The P2P lending year 2025 is now history. While I already shared my personal winners and losers of the past year, here I take a look at the development of my personal P2P portfolio. In addition, there is a brief outlook for 2026.

Development of Outstanding P2P Portfolio

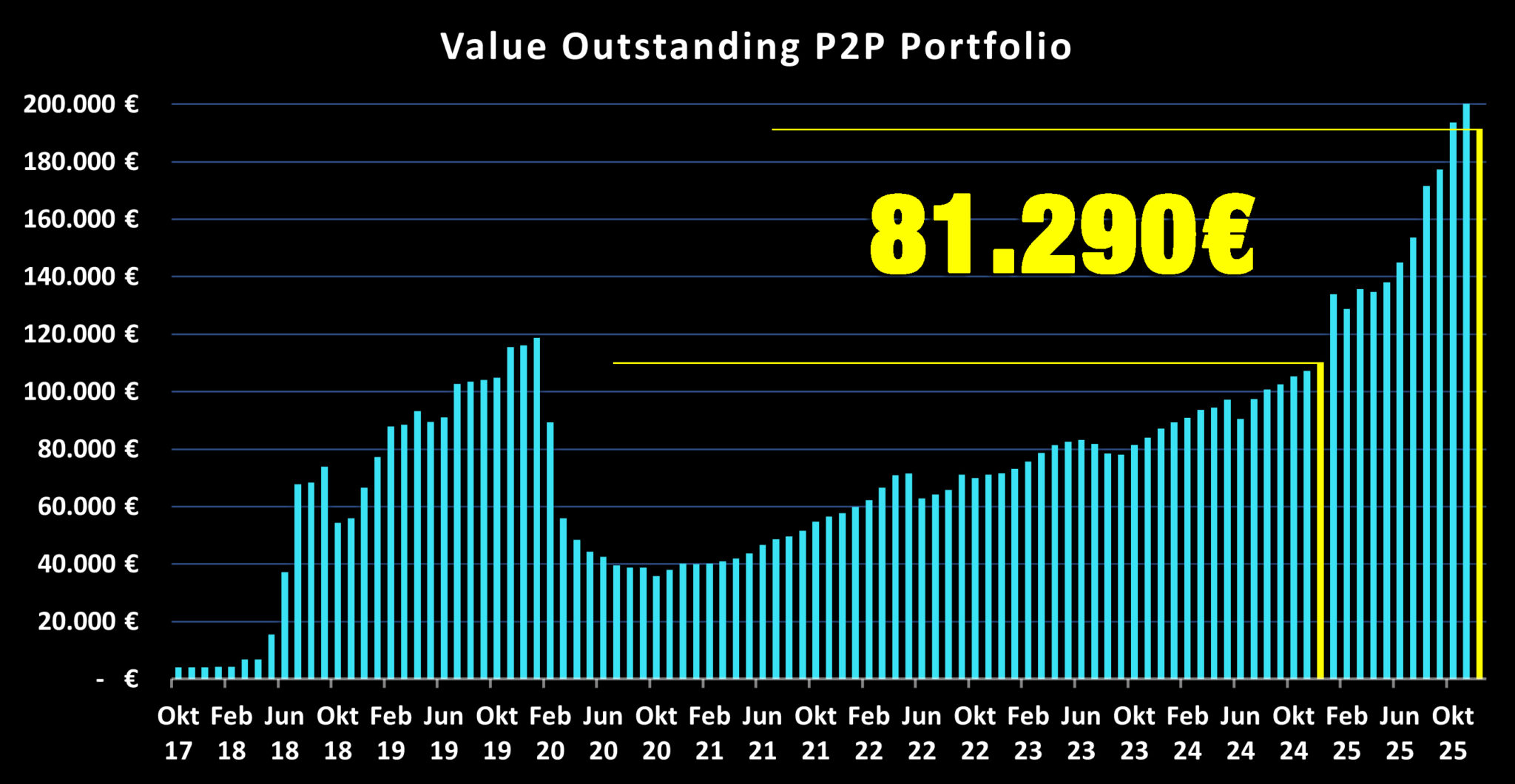

As always, let’s start with a look at the big picture and the development of my personal P2P portfolio. Over the past year, my portfolio made a solid leap forward, growing from EUR 109,947 to EUR 191,237. This represents an increase of EUR 81,290, the highest annual growth in my P2P investment journey so far.

At the end of November 2025, I was even able to surpass the EUR 200K mark for the first time (EUR 202,267).

For my long-term P2P investments (excluding Bondora Go & Grow and Monefit SmartSaver), I invested a total of EUR 64,000. In comparison, withdrawals amounted to EUR 34,696.

This results in a net inflow/outflow of EUR 29,304, which corresponds to roughly EUR 2,442 per month. For comparison: in previous years, it was EUR 1,116 (2024), EUR 1,720 (2023), and EUR 962 (2022).

In addition, there was a write-off of EUR 76.62 with Estateguru. Undoubtedly, many more of these are likely to follow in 2026.

Development of Portfolio Size by P2P Platforms

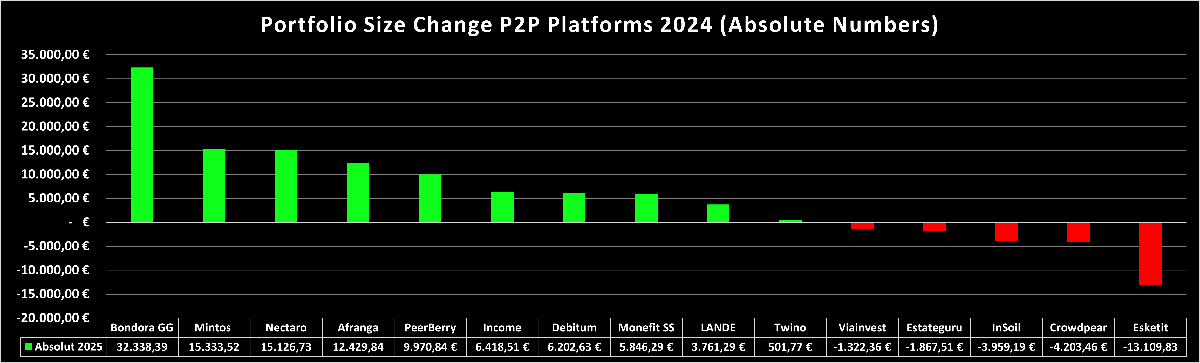

For ten out of fifteen P2P platforms, the absolute value of my outstanding portfolio increased over the past year. The biggest jump came from Bondora Go & Grow, with an increase of EUR 33,338. Due to the volatility of my short-term P2P investments, this figure should not be overestimated.

In second place are my Mintos bond investments, with an increase of EUR 15,334. Over the past year, three additional bonds were added: Iute Group, Credifiel, and the Mintos bond itself. The third-largest increase came from Nectaro, with EUR 15,126, one of two newcomers in 2025.

The largest monetary decline last year was EUR 13,110 with Esketit. Following that were Crowdpear with EUR 4,203 and InSoil Finance with EUR 3,959.

P2P Lending Income 2025

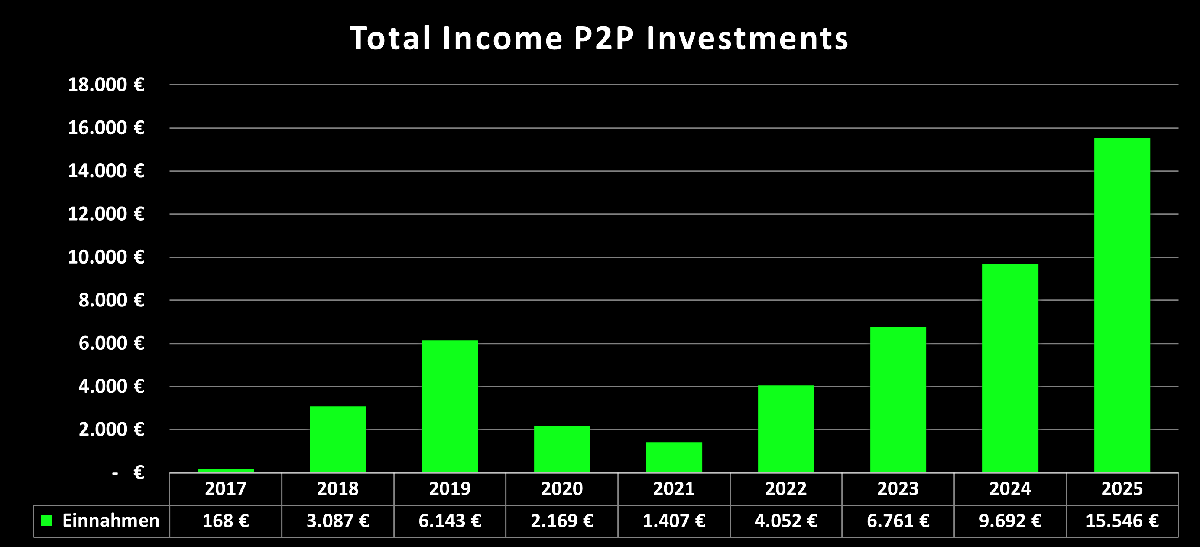

I have now been investing in P2P loans for over eight years. In 2025, I reached a new personal record for total annual income. In the previous year, my total income had been EUR 15,546.

This allowed me to break through two milestones at once. For the first time, my total income exceeded EUR 10,000, and I also achieved a monthly average of more than EUR 1,000 for the first time (EUR 1,296).

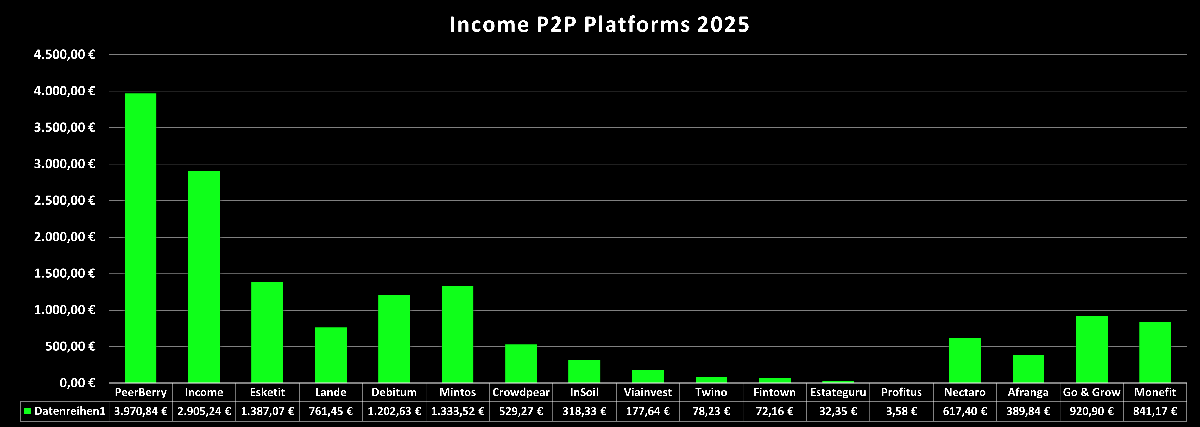

The income was once again led by the same three P2P platforms as in previous years, albeit in a different order. PeerBerry remained my largest position throughout the year and thus generated the highest income at EUR 3,971 (previous year: EUR 3,501).

In second place in 2025 was Income Marketplace with EUR 2,905 (previous year: EUR 1,517), improving by one position. Third place went to Esketit with EUR 1,387 (previous year: EUR 2,132), closely followed by the income from my bond investments on Mintos (EUR 1,334).

P2P Lending Performance 2025

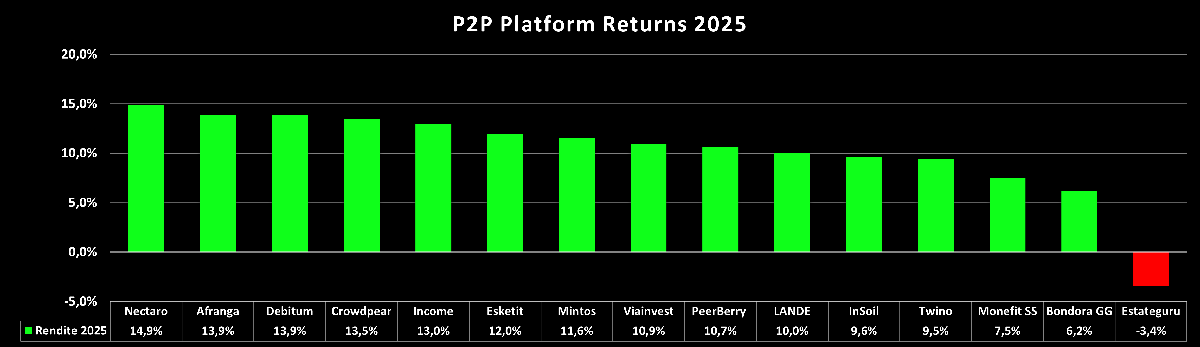

Last year, ten out of fifteen P2P platforms achieved an annual return above 10%. Leading this ranking were Nectaro (14.91%) and Afranga (13.92%), the only two P2P platforms added to my portfolio in 2025.

The top five is rounded out by Debitum (13.88%), Crowdpear (13.49%), and Income Marketplace (12.98%). For Monefit SmartSaver (7.54%) and Bondora Go & Grow (6.24%), it was already clear in advance that they would not reach double-digit returns. The only real disappointment was Estateguru, which recorded a negative annual return for the first time (-3.4%).

For greater objectivity and better comparability, only platforms that were actively part of my P2P portfolio throughout the entire year have been considered. Fintown and Profitus are therefore excluded from the ranking.

P2P Platform Ratings 2025

For the year-end review, I have already shared my opinion and assessment of the development and performance of a total of 12 P2P platforms.

Alternatively, you can also view the analysis on my YouTube channel:

Highlights 2025

At this point, I would like to briefly highlight some key moments from the past year.

French Interface

In recent years, a routine has been established whereby a new interface is released in the first quarter of each year to make the blog’s content accessible to a wider audience of investors. In 2023, the translation was into English, in 2024 into Spanish, and in 2025, the French interface followed.

2 P2P Newcomers

While the business model of some bloggers appears to be joining every party, regardless of the quality of the respective platform, I did not let myself be swept up in the gold rush of new affiliate commissions from unknown or unqualified companies in 2025 either, and have remained true to my motto: quality > quantity.

Once you reach a certain size and reach, at least in my case, you also become aware of greater responsibility. Hiding behind standard disclaimers and liability waivers is ultimately just a cheap excuse to give your own greed for commissions a free pass. At least, that’s my impression.

Back to the topic: In 2025, Nectaro and Afranga were two newcomers to join my P2P portfolio. Both providers are regulated platforms with a broad and attractive loan offering, consisting of profitable and, in some cases, very well-established lenders from across Europe.

By the end of the year, both platforms had not only reached five-figure portfolio sizes, but thanks to the combination of competitive interest rates and attractive bonus campaigns, they were also the top performers of the past year. Nectaro leads the table with 14.9%, followed by Afranga in second place at 13.9%.

P2P Lender Comparison

One key insight from last year has been the increasing focus on the lenders themselves. After all, they are the decisive factor in whether a platform’s returns can ultimately be achieved sustainably.

While individual analyses and evaluations of lenders existed in the past, they were never done on a larger scale or in a standardized style with a focus on financial stability.

The launch of the lender overview and comparison page is therefore certainly a milestone for this blog. Managing the page already takes a significant amount of time, and with its growing duration and additional lenders, this will certainly not decrease. For a blog run largely without external help or support, this is a considerable effort.

All the more, I am delighted by the positive reception from many investors and that a real added value for the P2P lending community has been created. If the page has helped you with your investment decisions, feel free to show your appreciation with a small donation on buymeacoffee.com. Thank you!

New Hosting

Behind the scenes of a blog, there are often infrastructural issues that readers don’t really notice. Hosting is one such example. For many years, I have been a customer of the Munich-based company DomainFactory. Other blogs and online projects of mine have also been managed by this host since 2013.

In recent years, however, the performance deteriorated significantly. Whether in terms of loading speed or even complete outages. In 2025, I felt the need to take action. IT is a topic I prefer to avoid, but there was no other option.

With WPspace, I have now (hopefully) found a strong and stable partner for the future. The first months have been very promising. While the pricing is somewhat higher in comparison, both performance and support have been impressive so far.

Outlook 2026

Finally, a brief outlook and some thoughts on how things might develop in 2026.

P2P Lending Investments

Attentive readers will have noticed that I only made it public toward the end of 2025 that I had been investing again in Bondora Go & Grow since the beginning of the year, and in Monefit SmartSaver since summer 2025. This temporary secrecy revealed two things for me:

Responsibility: My publicly expressed criticism regarding the “black-box” nature of both products is probably well known. Against this background, I was hesitant to share my investments publicly for a long time. Partly because I did not want to act as a “bad example,” and partly because I still believe the transparency standard should be higher.

Investment Strategy and Execution: As my P2P portfolio grows, it becomes clear that adjusting my strategy – and the execution of my investments – is necessary. What does this mean?

- Liquidity: Liquidity has always been a key component for me. My mantra: anything with up to a two-year term fits into my framework, but ideally, it should not exceed 12 months. Flexibility and agility are highly prioritized in my investments. Especially with P2P, where dynamics can change rapidly. In reality, however, this becomes increasingly difficult with a growing portfolio. On one hand, there are strong liquidity promises from the aforementioned one-click products; on the other hand, there are attractive loan offers that come with significantly longer terms. To simplify: one-way solutions and predefined structures will not serve me in the long run if I plan to continue expanding my P2P portfolio.

- Calculated Risks: Building on this, a second conclusion for me is that pursuing further growth also requires being willing to shift my risk tolerance to some extent. This means, for example, investing in platforms or products that I might have previously excluded due to heightened risk awareness. I categorize this under “calculated risks.” This does not mean playing Russian roulette or investing blindly; rather, it represents a measured increase in my risk tolerance for future investments.

In line with this, I recommend my recent discussion with Jakub from P2P Empire, where we exchange views on the risk profiles of individual platforms and discuss trends we expect for 2026.

re:think P2P

The blog is now entering its eighth (!) year. Incredible how fast time flies! As for my output in 2026, it will likely continue in the same vein as in previous years. The monthly P2P portfolio updates will remain a core pillar to transparently document my journey with P2P investments. In addition, I aim to establish the monthly analyses of lender financials as another cornerstone of my content.

The release of a new interface is also planned for this year. Q1 could be tight though, as several other projects are already in the pipeline.

For up-to-date information, I recommend joining the Telegram group or my WhatsApp channel. Here, you will always receive timely updates, reactions, and insights as soon as new developments occur.

Platform Visits

Last year, I had planned to travel to the Baltics again to continue my 2024 trip. In the end, it didn’t happen. Timing didn’t quite work out, and my motivation was limited as well.

For 2026, however, I am much more motivated. In February, I will be traveling to Sofia at my own expense to meet with several industry stakeholders in Bulgaria. A visit to the Afranga platform is on the agenda, as well as discussions with established lenders such as Stik-Credit and the ITF Group.

In the summer, I also plan to travel to the Baltics again. It will likely be a shorter trip, during which I will visit only selected platforms in Tallinn and Riga.

Final Words

In the end, I want to say a big THANK YOU to my loyal readers and viewers who once again accompanied and supported me in large numbers in 2025. Without your support, the blog would not exist in its current form.

Wishing us all a healthy, fulfilling, and successful 2026!

Yours,

Denny

Video: P2P Lending Income 2025 + Outlook 2026

I’m Denny Neidhardt, the founder of re:think P2P. On this blog, I help retail investors make smarter, well-informed investment decisions in the world of P2P lending. Since 2019, I’ve been publishing in-depth analyses, platform reviews, and risk assessments to bring more transparency to this investment space. My goal is to challenge marketing claims, question developments, and empower investors with honest, independent insights.