Estateguru is one of the biggest crowdfunding platforms for property-backed loans in Europe. The platform, which is regulated at EU level, has achieved this status by offering a high portfolio quality since its inception in 2013. This has enabled investors to achieve a return of around 10% over many years.

The breaking point happened in 2021 and 2022, when Estateguru pursued an aggressive expansion strategy. This led to massive loan defaults in the following years, which particularly affected the German market. Due to little recovery progress and the introduction of new fee strcutures, the platform has been in decline ever since.

In this Estateguru review, investors get a detailed look at the platform and why it is currently not a serious alternative for investors to consider.

Keep in mind that all the information that are covered in this Estateguru review are based on my own research and personal experiences with the platform since 2018. Please make sure to do your own due diligence before investing on Estateguru or any other platform. More information can be found in the Disclaimer.

Further analyses of other platforms can be found on my P2P Platform Review page.

Summary

Before we get started, here is a quick summary with the most important information about Estateguru.

- Estateguru is an Estonian and EU-regulated crowdfunding platform where investors can invest in property-backed loans and earn a return of up to 12%.

- With a track record since 2013, Estateguru is one of the most established platforms in the P2P environment. Estateguru’s vision is to become the leading marketplace for short-term and property-backed loans in Europe.

- Due to aggressive expansion into new markets, especially in Germany, the performance of the loan portfolio has deteriorated massively and caused many defaults.

- The platform’s fee policy showcases a lack of respect for retail investors and also highlights the company’s difficult economic situation.

| Founded / Started: | October 2013 / December 2014 |

| Legal Name: | EstateGuru OÜ (LINK) |

| Headquarter: | Tallinn, Estonia |

| Regulated: | Yes (ECSP License) |

| CEO: | Daniil Aal (September 2025) |

| Community Voting 2022: | P30 out of 30 | See Voting |

| Assets Under Management: | EUR 218+ Million |

| Number of Investors: | 164.000+ |

| Expected Return: | 10,07% |

| Primary Loan Type: | Real Estate |

| Collateral: | Mortgage |

About Estateguru

Estateguru is an Estonian P2P platform, launched in October 2013, where investors can invest in property and development loans from Europe with a minimum amount of EUR 50. The interest rate is often around 10%.

The crowdfunding platform, which has been regulated at EU level since May 2023, pursued a sustainable and conservative growth strategy up until the coronavirus pandemic, making Estateguru a solid investment in volatile times.

The aggressive growth trajectory from 2021 onwards, particularly with the expansion in Germany, has led to a massive deterioration in the performance of the loan portfolio. At its peak, more than EUR 135+ million of loans were in debt collection, which at times affected more than 60% of the managed loan portfolio.

The Origin Story

Marek Pärtel is an Estonian businessman who has extensive knowledge of the property sector, both as an investor and as a project developer.

After experiencing first-hand that property financing from banks was progressing very slowly and was sometimes not even approved despite sufficient collateral, he came up with the idea of founding an alternative marketplace for property financing.

Together with his two partners, Kaspar Kaljuvee (now CRO) and Marko Arro (now CFO), he then founded the Estateguru platform.

Ownership and Management

Who are the main shareholders and management executives behind Estateguru? Let’s have a look!

Estateguru Ownership

Who owns Estateguru? The Baltic-based P2P platform is operated by the company “Estateguru OÜ”. This company in turn belongs to the parent company “Estateguru Holding OÜ”.

Who owns Estateguru? The Baltic-based P2P platform is operated by the company “Estateguru OÜ”. This company in turn belongs to the parent company “Estateguru Holding OÜ”.

If we look into the Estonian company register, we will find a large number of different shareholders for this company.

The largest shareholders include:

- 17.52% belong to “Meb Trust OÜ”, which is 100% owned by the Estonian “Kristjan-Thor Vähi”.

- 17.23% belong to “Euro Holding OÜ”, which is 100% owned by the Estonian “Marek Pärtel”.

- 11.09% belong to “Sparkle Holding OÜ”, 62.52% of which is owned by the Estonian “Marek Pärtel”.

In accordance with IFRS standards, Marek Pärtel is the ultimate beneficial owner of Estateguru.

Estateguru Management

In September 2025, Daniil Aal has been appointed as the new CEO of Estateguru. He thus follows Mihkel Stamm, who previously headed the operational leadership of the P2P platform for two and a half years.

In September 2025, Daniil Aal has been appointed as the new CEO of Estateguru. He thus follows Mihkel Stamm, who previously headed the operational leadership of the P2P platform for two and a half years.

A long training or settling-in period will probably not be necessary for Daniil Aal, as he had already been working for Estateguru in various positions for 10 years prior, most recently as COO.

Somewhat disappointing was his first publication in his new position on LinkedIn, where the improvement of debt collection processes and progress in the recoveries of the defaulted portfolio were not included among his four main points for further development.

Business Model and Finances

Throughout the process of due diligence, investors should also have a look at the business model of a P2P platform as well as the overall financial situation. How does the company earn money? Does the platform operate profitably? And how well is the company positioned financially? In the following paragraphs of this Estateguru review, you can follow-up on those questions.

Monetization

To understand Estateguru’s revenue model, we take a closer look at its most recently available annual report. The report reveals that Estateguru generated a turnover of EUR 8.3 million through its business model.

To understand Estateguru’s revenue model, we take a closer look at its most recently available annual report. The report reveals that Estateguru generated a turnover of EUR 8.3 million through its business model.

In recent years, the majority of revenue has been derived from loan brokerage and commission fees charged to borrowers, typically ranging from 2.5% to 4% of the loan amount. While this revenue stream remained the largest contributor in 2023, its percentage share dropped to 34%, compared to 65% in the previous year. This decline highlights the reduction in new financing activity, as many investors have distanced themselves from the platform due to its weak performance in recent years.

Poor performance and delayed loan projects have led to an increase in other revenue sources which are directly tied to these challenges. These include prolonging fees, penalties, debt management fees, and debt realization charges.

Since 2020, Estateguru has also introduced additional fees for investors. These include a 1% transaction fee for the early sale of projects on the secondary market, an inactivity fee of EUR 10 per month (charged after 12 months), an asset management fee of up to 0.96% p.a., and a withdrawal fee of EUR 3.

Profitability

Is Estateguru profitable? No, Estateguru is not. According to last year’s annual report, the company recorded a negative result of EUR 2.33 million. This means Estateguru has been unprofitable for the past five years in a row.

Estateguru has attempted to reduce costs compared to the previous year. For instance, the company cut over EUR 2 million in labour expenses. However, expenditures remained too high to be offset by the slight increase in turnover.

Balance Sheet

Estateguru’s balance sheet has significantly deteriorated due to the latest key financial figures. The total assets have declined further, and negative equity has risen to nearly EUR 2 million. Additionally, the liquidity ratio has dropped below 1, indicating that current liabilities now exceed current assets.

The company urgently requires support from its shareholders or an external financing round to service its liabilities and avoid the worst-case scenario of potential insolvency. While Estateguru began an economic consolidation process in 2023, it remains uncertain whether this alone will be sufficient.

Sign Up

On Estateguru, both natural and legal persons can register on the plaform. The only requirements are a minimum age of 18 and a European bank account. Funds are transferred directly to Lemonway, which is the platform’s partner bank that ensures a proper segregation of funds.

The registration process at Estateguru is very simple and intuitive. After opening an account via email, the KYC and AML questionnaires must be filled out. This is followed by the verification of identity and the declaration of tax residence.

Investing on Estateguru

How does Estateguru work and what should investors know and consider when investing on the plaform? In the following sections of my Estateguru review you will find all the necessary information that you need.

Loan Offering

On Estateguru, investors can invest in three different types of loans:

- Development loans: these are loans used to finance either the planning process of a property or the development/construction of the property itself.

- Bridge loans: Also known as interim financing, these often short-term loans are used to bridge temporary liquidity bottlenecks. As a rule, these loans are usually redeemed by another loan after a short term.

- Business loans: these loans are used to support the day-to-day operations of a business, which may include, but are not limited to, business expansion, the purchase of equipment and goods, or to cover outstanding obligations.

Currently, Estateguru offers loan financing in eight different countries. In addition to the Baltic countries, these include Finland, Germany, Spain, Portugal and Sweden.

The biggest funding sources for the loan portfolio are private retail investors, high net worth individuals and family offices. The proportion of financing from institutional investors, which has risen steadily in recent years and in some cases accounted for up to 30% of the total portfolio, has now fallen to 5%.

EG Grow

In June 2025, Estateguru launched “EG Grow”. Its new product is an automated investment option where the P2P platform selects the property-backed loans on behalf of the investor.

The clear similarity to the Estonian alternative Bondora Go & Grow is reflected not only in the name but also in EG Grow’s main features: simplicity, a fixed interest rate, and broad diversification.

Investors who choose EG Grow are offered a net return of 7%, with interest paid out monthly. The principal, however, is repaid according to the individual loan terms. An early exit – unlike with Bondora Go & Grow – is therefore not possible. The minimum investment amount is EUR 100.

Costs and Fees

There are many fees that have been added in recent years for Estateguru investors. Here is an overview:

- 1% Transaction fee for selling on the secondary market

- EUR 3 Withdrawal fee

- EUR 10 Inactivity fee (per month)

- 0.96% p.a. assets under management fee

Especially the introduction of the assets under management fee, in October 2023, has caused dissatisfaction among many investors. As a result, investors have to give up up to 0.6% (now 0.96%) in annual returns on a properly performing portfolio. Considering the poor performance of the loan portfolio, which has already forced investors to adjust their return expectations downwards, the timing of this introduction could hardly be worse.

In addition, the withdrawal fee has also increased to EUR 3 from 1 June 2024. This is a clear indication that Estateguru wants to earn extra money from the exit of many investors. However, it should be questioned whether the additional income is in proportion to the reputational damage (see Trustpilot) and that this will probably scare away the last and undecided 50-50 investors who initially wanted to wait for the performance of the recoveries.

The full price list can be reviewed on this page.

Expected Returns

According to the platform, the average return achieved on Estateguru is said to be 10.07%.

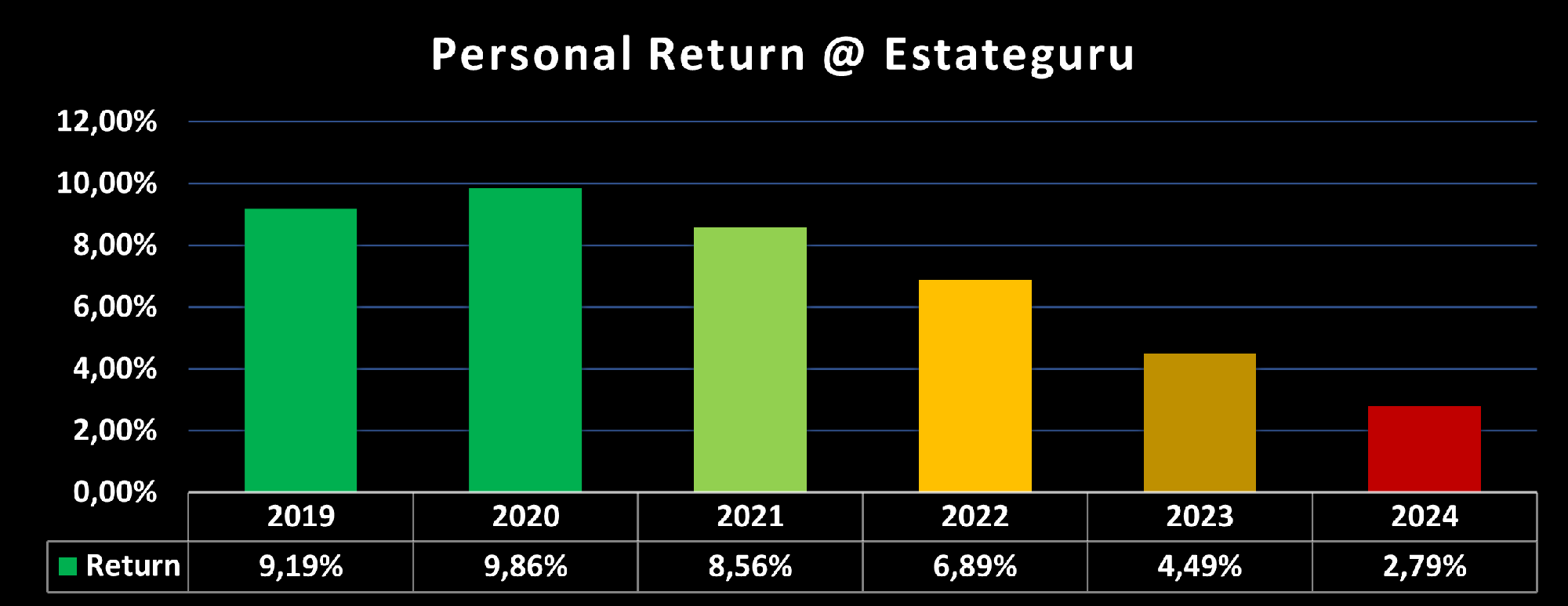

My personal investment experience goes back to November 2018. During this time, I was able to achieve a total return of 5.08%, with the lack of recoveries indicating that the return will deteriorate even further. To visualize the impact of increasing defaults, here is an overview of my personal annual return on Estateguru and how it has developed over the years.

Auto Invest

Investors have three different ways on how to invest on the platform:

- Manual loan selection on the primary market

- Manual loan selection on the secondary market

- Automated investing on the primary market

With the Estateguru Auto Invest feature, investors have the option to set predefined criteria for their loan selection, thus passively managing the investment. Possible configuration criteria include:

- Investment amount: From EUR 50 (but with limited filtering options)

- Interest rate: 8% to +11%

- Loan period: Up to 60 months

- Loan-to-value: Up to 75%

- Collateralization: First-rank or second-rank mortgage

- Borrower country: Estonia, Latvia, Lithuania, Finland, Germany, Spain, Portugal, Sweden

The full Auto Invest selection options can only be used with a minimum investment amount of €250 per loan. For those who have less money available on Estateguru, it is recommended to select loans manually first to achieve better diversification.

Liquidity

The average loan term is around 12 months, which is an average length for this loan segment. Those who need more liquidity can use the secondary market on Estateguru (3% transaction fee) or the instant exit option (for 35% discount). If this doesn’t offer enough liquidity for you, then you should look for other P2P platforms.

Estateguru Forum

The P2P lending industry is a fast-moving environment. Hence, make sure to stay on top of all relevant information by subscribing to my channels on Telegram or WhatsApp. This way, you will always receive the latest information from the P2P industry, including platform news regarding Estateguru.

Estateguru Taxes

In general, interest income generated by loan financing is considered investment income and must be reported as such on the tax declaration. Unlike other P2P platforms, Estateguru does not withhold taxes on interest income.

Through the dashboard, investors can download an extract of the tax report for the given year, where the corresponding income is listed.

Estateguru Risks

Investors should take a very close look at the existing risk when evaluating a P2P platform, and assess it before a possible investment. What should one pay attention to with Estateguru? Where do the risks lie and how should these be assessed?

Platform Risk

The operational launch of the platform, which is operated by the Estonian “Estateguru OÜ,” took place in October 2013. The platform therefore has a very long track record, which can generally be evaluated positively.

The operational launch of the platform, which is operated by the Estonian “Estateguru OÜ,” took place in October 2013. The platform therefore has a very long track record, which can generally be evaluated positively.

In May 2023, the platform also received a license as a European Crowdfunding Service Provider (ECSP license), allowing Estateguru to offer its services across Europe under uniform regulatory conditions. Due to the licensing, a proper separation of investor funds must be ensured, protecting investors from misuse. For this purpose, Estateguru works with third-party supplier Lemonway.

Due to its regulation, Estateguru must also meet a high level of compliance and transparency standards, which increases the safety of the P2P lending platform. Possible loan defaults are not covered though.

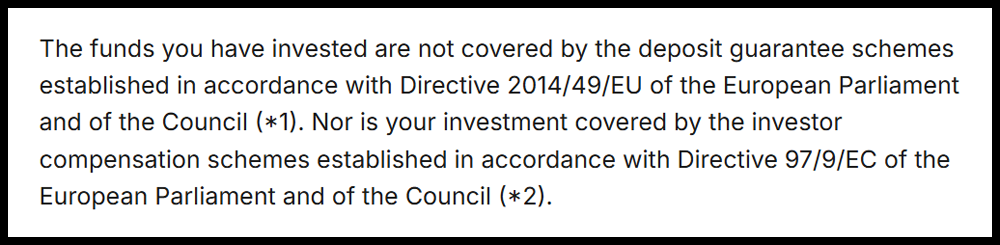

Deposit Protection

Investments offered through Estateguru are not covered by European deposit protection schemes (such as the Deposit Guarantee Directive 2014/49/EU). This means that – unlike traditional bank deposits – the funds invested on Estateguru are not insured or guaranteed by any national or European compensation system.

Accordingly, investors should be aware that the capital invested is subject to the risk of loss, that returns are not guaranteed, and that they may not recover the full amount originally invested.

Loan Portfolio Defaults

Since 2022, Estateguru has increasingly struggled with loan defaults. Projects that are no longer on schedule for repayment primarily include markets in Germany and Finland.

Since 2022, Estateguru has increasingly struggled with loan defaults. Projects that are no longer on schedule for repayment primarily include markets in Germany and Finland.

As of August 2025, EUR 133.6 million were in debt collection. This corresponds to a default rate of over 60% relative to the loan portfolio managed by the platform.

It appears that not only the risk assessment at Estateguru is insufficient, but also the ability to recover real estate investments through legal means. Of the EUR 38 million in recoveries announced for 2024, only EUR 13 million could actually be recovered. At the same time, an equal amount of new defaults occurred.

Estateguru Germany

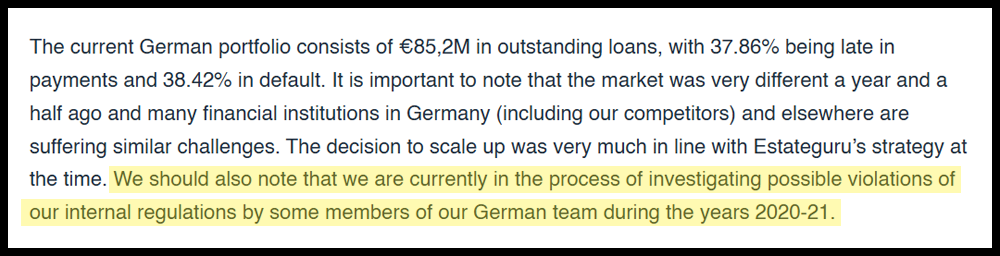

As of August 2025, more than EUR 78 million of loans are defaulted in Germany alone. An absolute disaster for the platform, which had seen Germany as a major growth market. How did it come to this?

In January 2023, the platform announced on its blog that it was investigating its German employees for potential violations of internal regulations.

After the investigations were completed, Estateguru chose not to communicate detailed results. The CEO only stated that external irregularities had been found and that the matter was being followed up.

Whether the question of responsibility is being shifted should be critically considered. As recently as September 2022, the platform had communicated that decisions on loan financing could not be made solely by the Germany team.

To recover loans in Germany, Estateguru has been working with the company Steinberger since 2023. In parallel, the platform has deployed its own team of lawyers and risk managers. Annual costs for this reportedly amounted to EUR 1 million in 2023.

As part of the recovery strategy, the platform decided to process each defaulted loan individually rather than selling the entire portfolio at a larger discount of 40% to 60%. Due to the high bureaucratic hurdles in Germany, a recovery period of 3 to 5 years is now expected.

In an interview with former Estateguru CEO Mihkel Stamm in June 2024, he estimated that losses arising from the current market situation would range between 10% and 20%. In an optimistic scenario, however, it would still be possible for investors to avoid any capital losses.

Advantages and Disadvantages

In this section, I have listed the most important advantages and disadvantages of Estateguru.

Advantages

- Track Record: Market experience since 2013.

- Regulation: The platform obtained the European crowdfunding license in 2023.

- Investor Funds: Legally supervised separation of investor and company funds.

- Auto Invest: Automated option to invest your money.

Disadvantages

- Loan Portfolio: At its peak, Estateguru had more than EUR 135 million in defaulted loans.

- Debt Collection: Limited recovery performance of defaulted loans.

- Liquidity: 3% sales fee on the secondary market and 35% discount via EstateGuru Instant Exit.

- Policy Violations: Investigations concerning German team members.

- Community: Estateguru received the lowest rating of all 30 platforms in 2025.

- Fees: Since 2020, a variety of fees have been introduced for investors.

- Conflicts of Interest: In the past, loans involving Estateguru management members were not fully repaid.

Estateguru Alternatives

Real estate platforms have a good tradition in Estonia and the Baltics in general. Some Estateguru alternatives to consider are Crowdpear and Profitus from Lithuania. Both crowdfunding platforms, which are controlled by the Lithuanian central bank and have a European Crowdfunding Licence (ECSP), offer many senior secured real estate projects on their site. Investors can find a similar collateral structure in the agricultural sector with LANDE.

Other Estateguru alternatives can be found on the P2P Platform Comparison page.

Community Feedback

Just a few years ago, Estateguru was among the most popular P2P lending platforms. In both 2021 (4.12 points) and 2022 (4.14 points), the platform achieved the second-highest ratings in the annual P2P Community Voting.

However, due to a sharp increase in loan defaults combined with modest recoveries, Estateguru has been heavily penalized in recent years. In the 2023 and 2024 community votings, Estateguru only managed to reach 21st place, and in 2025, it was even voted the worst P2P platform. Its score has also declined year by year since 2022, highlighting the widespread dissatisfaction among many investors.

The Top 5 P2P platforms in 2025 were Viainvest, Debitum, Mintos, Swaper, and Income Marketplace.

Summary Estateguru Review 2025

What is the final verdict of my Estateguru review?

What is the final verdict of my Estateguru review?

For years, Estateguru has been an attractive option to diversify its loan portfolio with property projects. The platform was established, pursued a conservative risk management approach and delivered stable returns.

Due to the platform’s aggressive expansion strategy from 2021 onwards, Estateguru may have jeopardized its own future. At times, defaults have reached a level of more than EUR 135 million, while there was hardly any noticeable progress on the recovery side as well. Looking at these conditions, coupled with the investor-unfriendly fee structure, the expected returns on the platform are hardly competitive.

As long as there is no recognisable progress in recoveries, it is advisable to watch Estateguru from the sidelines for the time being.

If investors still want to diversify their portfolio with property-backed loans, platforms such as Crowdpear or Profitus are worth a closer look. The reviews for both Estateguru alternatives can be found on the blog.

FAQ EstateGuru Review

Estateguru is an Estonian and EU-regulated crowdfunding platform where investors can invest in property-backed loans and earn a return of up to 12%.

In accordance with IFRS standards, Marek Pärtel is the ultimate beneficial owner of Estateguru.

Estateguru generated a revenue of EUR 8 million in 2022. According to the numbers of the audited annual report, the platform generated a large part of its revenue through brokerage and commission fees from borrowers.

I’m Denny Neidhardt, the founder of re:think P2P. On this blog, I help retail investors make smarter, well-informed investment decisions in the world of P2P lending. Since 2019, I’ve been publishing in-depth analyses, platform reviews, and risk assessments to bring more transparency to this investment space. My goal is to challenge marketing claims, question developments, and empower investors with honest, independent insights.

Well, I can only say that one year ago I had a lot in recovery projects. Now, I only have three and the amount reduced significantly. So, some progress has been achieved, which is great.

Lithuanian media (“Verslo žinios”) report – a property valuation professional’s comment about German loans

https://manopinigai.vz.lt/investavimas/s-vagonis-apie-estateguru-vokietijos-paskolas-uzstat-vertes-kliuvo-jau-pries-3-m/

Google translate (LT->EN):

Saulius Vagonis, head of the Valuation and Market Research Department of the real estate (NT) service company Ober-Haus, after reading in “Mano pinigaoi” about the waning patience of Estateguru investors due to stuck loans, says that he raised questions with the platform about loans in Germany as early as 2021. and he didn’t hear the answers either.

Estateguru investors complain that they do not receive not only the promised interest, but also clear information about their investments in the various loans distributed through this platform.

After reading about their anger, real estate appraisal expert S. Vagonis recalled how he had approached Estateguru 3 years ago directly asking about “very strange loans issued in Germany”.

“Then they looked at my remarks very calmly and confidently. Oh, it turns out I was right,” he says today.

S. Vagonis claims that he was interested in the platforms not only as a potential investor, but also as a representative of the community of evaluators.

“The reputation of appraisers was severely damaged after the bankruptcies of Snoro and Ūkio bankas and several unions, we really didn’t want something like that to happen when the platforms broke. It was important for me to understand the quality of the assessments they use,” explains the expert.

He shared in 2021. correspondence with Estateguru Group Marketing Manager Egle Kučinske, who inquired about loans to BKFI Zweite Beteiligungs GmbH.

For this company, according to S. Vagonis, “Estateguru” (through 4 loans with 4 collaterals) collected about 3.2 million. Eur investors’ money.

He pointed out that the loanable amounts (the maximum LTV ratio of the projects – the ratio of the loan size to the value of the mortgaged property) were calculated based on the valuations signed by an appraiser who had not had a license for a year, who still used the requisites of HypZert (a certification body for property appraisers in Germany) and stamp

“The appraisal reports are written incoherently, with grammatical errors, it is not even clear from them what is the object of the appraisal – are the plots mortgaged to Estateguru, or can future buildings be built on them?” S. Vagonis tried to find out at the time.

He wrote to “Estateguru” that it never answered his questions, what statistics were used to assess the price ranges of land plots?

“The official statistics I found in the case of Dahme/Mark (one of the projects of BKFI Zweite Beteiligungs GmbH) are ten times higher than the figures presented in the evaluation reports,” S. Vagonis taught, also noting that from the information provided he cannot understand whether to pledge plots definitely have building permits.

“Is the development depicted in those dubious ‘projects’ really permissible and coordinated?” For example, there are articles in the German press about residents’ opposition to construction on the Liebenwald site. The Dahme/Mark plot is agricultural on existing maps, marked as a green zone,” he explained.

Invested automatically

Many of the investors who spoke to “My Money” today admit that they did not ask Estateguru questions, did not analyze the proposed projects too much.

Darius, who does not want to reveal his last name, says that he invested over 20,000 euros in German loans.

“Maybe even in every loan offered there, because I invested through the automatic investment service, setting the minimum amount – 50 EUR. I didn’t delve too much into those evaluations – I trusted the Estateguru company: after all, it did the evaluation and selected that loan as a good one, because now it offers me to invest in it,” Darius teaches, emphasizing: he did so because he thought he was investing in a supervised platform .

“It was a platform regulated by the Bank of Lithuania, so I invested with confidence, just as I invest in almost all platforms operating in Lithuania,” he explains.

According to Darius, about 7,000-8,000 EUR of the money invested through “Estateguru” are “frozen” today.

“And, probably, you need to be prepared that they will not be returned. Unless some kind of miracle happens,” he thinks.

It seemed primitive to a specialist

However, the analysis of at least one project by S. Vagonis shows that there was a lack of basis for investors’ confidence here.

“Looking at the primitive visualizations, as well as the inconsistencies between these visualizations and the building plans, doubts arise both about the fact of the construction permits received, and about the adequacy of the values of the plots themselves. Did “Estateguru” check the fact of the construction permits and their compliance with the published visualizations?” S. Vagonis asked about the already mentioned project.

He taught that in the absence of building permits or if they are issued for a different development than what is depicted in the visualizations, the land values provided are not suitable for calculating the LTV indicator.

“Moreover, there is no usable value of the future buildings for the LTV calculation (in the case of the Liebenwalde loan),” he said.

Emphasizing that the value of a plot of land depends on the specific possibilities to build something on that land, S. Vagonis explained in capital letters to “Estateguru” that one cannot be guided by average values until all the circumstances have been examined.

He recalled the recovery of Nordstreet’s loan at that time, when the platform granted a 320,000 EUR loan for a mortgaged plot, but the protection zones provided for in it severely limited possible activities.

“The amount of EUR 320,000 may correspond to the price level of the area (if the plot was without protection zones), but the real transaction with the plot was only EUR 33,000 – i.e. was 10 times lower than the average price cuts in the area,” he taught.

He promises to answer the questions

In response to S. Vagonis’ questions in 2021 in the letter, E. Kučinskė promised that the company would take additional steps regarding the property valuation in a specific German project that raised questions for him.

“I remember the correspondence with S. Vagonis, but whether there were any additional assessments and other actions, I certainly cannot say now,” she says today.

According to the investors, their Estateguru accounts currently state that this loan is in default.

Mihkel Stamm, CEO of Estateguru, promises to answer all the questions investors have this week in a podcast dedicated to the topic.

Lithuanian media (Verslo žinios) about Estateguru’s problems – “Estateguru Investors Are Running Out of Patience: Where’s Our Money?”

https://manopinigai.vz.lt/investavimas/estateguru-investuotoj-kantrybe-baigiasi-kur-musu-pinigai/

Search Google and translate: „Estateguru“ investuotojų kantrybė baigiasi: kur mūsų pinigai?

“The pile of questions that Estateguru urgently needs answers to is growing.

in 2023 Mihkel Stamm, looking ahead to 2022, said that the company is under investigation into possible violations of internal rules by some members of the German team in 2020-2021. However, the results of this study have not been reported so far.

Also, the company’s 2023 a November news release on German loan portfolio solutions promises: “Results are expected to be seen as early as Q2 2024.”

However, the II quarter ends, investors do not have any new information.

“Estateguru chose not to answer the questions asked by “Verslo žinios” regarding the company’s internal investigation and the German portfolio.”

Thanks for sharing, Justas. I recommend watching the latest interview that I conducted with Estateguru CEO Mihkel Stamm for further insights. Unfortunately, the announcement on increased fees and fired staff came a few days after our conversation. Still, lots to learn about approach in German market.

Thank You

aucune vidéo trouvée de votre interview.