Bondora Go and Grow is one of the most popular investment products among P2P lending investors. With Go & Grow, investors have the opportunity to finance the loan portfolio of the Estonian P2P platform in exchange for a fixed annual return of 6% and daily access to their funds.

On this page, you’ll find a comprehensive analysis and review of my personal Bondora Go and Grow experiences, which I’ve gathered since its launch in 2018.

In addition to covering the platform’s origin story, taxation, and Go and Grow features, the focus is especially on the hidden risks behind the Estonian “savings account alternative”.

Further analyses of other platforms can be found on my P2P Platform Review page.

Bondora Overview

Before we get started, here is a quick summary with the most important information about Bondora.

- Bondora Go & Grow was launched in 2018 by the Estonian P2P platform Bondora.

- The product is defined by three main features: a predetermined return of 6%, daily liquidity, and ease of use.

- Bondora has been consistently profitable since 2017 and maintains a stable financial position.

- So far, the platform has not published any detailed figures regarding the performance of the Go & Grow loan portfolio.

- The platform is not subject to any legal supervision by a regulatory or financial authority.

| Founded: | 2008 |

| Legal Name: | Bondora Capital OÜ (LINK) |

| Headquarter: | Tallinn, Estonia |

| Regulated: | No |

| CEO: | Pärtel Tomberg (December 2007) |

| Community Voting: | P10 out of 30 | See Voting |

| Assets Under Management: | EUR 500 Million (December 2024) |

| Number of Investors: | 550.000+ |

| Expected Return: | 6% |

| Primary Loan Type: | Consumer Loans |

| Collateral: | No |

| Bonus: | 5 Euro |

About Bondora Go and Grow

Bondora Go and Grow is an investment product from the Estonian P2P lending platform Bondora. Founded in 2008, Bondora is one of the oldest and most established P2P platforms in Europe due to its long track record.

With the launch of Go and Grow in 2018, the P2P platform set a new standard in terms of simplicity and liquidity within the P2P lending space. Go and Grow offers investors the opportunity to invest directly in the platform’s loan portfolio. In return, they receive an annual return of 6%, with daily interest crediting and instant liquidity.

Because of these characteristics, Go & Grow is often referred to as an alternative to a savings account. For more information about the Estonian P2P platform, I recommend to check out my Bondora review.

The Origin Story

The first investors were able to test Bondora Go and Grow as early as April 2018. In June 2018, the product was officially launched to all P2P lending investors.

At that time, Bondora offered three additional investment options alongside Go and Grow: the two portfolio builders (Portfolio Pro and Portfolio Manager), as well as the API. Each of these options provided a different level of investment control, diversification, and return.

| Product | Investment Control | Diversification | Return |

|---|---|---|---|

| Go & Grow | Low | High | 6% |

| Portfolio Pro | Hight | Middle | Variable |

| Portfolio Manager | Middle | Middle | Variable |

| API | High | Variable | Variable |

With the launch of Go and Grow, Bondora meaningfully expanded its product portfolio. For the first time, a product was introduced in the P2P lending space that offered a predetermined return, combined with high diversification and maximum liquidity. A combination that had never existed before.

Up until then, investors who wanted quick access to their money either had to invest in short-term consumer loans (which Bondora doesn’t offer) or sell their loans on the secondary market (which can be costly).

Thanks to its high liquidity (daily access), broad diversification (100,000+ borrowers), and user-friendly interface, Bondora created a unique product with Go and Grow. One that adaptations such as Mintos Invest & Access or Crowdestor Flex have never truly been able to match.

How Does Bondora Go and Grow Work?

The functionality and operation of Bondora Go & Grow is fairly simple. The following steps need to be followed to get started.

Sign Up and Deposit

To invest via Bondora Go and Grow, investors need to open up an account on the website of the Estonian P2P lending platform first. Only two requirements need to be met:

- A minimum age of 18 years

- A residency in the European Union, Norway or Switzerland

Once all the required information have been provided and the account has been opened, money can be sent to the Bondora wallet via SEPA transfer using the “Deposit” tab. The money can then later be transferred to the Go and Grow account. Depending on the bank, the transfer can take up to two or three working days.

Alternatively, investors can create a Go and Grow account on Bondora first and then transfer the money directly to the investment product.

To do this, select the “Create a new Go & Grow account” setting in the Go and Grow menu and then enter the primary reason for use (e.g. retirement, major purchase or additional income). Transfers can then be made directly to the Go and Grow account.

Bondora Go and Grow Bonus

If you want to try Bondora Go and Grow, you will receive a EUR 5 investment bonus to your account when you register via my partner link. A platform overview with all bonus offers and cashback promotions can be found on the bonus page.

Settings

Investing with Bondora Go and Grow is quite passive and requires very little maintenance. However, a few adjustments can be made. For example, investors can set up automatic transfers to their Go and Grow account.

This means that as soon as funds accumulate in the investor wallet, they are automatically transferred to Go and Grow and invested there. This can happen in scenarios such as: repayments from P2P loans via Portfolio Pro or Portfolio Manager, referral bonuses, or standard bank transfers.

Go & Grow Limit

In September 2020, Bondora introduced a monthly deposit limit for the Go & Grow product. The implementation of a deposit limit was a response to the significant volatility in deposits and withdrawals following the outbreak of the COVID-19 crisis.

Due to the monthly Go & Grow limit, it took investors much longer to build up a sufficiently large position. The result: the artificial scarcity led to a greater appreciation for the product, and on the other hand, Bondora had better planning visibility when balancing (loan) supply and (investor) demand.

The monthly limit was last set at EUR 1,000 (until September 8, 2024). This limit was already the sixth adjustment since its initial introduction. On September 9, 2024, Bondora announced a temporary removal of the deposit limit. Since then, the deposit limit has not been reintroduced.

Loan Portfolio

With Go and Grow, investors invest in the loan portfolio of the Bondora Group, which is active across Europe with various lenders. This includes countries such as Estonia, Finland, the Netherlands, Spain, and Latvia. As an investor, you can think of it like an investment fund with more than 100,000 loans.

There are no publicly available statistics regarding the assets managed by Bondora Go & Grow or the exact performance of the loan portfolio. For this reason, Go & Grow has a sort of “black box” nature, making a precise risk assessment difficult.

The only information regarding the quality of the loan portfolio is provided to investors in the form of breakdowns by borrower country and risk rating. These results are published intermittently on the blog. Looking at the percentage distribution of risk ratings, it appears that Bondora has followed a rather conservative approach to lending over the years.

Withdrawals

Generally, withdrawals from Bondora Go and Grow can be made instantly and in full. There are no withdrawal restrictions.

However, this condition is also dependent on certain market situations. During the peak of the COVID-19 crisis, Bondora had to temporarily introduce partial payouts between March 2020 and June 2020 due to the high volume of withdrawal requests.

If money is withdrawn from Bondora Go and Grow, the Estonian P2P platform charges a flat withdrawal fee of 1 euro.

Fees

Currently, there are no costs or hidden fees for managing the Go & Grow investment on Bondora. Only a fee of EUR 1 per withdrawal is charged.

Bondora Go and Grow Forum

The P2P lending industry is a fast-moving environment. Hence, make sure to stay on top of all relevant information by subscribing to my channels on Telegram or WhatsApp. This way, you will always receive the latest information from the P2P industry, including platform news regarding Bondora Go & Grow.

Bondora Go & Grow Taxes

How is the income from Bondora Go & Grow taxed? There are different opinions and experiences among P2P investors on this popular and frequently asked question.

In general, income generated through P2P loans must be taxed as interest income.

With Bondora Go & Grow, the situation is somewhat different. The platform itself writes:

You only pay tax on the money you withdraw which is over the total amount you have paid in. For example, if you invest €1,000 then anything you withdraw up to €1,000 is considered as a principal withdrawal, anything above €1,000 is considered as interest.

In plain terms: If you do not withdraw more money than you originally invested, you have not realized any profits and therefore do not need to pay taxes. This is also referred to as alternative taxation. According to the platform’s evaluation, Bondora Go & Grow is considered a tax-optimized investment product, allowing compound interest to work effectively.

Whether the tax-optimized model applies should be discussed with a tax advisor or directly with the tax office in each individual case.

Go & Grow Tax Report

Investors can download a tax report under the “Go & Grow Tax Report” section in the settings.

Bondora Go & Grow Risk

Anyone looking to invest in Bondora Go & Grow must be aware of the risks associated with the investment product. But what are these risks? And how can they be assessed? More details are provided in the following sections.

Platform-Risk

The Go & Grow offering is operated by “Bondora Capital OÜ,” an unregulated P2P platform from Estonia. This means there is no regulatory authority or financial oversight controlling and monitoring the platform’s operations.

An important factor is therefore the trust in the platform, both at the economic level and the shareholder level.

Economic Level: Over the years, Bondora has built a stable economic foundation. Even during times of crisis, the platform has managed to remain profitable.

At the same time, the financial reports have been consistently audited by large, recognized auditors (BDO), which adds credibility to the financial figures. Check out the lender overview and comparison page for additional information regarding applied KPIs and their interpretation.

| Loan Originator | Year | Audited | Profit | ROA | Equity Ratio | Debt | Liquidity | Impairments | Score |

|---|---|---|---|---|---|---|---|---|---|

| Bondora Group | 2024 | KPMG | EUR 1,22M | 4,5% | 71,3% | 0,4 | 3,45 | 3,3% | 94 |

Shareholder Level: Pärtel Tomberg, the founder and CEO of Bondora, is the ultimate beneficiary owner of “Bondora Group AS.” For several times in the past, I have personally discussed with him the business operations of his company. From my perspective, he is a sharp-minded individual with clear opinions who is not easily influenced by external demands.

Bondora Deposit Protection

Investors should note that there is no form of deposit protection with Bondora Go and Grow. In banking, deposit protection is a form of creditor protection designed to prevent the loss of one’s funds. In Germany, for example, customers’ capital is protected by statutory deposit insurance up to EUR 100,000.

Since Bondora is an unregulated P2P lending platform without a banking license, there is no entitlement to compensation in the event of a loss.

Return-Risk

Bondora promotes Go & Grow with a return of 6%. In order for this return to be sustainably paid out to investors, it must be generated by the loan portfolio. Otherwise, the system behind Go & Grow will eventually collapse. How should this risk be assessed?

For a long time, the Bondora statistics, which cover all loans since 2008, showed a negative trend in the overall performance of the loan portfolio. By early 2025, the performance of the Bondora loan portfolio was below the initial return of 6.75%, which had been offered to Go & Grow investors from the start.

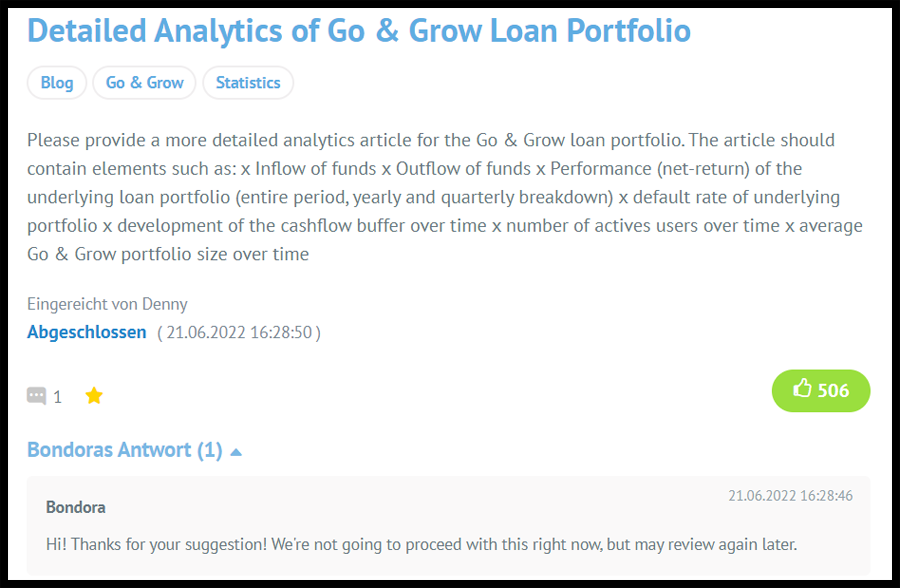

A petition I started, which advocated for transparent reporting of the Go & Grow loan portfolio, was rejected by Bondora. As a result, important questions regarding the transparency and return of Go & Grow remain unanswered.

Liquidity-Risk

Investors should also keep an eye on the liquidity risk, as Bondora heavily markets the daily availability of funds. Has this promise been upheld in the past?

At the beginning of the COVID-19 pandemic, the demand for withdrawals was so high that the platform had to temporarily introduce partial withdrawals (Partial Payouts) between March 2020 and June 2020. This indicated that the reserves of the Go & Grow loan portfolio were not large enough to maintain the promise of daily liquidity.

Therefore, investors should be aware of the Go & Grow risk that daily liquidity can only be guaranteed during certain market conditions.

Loan Default Risk

Loan defaults are part of the daily business of any P2P lending platform. Since Bondora Go & Grow investors have no protection or guarantees for the advertised return, it’s worth taking a closer look at the debt collection and recovery process, which at Bondora consists of four phases:

- Step 1: Internal Debt Collection. Internal debt collection begins even before the official payment default, which helps to prevent immediate defaults in up to 97% of cases.

- Step 2: Debt Collection Agency. If the loan has been overdue for 90 days, the contract is terminated and handed over to a debt collection agency.

- Step 3: Court Proceedings. As a last resort, the case is taken to court. The timeline varies by country, but on average, a court decision is reached within two to six months.

- Step 4: Bailiff Enforcement. Once a court ruling has been issued, the case is passed on to a local bailiff. Bondora receives regular updates to monitor the progress.

According to Bondora, about 31% to 54% of the defaulted principal is recovered within three years, depending on the country. On average, the amount recovered from a defaulted EUR 1,000 loan is between EUR 667 and EUR 689.

In July 2025, Bondora published a breakdown of the currently defaulted loans and the phase they are in. In established markets like Estonia and Finland, 54% and 66% of loans, respectively, are already at the bailiff stage, meaning the final phase of the collection process. In the Netherlands, a newer market, 75% of loans are still with the collection agency.

Recovery prospects are considered particularly low in Estonia, where 23% of defaulted loans are classified as unlikely to be recovered. In contrast, the outlook is significantly more optimistic in Latvia, where only 3% of loans are considered unlikely to be recovered.

Advantages and Disadvantages

In this section, I have listed what I consider to be the most important advantages and disadvantages of Bondora Go & Grow.

Advantages

- Realiability: The advertised return promise of 6% p.a. has always been fulfilled to date.

- Daily Crediting: Interest is added on a daily basis.

- High Liquidity: Daily availability of the invested capital.

- Broad Diversification: The Go & Grow loan pool consists of 100,000+ borrowers.

- Simple Management: The investment can be managed with just a few clicks.

- Reputation: Bondora is one of the most experienced and most popular P2P platforms in Europe.

- Financial Stability: Bondora has been profitable for many years already.

- No Management Fees: There are no expenses for managing the Go& Grow investment.

- Tax Optimisation: Taxes are only due when money gets withdrawn.

Disadvantages

- No Deposit Protection: An investment with Bondora is not a free lunch. Capital losses can occur at any time.

- No Guaranteed Interest Rate: The interest rate of 6% can be adjusted at any time.

- Transparency: Bondora Go & Grow is a black box with regards to the performance of the loans.

- Withdrawal Fee: A fee of EUR 1 is charged per withdrawal.

Bondora Go and Grow Alternatives

In the past, there have been repeated attempts to establish a Bondora Go & Grow alternative in the market. Whether through Mintos Invest & Access or Crowdestor Flex. However, the combination of simple handling, fixed interest, high liquidity, and broad diversification is difficult to replicate.

The most similar Go & Grow alternatives at the moment are Monefit SmartSaver and Modena. The following table is intended to illustrate which parallels and differences exist between the products.

| Bondora Go & Grow | Monefit SmartSaver | Modena | |

|---|---|---|---|

| Start | 2018 | 2022 | 2025 |

| Jurisdiction | Estonia | Estonia | Estonia |

| Return | 6% | 7,25% to 8,33% | Up to 11% |

| Interest Credit | Daily | Daily | Monthly |

| Availability | Daily | Max. 10 Days | Max. 31 Days |

| Min. Investment | EUR 1 | EUR 10 | EUR 50 |

| Max. Investment | Unlimited | EUR 500,000 | Unlimited |

| Deposit Limit | Unlimited | Unlimited | Unlimited |

| Collateral | No | No | No |

Additional Bondora Go & Grow alternatives can be found in my P2P platform comparison.

Summary Bondora Go and Grow Review

What is the final conclusion of this Bondora Go & Grow review? Is the Estonian investment product worth a try?

What is the final conclusion of this Bondora Go & Grow review? Is the Estonian investment product worth a try?

Launching in 2018, Bondora Go & Grow has set new standards in terms of fixed returns, ease of use, high liquidity, and broad diversification.

In particular, the combination of simplicity and high liquidity makes Go & Grow a good option for two types of investors:

first, for new and more inexperienced investors who want to start investing in P2P loans quickly and easily; and second, for investors with a strong need for liquidity who want to invest their money short-term at an attractive interest rate.

With the exception of a three-month period following the outbreak of the Covid-19 pandemic, the platform has consistently maintained daily liquidity since 2018. Despite this strong track record, it is clear that liquidity can be limited in exceptional situations.

Apart from liquidity, investors should also pay close attention to the underlying risks related to transparency and returns, which are discussed in detail in these Go & Grow review. Those with a long-term investment horizon will find stronger alternatives within the P2P lending space in terms of expected returns and risk mitigation.

Personally, I used Bondora Go & Grow as an active investor between June 2018 and August 2023, and again starting in January 2025. During this time, I earned more than EUR 6,000 in interest.

My expectations were met over most of this period. The advertised return was always achieved, and daily liquidity was reliably maintained with only a few exceptions.

Do you also want to try Bondora Go & Grow? Then register now by using the link below.

I’m Denny Neidhardt, the founder of re:think P2P. On this blog, I help retail investors make smarter, well-informed investment decisions in the world of P2P lending. Since 2019, I’ve been publishing in-depth analyses, platform reviews, and risk assessments to bring more transparency to this investment space. My goal is to challenge marketing claims, question developments, and empower investors with honest, independent insights.

I started using Bondora Go & Grow 4 years ago. I use different other P2P platforms as well. Bondora feels as one of the safest and most stable options, and offers an intuitive, user-friendly interface and investment experience and, as I experienced first-hand, a helpful and responsive customer service.

While the interest rate is lower than on other platforms, the big advantage is that the entire amount can be withdrawn instantly when needed. I needed the money in 2022 when making a real estate purchase, and had the entire amount on my bank account the next day. This convinced me to add funds to my account on Bondora again as soon as I had money available, and since then it’s again a worry-free passive investment where I see my money growing literally every day.

Hi Cedric,

thanks for contributing to my Bondora Go & Grow review by sharing your extensive opinion. If you value liquidity, then Go & Grow is indeed a great option. Even at the expense of a lower interest rate.

Kind Regards,

Denny

I understand the interest is low, but for high liquidity, short period, I think we can considere Bondora as a great option. Especially in order to avoid some cash drags when we compare with other P2P platforms.

Hi Thiago,

thanks for contributing to my Bondora Go & Grow review by sharing your opinion.

Kind Regards,

Denny

I find the platform very beginner friendly and a good choise for someone who want to begin his investment journey. The daily accumulation of interest makes it quite handy for your first steps in the space.

Hi Michail,

thanks for contributing to my Bondora Go & Grow review by sharing your opinion. I agree that the product is an easy entrance for less experienced P2P investors. How do you see the recent interest rate change to 6%?

Kind Regards,

Denny