Monefit SmartSaver is an alternative for P2P investors who prefer to invest in products with high liquidity, fixed returns and an easy handling.

The product itself was set-up by the Creditstar Group, which is an international fintech company from Estonia. Launching Monefit SmartSaver was mainly intended to establish another financing source for Creditstar’s lending operations.

In this Monefit SmarSaver review, investors will find a summary of all relevant information they should know about. From the investment basics up to the various risks that need to be considered. In addition, readers will learn in this review whether the Creditstar product is a serious alternative to Bondora Go & Grow.

Further analyses of other platforms can be found on my P2P Platform Review page.

Summary

Before we get started, here is a quick summary with the most important information about Monefit SmartSaver.

- Monefit SmartSaver is an investment platform from the international fintech company Creditstar. Investors can invest directly in the Creditstar Group’s loan portfolio and achieve a return of up to 10.52%. The operational launch took place in November of 2022.

- The main characteristics of Monefit SmartSaver are high liquidity, a fixed return and simple handling. The profile of the product is therefore very similar to the Bondora Go & Grow offering.

- Monefit SmartSaver is not subject to any supervision by a regulatory or financial supervisory authority. The platform has not yet published any KPI’s on the performance of the loan portfolio, which makes it difficult to assess the quality of the product and the promised repayment quality.

- Monefit SmartSaver is perceived as a slightly above-average platform in the P2P lending sphere. In the Community Voting 2024, Monefit took 14th place out of 30 platforms.

| Started: | November 2022 |

| Company: | Monefit Card OÜ (LINK) |

| Headquarter: | Tallinn, Estonia |

| Regulated: | No |

| Community Voting: | P14 out of 30 | See Voting |

| Assets Under Management: | Not Disclosed |

| Number of Investors: | 25.000+ |

| Expected Return: | Up to 10,52% |

| Primary Loan Type: | Consumer Loans |

| Collateral: | None |

| Bonus: | 0.25% Cashback (90 Days) |

About Monefit SmartSaver

Monefit SmartSaver is an investment platform from the international fintech company Creditstar, where investors can directly invest in the Creditstar Group’s loan portfolio and earn a return of up to 10.52%.

Monefit SmartSaver is an investment platform from the international fintech company Creditstar, where investors can directly invest in the Creditstar Group’s loan portfolio and earn a return of up to 10.52%.

What makes the SmartSaver product stand out is its high liquidity and the ease of use when investing. For example, the platform does not allow manual or automated loan selection, which makes the overall investment experience with Monefit very straightforward. Due to these characteristics, it bears a certain resemblance to the already established Bondora Go & Grow product.

The expected return depends on the duration of the investment. By using the SmartSaver main account, which offers the highest possible liquidity, investors receive an annual percentage yield (APY) of 7.5%. In contrast, by committing to a longer investment period via the SmartSaver Vaults (up to 24 months) returns of up to 10.52% can be achieved.

Ownership and Management

Who are the main shareholders and management executives of Monefit SmartSaver? Let’s have a look!

Ownership

Who owns Monefit SmartSaver? Monefit SmartSaver operates under the name Monefit Card OÜ. A look at the Estonian company register reveals that this is a limited liability company with an equity contribution of EUR 50,000.

Monefit Card OÜ is 100% owned by the Estonian parent company “CREDITSTAR INTERNATIONAL OÜ”. This company in turn is 100% owned by the Estonian Creditstar Group AS.

The Estonian holding company is more than 50% owned by businessman Aaro Sosaar. He is the founder of both the Creditstar Group and Lendermarket. In June 2024, as part of my P2P journey through the Baltic States, I was able to meet the Creditstar founder in person for the first time.

Management

The Monefit SmartSaver team is led by Creditstar CPO Kashyap Shah, who is a manager with 20+ years of experience in the financial sector. At Monefit, he is responsible for the strategy, new implementations as well as the overall product growth.

The Monefit SmartSaver team is led by Creditstar CPO Kashyap Shah, who is a manager with 20+ years of experience in the financial sector. At Monefit, he is responsible for the strategy, new implementations as well as the overall product growth.

Currently, around 10 permanent employees are working on the development of Monefit. In addition, there are shared resources with Creditstar Group as well. In my podcast with Kashyap, we talked about the origin story of Monefit SmartSaver, how transparent the product will become later on, how to ensure liquidity and when Creditstar repayments on Mintos will occur.

Sign Up and Bonus

To invest on Monefit SmartSaver, investors must meet three requirements:

- A minimum age of 18 years,

- A personal bank account in the European Economic Area or Switzerland,

- Successful verification of identity by the SmartSaver team

Also legal entities have the opportunity to register on Monefit SmartSaver. These must also have a bank account in the EEA or Switzerland.

Monefit SmartSaver Bonus

If you want to sign up on Monefit SmartSaver, make sure to register by using this link. This will enable you to get an additional Cashback of 0.25% on all net deposits in the first 90 days after registration, including a EUR 5 sign up bonus after succesful registration.

A cross-platform overview with all bonus offers and cashback promotions can be found by investors on the bonus page.

Investing on Monefit SmartSaver

On Monefit SmartSaver, investors have two ways to invest their money on the platform. The first is through the main account, where the balance earns 7.5% APY with daily interest accrual. The second option is the SmartSaver Vaults, where returns of up to 10.52% can be achieved depending on the chosen time frame.

The following sections provide more information on investing through the SmartSaver platform.

Main Account

Investing on Monefit SmartSaver is as simple as on Bondora Go & Grow. All that is required is to deposit funds and select the desired term. The platform does not offer an Auto Invest configuration or manual loan selection.

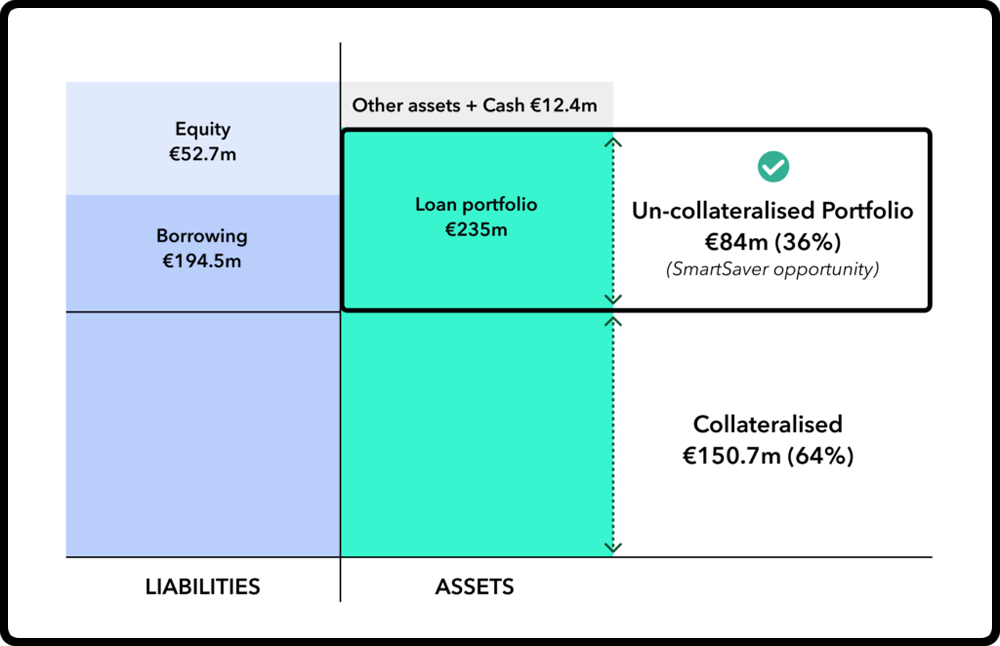

In the background, the platform automatically invests in a broadly diversified loan portfolio of the Creditstar Group. Investors do not have direct visibility into the individual loans they are acquiring. What can be said about the loans is that they are unsecured consumer loans from the EEA. Possible borrower countries include Estonia, Finland, Sweden, Czech Republic, Denmark, Poland and the UK.

In the background, the platform automatically invests in a broadly diversified loan portfolio of the Creditstar Group. Investors do not have direct visibility into the individual loans they are acquiring. What can be said about the loans is that they are unsecured consumer loans from the EEA. Possible borrower countries include Estonia, Finland, Sweden, Czech Republic, Denmark, Poland and the UK.

Funds in the main account accrue daily interest at an annual percentage yield (APY) of 7.5%. The minimum investment amount is currently EUR 10, while the maximum investable amount is EUR 500,000.

Up to EUR 1,000 per calendar month can be withdrawn daily from the main account. Amounts above this limit are subject to a processing time of up to 10 business days. Therefore, the main account is particularly suitable for short-term use when quick liquidity is required.

SmartSaver Vault

Since March 2024, Monefit SmartSaver has offered the option to invest in “Vaults,” which are comparable to fixed-term deposits. Depending on the chosen investment period, investors can achieve different levels of returns.

For a 6-month term, investors are offered a return of 8.33% APY, while a 12-month term provides 9.42% APY. Additionally, there are Vaults with an 18-month term offering 9.96% APY, and Vaults with a 24-month term yielding 10.52% APY.

The minimum investment amount for SmartSaver Vaults is currently EUR 100, while the maximum investable amount is EUR 500,000. Unlike the main account, SmartSaver Vaults are particularly suited for slightly longer-term investments where a higher return is desired.

Expected Returns

The return achievable on Monefit ranges between 7.5% and 10.52%, depending on the chosen product. Through the classic Monefit SmartSaver main account, investors can earn an annual percentage yield (APY) of 7.5%.

However, higher returns can be achieved with longer-term commitments through the “SmartSaver Vaults”. A six-month term commitment yields 8.33%, a twelve-month term commitment yields 9.42%, an 18-month term commitment yields 9.96%, and a twenty-four-month term commitment yields 10.52%.

However, higher returns can be achieved with longer-term commitments through the “SmartSaver Vaults”. A six-month term commitment yields 8.33%, a twelve-month term commitment yields 9.42%, an 18-month term commitment yields 9.96%, and a twenty-four-month term commitment yields 10.52%.

Monefit has reserved the right to make possible adjustments to their offered interest rates in the future.

Costs and Fees

The use of Monefit SmartSaver is completely free of charge for investors. This applies to registration, investing as well as deposits and withdrawals.

Alternative Savings Account

Monefit SmartSaver meets many of the criteria that can be compared to a traditional savings account. These include features such as an open-ended term, no notice period, and the possibility of daily interest rate adjustments.

Daily accessibility is somewhat limited, as SmartSaver allows only up to EUR 1,000 per calendar month to be withdrawn daily. Amounts above this are subject to a processing time of up to 10 days. Additionally, liquidity could deteriorate during economic turbulence (see partial withdrawals with Bondora Go & Grow).

On the positive side, Monefit SmartSaver offers significantly higher interest rates. Even though the 7.5% annual return is not guaranteed, it is still far above the typical rates offered by savings accounts in Europe.

The trade-off for this higher return is reduced security. While savings accounts in Germany are protected by a deposit insurance of up to EUR 100,000, no such protection exists with Monefit SmartSaver. Furthermore, the Creditstar Group does not provide any additional guarantees to secure investors’ capital.

Conclusion: Monefit SmartSaver is not a traditional savings account, but it can be seen as an alternative with an expanded risk-return profile.

Liquidity

Monefit SmartSaver markets itself strongly on offering high liquidity, allowing investors to access their funds promptly. In November 2025, the platform introduced two new product updates that further improve liquidity and the predictability of withdrawals.

Instant Withdrawals: Investors can withdraw up to EUR 1,000 per calendar month immediately from their SmartSaver main account. For amounts over EUR 1,000 per month, a processing time of up to 10 business days still applies.

Scheduled Withdrawals: Investors can schedule withdrawals up to 365 days in advance. Both one-time and recurring withdrawals can be prepared in this way.

There is currently no fee charged for withdrawals on Monefit SmartSaver.

Important: When making a withdrawal, only bank accounts that have previously been used to deposit money can be selected. If the desired bank account is not available, funds must first be deposited from that account.

Monefit SmartSaver Forum

The P2P lending industry is a fast-moving environment. Hence, make sure to stay on top of all relevant information by subscribing to my channels on Telegram or WhatsApp. This way, you will always receive the latest information from the P2P industry, including platform news regarding Monefit SmartSaver.

Monefit SmartSaver Taxes

Generally, interest income generated by loan financing is considered investment income and thus must be reported as such at the tax declaration.

Unlike other platforms, Monefit SmartSaver does not withhold taxes through interest income such as in Latvia or Lithuania.

Monefit SmartSaver Risks

The risks of Monefit SmartSaver should be considered carefully and in detail, as it is neither a traditional P2P platform nor a P2P marketplace.

Monefit primarily serves to raise funds for the Creditstar Group’s loan portfolio. So far, neither Creditstar nor Monefit have provided information on how investors’ funds have been used.

Platform Risk

The platform, operated by the Creditstar Group, launched in November 2022. In its domestic market Estonia, the platform is not supervised by any financial or regulatory authority.

Investors should therefore familiarize themselves thoroughly with Creditstar’s risk profile.

The Creditstar Group is a fintech company founded in 2006, headquartered in Estonia, and comprises a variety of internationally active lenders across Europe.

The Creditstar Group is a fintech company founded in 2006, headquartered in Estonia, and comprises a variety of internationally active lenders across Europe.

With Monefit SmartSaver, the Creditstar Group aims to establish an additional funding source for its lending business. To this end, the P2P platform Lendermarket was launched in April 2019, promoting above-average return expectations.

Since loans on Monefit are offered exclusively by Creditstar, investors should look into the performance of the Estonian company more closely.

| Loan Originator | Year | Audited | Profit | ROA | Equity Ratio | Debt | Liquidity | Impairments | Score |

|---|---|---|---|---|---|---|---|---|---|

| Creditstar Group | 2024 | KPMG | EUR 7,24M | 2,2% | 19,2% | 4,2 | 0,4 | 15,2% | 57 |

You can check out the lender overview and comparison page for additional information regarding applied KPIs and their interpretation.

Repayment Issues

In the past, the Creditstar Group has not always been able to fulfill the promised buyback guarantees on Mintos and Lendermarket on time.

This is mainly due to Creditstar’s rather aggressive approach to debt financing, which has led to volatility in securing external funding and, in turn, to delays in repayments to investors. It is likely for this reason that Monefit SmartSaver was introduced as an additional and more cost-effective funding source.

This is mainly due to Creditstar’s rather aggressive approach to debt financing, which has led to volatility in securing external funding and, in turn, to delays in repayments to investors. It is likely for this reason that Monefit SmartSaver was introduced as an additional and more cost-effective funding source.

From an investor’s perspective, this aspect should not be overlooked, especially since Monefit SmartSaver is heavily marketed on the basis of high liquidity. While payouts have so far been made on time, investors should be aware that liquidity may not always be guaranteed at all times.

Intransparency of Loan Portfolio

So far, Monefit SmartSaver has not provided detailed information on the performance of the underlying loan portfolio.

As a result, important data is missing to properly assess and evaluate the risk profile of Monefit SmartSaver.

In the past, the Creditstar CPO promised that a report with transparency KPIs would be made available in the future. However, this report has not yet been published. Interested investors should therefore examine the development of the Creditstar Group very carefully.

Deposit Insurance

Investments offered through Monefit SmartSaver are not covered by European deposit guarantee schemes (such as the Deposit Guarantee Directive 2014/49/EU). This means that, unlike traditional bank deposits, the funds invested on Monefit are not insured or guaranteed by any national or European compensation system.

Investors should therefore be aware that the invested capital is subject to loss, returns are not guaranteed, and they may not recover the full amount invested.

Advantages and Disadvantages

In this section, I have listed the most important advantages and disadvantages of Monefit SmartSaver.

Advantages

- Creditstar: Established fintech company with a profitable business model.

- Liquidity: Faster availability of funds compared to traditional P2P platforms.

- Stability: So far, all payout requests have been honoured within 10 days.

- Alternative: Possible alternative for investors who like Bondora Go & Grow.

Disadvantages

- Return: The interest rate is not competitive compared to traditional P2P platforms.

- Transparency: No insights into the actual performance of the loan portfolio.

- Protection: The investment is not protected or secured in any other way.

- Repayments: Creditstar loans are frequently extended and not always repaid on time.

Monefit SmartSaver Alternatives

Which Monefit SmartSaver alternatives exist in the P2P lending space?

The key features of the product include easy handling, a fixed interest rate, and a high degree of liquidity. These criteria are currently offered in the market both by Bondora Go & Grow and Modena.

The table below is intended to illustrate the parallels and differences between the respective products.

| Bondora Go & Grow | Monefit SmartSaver | Modena | |

|---|---|---|---|

| Start | 2018 | 2022 | 2025 |

| Jurisdiction | Estonia | Estonia | Estonia |

| Return | 6% | 7,25% to 8,33% | Up to 11% |

| Interest Credit | Daily | Daily | Monthly |

| Availability | Daily | Max. 10 Days | Max. 31 Days |

| Min. Investment | EUR 1 | EUR 10 | EUR 50 |

| Max. Investment | Unlimited | EUR 500,000 | Unlimited |

| Deposit Limit | Unlimited | Unlimited | Unlimited |

| Collateral | No | No | No |

You can find more Monefit SmartSaver alternatives on the P2P Platform Comparison page.

Community Feedback

Monefit SmartSaver’s reputation within the P2P lending community is being viewed increasingly positively, based on the results of the annual P2P community voting. The platform improved its score by 0.25 points compared to the previous year. With a 14th place finish, Monefit secured once again a solid midfield position.

The Top 5 P2P platforms in 2025 were Viainvest, Debitum, Mintos, Swaper, and Income Marketplace.

Summary Monefit SmartSaver Review

What is the final verdict of this Monefit SmartSaver review?

What is the final verdict of this Monefit SmartSaver review?

The two main selling points of Monefit SmartSaver are its ease of use and high liquidity. For investors who do not want to engage deeply with P2P loans, looking for alternatives similar to Bondora Go & Grow, Monefit SmartSaver can be a possible option. The same applies to investors who prioritize liquidity and the fast availability of invested funds.

In general, a return of only 7.5% for short-term, unsecured consumer loans does not represent an adequate risk-return ratio, especially since Monefit provides no protection or guarantee for the advertised returns.

Another aspect to watch is Monefit’s payment behavior. Due to the frequently used credit lines, delays have often occurred on marketplaces like Mintos or Lendermarket. If there is a higher demand in withdrawal requests, partial payouts would certainly not be surprising.

On a positive note, Monefit SmartSaver has fulfilled all promises regarding returns and payout timelines during its first three years of operation.

Since June 2025, I have been using the Monefit SmartSaver main account as a short-term liquidity reserve.

FAQ Monefit SmartSaver Review

Monefit SmartSaver is a new investment platform from the international fintech company Creditstar, where investors can invest directly in the Creditstar Group’s loan portfolio and achieve a return of up to 10.52%.

Monefit SmartSaver operates under the legal name of Monefit Card OÜ. This is a limited liability company from Estonia with an equity contribution of EUR 50,000. The company is more than 50% owned by businessman Aaro Sosaar who is also the founder of Creditstar Group and Lendermarket. Another shareholder is Tauri Jaanson.

The company behind Monefit SmartSaver is limited by liability. In addition, there is no form of investment protection. The funds can theoretically be lost at any time.

As you can see, the liquidity is a bit better at Bondora Go & Grow. In return, Monefit SmartSaver can score with a slightly higher return and more flexibility when it comes to deposits.

If you want to register on Monefit SmartSaver, make sure to use this link for sign up. This will enable you to get an additional Cashback of 0.25% on all net deposits in the first 90 days after registration, including a EUR 5 sign up bonus.

I’m Denny Neidhardt, the founder of re:think P2P. On this blog, I help retail investors make smarter, well-informed investment decisions in the world of P2P lending. Since 2019, I’ve been publishing in-depth analyses, platform reviews, and risk assessments to bring more transparency to this investment space. My goal is to challenge marketing claims, question developments, and empower investors with honest, independent insights.

Credistar currently offers loans with a 15.5% yield on Mintos and I even managed to buy some at 17.5%. If the risk with Moneyfit vs Loans is the same, guess that investing on their loans on Mintos is safer.

Hi Lavinia,

thanks for commenting and sharing your view. Everything involving Creditstar is a bit of a gamble. But your are right, if you commit to it, then you might as well go for the high-yield option in exchange for a bit less liquidity.

Best, Denny

Both Monefit and Creditstar have huge bad history on Lendermarket, where investor money are locked for longer 6month. Before that Creditstar had issues for several month on Mintos. So they are not a kind of entrepreneurs who value investor money and are responsible for promises. Good luck to investors who is still trusting in them.

The tie from Monefit to Lendermarket comes via Creditstar. Apart from that, you are right with your conclusions. Thanks for sharing.