Bondora is one of the largest P2P lending platforms in Europe. A fact that is clearly demonstrated by several key indicators: track record since 2008, more than 520,000 registered investors, and over EUR 500 million in investor assets under management.

Alongside its size, Bondora is also an extremely popular platform among P2P investors. In the annual community voting, Bondora has consistently ranked among the top eight platforms. In both 2021 and 2022, the Estonian company even secured first place.

One of the main reasons for Bondora’s success is Bondora Go & Grow, which was launched in 2018. The product is characterised by a fixed interest rate of 6%, daily liquidity, broad diversification, and simple usability.

Which Bondora alternatives are currently available on the market, and how closely do they compare to the Estonian original? This page presents several options and compares them with Bondora.

Not yet invested in Bondora? Then check out my Bondora review on the blog or sign up on the P2P platform using the button below.

Why Consider Bondora Alternatives?

Exploring potential Bondora alternatives can be driven by two main motives.

First: Expanding one’s P2P lending portfolio for diversification purposes. In this case, you may already be registered with Bondora but are looking for an additional option with similar characteristics.

Second: Certain features might be missing on Bondora but are available (or more strongly pronounced) on other platforms. These could include regulation, transparency, or a better return expectation.

The Approach

To identify suitable Bondora alternatives, it is essential to first outline the key features and characteristics of the Estonian P2P platform. Here is a brief overview:

Track Record: Bondora began its operations amid the 2008 financial crisis. This gives the company nearly two decades of experience, during which it has weathered multiple country-specific and global crises.

Business Model: The loan originators within the Bondora Group finance unsecured consumer loans across Europe. There are no protections or guarantees in place to shield investors from potential credit default risks.

Product: With the introduction of Bondora Go & Grow in 2018, the platform set new standards for easy usability, fixed interest rates, and high liquidity. The launch has marked the birth of the “one-click” products that would follow in the years after.

Financial Stability: Bondora Group AS, the parent company of the platform, has been consistently profitable since 2017. Its financial statements are audited by recognised auditors in accordance with IFRS standards and are published annually.

Bondora Alternative #1: Viainvest

Viainvest is a regulated P2P platform from Latvia where investors can earn up to 13% in returns. Below is a brief overview of the platform.

| Founded / Started: | August 2016 / December 2016 |

| Legal Name: | SIA Viainvest (LINK) |

| Headquarter: | Riga, Latvia |

| Regulated: | Yes (Financial and Capital Market Commission) |

| CEO: | Eduards Lapkovskis (December 2016) |

| Community Voting: | P1 out of 30 | See Voting |

| Expected Return: | Up to 13% |

| Primary Loan Type: | Consumer Loans |

| Collateral: | Buyback Guarantee |

| Bonus: | 1% Cashback | 90 Days |

Why is Viainvest a good Bondora alternative?

Similar to the Bondora platform (Bondora Group AS), Viainvest also has a large and established parent company behind it – the VIA SMS Group. Founded in 2009, it offers a similarly long track record, although the P2P platform itself only launched in 2016.

While the business results were not always positive in every single year, the VIA SMS Group has generally been profitable over time. Their reporting standards have also been consistently strong.

There are also several overlaps in the business model: like Bondora, Viainvest primarily finances unsecured consumer loans issued to European borrowers. However, unlike Bondora, these loans come with a buyback guarantee, which is triggered after 60 days of repayment delay.

Investors can invest almost as passively on Viainvest, but the Auto Invest tool allows for some configuration options. Loan terms start at 90 days, meaning the platform cannot fully compete with Bondora in terms of liquidity. In return, loans are typically offered at 10% to 13% interest, depending on market conditions and the loan originator.

Additional information can be found in my Viainvest review.

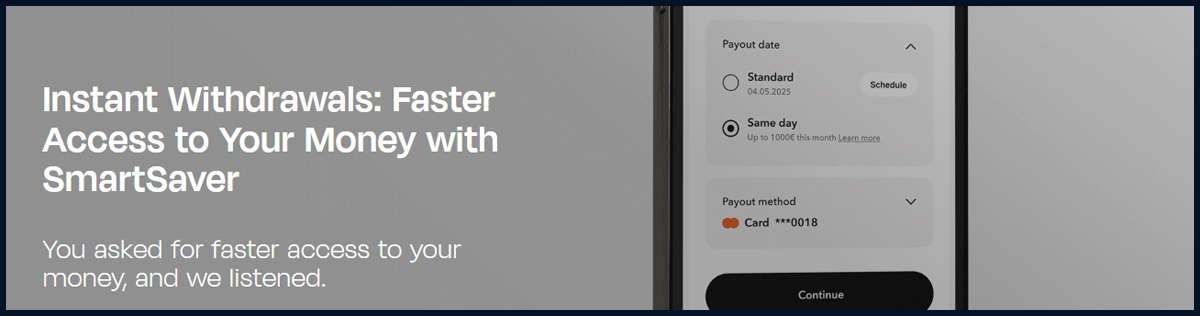

Bondora Alternative #2: Monefit SmartSaver

Monefit SmartSaver is an Estonia-based company where investors will find the most similar alternative to Bondora Go & Grow.

| Founded / Started: | 2022 |

| Legal Name: | Monefit Card OÜ |

| Headquarter: | Tallinn, Estonia |

| Regulated: | No |

| Expected Return: | Up to 10,52% |

| Community Voting: | P14 out of 30 | See Voting |

| Primary Loan Type: | Consumer Loans |

| Collateral: | None |

| Bonus: | EUR 5 Bonus + 0.25% Cashback (90 Days) |

Why is Monefit SmartSaver a good Bondora alternative?

Monefit SmartSaver is operated by the Creditstar Group, a fintech company founded in 2006 and headquartered in Estonia. Just like Bondora’s parent company, Creditstar operates only in the European lending sector. At the core of its business model is the financing of unsecured consumer loans for private individuals.

From a financial perspective, Creditstar is also well positioned. The company has been profitable for many years and reports annual profits in the mid-single-digit million range.

While Bondora’s operations are funded solely through P2P lending, Creditstar has a much broader financing structure. Since 2022, this includes also the Monefit SmartSaver product.

On SmartSaver, investors can put their money to work with just a few clicks. The interest rate is slightly higher at 7.5%, while liquidity – compared to Go & Grow – is somewhat more restricted. Currently, investors can withdraw up to EUR 1,000 per month instantly, with a waiting period of up to 10 days beyond that amount. The lack of guarantees or protection mechanisms is another shared characteristic between the two platforms.

Additional information can be found in my Monefit SmartSaver review.

Bondora Alternative #3: Mintos

Mintos is the biggest marketplace for consumer loans in Europe. In addition, the company also offers many other asset classes as investment opportunities. Below is a brief overview of the platform.

| Founded / Started: | May 2014 / January 2015 |

| Legal Name: | AS Mintos Marketplace (LINK) |

| Headquarter: | Riga, Latvia |

| Regulated: | Yes (Financial and Capital Market Commission) |

| CEO: | Martins Sulte (May 2014) |

| Community Voting 2022: | P3 out of 30 | See Voting |

| Expected Return: | 10,4% |

| Primary Loan Type: | Consumer Loans |

| Collateral: | Buyback Obligation |

| Bonus: | EUR 25 Bonus |

Why is Mintos a good Bondora alternative?

The Latvia-based Mintos platform started operations in 2015, making it one of the more experienced players in the P2P lending space.

The biggest difference between the two platforms lies in the business model. While Bondora manages its own loan originators, Mintos operates as a marketplace for external lending companies from around the world. This creates greater scalability, which is why Mintos manages the largest portfolio of investor assets among all European P2P platforms.

This leads to a broader variety of investment opportunities, including geographic preferences, different types of loans, and both short and long-term maturities. In recent years, additional asset classes such as ETFs, real estate, and bonds have also been added.

In terms of liquidity, investors have access to Mintos Smart Cash, where capital is invested in a money market fund managed by BlackRock. Since returns are closely tied to central bank interest rates, expected yields are significantly lower compared to Bondora Go & Grow.

Additional information can be found in my Mintos review.

Bondora Alternative #4: Twino

Twino is a Latvia-regulated P2P platform where investors can earn up to 12% returns by investing in Polish consumer loans. Below is a brief overview of the platform.

| Founded / Started: | August 2015 |

| Legal Name: | AS TWINO Investments (LINK) |

| Headquarter: | Riga, Latvia |

| Regulated: | Yes (Financial and Capital Market Commission) |

| CEO: | Nauris Bloks (April 2025) |

| Community Voting: | P21 out of 30 | See Voting |

| Expected Return: | Up to 12% |

| Primary Loan Type: | Consumer Loans |

| Collateral: | Buyback Guarantee |

| Bonus: | EUR 20 |

Why is Twino a good Bondora alternative?

The Latvia-based P2P platform belongs to SIA FINNO (formerly SIA TWINO), founded in 2009. The foundation of the P2P platform, which followed in 2015, was established in a similar timeframe as Bondora. While Pärtel Tomberg serves as CEO and main shareholder at Bondora, Twino’s parent company was founded by Armands Broks, who remains its sole shareholder.

The parallels between the two platforms are also evident in their focus on financing unsecured consumer loans, although Twino has often pursued markets outside of Europe – mostly without much success though.

What remains are investment opportunities with an established Polish loan originator. Loans are offered at 12% interest with a 12-month term. Compared to Bondora Go & Grow, this means lower liquidity but the potential for twice the expected return.

From a financial perspective, Twino has experienced a multi-year rollercoaster and consolidation phase, primarily due to an unsuccessful expansion strategy starting in 2017. At the same time, Bondora has built a financially stable foundation over recent years and has surpassed Twino in this regard.

Additional information can be found in my Twino review.

Conclusion: The Best Bondora Alternatives

Looking at the different P2P platforms, Viainvest and Monefit SmartSaver emerge as the most comparable Bondora alternatives in today’s P2P market.

In terms of history, business model, and financial stability, Viainvest shows the strongest overlap. Meanwhile, Monefit SmartSaver offers the product features most similar to Bondora Go & Grow.

Still haven’t found the right fit? Those who are interested in finding Bondora alternatives beyond the P2P platforms listed here can explore my P2P platform review page for additional options.

I’m Denny Neidhardt, the founder of re:think P2P. On this blog, I help retail investors make smarter, well-informed investment decisions in the world of P2P lending. Since 2019, I’ve been publishing in-depth analyses, platform reviews, and risk assessments to bring more transparency to this investment space. My goal is to challenge marketing claims, question developments, and empower investors with honest, independent insights.