CEOs have worked for Lendermarket.

- Annual Reports: The platform is not frequently publishing its annual reports.

- Profitability: Lendermarket’s revenue is still very small. The platform is therefore still far from profitability.

- Regulation: The platform is based in Ireland, hence no control by a financial regulator applies.

- Loan Extensions: Loans can be extended up to 240 days in some cases, which provides investors with significantly less liquidity.

- Pending Payments: With the introduction of pending payments, Lendermarket allows its investors to reinvest unavailable funds.

- Aggressive Marketing: Lendermarket is publishing cashback campaigns of up to 5% on a regular basis.

Lendermarket Alternatives

Lendermarket has been a “mono-lender” for a long time, offering only Creditstar loans for the first three years of operations. When it comes to Lendermarket alternatives, this model is most comparable to the Irish-based platform Esketit, which primarily finances Creamfinance loans.

With the ambition to become a global marketplace for P2P loans in the future, the platform’s approach is more similar to providers such as Income Marketplace, Mintos or PeerBerry.

You can find other Lendermarket alternatives on the P2P Platform Comparison page.

Lendermarket Community Feedback

The Lendermarket reviews within the P2P lending community are rated slightly above average. In the community voting 2023, a score of 3.22 was achieved with 41 votes. The year before (2022), the score was only 2.67.

The most popular platforms in 2023 included Esketit, Robocash, PeerBerry, LANDE and Income Marketplace.

Summary Lendermarket Review 2024

Lendermarket is on the verge of change. After three years of exclusively financing Creditstar Group loans, the platform is now planning to provide fundraising and liquidity for external non-bank lenders. How should this step be assessed?

On one hand, it will increase diversification for investors and reduce dependency on Creditstar. In addition, scaling the loan offering could also boost the revenue. On the other hand, the marketplace model also entails other requirements. The acquisition, support and monitoring of a large number of lenders can prove to be very demanding. The developments at Mintos have made it impressively clear that this is not always as easy. It remains to be seen how and whether Lendermarket can live up to its new approach.

Investors should also take a critical look at the fact that Lendermarket has not published any performance-relevant data from its lenders to date. Due to this black box character, investors have no possibility to perform an objective risk assessment.

In addition, developments such as the constant management changes on the platform, the reinvestment of unavailable funds or the promotion of high cashback campaigns have to be questioned. Investors should also observe the developments at Creditstar very closely. Although the group operates profitable, certain liquidity issues seem to be obvious.

Investors should carefully consider these factors before investing on Lendermarket.

FAQ Lendermarket Review

Lendermarket is an Irish-based P2P platform founded by Creditstar Group in June 2016. Since the operational launch of the platform, in June 2019, investors have been able to invest in a variety of international consumer loans on Lendermarket, earning an average return of 15.5%.

The P2P platform “Lendermarket Limited” is fully owned by “SA Financial Investments OÜ“. This is an Estonian holding company to which a total of 18 companies belong. Its owner and ultimate beneficiary is Aaro Sosaar, who is also the CEO and main shareholder of Creditstar Group.

Lendermarket generates its revenue through a variable brokerage fee, which is charged to lenders in exchange for financing through the marketplace. This amount is primarily dependent on the amount of the financed loan volume and can range from 2% to 5%. The exact percentage also depends on the borrower country and the type of loans the lender offers.

If you sign up for Lendermarket via this link, you will receive a 1% cashback on all investments made in the first 60 days after registration.

Hi, ich bin Denny! Seit Januar 2019 schreibe ich auf diesem Blog über meine Erfahrungen beim Investieren in P2P Kredite. Meine Analysen sollen Privatanlegern dabei helfen reflektierte und gut informierte Anlageentscheidungen treffen zu können. Dafür schaue ich mir die Risikoprofile der einzelnen P2P Plattformen an, hinterfrage deren Entwicklungen, teile meine persönlichen Einschätzungen und beobachte übergeordnete Trends aus der Welt des Crowdlendings.

Mein Bestseller "Geldanlage P2P Kredite" gilt in Fachkreisen als das beste deutschsprachige Finanzbuch zum gleichnamigen Thema. Zudem versammeln sich in der P2P Kredite Community auf Facebook tausende von Privatanlegern, die sich regelmäßig über die Anlageklasse P2P Kredite austauschen.

you are criticising hive5 ,which works excellent , and being moderate with this big p2p issue called lendermarket

Did you really read my Lendermarket review? It doesn’t look like it.

You should say : people,stay away from those liars !