With EUR 600+ million in investor assets under management and more than 500,000 registered users, Mintos is the largest P2P lending platform in Europe. Therefore, the Latvian P2P marketplace enjoys a special status in the P2P market.

For years, Mintos’ vision was to establish itself as the leading marketplace for investing in loans. However, since receiving its European licence as an investment company in August 2021, Mintos has increasingly developed into a multi-asset platform that offers products such as ETFs, bonds and real estate in addition to loans.

In this Mintos review, we take a closer look at the risk-return profile of the Latvian platform. Among other things, we look at the business model, the financial situation, the investment offering and the risk factors that have become particularly apparent in the crises of recent years.

Further analyses of other platforms can be found on my P2P Platform Review page.

Summary

Before we get started, here is a quick summary with the most important information about Mintos.

- With EUR 600+ million in investor assets under management and more than 500,000 registered users, Mintos is the largest P2P lending platform in Europe.

- The platform is operated by AS Mintos Marketplace, which is controlled by the financial supervisory authority in Latvia since August 2021 and is regulated in accordance with MiFID II. As a result, investors’ accounts with up to EUR 20,000 are protected against misappropriation or insolvency of the platform by the investor compensation scheme.

- Mintos offers a variety of different asset classes for investing. In addition to traditional debt financing (loans), these also include assets such as ETFs, bonds and real estate.

- During the pandemic, but also due to the war in Ukraine, some weaknesses at Mintos have been exposed. As a result, up to EUR 150 million in investor funds have ended up in recovery.

| Founded / Started: | May 2014 / January 2015 |

| Legal Name: | AS Mintos Marketplace (LINK) |

| Headquarter: | Riga, Latvia |

| Regulated: | Yes (Financial and Capital Market Commission) |

| CEO: | Martins Sulte (May 2014) |

| Community Voting 2022: | P3 out of 30 | See Voting |

| Assets Under Management: | EUR 650+ Million |

| Number of Investors: | 600.000+ |

| Expected Return: | 10,4% |

| Primary Loan Type: | Consumer Loans |

| Collateral: | Buyback Obligation |

| Bonus: | Up to EUR 500 Bonus (“THINK2027”) |

About Mintos

Mintos is a P2P marketplace based in Latvia, which is operated by AS Mintos Marketplace. The operational launch of the platform took place in 2015. In the following years, Mintos has developed into one of the largest P2P platforms in Europe, thanks to a highly scalable business model with externally connected lenders.

Mintos currently manages investor assets of EUR 600+ million, with more than 500,000 registered users.

With its licence as a European investment company, Mintos has increasingly integrated other asset classes on the platform. In addition to the traditional and historically grown range of loans, the platform’s portfolio now also includes ETFs, bonds and real estate.

Origin Story

The Latvian Martins Sulte, one of the founders and CEO of Mintos, was in the final stages of his MBA studies in 2014. At the time he wrote down some ideas about what he could do after graduation.

The Latvian Martins Sulte, one of the founders and CEO of Mintos, was in the final stages of his MBA studies in 2014. At the time he wrote down some ideas about what he could do after graduation.

With his experience in the financial sector (Ernst & Young, later investment banker at SEA) and his natural interest in technology, he wanted to combine both of his passions.

After reading an article about the British platform Landbay on TechCrunch, he became aware of the P2P lending business model.

Together with Martins Valters, who had previously been his supervisor at Ernst & Young, the two founded the company Mintos in 2014.

Ownership and Management

Who are the main shareholders and management executives behind Mintos? Let’s have a look!

Mintos Ownership

Who owns Mintos? The Latvia based P2P platform is operated by the company “AS Mintos Marketplace”. This company in turn belongs to the parent company “AS Mintos Holdings”. If we take a look in the Latvian company register, we will find a large number of different shareholders for this company.

The largest share, 30.52%, belongs to AS ALPPES Capital, which is 100% controlled by Aigars Kesenfelds. The Latvian multimillionaire, who was one of the four founders of 4finance in 2008, rarely appears in public. However, his reputation precedes him by far.

The article “The Fast Millionaire” portrays the rise and background of Aigars Kensenfelds’ empire and also reveals his links to Mintos.

Mintos Management

Mintos is represented at the top of the management team by CEO and co-founder Martins Sulte. The Latvian citizen worked as an investment banker at SEB for six years after studying economics at the University of Riga. After receiving his MBA in 2013, he then founded the Latvian P2P marketplace with Martins Valters, his former supervisor at Ernst & Young and current COO at Mintos.

In personal meetings with Martins from 2019 to 2024, he always made a tidy and competent impression. He was also frequently available to answer questions outside of official interviews.

Business Model and Finances

Throughout the due diligence process, investors should also have a look at the business model of a P2P platform as well as the overall financial situation. How does the company earn money? Does the platform operate profitably? And how well is the company positioned financially? In the following paragraphs of this Mintos review, we will follow-up on those questions.

Monetization

How does Mintos make money? To find out, let’s take a look at the 2024 annual report. That year, Mintos was able to generate a revenue of nearly EUR 12.1 million, spread across eight different sources of income.

Mintos was able to earn 73.6% of its revenue from service fees, which are charged to the lenders on the P2P marketplace for financing their assets. Historically, this has always been the largest source of income for Mintos.

The net interest income, amounting to EUR 1.8 million (15% of revenue), was earned by Mintos through the uninvested funds of investors. Since its licensing in 2021, Mintos has a business relationship with the asset manager BlackRock, through which the platform parks the uninvested funds in a money market fund managed by BlackRock.

Other sources of income include bond placement fees, one-time transaction fees for lenders, inactivity fees for investors, commissions on foreign currency exchanges, and fees for transactions on the secondary market. The smaller items account for less than 12% of Mintos’ total revenue.

Profitability

After two years of profitability, Mintos incurred a loss of nearly EUR 2.1 million in 2024. While revenue increased by 9%, operating costs rose even more significantly due to investments in new products, IT systems, as well as higher personnel costs.

Balance Sheet

In September 2024, Mintos secured external financing of EUR 2 million from the Latvian growth fund FlyCap. Along with share-based payments of EUR 430,000, this improved the equity position, despite the negative financial result in 2024.

As a result, Mintos’ balance sheet remains very positive. The equity ratio continues to be strong at 54%, the liquidity ratio has reached a historically new high of 2.16, and the debt-to-equity ratio is a decent 0.85. Only the historically high value of intangible assets could be questioned critically.

Overall, Mintos has a healthy liquidity and capital structure. With the EUR 3.1 million raised through Crowdcube in April 2024, which has not yet been recorded in the balance sheet, the P2P lending marketplace still has additional room for further growth.

Sign Up and Bonus

In order to invest on Mintos, investors must meet two important requirements: A minimum age of 18 years and proof of a European bank account in their own name.

The registration process on Mintos is very simple and intuitive. After opening an account via email, the KYC and AML questionnaires must be filled out. This is followed by the verification of identity and the declaration of tax residence.

Mintos Bonus

For new investors, there is currently a bonus campaign where up to EUR 500 in investment bonus can be earned. To receive the bonus, investors must first sign up on the P2P platform via my partner link between December 18, 2025, and January 31, 2026, and enter the promo code “THINK2027”.

The Mintos bonus is calculated based on the invested amount:

- EUR 1,500+ : EUR 20 bonus

- EUR2,500+ : EUR 35 bonus

- EUR 5,000+ : EUR 75 bonus

- EUR 15,000+ : EUR 175 bonus

- EUR 25,000+ : EUR 500 bonus

All asset classes are included in this campaign (loans, bonds, ETFs, and real estate), with the exception of Mintos Smart Cash.

A cross-platform overview with all bonus offers and cashback promotions can be found by investors on the bonus page.

Investing on Mintos

How does Mintos work and what should investors know and consider when investing on the marketplace? In the following sections of my Mintos review you will find all the necessary information that you need.

Loan Offering

The 80+ lenders represented on Mintos offer a variety of different loan types. These include:

- Private: Consumer Loans, payday loans, car loans

- Corporate: Business loans, agricultural and factoring loans

- Real Estate: Mortgage loans.

From an investor’s perspective, the large number of loan types is a big advantage in terms of diversifying the loan portfolio on Mintos.

Investors can achieve further diversification with the geographical selection of their P2P loans, as up to 33 different countries can be selected for investments. The geographical focus is on Europe, with a focus on the Baltic States, the Balkans and Eastern Europe. However, it is also possible to invest in Africa (South Africa, Zambia, Namibia, Botswana, Kenya), South America (Colombia, Mexico) or South East Asia (Philippines, Vietnam, Indonesia).

The terms of the loans depend on the lending company and the structure of the individual bonds (notes).

Fractional Bonds

Due to its licensing as a brokerage company, Mintos can make further asset classes accessible to its investor community, apart from the lending business. Since October 2023, this also includes the possibility to invest in bonds.

Interesting here is both the low minimum investment amount of only EUR 50 and the fact that there are no management fees. The first offer on Mintos comes from Eleving Group (formerly Mogo). The bond of EUR 3 million runs for 5 years and offers investors an interest rate of 13%.

High-Yield Bonds Portfolio

In November 2025, Mintos launched the automated “High-Yield Bonds Portfolio,” an expansion of its existing bond offerings. The idea is fairly simple: instead of selecting individual bonds, Mintos creates a broad portfolio with at least 20 different high-yield bonds from various industries.

Advantages for investors: broader diversification, more predictable and regular income, and a daily cash-out feature (liquidity depending on market conditions). The minimum investment amount is set at EUR 50.

Until the end of 2025, the bond portfolios will be free of charge. Starting in 2026, an annual management fee of 0.39% will apply.

The introduction of the “High-Yield Bonds Portfolio” strongly resembles Mintos’ launch of Invest & Access in 2019, which aimed to offer an alternative to Bondora Go & Grow. At least the three underlying goals are nearly identical: increase revenue, integrate less popular offerings, and provide seemingly more liquidity for investors.

Mintos Core ETF Portfolio

With the Mintos Core ETF portfolio, the P2P marketplace added another asset class in December 2023. The platform takes care of all portfolio management aspects, including market analysis, selecting ETFs and scheduling transactions. Based on a catalogue of questions, the company puts together an ETF portfolio that is designed to meet the investor’s risk tolerance and investment objectives.

Investments in the Mintos Core ETF can be made from as little as EUR 50. Mintos does currently not charge any fees for this service.

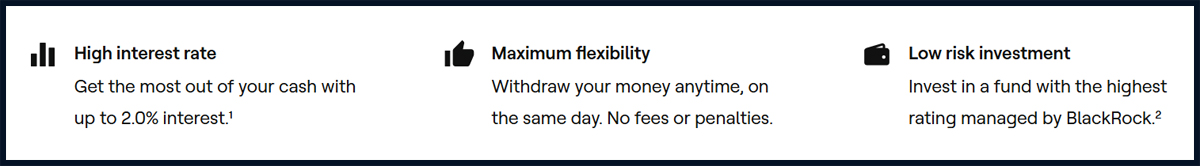

Mintos Smart Cash

In June 2024, the P2P marketplace launched Mintos Smart Cash. Here, investors can invest their cash reserves flexibly and achieve a return of up to 2.0%. The return is generated by a money market fund which is managed by BlackRock.

Mintos has been working with BlackRock since its IBF licensing and manages non-invested funds from its investor accounts there. This enabled Mintos to generate a revenue of EUR 1.2 million in 2023 (10.7% of total revenue). Further details of Mintos Smart Cash have been discussed with CEO Martins Sulte during my stay in Riga.

Costs and Fees

Investors can register on Mintos free of charge. There are also no costs or hidden fees for deposits and withdrawals. However, there are some cost factors on Mintos to consider.

- Inactivity fee: EUR 4.90 per month

- Deposits via card, Apple Pay, or Google Pay: 2%

- Transaction fee for sales via secondary market: 0.85%

- Currency exchange: from 0.5%

- Management Fee Mintos Core Loans: 0,39%

- Management Fee Mintos Custom Loans: 0,29%

- Access Mintos Smart Cash: 0.19%

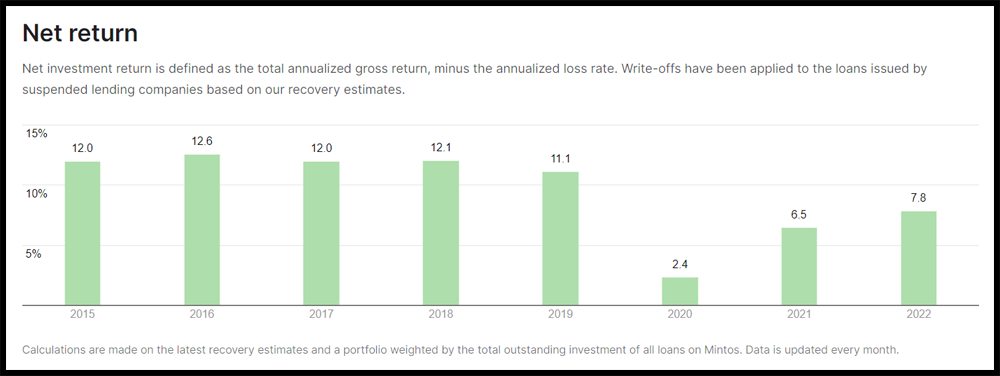

Expected Returns

According to Mintos, the net return on the platform is between 10% and 12%. The calculation is made including an annual loss ratio. For this reason, the return on investment in 2020 is only at 2.4%.

Write-downs were taken on loans issued by suspended credit entities based on our recovery estimates.

Afer being five years with Mintos, my personal return is at 10.79%. However, there are still more than EUR 1,000 in the recovery process, which I declared as a loss since no recoveries have been made for two straight years. As a result, my total return has dropped to 7.22%.

Auto Invest

Mintos offers an Auto Invest feature (Mintos Custom Loans), which allows users to set individual criteria for loan selection in advance. This means that loan repayments are automatically reinvested, eliminating the need for manual handling. With Mintos Auto Invest, the following settings, among others, can be configured:

- Selection of lenders and borrower countries

- Loan type (Personal, Corporate, Real Estate)

- Buyback obligation (Yes, No)

- Interest rate: From 5% to 30+% percent

- Loan term: Up to 72 months

- Investment amount per loan

The minimum investment amount on Mintos is EUR 10. Since May 16, 2025, an annual fee of 0.29% is charged for using the “Custom Loan Portfolios.” This fee applies to both the primary and the secondary market.

Mintos App

Mintos launched a smartphone app for its investors in February 2020. Check here for iOS (App Store) and Android (Play Store) to download the app.

Mintos Forum

The P2P lending industry is a fast-moving environment. Hence, make sure to stay on top of all relevant information by subscribing to my channels on Telegram or WhatsApp. This way, you will always receive the latest information from the P2P industry, including platform news regarding Mintos.

Mintos Taxes

After Mintos has become a licensed brokerage company, the platform is now legally obligated to withhold taxes on your income earnings that derives from investments into regulated financial instruments (Notes). The tax will be automatically withhold after receiving an interest payment.

The applicable tax rate is depending on the country of your tax residency and according to the submitted tax information and certificates.

- 20% for private investors and tax residents of Latvia

- 20% for investors from outside the EU/EEA

- 5% for private investors with residency in the EU/EEA (except for Latvia)

- 0% for Lithuanian tax residents (tax certificate is required)

- 0% for legal entities

Mintos Risks

Mintos faced several crises and problems in the past. While the origins of these crises are not related to Mintos (Covid-19 pandemic, war in Ukraine), they have clearly exposed the problems at Mintos. Especially in 2020, there have been numerous actions and entanglements that have not painted a good picture with regards to the integrity of the platform.

Platform Risk

AS Mintos Marketplace obtained an investment brokerage licence in August 2021, issued by the Latvian Central Bank. As a result, the platform is subject to the requirements of the MiFID II (Markets in Financial Instruments Directive). This regulatory framework is designed to enhance investor protection and reduce systemic risks by establishing common standards and rules for investment firms operating within the EU. Among other things, it covers the following areas:

Investor Compensation Scheme: Investors are entitled to compensation if Mintos fails to return financial instruments or funds due to fraud or administrative errors on the part of the P2P platform. The compensation that an investor may claim under this scheme is limited to Mintos’ outstanding obligations toward the investor and capped at a maximum of EUR 20,000.

It is important to note that this compensation scheme does not protect against investment risks. Therefore, potential loan defaults by lending companies are not covered by the investor compensation system.

Segregated Investor Accounts: As part of its regulatory obligations, Mintos must keep investors’ financial instruments and uninvested funds separate from its own assets. This segregation helps prevent any misuse or misappropriation of investor funds by the P2P lending platform.

Transparent Information: Investors are provided with comprehensive information designed to help them make well-informed investment decisions. Among other things, Mintos regularly publishes annual reports audited by KPMG, offering insight into the platform’s financial stability.

Deposit Insurance

The investments offered through Mintos are not covered by European deposit guarantee schemes (such as the Deposit Guarantee Directive 2014/49/EU). This means that – unlike traditional bank deposits – funds invested on Mintos are not insured or guaranteed by any national or European compensation scheme.

Accordingly, investors should be aware that the capital invested is subject to the risk of loss, that returns are not guaranteed, and that they may not recover the full amount originally invested.

Lender Risk

At the shareholder level, Mintos has always had significant overlaps with many of its lending companies. This creates the issue that measures taken often serve the interests of shareholders first and investors only second.

Particularly in the period before obtaining the IBF license, there were several instances where apparent conflicts of interest resulted in disadvantages for investors.

Finko Group

With an outstanding portfolio of around EUR 100 million, the Finko Group was the largest non-bank lender on Mintos at the beginning of 2020. The year before, the group — which was represented on Mintos through seven lending companies — had financed EUR 366 million in consumer loans and generated a profit of EUR 17.6 million.

One year later, little more than an empty shell was left of the group. Some lenders had their licenses revoked under dubious circumstances (such as Varks in Armenia), others filed for bankruptcy (Metrokredit and Kiva in Russia), and some were sold off for a fraction of their value to competitors with the same shareholders (such as Sebo in Moldova). As a result, no funds remained to honour the previously promoted buyback guarantees.

Varks

With an outstanding portfolio of EUR 30 million on Mintos, the Armenian lender Varks was the largest lender within the Finko Group at the time its license was revoked in March 2020. Although there were already obvious issues with the lender from the Armenian central bank at that time, Varks was still promoted by Mintos through a variety of measures, including forward flows and cashback campaigns.

In the case of Varks, Mintos was well aware of the lender’s financial situation and problems with the central bank. Yet, no measures were taken or initiated to protect investors funds. In the end, it was publicly communicated that a two-year repayment plan was in place, serving the outstanding obgligations by the end of 2022. In June 2024, around EUR 10 million in investor funds had still not been repaid. Mintos now forecasts a loss of 50% to 25%.

Lender Analysis

Due to the COVID-19 pandemic and the war in Ukraine, Mintos experienced numerous problems with lenders, many of whom were subsequently unable to meet their outstanding obligations to investors. At times, up to EUR 150 million of investor funds were in recovery, affecting around 30% of Mintos’ total loan portfolio.

For a successful investment on Mintos, it is therefore essential that investors independently examine the risk profile of each lender. To assess the financial stability, the following table provides an overview of the current financial figures.

| Loan Originator | Year | Audited | Profit | ROA | Equity Ratio | Debt | Liquidity | Impairments | Score |

|---|---|---|---|---|---|---|---|---|---|

| BB Finance | 2024 | KPMG | EUR 1,07M | 5,0% | 18,0% | 0,82 | 1,09 | 9,7% | 78 |

| Cash Credit | 2024 | Unaudited | EUR 286K | 4,3% | 54,8% | 0,45 | 2,18 | 1,8% | 78 |

| Credifiel | 2024 | RSM Mexico | EUR 7,09M | 6,0% | 35,8% | 0,64 | 1,52 | 5,3% | 92 |

| Creditstar (FI) | 2024 | Unaudited | EUR 283K | 0,4% | 1,00 | 3,0% | 43 | ||

| Credius IFN (RO) | 2024 | Unaudited | EUR (309K) | (1,4%) | 44,1% | 0,56 | 1,58 | 26,2% | 52 |

| Delfin Group (LV) | 2024 | KPMG | EUR 7,4M | 6,4% | 19,7% | 0,80 | 1,11 | 9,6% | 78 |

| Esto (EE) | 2024 | KPMG | EUR 11,2M | 16,9% | 33,4% | 0,67 | 2,73 | 3,0% | 96 |

| Esto (LT) | 2023 | Provisus | EUR (820K) | (23,1%) | (40,1%) | 1,40 | 1,51 | 3,0% | 51 |

| Evergreen Finance | 2024 | Unaudited | EUR 829K | 23,4% | 0,77 | 1,68 | 42,9% | 54 | |

| Finclusion | 2024 | PwC | EUR 234K | 2,3% | 24,7% | 0,75 | 0,73 | 16,0% | 64 |

| Finmak | 2024 | Unaudited | EUR 5,69M | 49,3% | 0,51 | 1,87 | 57 | ||

| Finopro IFN (RO) | 2024 | Grant Thornton | EUR 5,64M | 40,5% | 78,6% | 0,21 | 0,03 | 64 | |

| Fintech Finance | 2024 | Baker Tilly | EUR 14,5M | 29,9% | 37,0% | 0,63 | 1,43 | 22,7% | 74 |

| Hipocredit (LT) | 2024 | Nexia Auditas | EUR 1,31M | 5,4% | 12,1% | 0,88 | 4,95 | 57 | |

| Hipocredit (LV) | 2024 | Unaudited | EUR 546K | 12,9% | 0,87 | 22,85 | 50 | ||

| ID Finance | 2024 | EY | EUR 6,61M | 4,2% | 16,0% | 0,84 | 1,20 | 39,8% | 70 |

| Iute Credit (AL) | 2024 | RSM Albania | EUR 4,69M | 5,9% | 26,4% | 0,74 | 1,42 | 14,2% | 75 |

| Iute Credit (BG) | 2023 | HLB Bulgaria | EUR (2,23M) | (27,3%) | 16,2% | 0,84 | 13,26 | 24,4% | 58 |

| Iute Credit (MD) | 2024 | Baker Tilly | EUR 2,39M | 4,1% | 35,4% | 0,65 | 4,00 | 10,3% | 78 |

| Iute Credit (MK) | 2024 | Moore | EUR 1,98M | 5,8% | 16,5% | 0,83 | 5,5% | 71 | |

| Luma Finans | 2024 | WeAudit | EUR 5,34M | 18,4% | 18,0% | 0,82 | 1,93 | 29,9% | 63 |

| Mikro Kapital (MD) | 2024 | Crowe Audit | EUR 361K | 1,2% | 29,4% | 0,71 | 0,65 | 5,9% | 74 |

| Mikro Kapital (RO) | 2024 | PwC | EUR 1,56M | 3,9% | 21,9% | 0,78 | 0,27 | 6,0% | 75 |

| Mikro Kapital (UZ) | 2023 | Grant Thornton | USD 3,65M | 6,9% | 16,7% | 0,83 | 0,31 | 2,6% | 78 |

| Mogo (GE) | 2024 | Unaudited | EUR 4,47M | 95,0% | 0,05 | 15,57 | 10,8% | 68 | |

| Mogo (LT) | 2023 | ROSK Consulting | EUR 381K | 1,1% | 8,9% | 0,91 | 1,08 | 3,4% | 71 |

| Mogo (LV) | 2024 | Unaudited | EUR (970K) | 72,2% | 0,28 | 1,66 | 12,9% | 53 | |

| Mogo (RO) | 2024 | Unaudited | EUR 1,70M | 12,0% | 0,88 | 3,22 | 16,4% | 58 | |

| Moment Credit (LT) | 2024 | Grant Thornton | EUR 233K | 1,4% | 31,1% | 0,69 | 1,35 | 10,7% | 72 |

| Monefit (EE) | 2024 | Unaudited | EUR 112K | 13,8% | 0,86 | 2,0% | 55 | ||

| Mozipo (RO) | 2024 | BDO | EUR 178K | 3,3% | 41,6% | 0,58 | 1,91 | 29,6% | 73 |

| Nera Capital | 2024 | Unaudited | EUR 3,84M | 14,6% | 0,85 | 0,40 | 42 | ||

| Nordecum | 2024 | Unaudited | EUR 958K | 4,5% | 21,0% | 0,79 | 3,75 | 57 | |

| Placet Group | 2024 | Unaudited | EUR 4,67M | 49,1% | 0,51 | 3,62 | 57 | ||

| Sun Finance (LV) | 2024 | Unaudited | EUR 2,49M | 39,2% | 0,61 | 1,65 | 10,1% | 65 | |

| Watu Credit | 2024 | Unaudited | EUR 7,97M | 28,9% | 0,71 | 4,08 | 6,2% | 69 |

You can check out the lender overview and comparison page to learn more about the applied KPIs and their interpretation.

Mintos in Crisis Situations

To better assess Mintos’ risk management, it is useful to take a closer look at how the platform has behaved during past crisis situations.

Covid-19 Pandemic

Mintos responded relatively early to the COVID-19 crisis, implementing both strategic and operational adjustments. In the first “Ask Mintos Anything” session on March 19, 2020, Mintos CEO Martins Sulte communicated several measures, including financial stabilization and platform consolidation, cost reductions of around 40%, the dismissal of 45 employees (after 140 new hires in 2019), and a scaling back of marketing budgets.

Particularly questionable, however, were two measures that Mintos implemented in the aftermath of the pandemic.

Schedule Extension: In October 2019, Mintos introduced a schedule extension for the first time. While the measure initially appeared reasonable (no loan buybacks would be triggered when a loan term was extended) it soon became a pretext to give loan originators maximum flexibility at the expense of investor liquidity.

In March 20220, the schedule extension was increased to up to 6 intervals of 31 days each. In the same month, Mintos announced that also defaulted loans could be further postponed. Not only did Mintos violate its own terms of use with these actions, they also worked more in favor of their (affiliated) loan originators rather than the interest of their investor community.

New Terms & Conditions: Equally controversial was the introduction of new terms and conditions in August 2020. What was presented to investors as an update regarding “Mintos Strategies” actually included nothing less than requiring investors to cover legal costs if loan originators were to default. This effectively shifted liability from Mintos to the investor, reducing the platform’s responsibility.

War in Ukraine

The war in Ukraine had a significant impact on Mintos investors. After Russia invaded Ukraine in April 2022, Mintos suspended all new investments on the primary market for Russian and Ukrainian loans. A total of eight loan originators were affected: Creditter, DoZarplati, EcoFinance, Kviku, Lime, Mikro Kapital, Mokka, and SOSCREDIT.

Mintos has taken the following actions in response:

- Removal of all Russian and Ukrainian loan originators from Mintos Strategies.

- No currency conversion with the Russian ruble, applicable to all currencies.

- Potential buying and selling of Russian and Ukrainian loans only via the secondary market.

- Russian and Ukrainian loans in Mintos Strategies are not available for standard payouts.

Advantages and Disadvantages

In this section, I have listed the biggest advantages and disadvantages of Mintos.

Advantages

- Track Record: Mintos has been active in the P2P market since 2015.

- Market Leader: In terms of managed assets, Mintos is the largest P2P platform in Europe.

- Regulation: Licensed as a European investment firm since August 2021.

- Asset Classes: Mintos offers a variety of different investment classes.

- Transparency: Audited financial results are regularly published.

Disadvantages

- Due Diligence: Crisis periods have exposed weaknesses in the due diligence process.

- Loan Defaults: At times, around EUR 150 million of investors’ funds were in recovery.

- Conflict of Interest: Shareholder overlaps with multiple loan originators.

- Schedule Extension: Implementation of measures detrimental to investors.

Mintos Alternatives

In terms of its business model, Mintos is most comparable to P2P marketplaces such as PeerBerry or Income Marketplace. The biggest difference between the marketplaces is that PeerBerry is backed by a large and established non-bank lender from Europe (Aventus Group), which primarily offers its own loans on the marketplace.

On my blog, investors can find a detailed breakdown with the best Mintos Alternatives in 2026.

Income Marketplace

Income Marketplace is an unregulated P2P marketplace based in Estonia. The platform, which had its operational start in January 2021, markets itself with a range of innovative security features that are designed to provide investors with significantly better protection against problematic lenders. So far, investors have not suffered any losses on Income Marketplace yet. In addition, many of the lenders represented on Income offer an attractive combination of high interest rates and high liquidity. Further information on the Mintos alternative can be found in my Income Marketplace review.

PeerBerry

PeerBerry is also a P2P marketplace, but it works exclusively with partners from the Aventus Group. In terms of investor assets under management, PeerBerry is number two in Europe, just behind Mintos. The Croatian-based platform has attracted particular attention due to its good performance in times of crisis. PeerBerry partners have repaid more than EUR 45 million in war-affected loans to investors within two years. Further information can be found in my PeerBerry review.

You can find other Mintos alternatives on the P2P Platform Comparison page.

Community Feedback

Over the years, Mintos has established itself as one of the most popular alternatives in the P2P lending space. In the annual community voting, Mintos has consistently improved its ranking over the past three years. In 2025, it even secured third place among 30 participating P2P platforms.

In 2025, only the Latvian P2P platforms Viainvest and Debitum were rated more popular. Following Mintos, Swaper and Income Marketplace ranked next.

Summary Mintos Review

Mintos is the market leader in the European P2P lending environment. This status has been achieved through a highly scalable business model with externally connected lenders.

Mintos is the market leader in the European P2P lending environment. This status has been achieved through a highly scalable business model with externally connected lenders.

With a favourable economic situation behind them, investors have been able to regularly achieve double-digit returns. However, investors had to pay the price for this rapid growth due to a combination of inadequate due diligence and macroeconomic events.

As a result, more than EUR 140 million are still in the recovery process in 2024. Mintos itself is already expecting a loss of at least EUR 64 million.

Because the overall performance of the Mintos portfolio shows that a diversified approach across multiple lenders does not work, investing in P2P loans is only recommended for advanced investors who are able to evaluate individual lending companies.

Apart from that, asset classes like fractional bonds offer a much more interesting alternative for investors on Mintos.

FAQ Mintos Review

With EUR 600+ million in investor assets under management and more than 500,000 registered users, Mintos is the largest P2P lending platform in Europe.

The Latvia based P2P platform belongs to “AS Mintos Holdings”. The largest share, 30.52%, belongs to AS ALPPES Capital, which is 100% controlled by Aigars Kesenfelds.

Mintos was able to earn 80% of its revenue from service fees charged to lenders for financing their loans on the P2P marketplace. Historically, this has always been the largest source of income for Mintos.

After four consecutive years with losses, Mintos was able to make a profit again in 2022 and 2023. The result of EUR 1 million achieved in 2023 is also the highest profit in the platform’s history.

I’m Denny Neidhardt, the founder of re:think P2P. On this blog, I help retail investors make smarter, well-informed investment decisions in the world of P2P lending. Since 2019, I’ve been publishing in-depth analyses, platform reviews, and risk assessments to bring more transparency to this investment space. My goal is to challenge marketing claims, question developments, and empower investors with honest, independent insights.

Hi, thank you for the blog and the info, I am looking to divesify my portfolio and I will deffinetly open Esketit shortly and Peerbeery is next and will use your referal link. I have started Bondora as well in 2017, the porfolio was a disaster and stopped it (lost only €1) but I made some profits with their Go&Grow. I have just deposited 1k again to have a chance to win their prize :). I stated Mintos in 2018 where I had 10k, from August 2018 to 2021 or so when I took out all my money and left only my profits, but I didn’t really look after it. I added again 10k to Mintos in a few steps this summer and I think you are doing it wrong with Mintos. I did experience loss as well of around €700 but this was due to buying discounted loans during the pandemic from companies I knew were bad and I also did not respect my own strategy. Losses were mostly because of my greed, but… the discount I made on premium when buying those loans was over €1000, so I did not actually lose. Soon after the cracks happened I was exposed with 1.5k but half of it has been recovered so fine for me. Some might still be recovered. It’s true that lately I login daily to the platform and buy only manually, but my return is 19.05% (add 2% with campaigns and bonuses). I made more money on SM than interest. THere are some good loan originators such as Esto, Placet Group (small but always on profit), Delfin and Iute. I invest in most of the listed LOs to diversify but in the shady ones I only do invest 1-2% max and if I find discounted loans on SM or they offer good return (Credistar has loans at 15.5% up to 17.5%, I have about 2% of my portfolio in those). I always try to get the highest yields from each LO and I have a strategy for it. :). My current estimated average return is 13.10%. But can’t wait to try out the other ones.

Hi Lavinia,

thanks for commenting and sharing your experiences so far.

Best, Denny

Hi Denny,

Mr. Harrington has made for years a very frequent and appreciated update of his personal loan originators rank in Mintos, fixed from official data: https://explorep2p.com/mintos-lender-ratings/. It was great but in the last year he’s time by time less active. Why don’t you launch your personal one? we’ll surely be glad tò you!

Hi Mario,

thanks for hinting at this idea. To be honest, this involves a lot of work. Not just to set it up, but also maintaining the rating. I would rather manage my resources differently and cover different platforms instead.

Kind regards,

Denny

Pure maffia still owing me money.

offering buyback but not being able to collect the money.

they knew varks was in trouble at that time even giving higer rates and coming with al new constructions..

its a goddame miracle this company can get away with this rubbish.

Hi Rob,

thanks for contributing to my Mintos review.

You are right, the whole Varks and Finko case has indeed been a very shady chapter in Mintos’ long history.

Best, Denny