Maclear is a Switzerland-based crowdfunding platform that offers above-average interest business loans. Is it worth investing? What risks should investors be aware of?

All relevant information, including a detailed risk assessment, can be found in my Maclear review below.

Further analyses of other platforms can be found on my P2P Platform Review page.

Summary

Before we get started, here is a quick summary with the most important information about Maclear.

| Started: | May 2023 |

| Legal Name: | Maclear AG (LINK) |

| Headquarter: | Wallisellen, Switzerland |

| Regulated: | Yes (Self Regulatory Organization) |

| CEO: | Denis Ustjev (August 2020) |

| Assets Under Management: | EUR 44+ Million |

| Number of Investors: | 25.000+ |

| Expected Return: | 15,6% |

| Primary Loan Type: | Business Loans |

About Maclear

Maclear is a crowdfunding platform registered in Switzerland that allows investors to invest in international SME loans. The platform promotes above-average returns of up to 15.6%.

Maclear began operations in May 2023 and therefore ranks among the younger and more inexperienced platforms in the P2P lending space.

The registered office in Switzerland is a notable peculiarity in Maclear’s case. Neither the shareholders have any connection to Switzerland, nor are there any Swiss projects or borrowers, and the platform’s operational activities are managed from the Baltics. This strongly suggests that the location was chosen strategically in order to circumvent the European Crowdfunding Service Providers regulation (ECSP).

The misleading and, in some cases, falsely presented information on the loan projects also raises serious doubts about the credibility and trustworthiness of Maclear’s business model. More on this can be found in my Maclear review.

Ownership and Management

Who are the main shareholders and management executives behind Maclear? Let’s have a look!

Ownership

Maclear AG was originally founded on May 11, 2010. At the time, the company operated in the GRC software sector (Governance, Risk, Compliance). In 2020, the company was acquired by the two business partners Aleksandr Nikitin and Denis Ustjev, who each hold 50% of the shares in the Swiss company.

Maclear Management

Denis Ustjev is the CEO of the Maclear P2P platform.

Denis Ustjev is the CEO of the Maclear P2P platform.

He has several years of experiences in the international banking sector, where he e.g. has worked in management consultancy.

He originally came up with the idea of a Swiss crowdlending platform. He has been CEO of Maclear’s operational activities since August 2020.

Maclear Risk Elements

When evaluating a P2P platform, investors should take a very close look at the potential risk factors. What should you look out for at Maclear? What are the risks and how can they be assessed?

Regulation

The P2P platform is operated by the Swiss company “Maclear AG.” This company is regulated by the General Self-Regulatory Organisation PolyReg. PolyReg is an officially FINMA-recognised self-regulatory organisation (SRO) pursuant to Article 24 of the Swiss Anti-Money Laundering Act (AMLA). In short, the organisation supervises financial intermediaries that are members of it.

Overall, PolyReg is considered reputable and regulatorily sound, with a clear integration into the FINMA-led system for combating money laundering. With regard to its effectiveness, it should be noted that PolyReg primarily monitors compliance with due diligence obligations under the AMLA (identification requirements, suspicious activity reports, documentation, etc.), but not financial market stability or investor protection. In this respect, the organisation cannot be compared to a traditional financial supervisory authority that is active in prudential or risk supervision.

It is therefore legitimate to question why Maclear chose Switzerland as its location in the first place.

The shareholders have no connection to Switzerland, no projects from Switzerland are offered, and the operational activities are managed from the Baltics.

This raises the suspicion that the location was strategically chosen in order to circumvent potential regulations under the European Crowdfunding Regulation (ECSP). Since Switzerland is not an EU member state, the Maclear platform does not fall under the European Crowdfunding Regulation.

Exploiting regulatory gaps exposes investors to additional and avoidable risks.

Profitability

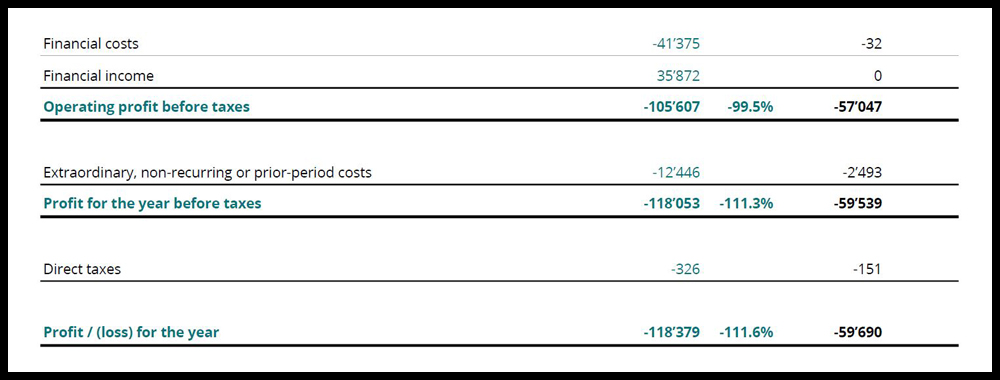

Maclear is currently not profitable. According to the unaudited financial statements, the company recorded a loss of CHF 118,379 in the 2023 fiscal year. Originally, Maclear AG had communicated that the financial report would be audited by BlueAudit, which, however, did not happen.

It is also questionable why the 2023 financial report was only shared in the Maclear Telegram group in June 2025 and was not made publicly accessible. The file name (“20240417_Maclear_AG_Annual_report_2023”) further suggests that the report was created as early as April 17, 2024, yet it was only published more than a year later.

As of today (December 2025), no financial statements have been released for the 2024 fiscal year.

Transparency

Maclear finances high-interest SME loans across different industries and legal jurisdictions. The complexity of this business model carries significant risks, which should also be reflected in the default rate.

The problem: the platform does not publish meaningful statistics on the performance of the outstanding loan portfolio, and in particular, no data on non-performing loans.

In the past, no comparable platform has been able to operate such a business model successfully over the long term without sufficient transparency.

Bots

Maclear uses bots and PR agencies to artificially increase its brand presence in online communities. Both this blog and the YouTube channel have been affected.

This approach appears unprofessional and further raises doubts about the credibility of the platform.

Questionable Loan Projects

The loans on Maclear contain numerous incorrect and misleading pieces of information, raising doubts about the platform’s credibility. An overview:

Vibroedil S.R.L.

Maclear does not publish performance-relevant data on the development of the managed loan portfolio. The platform only states that, so far, there has been one defaulted loan. This concerns the Italian company Vibroedil S.R.L.

According to official registries, the company has specialized in the production and trade of construction materials and building products since 1980. Through Maclear, EUR 150,000 was financed in three tranches of EUR 50,000 each. While the project is no longer accessible on Maclear’s website, it can still be viewed via the partner platform 8lends.

What stands out: the financial figures listed for Vibroedil on 8lends are completely different from the numbers in the official Italian company registries.

On 8lends, a revenue of EUR 15.9 million and a net profit of EUR 144,390 for 2024 are reported. According to an official Italian registry, Vibroedil shows only a revenue of EUR 6.4 million and a loss of EUR 1.9 million. The platform thus shared false and misleading information with its investors.

Only a few months after the financing via Maclear (April 2025), Vibroedil officially filed for insolvency on July 22, 2025. Maclear only communicated this insolvency on October 15, 2025, after the loan had already been fully repaid.

Additional irregularities: The project description mentions a loan of EUR 600,000, secured by a combination of real estate, inventory, and equity, with a total collateral value of EUR 6.1 million, implying a multiplier of 40 (considering a loan of EUR 150,000, not EUR 600,000).

Although there should have been sufficient assets for liquidation, Maclear stated that an amicable agreement with the borrower was reached and that the loan was repaid with personal funds.

Estlat Building Co OÜ

Many Maclear projects show incorrect and misleading figures. Another example is the Estonian company Estlat Building Co OÜ, a manufacturer and supplier of prefabricated wooden construction products. The loan was financed in August 2023 and repaid in August 2024.

The Estlat pitch on Maclear: The Estonian company, which supposedly has 12 employees, wanted a EUR 400,000 loan to acquire technical equipment, hire new specialists in construction and project management, and cover marketing and business development costs. For fiscal year 2023, projected revenue was EUR 1.65 million, and for 2024 EUR 1.97 million.

The reality is very different. According to the financial statements for 2023 and 2024, available via the Estonian business registry, this is what the situation actually looks like:

- Employees: The company has only one employee (not 12).

- Revenue: Revenue was EUR 33,626 in 2023 and EUR 20,450 in 2024. Compared to the projected revenue, this represents an overstatement by a factor of 50 to 95.

- Assets: The 2024 balance sheet shows no fixed assets, even though the loan was supposedly secured by machinery and production equipment.

- Debt Evidence: The 2023 financial report lists a loan of EUR 176,048 from Maclear AG as a liability. How could this loan have been repaid without revenue or other assets?

- External Financing: According to the 2024 figures, Estlat has EUR 429.358 in assets, of which EUR 419,956 are liabilities. The company is therefore fully leveraged.

Conclusion: Estlat was completely overvalued and misrepresented on Maclear. It also remains questionable how the liabilities to Maclear were settled, given that the company generated negligible revenue and held no tangible assets.

Transbaltika OÜ

Between September 2024 and November 2024, Maclear collected nearly EUR 300,000 in investor funds for a loan to the Estonian company Transbaltika OÜ.

The Transbaltika pitch on Maclear: The company is described as a logistics and freight transport business, founded in October 2001 in Tallinn. It allegedly provides freight transport services for both legal entities and private individuals, using its own fleet of vehicles.

Through Maclear, the company sought a loan of EUR 350,000 to finance a MAN TGX truck (stated value: EUR 287,000) and a special trailer with a 40-ton capacity (stated value: EUR 172,500). The remaining EUR 109,500 was to be covered by Transbaltika from its own funds.

The projection: EUR 856,000 in revenue and EUR 652,000 in cash flow within one year after securing the loan.

The reality, based on the 2024 financial statements, is different. Once again. Transbaltika generated only EUR 82,922 in revenue in 2024, less than one-tenth of the projected figure. Adding up the company’s revenue from 2021 to 2024 gives a total of around EUR 350,000 over four years, still less than half of the advertised annual revenue.

But it gets worse. The balance sheet lists total fixed assets at EUR 72,569. This suggests that, despite the financing via Maclear, neither the truck nor the trailer were actually purchased. The question remains: What was the money ultimately used for, and how was the loan repaid? Repayment from the company’s operational activities appears impossible.

TLMET OÜ

The Estonian company TLMET OÜ, which specializes in the production of metal structures, has previously appeared on Maclear with multiple financing rounds. So far, all loans have been repaid.

The TLMET pitch on Maclear: The company seeks a loan of EUR 460,000 to modernize its workshop and enable further business growth. The stated allocation of funds is as follows: purchase and implementation of a modern plasma cutter (stated value: EUR 280,000), equipping the workshop (EUR 120,000), acquisition of production materials and hiring of additional personnel (EUR 110,000). In each phase, the company intends to raise EUR 100,000 until the full loan amount of EUR 460,000 is reached (EUR 50,000 from its own funds).

The 2024 financial statements reveal little evidence of the intended investments. Fixed assets amount to EUR 195,510. No trace of the modern plasma cutter. Instead, the company shows sharply declining revenues and negative equity for the second consecutive year.

Summary Maclear Review

Maclear presents itself as a Swiss crowdfunding platform where investors can earn above-average returns by investing in international SME loans. At first glance, Maclear appears to be an attractive P2P platform for yield seekers. However, on closer inspection, fundamental weaknesses emerge that significantly increase the risk of investing.

Particularly striking is the company’s registered office in Switzerland. Neither the shareholders nor the operational activities have a real connection to the country, nor do the platform’s projects. It appears that the location was deliberately chosen to circumvent the stricter regulatory requirements of the European Crowdfunding Service Providers Regulation (ECSP). This places Maclear in a regulatory grey area, exposing investors to additional risks.

Transparency on the platform is also severely lacking. Key metrics on the loan portfolio, especially regarding non-performing loans or actual performance, are not published. Without this information, investors cannot assess default rates or the true stability of the portfolio.

Another red flag is the platform’s online activity. Maclear uses bots to artificially boost brand presence in online communities. This approach appears unprofessional and further undermines the platform’s credibility.

Equally concerning are the numerous inconsistencies in the financed projects. Examples such as Vibroedil, Estlat Building, and Transbaltika reveal significant discrepancies between the figures provided by Maclear and the actual company data from official registers. Overstated revenue projections, false employee numbers, or nonexistent collateral are not isolated incidents but a recurring pattern.

Overall, these factors lead to a very critical conclusion. The combination of regulatory grey areas, lack of transparency, artificial online presence, and numerous project misrepresentations makes investing on the platform difficult to justify.

Due to these structural risks, investing in Maclear is currently not recommended.

I’m Denny Neidhardt, the founder of re:think P2P. On this blog, I help retail investors make smarter, well-informed investment decisions in the world of P2P lending. Since 2019, I’ve been publishing in-depth analyses, platform reviews, and risk assessments to bring more transparency to this investment space. My goal is to challenge marketing claims, question developments, and empower investors with honest, independent insights.