Lendermarket, a spin-off of the Estonia-based Creditstar Group, has faced numerous problems in the past. These included payment delays (Pending Payments), a high level of intransparency, subpar communication, lack of regulation, and instability in key management positions.

This resulted in a rather unattractive overall profile, despite above-average interest rates and various bonus campaigns.

In recent years though, Lendermarket’s profile has shifted positively. Is it now worth investing again in the Ireland-based P2P platform? And which risk factors should investors still keep an eye on? In this Lendermarket review, you’ll find a detailed analysis with all the key information about the platform.

Further analyses of other platforms can be found on my P2P Platform Review page.

Summary

Before we get started, here is a quick summary with the most important information about Lendermarket.

| Founded / Startet: | June 2016 / June 2019 |

| Legal Name: | Lendermarket Limited (LINK) |

| Headquarter: | Dublin, Ireland |

| Regulated: | Yes (ECSPR License) |

| CEO: | Carles Federico (September 2023) |

| Community Voting: | P24 out of 30 | See Voting |

| Assets Under Management: | EUR 58+ Million |

| Number of Investors: | 20.000+ |

| Expected Return: | 15,58% |

| Primary Loan Type: | Consumer Loans |

| Collateral: | Buyback Guarantee |

| Bonus: | 1% Cashback (90 Days) |

About Lendermarket

Lendermarket is an Ireland-based P2P platform that was founded in June 2016 by the Creditstar Group. Since its operational launch in April 2019, investors on Lendermarket have been able to invest in a wide range of international consumer loans, with an advertised average return of 15.5%.

A particularly notable feature of Lendermarket is the high return expectations, driven by above-average interest rates and various bonus campaigns.

The majority of loans on Lendermarket come from the Creditstar Group, an Estonian fintech company that encompasses a variety of internationally active lenders.

In its early years, Lendermarket was used exclusively as a financing source for Creditstar Group’s lending operations. In May 2022, the first external lender was added, following the decision to transform the platform into a P2P lending marketplace.

Ownership and Management

Who are the main shareholders and management executives behind Lendermarket? Let’s have a look!

Lendermarket Ownership

Who owns Lendermarket? The P2P platform “Lendermarket Limited” is fully owned by “SA Financial Investments OÜ“. This is an Estonian holding company to which a total of 18 companies belong.

Its owner and ultimate beneficiary is Aaro Sosaar, who is also the CEO and main shareholder of Creditstar Group.

He holds a university degree in banking and international finance. He describes himself as an entrepreneur and investor in financial services and technology.

Lendermarket Management

In September 2023, Carles Federico was introduced as the new CEO of the Lendermarket P2P platform. Carles is an experienced manager in sales and finance who previously worked for the Creditstar Group between September 2015 and April 2021. As a result, the often emphasized independence of Lendermarket from its largest lender can be seriously questioned.

In September 2023, Carles Federico was introduced as the new CEO of the Lendermarket P2P platform. Carles is an experienced manager in sales and finance who previously worked for the Creditstar Group between September 2015 and April 2021. As a result, the often emphasized independence of Lendermarket from its largest lender can be seriously questioned.

Currently, around 15 to 20 employees work directly at Lendermarket. According to the platform, no operational support is provided by the Creditstar Group. On this page, investors can get an overview of the P2P platform’s team members.

Business Model and Finances

Throughout the process of due diligence, investors should also have a look at the business model of a P2P platform as well as the overall financial situation. How does the company earn money? Does the platform operate profitably? And how well is the company positioned financially? In the following paragraphs of this Lendermarket review, we will look at those questions.

Monetization

How does Lendermarket make money? Lendermarket generates its revenue through a variable brokerage fee, which is charged to lenders in exchange for financing via the P2P marketplace.

The amount depends on the volume of loans financed and can range between 2% and 5%. The exact fee also varies based on the borrower’s country and the type of loans the lender offers.

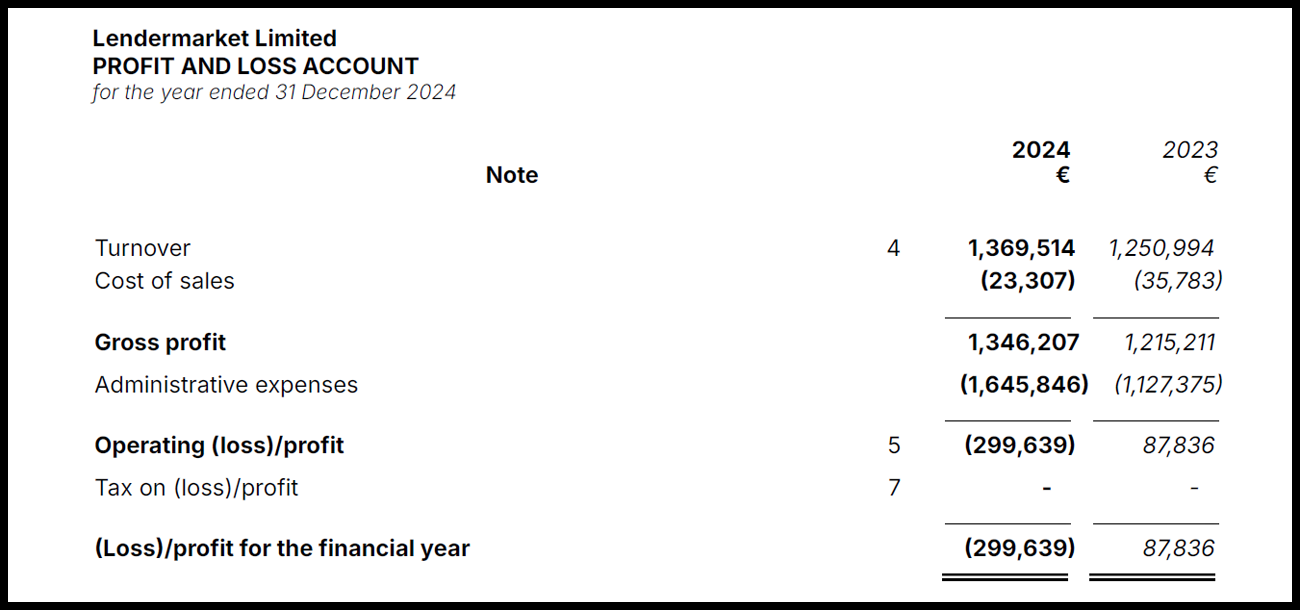

Profitability

Lendermarket is currently not profitable. According to the financial figures for 2024, the P2P lending platform had to accept a loss of nearly EUR 300,000. While revenue has slightly increased to EUR 1.37 million, operating and administrative costs rose disproportionately.

As a result of this performance, accumulated losses have now added up to nearly EUR 1.5 million.

On the positive side: A capital injection of approximately EUR 487,000 from the shareholders slightly improved the equity position. Cash reserves also increased by EUR 60,000.

Sign Up

In order to invest on Lendermarket, investors must meet three requirements:

- Minimum age of 18 years

- Residence in the European Economic Area or Switzerland

- European bank account in the specified name.

The registration process is pretty simple and intuitive. After opening an account with an email address, users must complete the KYC (Know-Your-Customer) and AML (Anti-Money Laundering) questionnaires. This is followed by identity verification and providing the tax residency information.

Legal entities also have the option to register with Lendermarket.

Lendermarket Bonus

If Lendermarket’s profile appeals to you, you can receive an additional investment bonus for the platform via this blog.

To do so, you must first register with Lendermarket via this link. You will then receive a 1% cashback on all investments you make in the first 90 days after successful registration. For an investment of EUR 10,000, this corresponds to a cashback of EUR 100.

A platform overview with all bonus offers and cashback promotions can be found on the bonus page.

Investing on Lendermarket

How does Lendermarket work and what should investors know and consider when investing on the plaform? In the following sections of my Lendermarket review you will find all the necessary information that you need.

Loan Offering

In 2022, Lendermarket completed its transformation into a P2P marketplace. As a result, it no longer finances loans exclusively from Creditstar Group companies, but also from external lenders.

“[..] a decision was made to become a separate and independent platform, and start offering fundraising and liquidity for non-banking lending companies globally.”

Below is a brief overview of the profiles of the current lenders on Lendermarket:

- Creditstar Group: Founder and driving force behind the Lendermarket platform. Established in Estonia in 2006, Creditstar is a profitable and internationally active financial company. Subsidiaries of the Creditstar Group are regulated in eight countries where the company offers its lending services. Investors are offered a group buyback guarantee to secure the obligations of the individual lenders within the group.

- Dineo: On Lendermarket since May 2023. The lender provides consumer loans to private individuals ranging from EUR 50 to EUR 600, with interest rates between 10% and 15% for short-term loans of up to 90 days. The loans are secured with both a 60-day buyback guarantee and the group buyback guarantee.

- RapiCredit: On Lendermarket since November 2023. One of the largest microfinance fintechs in Colombia, founded in 2014. Consumer loans to private individuals are offered on Lendermarket with interest rates of up to 18%, for terms of up to 180 days. Buyback guarantee applies after 60 days of payment delay.

- Credifiel: On Lendermarket since August 2024. A Mexico-based lender that is active since 2006. The lender primarily provides private consumer loans. Interest rates go up to 12%, with loan terms of up to 37 months. Loans are covered by a 60-day buyback guarantee. Credifiel is also present on Mintos.

Costs and Fees

On Lendermarket, investing is largely free of charge for investors. However, starting February 1, 2026, certain fees will apply to investors in individual cases.

- Withdrawal Fee: EUR 2 (from the second withdrawal per calendar month)

- Transaction Fee: 1.95% (for deposits and withdrawals via card)

Expected Returns

Lendermarket offers above-average interest rates across the P2P market. According to the platform, the expected average return is 15.5%, with some individual loans having offered interest rates of up to 19%.

Auto Invest

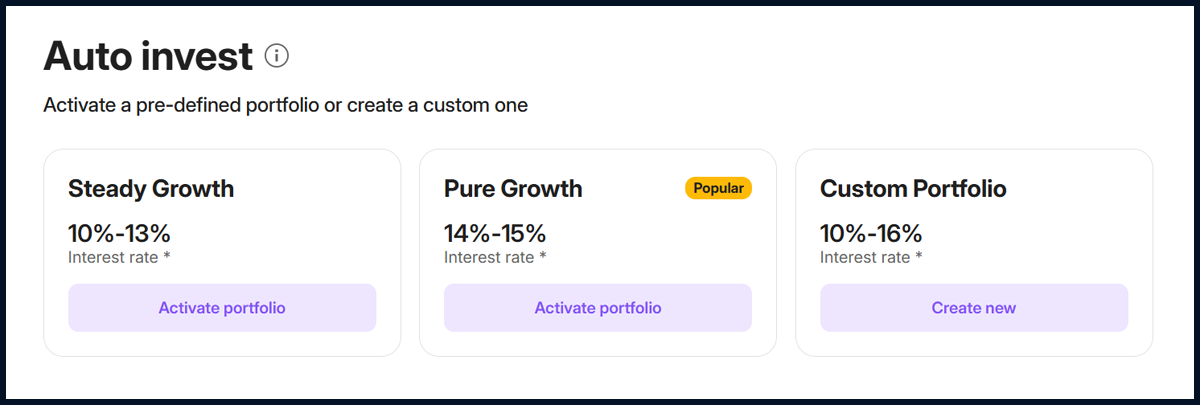

On Lendermarket, investors can use Auto Invest to allocate their funds. This means investors can set predefined criteria, which an algorithm then uses when assigning new loans. As a result, investments on Lendermarket can be managed passively.

Selectable criteria include the lender, minimum and maximum amount per loan, interest rate, and loan term. Alternatively, investors can choose from predefined Auto Invest strategies, which differ in terms of interest rates and loan durations.

A secondary market, where loans can be sold before maturity, does not yet exist on Lendermarket.

Buyback Guarantee

Similar to many other P2P platforms, Lendermarket promotes a loan protection mechanism in the form of a buyback guarantee.

This guarantee is triggered when a loan is more than 60 days overdue. The lender is then required to repurchase the loan in full, including both principal and accrued interest.

However, there are occasional differences in the extension periods depending on the lender.

For example, with Creditstar, up to 6 extensions of 30 days each can occur. This means that a loan with an original term of 30 days could theoretically be repaid only 240 days later (60 days until the buyback guarantee is triggered + 180 days of possible extensions). Since there is no secondary market on Lendermarket, this can significantly limit liquidity for investors.

To date, the buyback guarantee has always been honored.

Lendermarket Forum

The P2P lending industry is a fast-moving environment. Hence, make sure to stay on top of all relevant information by subscribing to my channels on Telegram or WhatsApp. This way, you will always receive the latest information from the P2P industry, including platform news regarding Lendermarket.

Lendermarket Taxes

Generally, interest income generated by loan financing is considered capital income and thus must be declared as such in the tax declaration.

Unlike other platforms, Lendermarket does not withhold taxes through interest income such as in Latvia or Lithuania.

For the tax declaration, investors can select the “Account Statement” tab in the main menu, where a tax report for the respective year can be downloaded. This information can then be submitted to the relevant tax office as part of a tax return.

Lendermarket Risks

Investing in P2P loans carries many risks. Which risk factors should be considered with Lendermarket, and how should they be assessed?

Platform Risk

The P2P platform, operated by the Irish company “Lendermarket Limited,” was founded on June 29, 2016, with its operational launch taking place in 2019.

After operating unregulated and without a license in its initial years, the platform received authorization from the Central Bank of Ireland in December 2024 to operate as a crowdfunding service provider under EU Regulation 2020/1503.

This requires, among other things, a proper separation of investor funds, protecting investors from potential misappropriation. To ensure this, Lendermarket works with FIRE Financial Services, an FCA-authorized and Irish Central Bank-regulated e-money institution.

As a result, investors retain full access to their funds in the event that Lendermarket ceases operations, and loan repayments can continue as scheduled.

The regulation also imposes stricter compliance and transparency standards on Lendermarket, increasing the platform’s overall security. However, potential loan defaults or insolvencies of the issuers are not covered by this regulatory framework.

Deposit Insurance

The investments offered through Lendermarket are not covered by European deposit guarantee schemes (such as the Deposit Guarantee Directive 2014/49/EU). This means that – unlike traditional bank deposits – funds invested on Lendermarket are not insured or guaranteed by any national or European compensation scheme.

Accordingly, investors should be aware that the capital invested is subject to the risk of loss, that returns are not guaranteed, and that they may not recover the full amount originally invested.

However, the claims against the lending companies remain valid and can be enforced legally.

Lender Risk

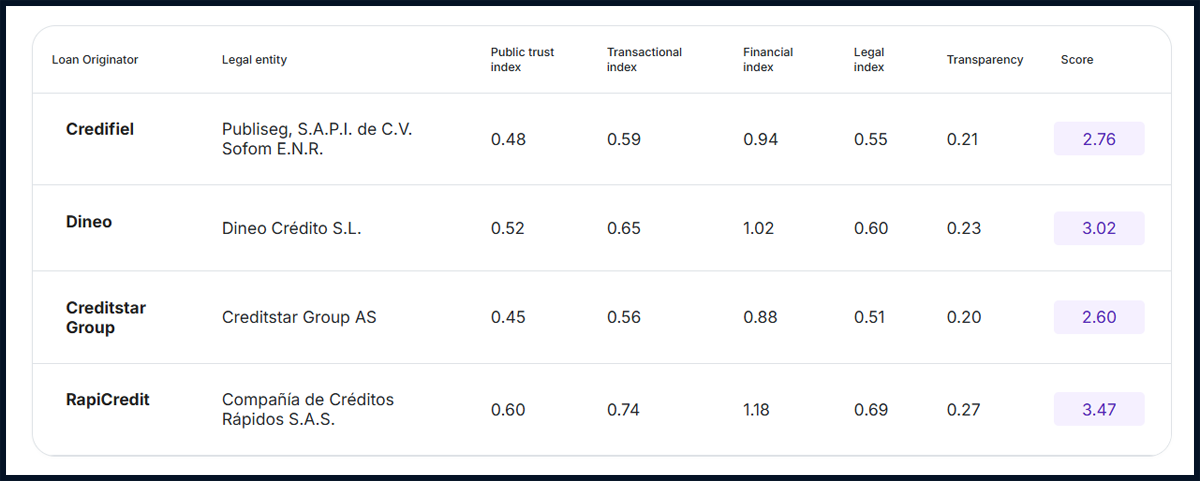

Lendermarket evaluates each of its lenders against several criteria. The platform also provides a public risk rating, in which loan originators are analyzed across four categories: transparency, legal environment, financial stability, and transactions.

Regardless of Lendermarket’s due diligence, investors should also review the financial statements of the respective lenders themselves, which are published on the platform. Below is a tabular overview of the current financial figures for each lender.

| Loan Originator | Year | Audited | Profit | ROA | Equity Ratio | Debt | Liquidity | Impairments | Score |

|---|---|---|---|---|---|---|---|---|---|

| Credifiel | 2024 | RSM Mexico | EUR 7,09M | 6,0% | 35,8% | 0,64 | 1,52 | 5,3% | 92 |

| Creditstar Group | 2024 | KPMG | EUR 7,24M | 2,2% | 19,2% | 4,2 | 0,4 | 15,2% | 57 |

| Dineo | 2024 | BNFIX Audit Auditores | EUR 75K | 0,2% | 15,5% | 0,85 | 1,84 | 22,5% | 57 |

| Rapicredit | 2023 | Ungeprüft | EUR 1,19M | 5,9% | 15,0% | 0,85 | 1,95 | 16,7% | 59 |

The lender overview and comparison page provides a detailed explanation of each evaluation criterion and guidance on how to interpret the figures.

Creditstar Repayments

Lendermarket has a history of repayment issues with loans from the Creditstar Group. One factor is the frequent use of extension periods, which can significantly limit investor liquidity.

Creditstar Group companies are not required to repay loans immediately after a 60-day delinquency under the buyback guarantee. Instead, they can extend the repayment six times, each for 30 days. For a loan with a 30-day term, this means it could potentially be repaid up to 240 days later (60 days until the buyback guarantee + 180 days of extension).

Another long-standing issue on the Lendermarket platform is the presence of Pending Payments.

Essentially, these are funds that are in the process of being transferred to the investor’s account. The reason behind this is that claims against the lenders are handled in batch processes, where investments and repayments are offset against each other, and only the net difference is transferred. As a result, investor payouts are shown as “Pending Payments” until the lender’s payment has actually been received.

Given the frequency and volume of Pending Payments, and taking into account the applied extension periods, it is difficult to dismiss the liquidity issues on the part of Creditstar companies. Additionally, the fact that investors can reinvest funds that have not yet been returned should also be seen as a critical point.

At least: In October 2025, the platform announced that all outstanding payments had been settled.

Advantages and Disadvantages

In this section, I have listed the most important advantages and disadvantages of Lendermarket.

Advantages

- Market Maturity: Operational in the P2P lending sector since 2019.

- Regulation: Licensed as a crowdfunding service provider under EU Regulation 2020/1503.

- Expected Returns: Above-average interest rates on loans.

- Loan Originators: A variety of large and internationally experienced lenders.

- Segregated Accounts: Protection against misappropriation by Lendermarket.

Disadvantages

- Profitability: The P2P platform is operating at a loss.

- Extension Periods: Can significantly restrict liquidity.

- Pending Payments: Unavailable funds can be reinvested.

Lendermarket Alternatives

In 2022, Lendermarket initiated its transformation into a P2P lending marketplace. This allows also external lenders, not affiliated with the Creditstar Group, to offer their loans for funding.

As a result, the business model can be closely compared with the following Lendermarket alternatives:

Mintos

With EUR 600+ million in investor assets under management and more than 500,000 registered users, Mintos is the largest P2P lending platform in Europe. In addition to a wide range of loans, the Latvian P2P marketplace also offers other asset classes. These include ETFs, bonds or real estate. Additional information can be found in my Mintos review.

Income Marketplace

Income Marketplace is an unregulated P2P marketplace based in Estonia. The platform, which had its operational start in January 2021, markets itself with a range of innovative security features that are designed to provide investors with significantly better protection against problematic lenders. So far, investors have not suffered any losses on Income Marketplace yet. Further information on the Lendermarket alternative can be found in my Income Marketplace review.

Debitum Investments

Debitum Investments (formerly Debitum Network) is a P2P marketplace based in Latvia and regulated by the local financial supervisory authority. What makes Debitum special is its unique positioning in the P2P lending environment, as it is regulated, follows a marketplace model and offers buyback-secured business loans. Additional information can be found in my Debitum review.

You can find other Lendermarket alternatives on the P2P Platform Comparison page.

Community Feedback

Over the past few years, experiences with Lendermarket have been rated increasingly negatively within the P2P lending community. At least if one looks at the results of the annual P2P Community Voting.

While the platform still managed to secure solid mid-tier rankings in 2022 and 2023, it has only reached 24th place in the last two years.

The Top 5 P2P platforms in 2025 were Viainvest, Debitum, Mintos, Swaper, and Income Marketplace.

Summary Lendermarket Review

Lendermarket is an Ireland-based P2P platform where investors can achieve above-average returns. In recent years though, investors had to pay a high price for these yields.

The platform operated in an unregulated environment, offered limited transparency in many areas, and liquidity was heavily constrained by extension periods and pending payments. In addition, management stability was lacking for years, and external communication also left room for improvement.

In recent years, however, a positive transformation can be observed. In December 2024, Lendermarket obtained a license from the Central Bank of Ireland to operate under the EU Crowdfunding Regulation. Pending payments have been settled, key management positions are now more stable, and transparency (though not yet perfect) has improved significantly.

Who should consider investing on the platform?

Investors seeking high returns from mature and profitable lenders such as Credifiel and Creditstar should consider Lendermarket as a good investment option. Those who prioritize liquidity more strongly should consider to join the Creditstar spin-off, Monefit SmartSaver, instead.

FAQ Lendermarket Review

Lendermarket is an Irish-based P2P platform founded by Creditstar Group in June 2016. Since the operational launch of the platform, in June 2019, investors have been able to invest in a variety of international consumer loans on Lendermarket, earning an average return of 15.5%.

The P2P platform “Lendermarket Limited” is fully owned by “SA Financial Investments OÜ“. This is an Estonian holding company to which a total of 18 companies belong. Its owner and ultimate beneficiary is Aaro Sosaar, who is also the CEO and main shareholder of Creditstar Group.

Lendermarket generates its revenue through a variable brokerage fee, which is charged to lenders in exchange for financing through the marketplace. This amount is primarily dependent on the amount of the financed loan volume and can range from 2% to 5%. The exact percentage also depends on the borrower country and the type of loans the lender offers.

I’m Denny Neidhardt, the founder of re:think P2P. On this blog, I help retail investors make smarter, well-informed investment decisions in the world of P2P lending. Since 2019, I’ve been publishing in-depth analyses, platform reviews, and risk assessments to bring more transparency to this investment space. My goal is to challenge marketing claims, question developments, and empower investors with honest, independent insights.

Another addition to my previous comment:

If you don’t take action, nothing happens with your pending payments. But, when you start questioning, they do take some action. I was told to submit a request for release of pending payments. Strange that I have to submit such a request. But I did, and as a result, this week I received about 80 Euro, of my 1600 Euro pending payments. Not much, but at least something, after a period of 5 months without any repayment. They promised further payments in december and january, without mentioning an amount.

I proposed a deal: pay somewhat less then what they owe me, but pay it quickly. They refused.

I also find it strange that they give 18% interest on pending payments, no matter what the original interest rate was. Good for investors, but with long delays, this only increases problems on their side. They don’t comment on this.

I find it a strange platform, but I still do have hope to receive my money back.

Please comment on their V2 platform, introduced about half a year ago. I feel the reasons for introducing this new version of the platform should be questioned. V1 still exists, with the old overdue loans. Till now it looks that V2 does not have the payment delays. They try to make investors believe that the problems on V1 are only technical, and V2 does not have these technical problems. I don’t believe that, I think they give priority to paying on V2, at the expense of old loans on V1. And I think over time, V2 will develop the same delays as V1. They tried to make me reinvest my V1 overdue loans to V2, by reinvesting pending payments. But this reinvesting is only possible with autoinvest, and these auto invested loans have a minimum term of 360 days. So then I even have to wait longer than waiting for the buy back procedure on V1. So I decided to stay an V1 with my overdue loans.

Very exhaustive analysis and description of the work of the platform. I didn’t know a lot of facts about Lendermarket. Thank you, Denny! I’m investing for a two years in Lendermarket and never met any serious issues with them. During the last two months I have withdrawn all possible funds from competitive platforms and reinvested in Lendermarket. Defenetely, the most convenient automatical investment functionality and one of the highest returns on the market.

I have to say, that you can say goodbye to your money! You will never get them back from Lendermarket.

Im using Lendermarket over a year now and recently was migrated to new platform. Like the new autoinvest options and it is very good way to earn passive income. Once per month I review my AI options.

You should say : people,stay away from those liars !

you are criticising hive5 ,which works excellent , and being moderate with this big p2p issue called lendermarket

Did you really read my Lendermarket review? It doesn’t look like it.