On many P2P platforms, investors have the option to choose from a variety of different lenders. Past experience has shown repeatedly that quality is often more important than quantity.

So how can one identify the best lenders?

A number of factors need to be considered. These range from financial stability to country-specific risks, portfolio quality, and potential guarantee promises.

Because the financial evaluation is one of the most important factors in lender analysis, this page provides an overview in which lenders are assessed with regard to reporting standards, profit, return on assets, equity ratio, debt, liquidity – and, in some cases, portfolio quality.

Disclaimer: The summary and evaluation of the published financial results have been carried out to the best of my knowledge and belief. However, isolated errors cannot be ruled out. Investors should therefore also examine the numbers and information independently. Furthermore, financial ratios in isolation are not a sufficient measure to judge a lender’s success or failure.

Last update: 16.02.2026 (Jet Finance)

Criteria and Evaluation Scale

Below is an overview of the criteria used to assess the financial stability, including their interpretation.

Reporting Standard

Meaning: Not every lender publishes audited financial statements. An audited report according to an internationally recognized standard (e.g., IFRS) builds trust and reduces the risk that the figures are manipulated or incomplete.

Calculation: Not a numerical value, but a qualitative rating. This considers two factors: first, is there a financial statement that has been audited from a recognized auditing firm? Second, according to which reporting standard (IFRS, local GAAP, unaudited) was the report prepared?

Scale:

- Strong (1): Audited according to IFRS by a Big Four firm (PwC, EY, Deloitte, KPMG)

- Stable (2): Audited according to IFRS by a smaller auditing firm

- Medium (3): Audited according to local GAAP (not IFRS), reliable auditor

- Risk (4): Audit by an unknown firm

- Critical (5): No audit, only management report or unaudited figures

Profitability

Meaning: Profitability indicates whether the business model is sustainable. Persistent losses can be a clear warning signal for investors, as they weaken the capital base and increase the risk of insolvency.

Calculation: Net profit according to the income statement (Profit & Loss statement).

Scale:

- Strong (1): Sustainable profits over several years

- Stable (2): Mostly profits, though minor fluctuations possible

- Medium (3): Low and highly fluctuating profits

- Risk (4): More losses than profits in recent years

- Critical (5): Significant and persistent losses

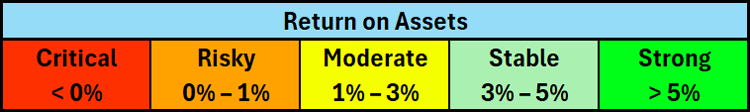

Return on Assets

Meaning: Return on assets (ROA) is a key profitability metric. It indicates how efficiently a company uses its total assets to generate profits.

Calculation: Net profit / Total assets

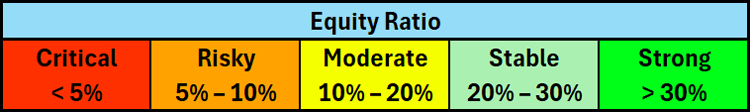

Equity Ratio

Meaning: The equity ratio is an indicator of a company’s financial stability and resilience.

Calculation: Equity / Total assets

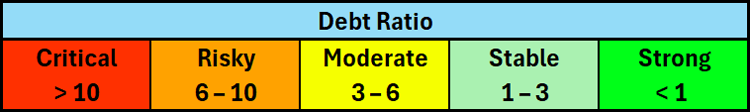

Debt Ratio

Meaning: The debt ratio measures a company’s dependence on external financing. The higher the debt, the more leveraged the company is, which represents a risk for investors.

Calculation: Debt / Equity

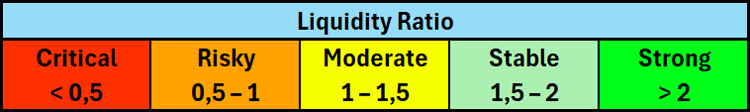

Liquidity

Meaning: The liquidity ratio indicates whether a company can cover its short-term liabilities with cash and short-term receivables.

Calculation: (Cash + Short-term receivables) / Short-term liabilities

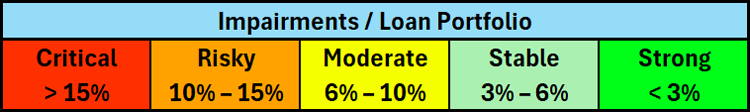

Impairments

Meaning: Impairments indicate the proportion of financed loans that have already been classified as risky or defaulted. A low value points to good credit quality and cautious risk management. A high value means that a larger portion of the loan portfolio is likely to default and will be difficult to recover.

Calculation: Impairments / Loan portfolio (gross)

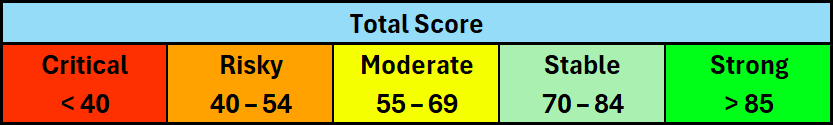

Total Score

Meaning: The overall score consolidates all available financial metrics and qualitative information into a unified risk indicator.

Calculation: Five evaluation criteria are created based on the seven assessed metrics. Each criteria has a different weight. In the end, a total score of up to 100 points can be achieved.

- Reporting Standard (20%): Qualitative criterion. Audit status and auditor quality.

- Profitability (20%): Comprised of profit (40%; 8% of the total score) and return on assets (60%; 12% of the total score).

- Capital Structure / Solvency (25%): Comprised of equity ratio (60%; 15% of the total score) and debt ratio (40%; 10% of the total score).

- Liquidity (15%): Liquidity ratio. Short-term payment capability.

- Loan Book Quality / Impairments (20%): Core risk of lending operations.

Handling of missing data: If a sub-criterion is missing, its weighting is proportionally redistributed to the remaining categories within the same group. Example: If no return on assets (ROA) is available because only one year of data exists, the 20% allocated to profitability is fully assigned to profit.

Transparency is a key element of sound financial management. Therefore, if a lender does not disclose certain key figures, this is considered an increased risk and results in 0 points. This applies particularly to missing disclosures for liquidity ratio and loan book quality (impairments).

Afranga

For years, Afranga has been used as a financing source for the lending operations of the Stik Credit Group. In recent years, this allowed investors to reliably earn above-average returns of up to 16%.

With its licensing as a European crowdfunding service provider, Afranga began its transformation into a regulated P2P marketplace at the beginning of 2025. This opens up additional diversification opportunities for investors. An overview of the currently available lenders is provided in the table below.

Further information can be found in my Afranga review. New investors who sign up via my partner link receive 0.5% cashback for 90 days.

| Loan Originator | Year | Audited | Profit | ROA | Equity Ratio | Debt | Liquidity | Impairments | Score |

|---|---|---|---|---|---|---|---|---|---|

| Credirect | 2024 | “TRANSIKA” LTD. | EUR 2,24M | 35,7% | 47,5% | 1,11 | 7,97 | 64 | |

| Lendivo | 2024 | Unaudited | EUR 8K | 24,8% | 3,03 | 34 | |||

| Lev Credit | 2024 | Expert Consult | BGN 201K | 13,9% | 95,6% | 0,05 | 22,69 | 29,4% | 70,4 |

| Stik-Credit | 2024 | ZAHARINOVA NEXIA | EUR 3,48M | 13,9% | 54% | 0,85 | 1,62 | 22% | 77 |

| Swiss Funds | 2024 | Unaudited | EUR 37K | 2,6% | 38,4% | 1,60 | 2,13 | 54 | |

| Tiberus | 2024 | Unaudited | BGN (86K) | 4 |

Bondora

Bondora is one of the largest and most experienced P2P platforms in Europe, which is why the Estonian fintech enjoys a special status among many investors. With Bondora Go & Grow, the platform also offers one of the most popular investment products in the P2P lending space, which has set new standards for simplicity, liquidity, and reliability since its launch in 2018.

The long-standing experience, combined with strong financial metrics, makes Bondora an ideal entry point for new investors who want to quickly and easily gain their first experience in the P2P market.

Further information can be found in my Bondora review. New investors who sign up via my partner link receive a EUR 5 bonus.

| Loan Originator | Year | Audited | Profit | ROA | Equity Ratio | Debt | Liquidity | Impairments | Score |

|---|---|---|---|---|---|---|---|---|---|

| Bondora Group | 2024 | KPMG | EUR 1,22M | 4,5% | 71,3% | 0,4 | 3,45 | 3,3% | 94 |

Debitum

Debitum Investments stands out in the P2P market due to its unique positioning: it is a regulated platform, operating with a marketplace model, and offers buyback-guaranteed business loans. A combination that cannot be found on any other P2P platform.

Since the change of ownership in August 2023, Debitum has added many new lenders to its marketplace, significantly improving the supply situation for investors. The overview below shows the financial situation of the lenders represented on the Latvian marketplace.

Further information can be found in my Debitum review. New investors who sign up via my partner link receive 1% cashback for 30 days.

| Loan Originator | Year | Audited | Profit | ROA | Equity Ratio | Debt | Liquidity | Impairments | Score |

|---|---|---|---|---|---|---|---|---|---|

| Baltic Terra | 2025 | S. Vilcānes Audits | EUR 265K | 91,9% | 98,9% | 0,01 | 84,02 | 65 | |

| Evergreen | 2024 | Unaudited | EUR 279K | 9,2% | 24,7% | 0,75 | 2,15 | 58 | |

| Juno | 2024 | Unaudited | EUR 158K | 1,4% | 7,6% | 0,92 | 0,99 | 38 | |

| LFDF | 2024 | S. Vilcānes Audits | EUR 70K | 1% | 15,9% | 0,84 | 1,19 | 48 | |

| Sandbox | 2024 | Latimira un Partneri | EUR 21K | 0,5% | 9,3% | 0,91 | 1,28 | 43 | |

| Triple Dragon | 2024 | Unaudited | EUR 0 | 3,3 | 24 |

Esketit

Esketit is an Ireland-based P2P platform that was founded in 2021 by two experienced fintech entrepreneurs. An attractive mix of established lenders and competitive interest rates provided a strong foundation in its early years.

Since the exit of some lenders, including AvaFin Holding, Esketit has developed into a hub for new fintech startups without a significant track record. The lender overview lists all current alternatives.

Further information can be found in my Esketit review. New investors who sign up via my partner link receive 0.5% cashback for 90 days.

| Loan Originator | Year | Audited | Profit | ROA | Equity Ratio | Debt | Liquidity | Impairments | Score |

|---|---|---|---|---|---|---|---|---|---|

| A24 Group | |||||||||

| Credus Capital | |||||||||

| Jet Finance | 2024 | Grant Thornton | EUR 1,18M | 4,3% | 20,6% | 3,86% | 14,9 | 7,6% | 77 |

| JMD Investments | 2024 | Baker Tilly | EUR 4,63M | 32,2% | 51,8% | 0,93% | 0,25 | 60 | |

| MDI Finance | |||||||||

| Mojo Capital | 2024 | Unaudited | (USD 98K) | (5,7%) | (18%) | 2,83 | 32 | ||

| Spanda Capital | 2024 | Cortés y Asociados Auditores | EUR 12K | 0,4% | 0,2% | 447 | 1,74 | 35 |

Income Marketplace

Income Marketplace is an unregulated P2P marketplace from Estonia, where investors can invest in buyback-guaranteed loans since 2021, while achieving returns of up to 15%.

The marketplace offers a wide range of different lender profiles, varying by geography, loan terms, and loan products. My overview provides an insight into the financial stability of each lender.

Further information can be found in my Income Marketplace review. New investors who sign up via my partner link receive 1% cashback for 30 days.

| Loan Originator | Year | Audited | Profit | ROA | Equity Ratio | Debt | Liquidity | Impairments | Score |

|---|---|---|---|---|---|---|---|---|---|

| Autofino | 2024 | Crowe | EUR 51K | 1,0% | 52,7% | 0,9% | 0,8 | 3,5% | 71 |

| Current Auto (LT) | 2023 | Unaudited | EUR (54K) | (0,7%) | (2,9%) | (35,0%) | 163,8 | 12,2% | 24 |

| Current Auto (LV) | 2024 | Unaudited | EUR (912K) | (19,4%) | (55,2%) | (2,8%) | 1,1 | 55,3% | 26 |

| Danabijak | 2023 | Kreston Indonesia | EUR 15K | 72,9% | 43 | ||||

| Danarupiah | 2024 | Unaudited | EUR 13,8M | 30,9% | 68,2% | 0,5 | 3,1 | 64 | |

| Hoovi | 2024 | Unaudited | EUR 661K | 9,9% | 12,1% | 7,3 | 0,6 | 5,9% | 57 |

| Ibancar | 2024 | BDO | EUR 463K | 3,4% | 9,9% | 9,1 | 1,9 | 6,4% | 72 |

| ITF Group | 2024 | ECOVIS | EUR 1,8M | 11% | 34,3% | 1,9 | 2,2 | 74 | |

| Sandfield Capital | |||||||||

| Simpleros | 2024 | Unaudited | EUR 259K | 15,9% | 31,3% | 2,2 | 2,3 | 59 | |

| Virtus Lending | 2024 | BDO | EUR 237K | 3,4% | 12,7% | 6,9 | 43 |

Lendermarket

Lendermarket is a spin-off of the Creditstar Group. Notable features include the above-average interest rates, sometimes up to 18%, as well as frequent repayment delays (pending payments).

Since 2022, external lenders have also been offered on the P2P marketplace. An overview can be found in the table below. Further information can be found in my Lendermarket review. New investors who sign up via my partner link receive 1% cashback for 90 days.

| Loan Originator | Year | Audited | Profit | ROA | Equity Ratio | Debt | Liquidity | Impairments | Score |

|---|---|---|---|---|---|---|---|---|---|

| Credifiel | 2024 | RSM Mexico | EUR 7,09M | 6,0% | 35,8% | 0,64 | 1,52 | 5,3% | 92 |

| Creditstar Group | 2024 | KPMG | EUR 7,24M | 2,2% | 19,2% | 4,2 | 0,4 | 15,2% | 57 |

| Dineo | 2024 | BNFIX Audit Auditores | EUR 75K | 0,2% | 15,5% | 0,85 | 1,84 | 22,5% | 57 |

| Rapicredit | 2024 | Nexia Montes y Asociados | EUR 486K | 1,6% | 19,9% | 0,80 | 2,09 | 22,1% | 65 |

Mintos

In terms of investor count and assets under management, Mintos is the largest P2P lending marketplace in Europe. The Latvian P2P marketplace therefore holds a special position in the P2P market.

In terms of investor count and assets under management, Mintos is the largest P2P lending marketplace in Europe. The Latvian P2P marketplace therefore holds a special position in the P2P market.

During the pandemic, but also due to the war in Ukraine, several weaknesses in Mintos’ lender due diligence were exposed. At times, up to EUR 150 million of investors’ funds were tied up in recovery. This highlights that while Mintos offers a wide variety of lenders, investors should carefully examine each individual company. An overview can be found in the table below.

Further insights can be found in my Mintos review. New investors who register through my partner link receive a EUR 25 bonus.

| Loan Originator | Year | Audited | Profit | ROA | Equity Ratio | Debt | Liquidity | Impairments | Score |

|---|---|---|---|---|---|---|---|---|---|

| BB Finance | 2024 | KPMG | EUR 1,07M | 5,0% | 18,0% | 0,82 | 1,09 | 9,7% | 78 |

| Cash Credit | 2024 | Unaudited | EUR 286K | 4,3% | 54,8% | 0,45 | 2,18 | 1,8% | 78 |

| Credifiel | 2024 | RSM Mexico | EUR 7,09M | 6,0% | 35,8% | 0,64 | 1,52 | 5,3% | 92 |

| Creditstar (FI) | 2024 | Unaudited | EUR 283K | 0,4% | 1,00 | 3,0% | 43 | ||

| Credius IFN (RO) | 2024 | Unaudited | EUR (309K) | (1,4%) | 44,1% | 0,56 | 1,58 | 26,2% | 52 |

| Delfin Group (LV) | 2024 | KPMG | EUR 7,4M | 6,4% | 19,7% | 0,80 | 1,11 | 9,6% | 78 |

| Esto (EE) | 2024 | KPMG | EUR 11,2M | 16,9% | 33,4% | 0,67 | 2,73 | 3,0% | 96 |

| Esto (LT) | 2023 | Provisus | EUR (820K) | (23,1%) | (40,1%) | 1,40 | 1,51 | 3,0% | 51 |

| Evergreen Finance | 2024 | Unaudited | EUR 829K | 23,4% | 0,77 | 1,68 | 42,9% | 54 | |

| Finclusion | 2024 | PwC | EUR 234K | 2,3% | 24,7% | 0,75 | 0,73 | 16,0% | 64 |

| Finmak | 2024 | Unaudited | EUR 5,69M | 49,3% | 0,51 | 1,87 | 57 | ||

| Finopro IFN (RO) | 2024 | Grant Thornton | EUR 5,64M | 40,5% | 78,6% | 0,21 | 0,03 | 64 | |

| Fintech Finance | 2024 | Baker Tilly | EUR 14,5M | 29,9% | 37,0% | 0,63 | 1,43 | 22,7% | 74 |

| Hipocredit (LT) | 2024 | Nexia Auditas | EUR 1,31M | 5,4% | 12,1% | 0,88 | 4,95 | 57 | |

| Hipocredit (LV) | 2024 | Unaudited | EUR 546K | 12,9% | 0,87 | 22,85 | 50 | ||

| ID Finance | 2024 | EY | EUR 6,61M | 4,2% | 16,0% | 0,84 | 1,20 | 39,8% | 70 |

| Iute Credit (AL) | 2024 | RSM Albania | EUR 4,69M | 5,9% | 26,4% | 0,74 | 1,42 | 14,2% | 75 |

| Iute Credit (BG) | 2023 | HLB Bulgaria | EUR (2,23M) | (27,3%) | 16,2% | 0,84 | 13,26 | 24,4% | 58 |

| Iute Credit (MD) | 2024 | Baker Tilly | EUR 2,39M | 4,1% | 35,4% | 0,65 | 4,00 | 10,3% | 78 |

| Iute Credit (MK) | 2024 | Moore | EUR 1,98M | 5,8% | 16,5% | 0,83 | 5,5% | 71 | |

| Luma Finans | 2024 | WeAudit | EUR 5,34M | 18,4% | 18,0% | 0,82 | 1,93 | 29,9% | 63 |

| Mikro Kapital (MD) | 2024 | Crowe Audit | EUR 361K | 1,2% | 29,4% | 0,71 | 0,65 | 5,9% | 74 |

| Mikro Kapital (RO) | 2024 | PwC | EUR 1,56M | 3,9% | 21,9% | 0,78 | 0,27 | 6,0% | 75 |

| Mikro Kapital (UZ) | 2023 | Grant Thornton | USD 3,65M | 6,9% | 16,7% | 0,83 | 0,31 | 2,6% | 78 |

| Mogo (GE) | 2024 | Unaudited | EUR 4,47M | 95,0% | 0,05 | 15,57 | 10,8% | 68 | |

| Mogo (LT) | 2023 | ROSK Consulting | EUR 381K | 1,1% | 8,9% | 0,91 | 1,08 | 3,4% | 71 |

| Mogo (LV) | 2024 | Unaudited | EUR (970K) | 72,2% | 0,28 | 1,66 | 12,9% | 53 | |

| Mogo (RO) | 2024 | Unaudited | EUR 1,70M | 12,0% | 0,88 | 3,22 | 16,4% | 58 | |

| Moment Credit (LT) | 2024 | Grant Thornton | EUR 233K | 1,4% | 31,1% | 0,69 | 1,35 | 10,7% | 72 |

| Monefit (EE) | 2024 | Unaudited | EUR 112K | 13,8% | 0,86 | 2,0% | 55 | ||

| Mozipo (RO) | 2024 | BDO | EUR 178K | 3,3% | 41,6% | 0,58 | 1,91 | 29,6% | 73 |

| Nera Capital | 2024 | Unaudited | EUR 3,84M | 14,6% | 0,85 | 0,40 | 42 | ||

| Nordecum | 2024 | Unaudited | EUR 958K | 4,5% | 21,0% | 0,79 | 3,75 | 57 | |

| Placet Group | 2024 | Unaudited | EUR 4,67M | 49,1% | 0,51 | 3,62 | 57 | ||

| Sun Finance (LV) | 2024 | Unaudited | EUR 2,49M | 39,2% | 0,61 | 1,65 | 10,1% | 65 | |

| Watu Credit | 2024 | Unaudited | EUR 7,97M | 28,9% | 0,71 | 4,08 | 6,2% | 69 |

Monefit SmartSaver

Monefit SmartSaver is a spin-off of the Creditstar Group, founded in 2022. This provided the group with an additional financing source for its own loan portfolio.

The SmartSaver product is easy to understand and offers both predictable income and a high degree of liquidity. However, the aggressive financing approach in the past has frequently led to delayed repayments for investors, which is also reflected in the financial metrics.

Further information can be found in my Monefit SmartSaver review. New investors who sign up via my partner link receive a 0.25% cashback for 90 days.

| Loan Originator | Year | Audited | Profit | ROA | Equity Ratio | Debt | Liquidity | Impairments | Score |

|---|---|---|---|---|---|---|---|---|---|

| Creditstar Group | 2024 | KPMG | EUR 7,24M | 2,2% | 19,2% | 4,2 | 0,4 | 15,2% | 57 |

Nectaro

Nectaro is a P2P newcomer from Latvia that meets all the criteria for long-term success: regulation in Latvia, competitive interest rates, an experienced team, and a large parent company in the background.

On the lender side, the two CreditPrime alternatives from Romania and Moldova are the primary options. While relatively small, they are well-established in their respective markets and have been profitable for years.

Further information can be found in my Nectaro review. New investors who sign up via my partner link receive 1% cashback for 30 days.

| Loan Originator | Year | Audited | Profit | ROA | Equity Ratio | Debt | Liquidity | Impairments | Score |

|---|---|---|---|---|---|---|---|---|---|

| Abele Finance | 2024 | Unaudited | EUR 1K | 19,9% | 4,02 | 1,25 | 40 | ||

| CreditPrime (MD) | 2024 | Crowe | EUR 869K | 11,8% | 22,1% | 3,52 | 54 | ||

| CreditPrime (RO) | 2024 | Forvis Mazars | EUR 2,2M | 23,1% | 34,4% | 1,91 | 3,05 | 9,8% | 86 |

PeerBerry

PeerBerry is one of the largest and most established P2P lending platforms in Europe. Its success is primarily based on reliable lenders and an outstanding approach to handling crisis situations.

PeerBerry is one of the largest and most established P2P lending platforms in Europe. Its success is primarily based on reliable lenders and an outstanding approach to handling crisis situations.

The repayment of over EUR 51 million in war-affected loans is unprecedented in the P2P sector, highlighting the high integrity and stability of the partners with whom PeerBerry collaborates.

Further information can be found in my PeerBerry review. New investors who sign up via my partner link receive 0.5% cashback for 90 days.

| Loan Originator | Year | Audited | Profit | ROA | Equity Ratio | Debt | Liquidity | Impairments | Score |

|---|---|---|---|---|---|---|---|---|---|

| A Credit (KZ) | 2024 | Baker Tilly | EUR 4,77M | 11,6% | 62,6% | 0,60 | 2,57 | 38,2% | 80 |

| Cash Express (PH) | 2024 | Caparros Cendaña & Co. | EUR (2,69M) | (31,0%) | (220,0%) | (1,45) | 1,74 | 100% | 37 |

| Credit365 (MD) | 2024 | Manager Audit | EUR 294K | 0,7% | 22,6% | 3,42 | 7,25 | 56 | |

| Findom (KZ) | 2024 | Baker Tilly | EUR 176K | 10,6% | 85,8% | 0,16 | 7,04 | 20,1% | 78 |

| Lend Plus (ZA) | 2024 | Mahleka D | EUR (87K) | (2,0%) | (3,7%) | (28,26) | 3,15 | 12,1% | 42 |

| Lithome (LT) | 2024 | Unaudited | EUR (18K) | 0,0% | 0,2% | 465,1 | 1,10 | 7,0% | 38 |

| NovaLend (PL) | 2024 | Advantim | EUR 122K | 2,7% | 18,4% | 4,43 | 1,46 | 48 | |

| One Credit (KZ) | 2024 | ALMIR CONSULTING | EUR 5,26M | 24,9% | 41,0% | 1,44 | 3,16 | 12,1% | 80 |

| SmartCredito (ES) | 2024 | Unaudited | EUR (1,41M) | (33,5%) | 17,2% | 4,82 | 7,48 | 0,6% | 60 |

Robocash

Robocash is a P2P platform registered in Croatia, where investors can invest in consumer loans and achieve average returns of around 10%. The P2P platform was launched in February 2017 by the UnaFinancial Group (formerly Robocash Group), which has years of experience in the financial sector.

Robocash does not publish financial results for individual lenders. Instead, investors must refer to the figures of the UnaFinancial Group. The recent significant impairments for loan defaults, the high tax burden (USD 11.4 million), and losses from currency conversions (USD 6.9 million) are clearly reflected in the financial metrics.

Further information can be found in my Robocash review. New investors who sign up via my partner link receive 1% cashback for 30 days.

| Loan Originator | Year | Audited | Profit | ROA | Equity Ratio | Debt | Liquidity | Impairments | Score |

|---|---|---|---|---|---|---|---|---|---|

| UnaFinancial Group | 2024 | Grant Thornton | EUR 574K | 0,5% | 3,8% | 25,1 | 1,00 | 41 |

Swaper

Swaper is an Estonia-based P2P platform that has been active since 2016 and focuses on short-term consumer loans. The loans come almost exclusively from the Wandoo Finance Group, which established Swaper as a financing tool.

| Loan Originator | Year | Audited | Profit | ROA | Equity Ratio | Debt | Liquidity | Impairments | Score |

|---|---|---|---|---|---|---|---|---|---|

| One Leasing | |||||||||

| SW Finance | 2024 | Assertum Audit | (EUR 49K) | (0,3%) | (0,3%) | (360,8) | 1,2 | 26 | |

| Wandoo Finance Group | 2024 | Sandra Dzerele un Partneris | EUR 2,1M | 6,7% | 17,5% | 4,7 | 1,2 | 52 |

Twino

Due to its size and history, Twino is considered one of the pioneers in the P2P lending space. After pursuing an ambitious international expansion strategy in its early years (which hasn’t been successful) the platform’s loan offering has gradually diminished.

Due to its size and history, Twino is considered one of the pioneers in the P2P lending space. After pursuing an ambitious international expansion strategy in its early years (which hasn’t been successful) the platform’s loan offering has gradually diminished.

In recent years, problems in Russia (war in Ukraine), Vietnam (insolvency), and the Philippines (uncertainty) have left only the Polish lending business remaining on the Latvian P2P platform.

Further information can be found in my Twino review. New investors who sign up via my partner link receive 1% cashback for 90 days.

| Loan Originator | Year | Audited | Profit | ROA | Equity Ratio | Debt | Liquidity | Impairments | Score |

|---|---|---|---|---|---|---|---|---|---|

| Fincard | 2024 | BDO | EUR 7,91M | 5,3% | 36,5% | 1,74 | 1,61 | 9,6% | 83 |

Viainvest

In recent years, Viainvest has consistently been one of the most popular alternatives in the P2P lending community. This is due to its long-standing reliability and stability, which has been particularly evident during times of crisis. Thanks to attractive interest rates combined with solid risk management, investors have been able to achieve double-digit returns on Viainvest since 2016.

The driving force behind the P2P platform is the VIA SMS Group, a fintech company founded in 2009. In addition to Viainvest, the holding company also offers a range of other financial services.

Further information can be found in my Viainvest review. New investors who sign up via my partner link receive 1% cashback for 90 days.

| Loan Originator | Year | Audited | Profit | ROA | Equity Ratio | Debt | Liquidity | Impairments | Score |

|---|---|---|---|---|---|---|---|---|---|

| VIACONTO (RO) | 2024 | SC SAVVY AUDIT SRL | EUR 172K | 12,4% | 54% | 0,9 | 3,7 | 73,4% | 78 |

| VIACONTO (SE) | 2024 | Lüsch & Co Revision AB | SEK 1,79M | 1,0% | 5,7% | 16,5 | 1,0 | 24,9% | 47 |

| VIA SMS (LV) | 2024 | BDO Assurance | EUR 933K | 2,2% | 16,4% | 5,1 | 1,1 | 1,1% | 71 |

| VIA SMS (CZ) | 2024 | BDO Audit s.r.o. | CZK (7,3M) | (8,5)% | 15,8% | 5,3 | 1,2 | 57% | 44 |

I’m Denny Neidhardt, the founder of re:think P2P. On this blog, I help retail investors make smarter, well-informed investment decisions in the world of P2P lending. Since 2019, I’ve been publishing in-depth analyses, platform reviews, and risk assessments to bring more transparency to this investment space. My goal is to challenge marketing claims, question developments, and empower investors with honest, independent insights.

Hi Denny. The Impairment ratio of Stik Credit now is 22%? Why have you lower it if no new audited report?

Thanks in advance

I was reviewing the numbers again prior my visit to Sofia. Turns out I made a mistake the first time. Now it displays the correct impairment ratio.

Thanks for Great data!

Would there be interest in reviewing PeerBerry’s Aventus Group as a whole? Or for example the iuvo Group and from that also MGF? And why not Bondster?

Thanks a lot for creating this useful comparison. It definitely took a lot of time, and we highly appreciate it.

Thank you so much for your work, I’m really glad I found this page ????????????! Hive5’s loan originators would be a great addition to your analysis.

Hi Anna,

thanks for sharing your feedback. Let’s see. I think the review is already enough exposure for them on my blog.

Best, Denny

Hi Denny,

First, I just want to say thank you for the excellent and detailed analysis you provide on Rethink P2P.

I have a quick question about your scoring methodology. I noticed that you don’t seem to assign a specific score to the “age” or operational history of the companies.

I was just wondering about the reasoning for this. For example, in the current rating, a company with good financials that has been active for less than 5 years seems to have no scoring difference compared to a company at a similar level that has been active for 20 years.

Was this a conscious decision? I’d be interested to know your thoughts on why longevity isn’t factored in as a specific scoring point.

Thanks again for your great work!

Hi Itta,

thanks for your feedback on the lender comparison page. The track record is indeed an important aspect of the overall lender assessment. However, this comparison focuses solely on financial stability, which is why I am looking only at the most recent financial data.

Including past financial performance could potentially penalize younger, yet stable, lending companies. At the same time, how would someone assess if an established loan originator has done good or bad in the past? Does a low rating become better, despite having great financials in the past?

Having the overall picture in mind is important. But for evaluating financial stability, only recent results provide the most relevant and comparable benchmark for all lenders.

Thanks again for sharing your feedback!

Denny

Comparison of originators is one of the most valuables things! I may suggest update it on regular basis and add new (if possible). Thank you.

Hi Mindaugas,

for now, updates will happen on a monthly basis.

Are there any bigger lenders that are currently missing?

Regards,

Denny

Hi Denny, I suggest to analyse:

Estateguru

Iuvo

LandSecured

Bondster

Peerbery

Robocash

Lendermarket

Esketit

Paskolu Klubas

Reinvest24

HeavyFinance

Indemo

Crowdpear

Fintown

Swaper

Twino

Afranga, StikCredit

Moncera

Bulkestate

Nordstreet

Crowdestate

Profitus

Inrento

Viainvest

Nectaro

Scramble

Stockcrowdin

Civislend Platforms and originators (where not analysed). I personally use ChatGPT plus in this case. I found Eleving group is missed. All the best, Mindaugas

Doesn’t anyone notice that you copy everything P2P Empire does? It was really noticeable recently. Even your portfolio is almost identical.

P2P Empire publishes lender reviews -> Danny publishes lender reviews.

P2P Empire invests in Afranga -> Denny invests in Afranga.

and so on…

It would be cool if you created your own content again 🙂 The blog is just a shadow of what it used to be. Very sad development….

Thanks for your feedback. Let me clarify a few things: I have a lot of respect for P2P Empire. They are doing a great job. As far as I know, I invested in Afranga before they did. The same goes for Nectaro, by the way. As for the lender page, I started publishing lender analyses earlier this year as part of my platform reviews (e.g., Income Marketplace, Nectaro). What has changed is that I’m now expanding this format and consolidating the information on one page to make it more structured and accessible for readers. In addition, we use different KPIs to assess financial performance. So while there may be some overlapses and similarities, I don’t believe your accusations are justified.

Have a good day,

Denny

Hi Denny,

What an impressive dashboard.

I never took the time to build mine / the size of my portfolio doesn’t justify so much work.

It would be great if you could extend it to other platforms.

The maintenance will be a real challenge I guess.

Thanks a lot.

Patrick,

Hi Patrick,

thanks for your feedback.

Mintos and PeerBerry will be added in the next days as well.

Indeed, maintenance is going to be a challenge. Maybe I will perform an update once each quarter.

So long,

Denny