Crowdestor is a small crowdfunding platform from Estonia where investors can fund various business loans from different sectors. Crowdestor is therefore a P2B (peer-to-business) platform.

Crowdestor has received attention from investors due to its offered above-average interest rates of up to 36%. However, the fact that a high return also means a high risk is made clear by the numbers when looking at the performance of the loan portfolio.

This Crowdestor review will show why investors should keep their hands off the platform and look at other alternatives instead.

Before you read through my Crowdestor review, please note that this is not a form of investment advice. All the information covered in this analysis are based on my own research about the platform. Please make sure to do your own due diligence before investing on this or any other platform. More information can be found in the disclaimer.

Further analyses of other platforms can be found on my P2P Platform Review page.

Crowdestor Overview

Before we get started, here is a quick summary with the most important information about Crowdestor.

| Founded / Started: | December 2017 |

| Legal Name: | Crowdestor OÜ (LINK) |

| Headquarter: | Tallinn, Estonia |

| Regulated: | No |

| CEO: | Jānis Timma (December 2017) |

| Community Voting: | 2,03 out of 5 | See Voting |

| Assets Under Management: | €40+ M (April 2024) |

| Number of Investors: | 27.000+ (April 2024) |

| Promoted Return: | 19,59% |

| Primary Loan Type: | Business Loans |

| Collateral: | No |

About Crowdestor

Crowdestor is an Estonian-based crowdfunding platform founded in December 2017, where investors can fund a variety of business loans from different sectors, while earning an average return of 20.35% (according to the platform).

The interest rates of the projects offered on Crowdestor are just as high as the default rates, which is well illustrating the connection between high returns and high risk.

The Origin Story

Crowdestor was founded in 2017 by the two Latvians, Janis Timma (CEO) and Gunars Udris, who had known each other since their school days. Janis Timma was the driving force behind the idea of founding a crowdfunding platform, having previously worked for 8 years in a law firm in the field of mergers & acquisitions.

Through his focus on the energy sector, where he also leads a company as chairman (Eco Energy Riga), he recognised the lack of equity capital in many projects, so he wanted to close the financing gap with his own platform. The idea of Crowdestor was born.

Ownership

Who owns Crowdestor? In the Estonian company register, Janis Timma is listed as the sole shareholder of Crowdestor OÜ. There are no other partners or shareholders.

Crowdestor Management

Janis Timma is the CEO and the face of Crowdestor. Born in Latvia, Timma first worked for a number of auditors (PwC, BDO) after studying financial management. During this time he built up his own companies in the energy sector (Heat and Power Plant Association of Latvia, Eco Energy Riga). In 2017, he founded the P2P platform Crowdestor, of which he is still CEO today.

Business Model & Finances

Throughout the process of due diligence, investors should also have a look at the business model of a P2P platform as well as the overall financial situation. How does the company earn money? Does the platform operate profitably? And how well is the company positioned financially? In the following paragraphs of this Crowdestor review, you can follow-up on those questions.

Monetization

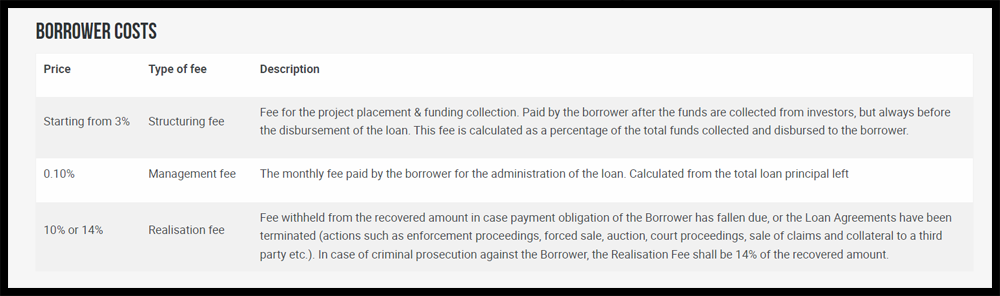

How does Crowdestor earn money? Crowdestor earns its money through different fees charged to borrowers. According to the website, the revenue is divided into the following aspects:

- 3+% commission and arrangement fee

- 2% restructuring and renewal fee

- 0.1% administration fee

- 10% to 14% realisation fee

Profitability

Is Crowdestor profitable? Crowdestor publishes annual reports for previous years on its website.

Is Crowdestor profitable? Crowdestor publishes annual reports for previous years on its website.

However, these are neither prepared by an external auditor nor was the reporting carried out using IFRS methodology. The informative value of the platform’s financial situation is therefore severely limited.

According to the annual report for 2022, the P2P platform generated revenue of EUR 232,000 (previous year: EUR 1 million). The loss in this period totalled EUR 646,000 (previous year: profit of EUR 75,000).

Investing on Crowdestor

How does Crowdestor work and what should investors know and consider when investing on the plaform? In the following sections of my Crowdestor review you will find all the necessary information that you need.

Loan Offering

On Crowdestor, the loan projects are divided into three segments:

- SME Loans: These are loans of up to a maximum of EUR 200,000 that are granted to small and medium-sized enterprises. These loans are usually secured by a personal guarantee of the borrower.ß

- Specialised Projects: These are special projects from the energy sector, forestry, show business or the entertainment industry. These loans are usually secured by a commercial lien on the business assets or intellectual property copyrights.

- Real Estate Projects: These loans are relatively self-explanatory. They are usually secured by a first-rank mortgage. Amortisation occurs towards the end of the term.

Costs and Fees

There are no costs or hidden fees for the most important functions when using Crowdestor. Both deposits and withdrawals are free, as is investing on the platform itself. Only when using the secondary market, where projects can be bought and sold, sellers pay a 2% transaction fee.

Expected Returns on Crowdestor

On its website, Crowdestor advertises an average expected return of around 20%. To achieve this return is extremely questionable, considering the poor performance of the loan portfolio.

On its website, Crowdestor advertises an average expected return of around 20%. To achieve this return is extremely questionable, considering the poor performance of the loan portfolio.

It is certainly possible to achieve an above-average return, provided one has selected the right loans.

However, a look at the statistics makes it clear that broad diversification should not lead to a positive return.

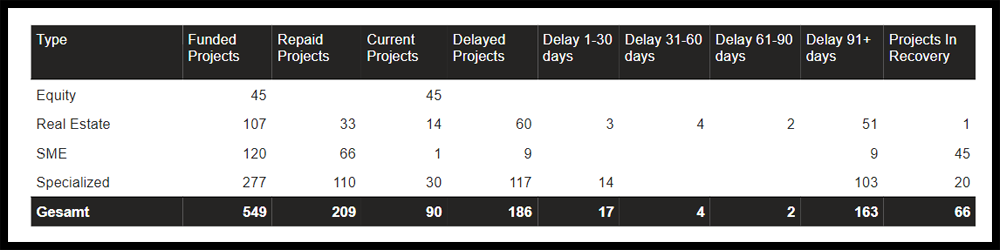

Of the 340 loans in the current outstanding loan portfolio, only 26% are being repaid according to schedule. 55% are in delay, the majority of which are 90+ days. 19%, on the other hand, are already in the recovery process.

Based on these figures, an average expected return of 20% seems absolutely delusional.

Crowdestor Auto Invest

Since 2021, Crowdestor also offers an Auto Invest feature. For many years, the company had refrained from doing so because a) they wanted to encourage investors to take a closer look at the loans and b) because many projects might not have been financed otherwise. However, since demand has remained consistently high, the company finally gave in to investors’ wishes.

At Crowdestor, you can invest in loans starting at EUR 50.

Provision Fund

There is no buyback guarantee on Crowdestor. However, the company has set up a Provision Fund (formerly: Buyback Fund) to absorb credit losses. The way it works is that Crowdestor independently invests 0.5% of the loan amount into the fund.

Investors can track the status of the Provision Fund on the website. However, investors should be prepared that they have to bear 100% of the credit default risk themselves.

Crowdestor Forum

If you have questions about Crowdestor, other platforms or different p2p-related topics, you can join the re:think P2P Community on Facebook and engage in discussions with more than 1,000 other private retail investors.

Alternatively, you can also find the latest news and updates on my Telegram channel.

Crowdestor Taxes

Generally, interest income generated by loan financing is considered investment income and thus must be declared as such in the tax return. Crowdestor does not withhold taxes at the moment.

Investors can download tax reports for their tax returns via the main menu under “Profile”.

Crowdestor Risks

Investors should look very carefully at the potential risk factors when evaluating a P2P platform. What is it that investors need to be aware of when it comes to Crowdestor? Where are the underlying risks and how are they assessed?

Covid-19 Pandemic / Corona Crisis

Borrowers on Crowdestor have been affected very badly by the Corona pandemic, with many of them unable to service their repayments due to a lack of revenue. After consultation with the affected Crowdestor investors, the company has decided to grant borrowers a three-month interest moratorium and to defer payments.

However, many loans are still in default two years after the pandemic outbreak, so a number of capital losses are to be expected. On the positive side, Crowdestor made a much better effort to communicate more openly with its investors after the outbreak of the Covid 19 pandemic. However, this effect has subsequently failed to materialise.

Is Crowdestor a Safe P2P Platform?

In general, Crowdestor cannot be considered as a safe P2P platform. Here is an overview of the risks to be aware of:

- Crowdestor is not regulated, controlled or supervised by any supervisory authority. Obtaining an ECSP licence seems impossible at the current time.

- There is no proper segregation of investor and company funds. Misuse is theoretically possible.

- No deposit insurance. Total default is also a theoretical possibility.

- The platform advertises and promotes unrealistic returns.

- No audited business reports are published.

- The platform does not offer any communication on defaulted loan projects.

- The performance of the loan portfolio is extremely bad and, in addition, there are hardly any verifiable successes in recoveries.

- Frequent conflicts of interest between the shareholder and the borrowers.

Pros & Cons

In this section I have listed the most important advantages and disadvantages of Crowdestor.

Advantages

- Return Potential: If you choose the right loans, you can achieve an above average return.

Disadvantages

- Performance: The performance of the loan portfolio highlights the platform’s poor risk management in terms of selecting suitable borrowers.

- Misleading Information: The promoted returns on Crowdestor are not realistic for an average investor.

- Recoveries: So far, the platform has hardly been able to prove that it is possible to recover defaulted loans.

- Conflict of Interest: There are occasional overlaps between Crowdestor’s shareholders and its borrowers.

- Transparency: No audited reports on the financial situation of the company are being published.

Crowdestor Alternatives

Anyone who likes to invest in business loans should definitely take a closer look at Debitum as a Crowdestor alternative. In addition to traditional business loans, the Latvian P2B marketplace also offers invoice financing, trade financing and promissory notes from a variety of international lenders.

You can find other PeerBerry alternatives on the P2P Platform Comparison page.

Crowdestor Community Feedback

Crowdestor is one of the least popular platforms in the P2P community year after year. In the 2023 community voting, Crowdestor only managed a score of 2.03 out of 34 votes. In the years before, Crowdestor reached 1.80 points (2022) and 2.26 points (2021).

The most popular platforms in 2023 included Esketit, Robocash, PeerBerry, LANDE and Income Marketplace.

Summary Crowdestor Review 2024

Crowdestor is neither suitable for conservative investors nor for newcomers.

In theory, you can get an above-average return if you can distinguish good loans from bad loans in your due diligence.

The fact that 75% of the Crowdestor portfolio is either delayed or in recovery illustrates that a diversified investment will inevitably lead to a loss of capital.

The poor performance of the loan portfolio, conflicts of interest, lack of transparency and poor recovery quality are all arguments why investors should definitely keep their hands off Crowdestor.

Although some projects sound quite exciting, the overall risk is not worth trusting your money to the platform.

On this page you will find a variety of better P2P platforms to chose from.

FAQ Crowdestor Review

Crowdestor is an Estonian-based crowdfunding platform founded in December 2017, where investors can invest in a variety of business loans from different sectors and earn an average return of 20.35% (according to the platform).

In the Estonian company register, Janis Timma is listed as the sole shareholder of Crowdestor OÜ. There are no other partners or shareholders.

Crowdestor earns its money through various fees charged to borrowers. According to the website, the revenue is divided into: 3% commission and brokerage fee, 2% restructuring and renewal fee, 0.1% administration fee and 10% to 14% realisation fee.

The poor performance of the loan portfolio, conflicts of interest, lack of transparency and poor recovery quality are all arguments why investors should definitely keep their hands off Crowdestor.

.

Hi, ich bin Denny! Seit Januar 2019 schreibe ich auf diesem Blog über meine Erfahrungen beim Investieren in P2P Kredite. Meine Analysen sollen Privatanlegern dabei helfen reflektierte und gut informierte Anlageentscheidungen treffen zu können. Dafür schaue ich mir die Risikoprofile der einzelnen P2P Plattformen an, hinterfrage deren Entwicklungen, teile meine persönlichen Einschätzungen und beobachte übergeordnete Trends aus der Welt des Crowdlendings.

Mein Bestseller "Geldanlage P2P Kredite" gilt in Fachkreisen als das beste deutschsprachige Finanzbuch zum gleichnamigen Thema. Zudem versammeln sich in der P2P Kredite Community auf Facebook tausende von Privatanlegern, die sich regelmäßig über die Anlageklasse P2P Kredite austauschen.