Income Marketplace is an Estonia-based P2P lending platform that markets itself with innovative security concepts such as the Junior Share and the Cashflow Buffer. These mechanisms are intended to minimize loan originator risk and increase security for investors.

How exactly these new safety mechanisms work and how they have performed since the operational launch in 2021 is one of the key questions addressed in this Income Marketplace review.

In addition to the detailed risk assessment, the loan offering is also analyzed, including an evaluation of the financial performance of all loan originators represented on the marketplace.

Further analyses of other platforms can be found on my P2P Platform Review page.

Summary

Before we get started, here is a quick summary with the most important information about Income Marketplace.

- Income Marketplace is an unregulated, Estonia-based P2P marketplace where investors can invest in buyback-secured loans and earn a return of up to 15%.

- The platform is operated by the Estonian company “Income Company OÜ”, which was founded in July 2020. The operational launch of the platform took place in January 2021.

- Income Marketplace stands out with its high standard when it comes to lender due diligence. The focus is on security features such as the junior share and the cash flow buffer. Less than 1% of managed investor assets are currently in recovery.

- The combination of portfolio quality, high transparency, and competitive interest rates makes Income Marketplace one of the most attractive options in the P2P lending space.

| Founded / Started: | July 2020 / January 2021 |

| Legal Name: | Income Company OÜ (LINK) |

| Headquarter: | Tallinn, Estonia |

| Regulated: | No |

| CEO: | Lavrenti Tsudakov (October 2023) |

| Community Voting: | P5 out of 30 | See Voting |

| Assets Under Management: | EUR 24+ Million |

| Number of Investors: | 10.000+ |

| Expected Return: | 13,78% |

| Primary Loan Type: | Consumer Loans |

| Collateral: | Buyback Guarantee (60 Days) |

| Bonus: | 1% Cashback | 30 Days |

About Income Marketplace

Income Marketplace is an Estonia-based P2P lending platform that launched in January 2021. Since then, investors have been able to invest with a variety of international loan originators and earn returns of up to 15%.

What stands out in particular is Income’s positioning as the supposedly safest P2P platform for investing in loans. This is due to new and innovative security features such as the Junior Share and the Cashflow Buffer, which differentiate from the traditional buyback guarantee approach.

Although Income Marketplace has already faced some challenges with certain loan originators, the overall portfolio quality can be assessed as very strong. To date, investors have not incurred any losses, and the debt collection rate remains below 1%.

Combined with competitive interest rates, as well as a high level of transparency and communication, Income Marketplace is one of the best alternatives in the current P2P lending landscape.

The Origin Story

Kimmo Rytkönen has been working in the international lending business since 2011. Among other jobs, he was the founder of the Polish lender Aasa Polska, which was also represented on Mintos at the time.

Kimmo Rytkönen has been working in the international lending business since 2011. Among other jobs, he was the founder of the Polish lender Aasa Polska, which was also represented on Mintos at the time.

Kimmo has not only gained a lot of experiences from the lender side, but also as a private investor on various P2P platforms. He experienced first-hand how little investors were protected after the outbreak of the coronavirus pandemic and how problems and weaknesses of some P2P platforms have been exposed.

Kimmo subsequently took these events as an opportunity to build a new P2P marketplace with additional security features according to his own ideas and standards. In July 2020, he founded the company “Income Company OÜ”, which marks the origin of Income Marketplace.

Ownership and Management

Who are the main shareholders and management executives behind Income Marketplace? Let’s have a look!

Income Marketplace Ownership

Who owns Income Marketplace? The P2P marketplace is operated by the company “Income Company ÖU”, which was entered in the Estonian company register on 22 July 2020.

Who owns Income Marketplace? The P2P marketplace is operated by the company “Income Company ÖU”, which was entered in the Estonian company register on 22 July 2020.

Due to a larger field of founding members and an interim fundraising round at SeedBlink, the ownership structure is broadly diversified.

The main shareholders include:

- The German Dr. Karl Hauptmann owns 39.86% of the shares. He is the chairman of a large private equity group from Berlin and was one of the platform’s first supporters.

- The Finn Kimmo Rytkönen holds 17.44% of the shares through his company “KJ Holdings OÜ”. He is the face of the platform. He was also CEO of Income Marketplace until October 2023.

- The Estonian Meliina Räty owns 9.59% of the shares through her company “MR Holdings OÜ”. She was one of the co-founders of Income. Her time as COO ended at the end of 2021.

The remaining shares are distributed among the other founding team, angel investors, private equity firms and smaller private investors who have secured shares in the company via SeedBlink.

Income Marketplace Management

Since October 2023, Estonian Lavrenti Tsudakov is CEO of Income Marketplace. He had already worked previously for the platform since June 2021. At Income, he was employed as COO, which is why he should have a good understanding about the operational challenges in the day-to-day business.

Since October 2023, Estonian Lavrenti Tsudakov is CEO of Income Marketplace. He had already worked previously for the platform since June 2021. At Income, he was employed as COO, which is why he should have a good understanding about the operational challenges in the day-to-day business.

Income founder Kimmo Rytkönen, who has been CEO of the platform since its inception, is now focusing more on the strategic challenges at Income Marketplace. These include the onboarding of new lenders, the licensing process for becoming a regulated P2P platform and the company’s next funding round.

Business Model and Finances

Throughout the process of due diligence, investors should also have a look at the business model of a P2P platform as well as the overall financial situation. How does the company earn money? Does the platform operate profitably? And how well is the company positioned financially? In the following paragraphs of this Income Marketplace review, you can follow-up on those questions.

Business Model

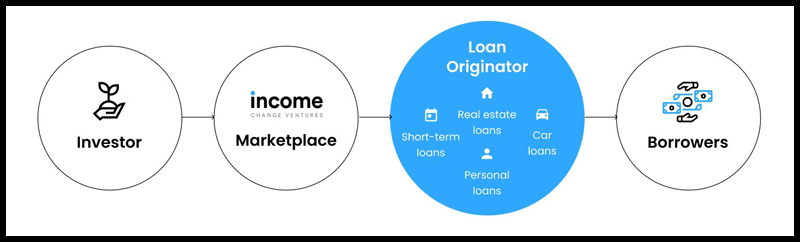

Income Marketplace pursues a P2P lending marketplace model. The platform is therefore an intermediary between investors, who aim to generate a return by providing their capital, and the lenders on the other side, who offer their assets for financing via the platform.

Unlike the ‘classic’ P2P model, in which the platform also scores the borrowers, Income focuses primarily on acquiring economically sound fintech companies that require loan financing to scale their business model.

Monetization

How does Income earn money? As a marketplace, Income monetises itself primarily through a commission fee, which is charged to lenders for financing their loans on the platform. In this regard, the business and monetisation model is not much different from other P2P marketplaces such as Mintos, Debitum or PeerBerry.

For those who want to know more details, the platform fee at Income ranges between 2% and 4% of the outstanding loan portfolio and is calculated on the basis of a daily balance. Invoices are issued monthly.

According to the 2024 annual report, Income Marketplace generated revenue of approximately EUR 507,000 through its business model, representing an increase of around 17% compared to the previous year.

Profitability

Income Marketplace is currently not profitable. A look at the latest annual report reveals that the company closed 2024 with a loss of EUR 613,381.

According to current projections, the company plans to reach breakeven on a monthly basis by the end of 2025. To achieve this, Income requires assets under management of approximately EUR 30 million. Until profitability is reached through its own funds, the platform’s shareholders are willing to finance further growth with equity.

Sign Up and Bonus

To invest on Income Marketplace, investors must meet three requirements:

- A minimum age of 18 years,

- a residence in the European Economic Area

- and a European bank account.

The registration process at Income is fairly simple and intuitive. After opening the account via email, the KYC and AML questionnaires have to be completed, followed by the identity verification through Veriff.

Also legal entities have the opportunity to sign up on Income Marketplace.

Income Marketplace Bonus

If you consider investing on Income Marketplace, a sign up through this link will enable you to get an unlimited cashback bonus of 1% in the first 30 days after registration.

A platform overview with all bonus offers and cashback promotions can be found on the bonus page.

Investing on Income Marketplace

How does Income Marketplace work and what should investors know and consider when investing on the plaform? In the following sections of my Income Marketplace review you will find all the necessary information that you need.

Loan Offering

There are a variety of international lenders on Income. These are geographically spread across the regions of Europe, South America and South East Asia. Below is a brief overview of the largest and most important lenders on Income Marketplace.

- Danarupiah: The Indonesian lender has been with Income since December 2021 and is one of the largest cornerstones of the platform. The assets have a maximum term of six months and offer above-average interest rates of up to 15%. More information in my DanaRupiah review.

- ITF Group: The ITF Group, founded 2012 in Bulgaria, has been financing some of its assets via Income since July 2022. The short-term consumer and instalment loans have interest rates of up to 15% and terms of up to 24 months.

- Ibancar: Since 2017, the Spanish-based lender has already been on a number of different P2P lending platforms. Even in times of crisis, there have never been any problems with repayments. The instalment loans have an interest rate of up to 12.5% with terms of up to 37 months.

- Hoovi: The Estonian lender primarily offers instalment loans between 10% and 12%. An integral part of Income Marketplace since May 2022.

- Sandfield Capital: The UK-based and FCA-regulated lender offers financing for civil litigation, which is covered by an external insurance. Interest rates of up to 13.5% and terms of up to 24 months.

- Virtus Lending: The Kosovo-based lender finances leasing loans for used cars and traditional consumer loans. The loan terms range from 3 to 84 months, with interest rates of between 10% and 12%.

- Simpleros: The Spain-based loan originator offers short-term consumer loans of up to 30 days and installment loans of up to 90 days. Interest rates are around 13%. Active on Income Marketplace since September 2025.

- Autofino: The Lithuanian company, founded in 2018, specializes in used vehicle rentals with a purchase option. On the Income marketplace, car loans are offered with an annual return of 11%. All listed loans come with a buyback guarantee. The loan terms range from 12 to 72 months.

The lenders represented on Income Marketplace offer a wide variety of loan types, maturities and interest rates for investors.

Costs and Fees

There are no fees or hidden costs for retail investors on Income Marketplace. Neither for deposits or withdrawals, nor for the functionalities when investing on the platform.

If you want to earn a passive income by investing in private consumer loans, you don’t have to worry about additional costs at Income that would reduce the advertised return.

Expected Returns

The overall return expectation on Income Marketplace largely depends on the selection and performance of the individual loan originators. In general, interest rates can be set by the lenders themselves, although the platform has capped the maximum rate at 15%.

My personal investment with Income Marketplace goes back to April 2022. During this time, I have built an outstanding P2P portfolio of more than EUR 25,000, achieving a total return of 13.24%. This represents a very competitive return within the P2P lending space.

In addition to the high interest rates, portfolio quality plays a pivotal role. Historically, the debt collection rate on Income Marketplace has never exceeded 2%, providing the foundation on which the achieved returns are built.

Auto Invest

On Income Marketplace, investors have the opportunity to invest manually in loans as well as through an Auto Invest feature.

With the Income Auto Invest, individual lenders can be selected as well as the borrower countries, the term of the loans, the interest rates, the investment amount, the loan type or the loan status. In addition, there are even more advanced filter options, where you can also filter by the total loan amount or the remaining loan amount, among other things.

The minimum investment amount per loan is currently EUR 10, which is common practice for most platforms.

Income Marketplace does not (yet) have a secondary market. The marketplace plans to introduce this functionality in the future though.

Income Marketplace Forum

The P2P lending industry is a fast-moving environment. Hence, make sure to stay on top of all relevant information by subscribing to my channels on Telegram or WhatsApp. This way, you will always receive the latest information from the P2P industry, including platform news regarding Income Marketplace.

Income Marketplace Taxes

Generally, interest income generated by loan financing is considered investment income and must be reported as such on the tax declaration. Unlike other platforms, Income Markeplace does not withhold any taxes at the moment.

For the tax declaration, investors can find an overview in the dashboard where a tax report for the respective year can be downloaded. This information can then be forwarded to the respective tax office as part of a tax declaration.

Income Marketplace Risks

Investors should look very carefully at the potential risk factors when evaluating a P2P platform. What is it that investors need to be aware of when it comes to Income Marketplace? Where are the underlying risks and how are they assessed?

Platform Risk

At the platform level, there are two key risk factors to consider: profitability and regulation.

Profitability: Income Marketplace is operated by the Estonian company “Income Company OÜ.” According to the published financial reports, the company has not yet reached profitability. As a result, it remains dependent on capital increases from shareholders or external financing rounds.

According to statements from the majority shareholder, there is a willingness to continue supporting the company’s growth for the foreseeable future. Nevertheless, the current lack of profitability represents a risk for investors.

Regulation: In Estonia, there is no legal or regulatory framework that applies to the business model of Income Marketplace. This reduces the need for the platform to comply with specific requirements. On the one hand, this grants greater freedom in operational management, but on the other hand, it also means fewer safeguards for investors.

Deposit Insurance

The investments offered via Income Marketplace are not covered by European deposit guarantee schemes (such as the Deposit Guarantee Directive 2014/49/EU). This means that – unlike traditional bank deposits – funds invested on Income are not insured or guaranteed by any national or European compensation scheme.

Accordingly, investors should be aware that the capital invested is subject to the risk of loss, that returns are not guaranteed, and that they may not recover the full amount originally invested.

However, the claims against the lending companies remain valid and can be enforced legally.

Income Insights Podcast

Since its inception, Income Marketplace has stood out for its high level of transparency and open communication.

This includes the “Income Insights” podcast, launched in November 2023, which aims to keep investors better informed about the P2P platform and the developments of individual lenders.

The main guest is Income founder Kimmo Rytkönen, though other team members and lenders active on the platform also participate.

Due to my long-standing history with the company and close exchange with the involved parties, I was asked to host the new format. My approach is to critically examine the platform’s developments and provide investors with a realistic insight into the marketplace’s challenges.

The Income Insights podcast is available on all major streaming platforms as well as on the platform’s YouTube channel.

Lender Risk

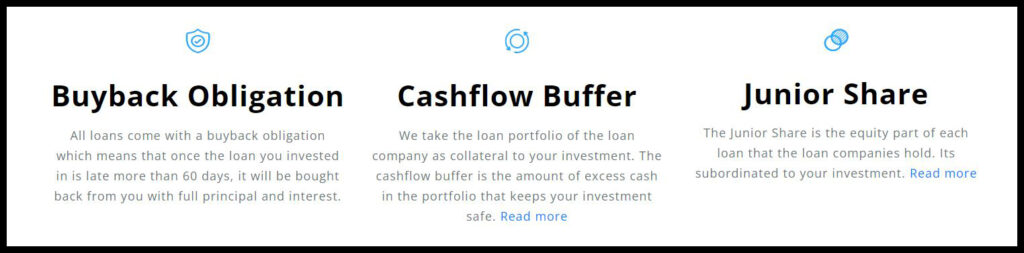

Income Marketplace markets itself as the “safest platform for investing in loans.” The platform emphasizes safety features such as the “Junior Shares” and the “Cashflow Buffer.” The question for investors is whether these are merely marketing claims or whether they represent genuine, innovative security mechanisms that effectively reduce risk.

Buyback Obligation

Income Marketplace offers a traditional buyback guarantee, which functions similarly to those on other P2P platforms. If a loan is more than 60 days overdue, the lender is obliged to repurchase it, reimbursing both principal and accrued interest.

As is often the case, investors should keep in mind that a guarantee is only as reliable as the financial strength of the issuer providing it.

Junior Shares

The Junior Shares are a modified version of the common “skin in the game” concept. The general assumption is that lenders should be similarly motivated to collect the debt in the event of default. Both parties, investors and lenders, are equal in this case.

Junior Shares on Income Marketplace differ as far as the lender’s “skin in the game” share is registered as a junior debt. This means that lenders, in the scenario of a default, have a lower repayment priority. Only when all outstanding receivables from the investors have been repaid in full, the lender has the option of get back his share. Accordingly, investors enjoy a preferential treatment in the event of default.

For the execution, special-purpose vehicles (SPVs) have been created, ensuring that borrower repayments are directly under the control of Income Marketplace. Lenders are also required to transfer their individual portion of the Junior Shares into this structure.

Cashflow Buffer

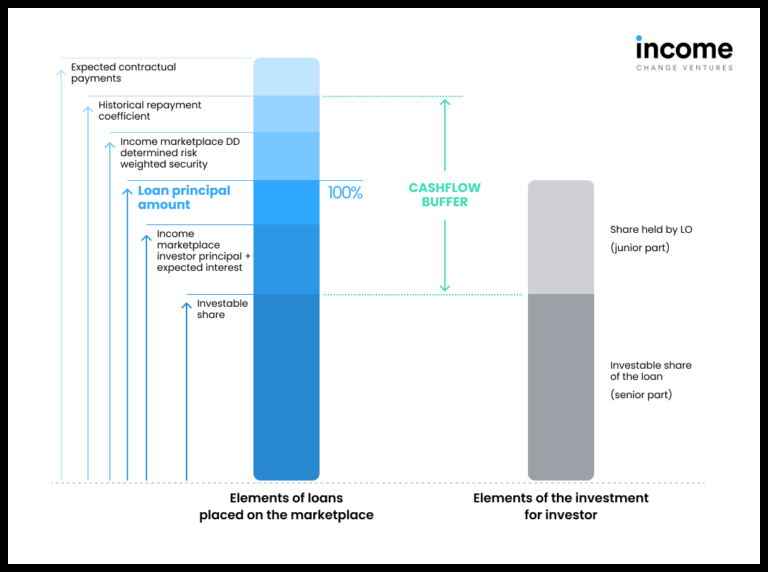

At Income Marketplace, the junior share is intended in particular to hedge the risk of default by borrowers and to encourage lenders to work to the best of their ability. The cashflow buffer, on the other hand, is designed to address the risk of a potential lender default.

The cashflow buffer is made up of several aspects. It is a combination of:

- Loan profitability of the lender loan portfolio

- Risk adjustment on the part of Income Marketplace

- The Junior Share

In reality, the way it works is that Income Marketplace looks at the quality of the lenders’ loan portfolio and calculates how much money those loans make on a portfolio basis (see “historical repayment coefficient” in the chart) and how profitable they are. This determines the value of the collateral, similar to how it works with mortgage loans.

After potential risk factors such as currency fluctuations, pandemics, or other value-reducing aspects are taken into account, the P2P marketplace calculates how many Junior Shares are needed to fully protect investors in a problem scenario. For this reason, the Junior Shares held by lenders—averaging 20% to 35%—are significantly higher than the classic “Skin in the Game” portion, which usually ranges from 5% to 10%.

ClickCash Default

With a default rate of less than 1%, Income Marketplace maintains an outstanding portfolio quality.

With a default rate of less than 1%, Income Marketplace maintains an outstanding portfolio quality.

Nevertheless, there are examples where risk assessment did not perform as expected. Among these is the suspension of the Brazilian lender ClickCash in October 2022. At the time of suspension, outstanding claims amounted to approximately EUR 180,000, while the cash flow from the pledged loan portfolio was reportedly only around EUR 50,000.

This raises the question of why Income did not monitor the pledged assets more rigorously, which could have allowed the platform to detect this problem at an earlier stage.

Lender Analysis

Regardless of the platform’s own assessment, investors should independently examine the risk profile of each lender. For an evaluation of financial stability, the following table provides an overview of the current financial figures. You can check out the lender overview and comparison page for additional information regarding applied KPIs and their interpretation.

| Loan Originator | Year | Audited | Profit | ROA | Equity Ratio | Debt | Liquidity | Impairments | Score |

|---|---|---|---|---|---|---|---|---|---|

| Autofino | 2024 | Crowe | EUR 51K | 1,0% | 52,7% | 0,9% | 0,8 | 3,5% | 71 |

| Current Auto (LT) | 2023 | Unaudited | EUR (54K) | (0,7%) | (2,9%) | (35,0%) | 163,8 | 12,2% | 24 |

| Current Auto (LV) | 2024 | Unaudited | EUR (912K) | (19,4%) | (55,2%) | (2,8%) | 1,1 | 55,3% | 26 |

| Danabijak | 2023 | Kreston Indonesia | EUR 15K | 72,9% | 43 | ||||

| Danarupiah | 2024 | Unaudited | EUR 13,8M | 30,9% | 68,2% | 0,5 | 3,1 | 64 | |

| Hoovi | 2024 | Unaudited | EUR 661K | 9,9% | 12,1% | 7,3 | 0,6 | 5,9% | 57 |

| Ibancar | 2024 | BDO | EUR 463K | 3,4% | 9,9% | 9,1 | 1,9 | 6,4% | 72 |

| ITF Group | 2024 | ECOVIS | EUR 1,8M | 11% | 34,3% | 1,9 | 2,2 | 74 | |

| Sandfield Capital | |||||||||

| Simpleros | 2024 | Unaudited | EUR 259K | 15,9% | 31,3% | 2,2 | 2,3 | 59 | |

| Virtus Lending | 2024 | BDO | EUR 237K | 3,4% | 12,7% | 6,9 | 43 |

The numbers for Danarupiah and Danabijak have been converted from IDR to EUR, as have the figures for the ITF Group from BNG to EUR.

Advantages and Disadvantages

In this section, I have listed the most important advantages and disadvantages of Income Marketplace.

Advantages

- Due Diligence: New mechanisms that provide more effective protection against default risks.

- Portfolio Quality: Sustainable default rate of less than 1%.

- Losses: Investors have not yet incurred any capital losses.

- Return Expectation: Competitive interest rates of up to 15%.

- Auto Invest: Option to invest funds automatically.

- Communication: High level of communication and transparency toward investors.

Disadvantages

- Profitability: The break-even point has not yet been reached.

- Regulation: No oversight or supervision by a financial authority.

- Liquidity: No secondary market or early exit options.

Income Marketplace Alternatives

In terms of the business model, Income Marketplace is most comparable to other marketplaces such as Mintos, PeerBerry or Debitum. Those platforms have also a similar focus in terms of loan types and regional spread.

Mintos

With EUR 600+ million in investor assets under management and more than 500,000 registered users, Mintos is the largest P2P lending platform in Europe. In addition to a wide range of loans, the Latvian P2P marketplace also offers other asset classes. These include ETFs, bonds or real estate. Additional information can be found in my Mintos review.

PeerBerry

PeerBerry is also a P2P marketplace, but working exclusively with partners from the Aventus Group. In terms of investor assets under management, PeerBerry is the number two in Europe, just behind Mintos. The Croatian-based platform has attracted particular attention due to its good performance in times of crisis. PeerBerry partners have repaid more than EUR 45 million in war-affected loans to investors within two years. Additional information can be found in my PeerBerry review.

Debitum Investments

Debitum Investments (formerly Debitum Network) is a P2P marketplace based in Latvia and regulated by the local financial supervisory authority. What makes Debitum special is its unique positioning in the P2P lending environment, as it is regulated, follows a marketplace model and offers buyback-secured business loans. A combination that cannot be found in this particular form on any other P2P platform. Additional information can be found in my Debitum review.

You can find other Income Marketplace alternatives on the P2P Platform Comparison page.

Community Feedback

The Income Marketplace experiences within the P2P lending community are rated as above average. Out of 30 P2P platforms to choose from, Income has consistently ranked between 5th and 9th place over the past four years.

In 2025, only the platforms Viainvest, Debitum, Mintos, and Swaper were rated more popular.

Summary Income Marketplace Review

What is the preliminary conclusion of this Income Marketplace review?

What is the preliminary conclusion of this Income Marketplace review?

Income Marketplace is an ambitious and innovative P2P platform from Estonia, which I have been closely monitoring since its inception. I have been actively investing on the platform since April 2022, during which time my portfolio has grown to over EUR 25,000 with a total performance exceeding 13%.

The marketing as the “safest” platform for investing in loans may be somewhat too ambitious. Nevertheless, the track record so far is impressive: investors have not yet suffered any losses, and the default rate remains consistently below 1% of managed investor assets.

Investors should, however, take note of the platform’s lack of regulation and profitability. As such, Income Marketplace may not be suitable for highly conservative investors.

Outside of these considerations, Income Marketplace presents a very attractive overall profile, combining excellent portfolio quality, high transparency, and competitive returns. For investors who value these features, Income Marketplace represents a strong alternative for their P2P portfolio.

FAQ Income Marketplace Review

Income Marketplace is an unregulated, Estonia-based P2P marketplace where investors can invest in buyback-secured loans and earn a return of up to 15%.

The German Dr Karl Hauptmann owns 39.86% of the shares in Income Company OÜ. He is the chairman of a large private equity group from Berlin and was one of the platform’s first supporters from the outset.

As a marketplace, Income monetises itself primarily through a platform fee, which is charged to lenders for financing on the platform. This is between 2% and 4% of the outstanding loan portfolio.

If you consider investing on Income Marketplace, a sign up through this link will enable you to get an unlimited cashback bonus of 1% in the first 30 days after registration.

Investors can register and open an account with Income Marketplace free of charge. There are also no costs or hidden fees for depositing, investing and trading P2P loans on Income Marketplace.

I’m Denny Neidhardt, the founder of re:think P2P. On this blog, I help retail investors make smarter, well-informed investment decisions in the world of P2P lending. Since 2019, I’ve been publishing in-depth analyses, platform reviews, and risk assessments to bring more transparency to this investment space. My goal is to challenge marketing claims, question developments, and empower investors with honest, independent insights.